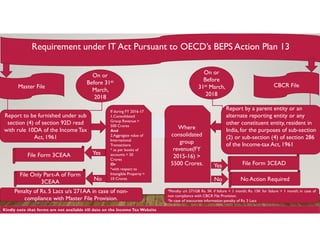

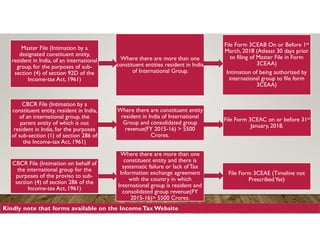

This document outlines the requirements under the Indian Income Tax Act for multinational companies to comply with OECD's Base Erosion and Profit Shifting (BEPS) Action 13 on country-by-country reporting. It specifies the deadlines and thresholds for Indian constituent entities of international groups to file the Master File, Country-by-Country Report, and related forms. It also notes penalties for non-compliance and provides instructions on electronically filing the required forms using digital signatures.