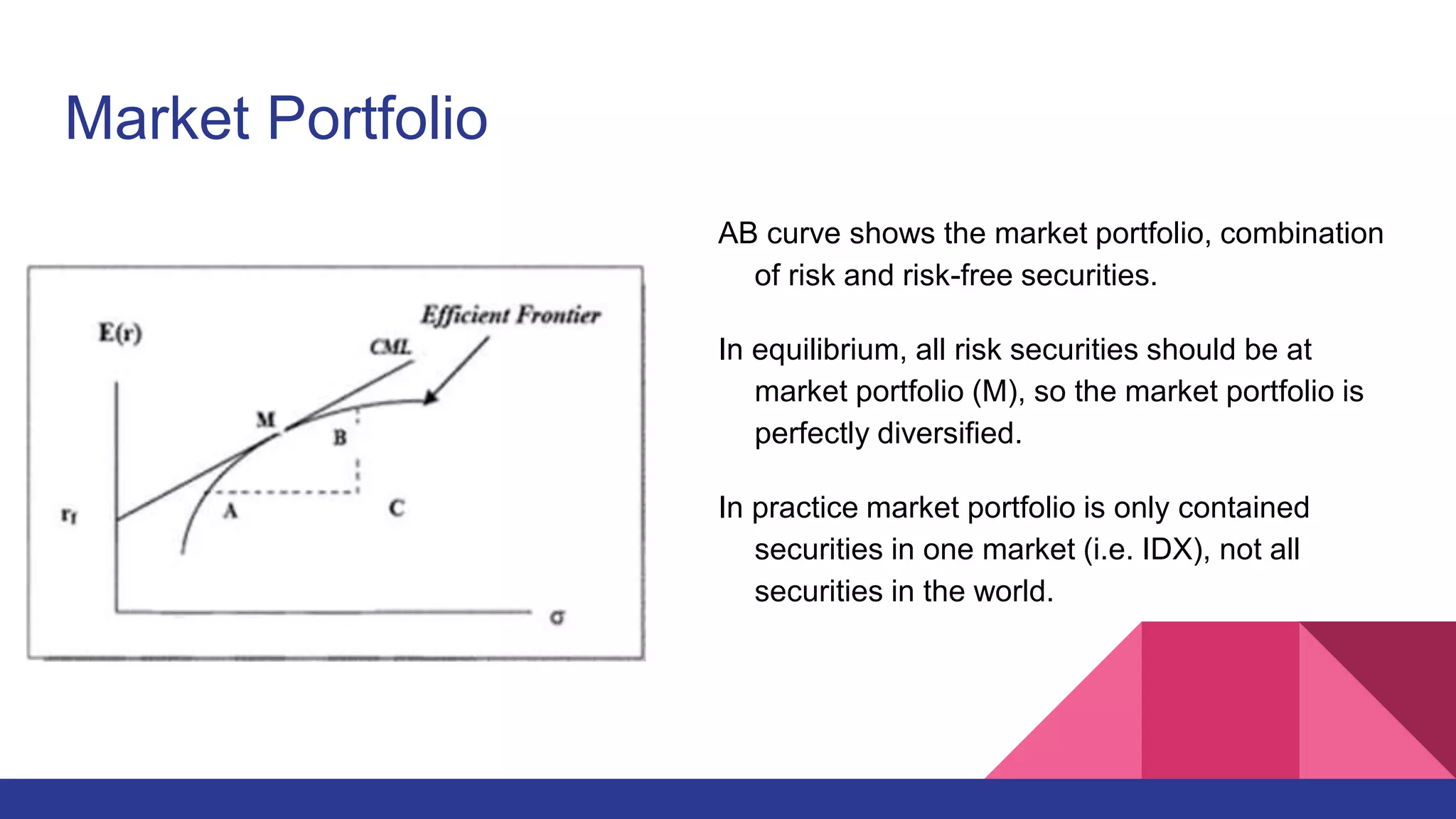

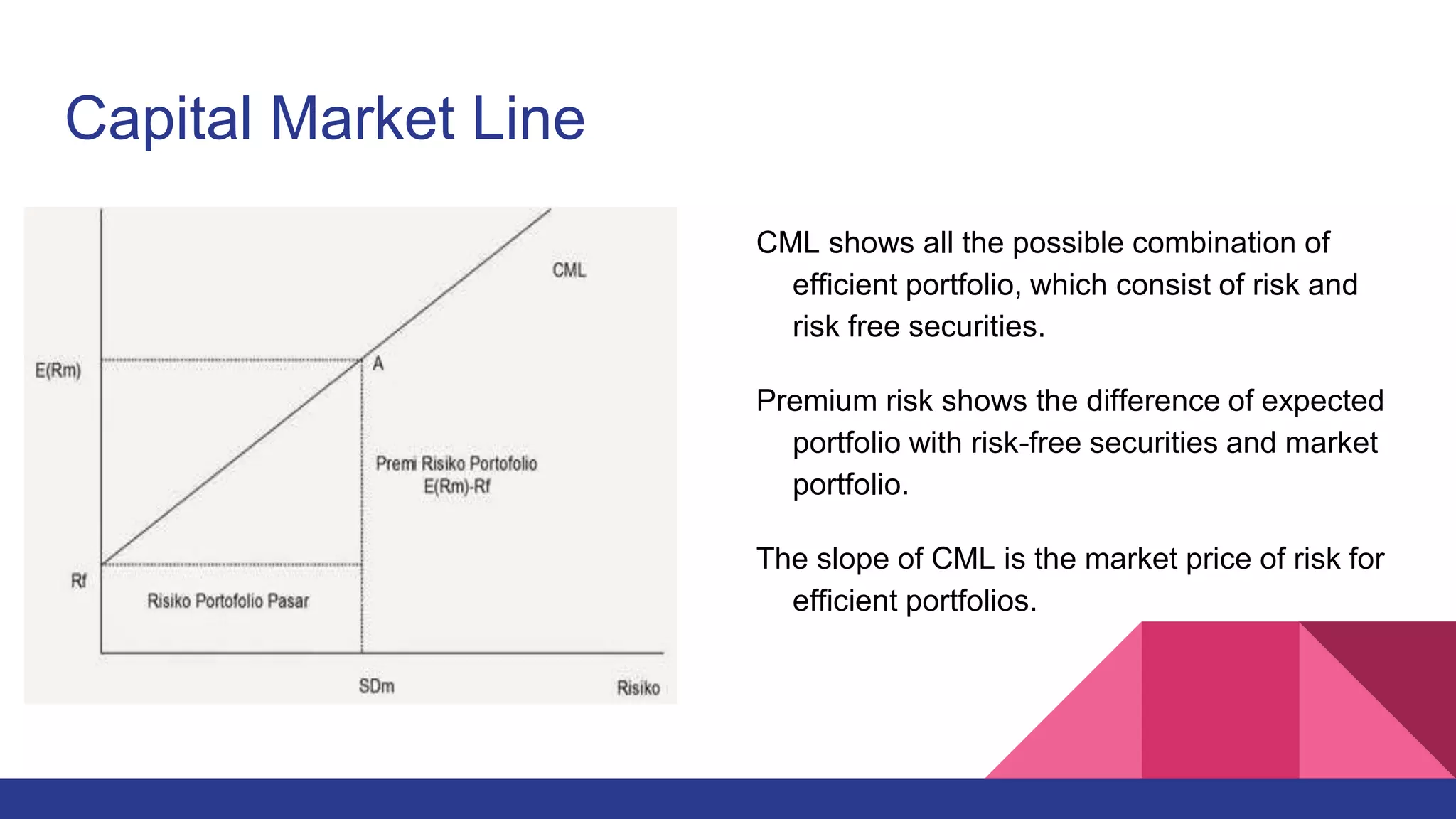

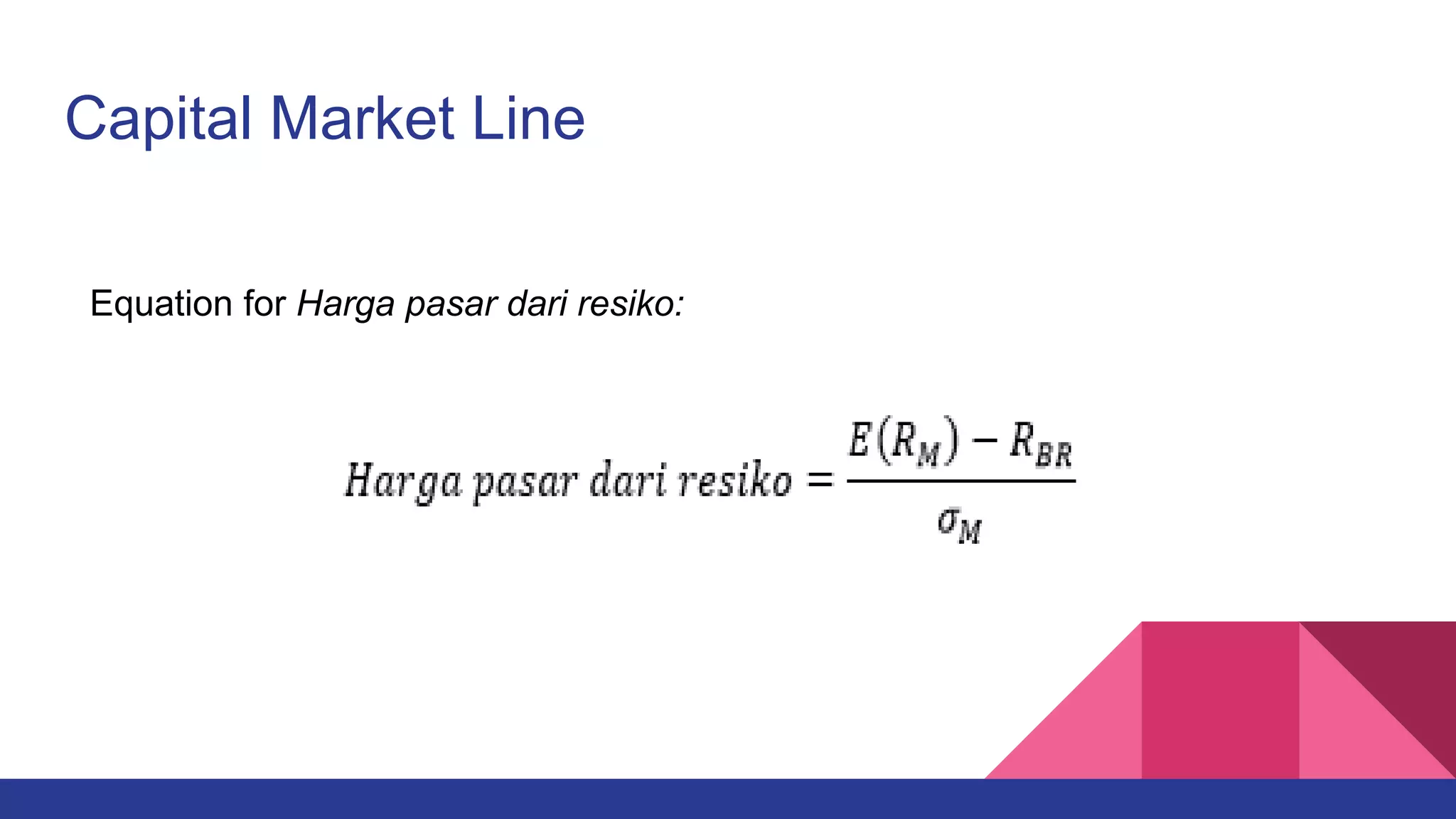

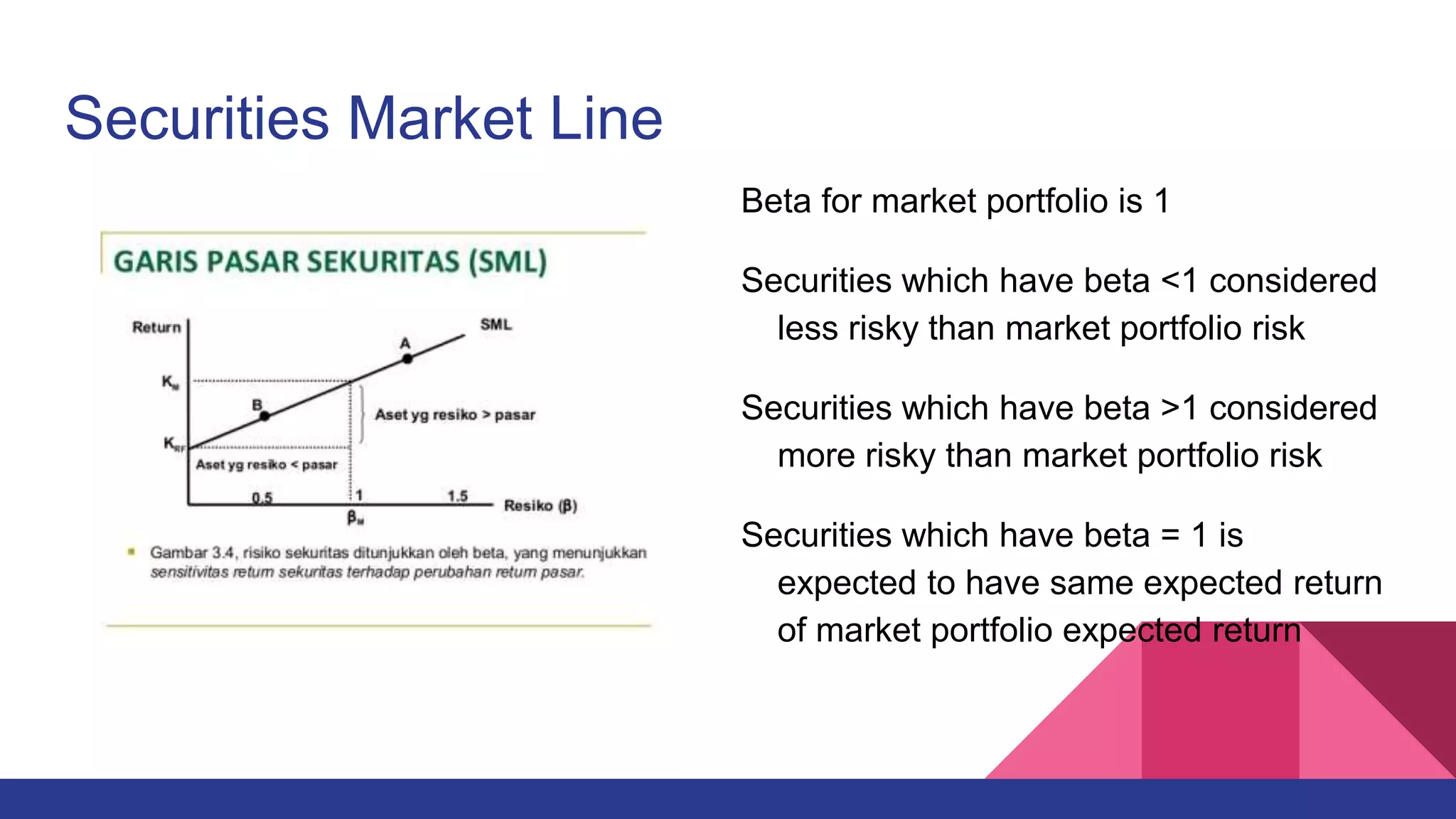

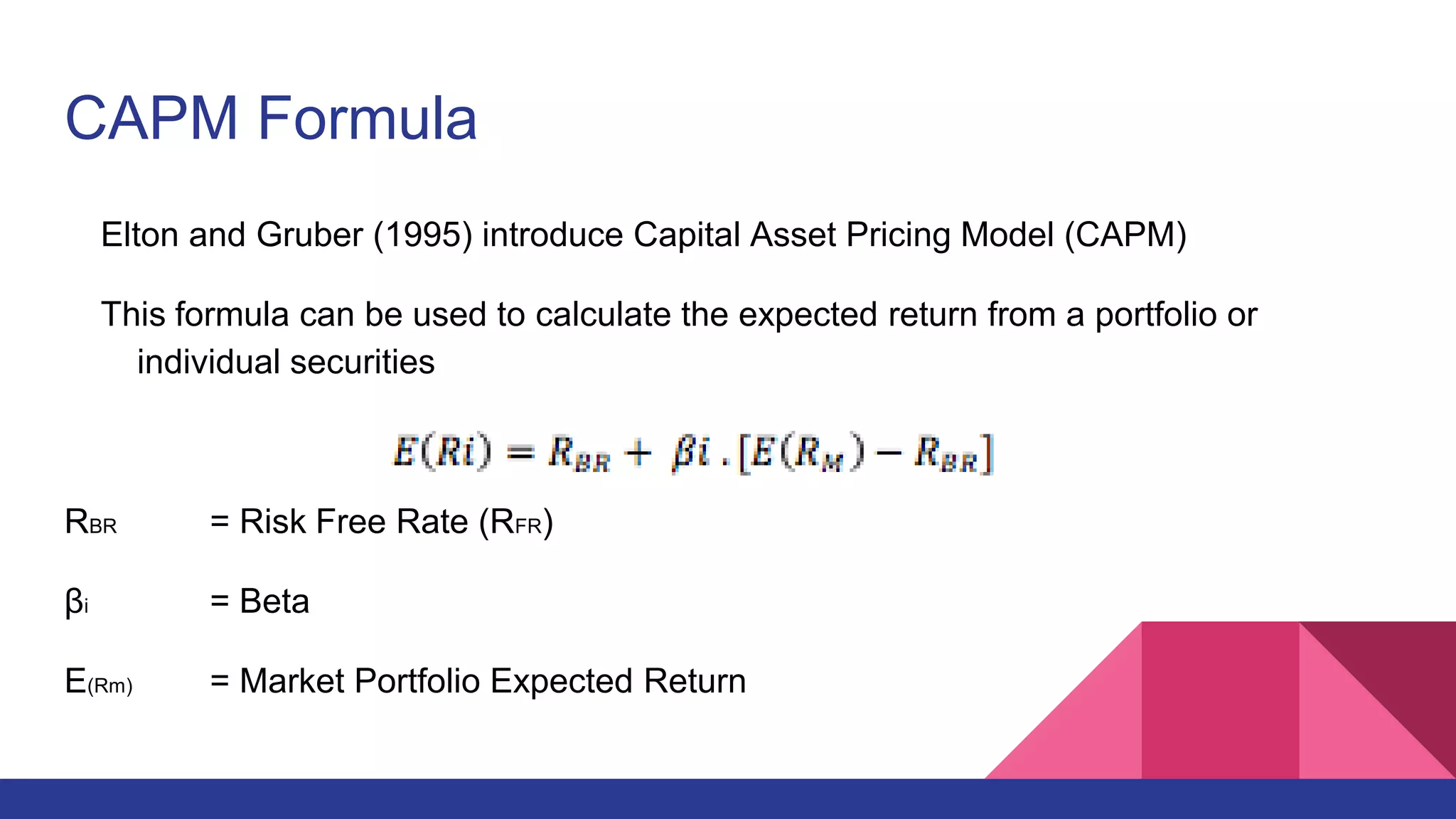

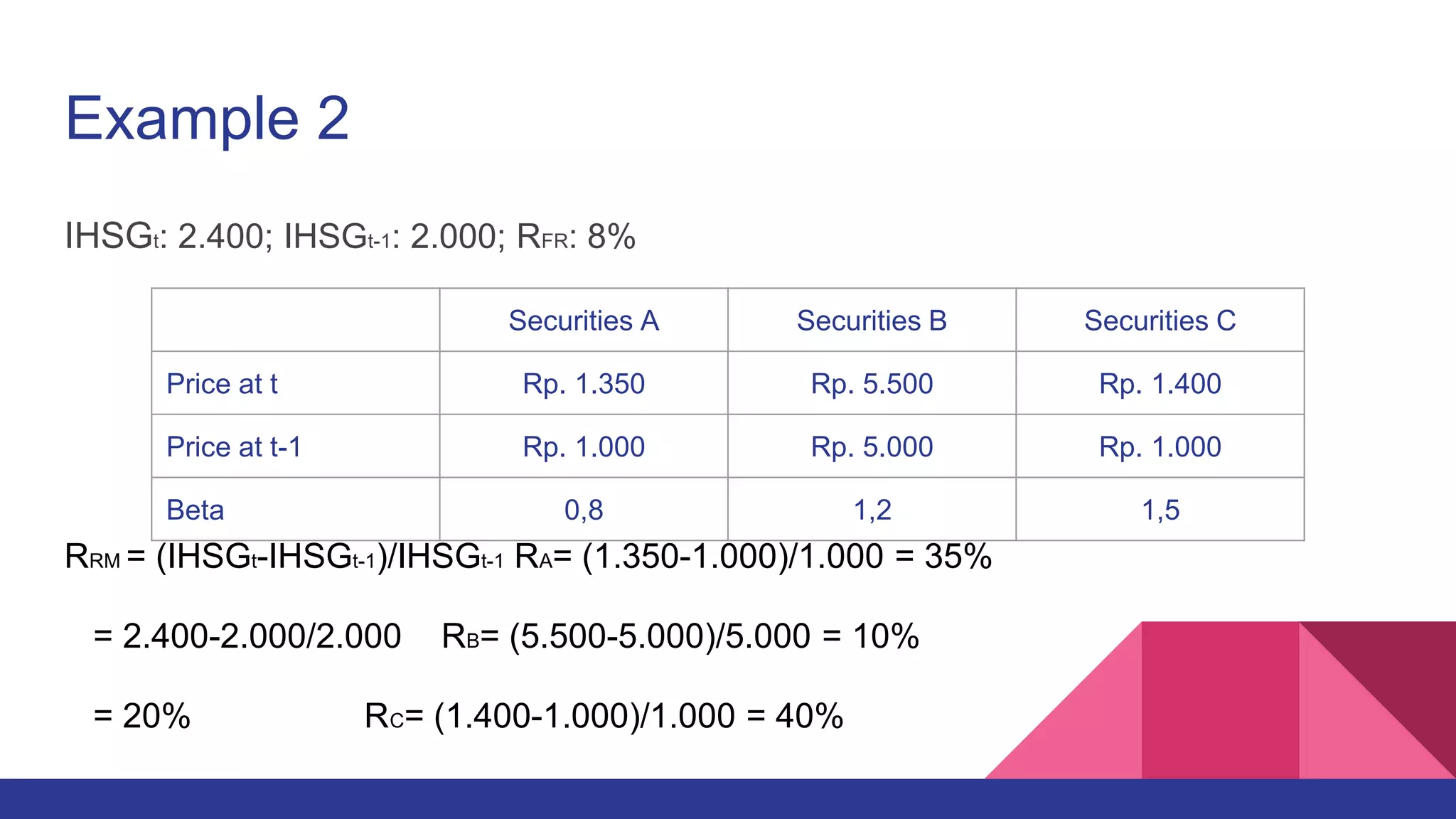

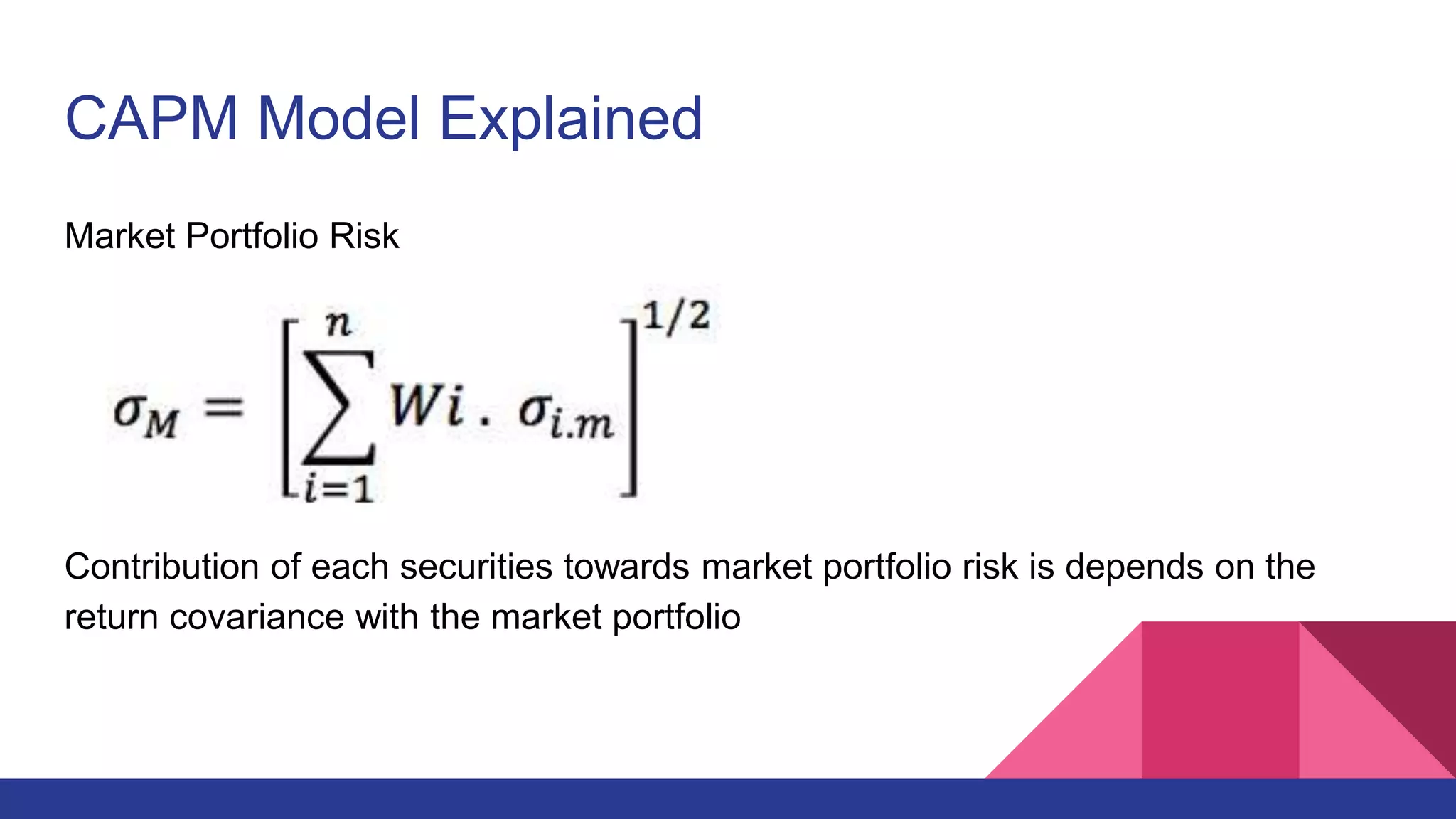

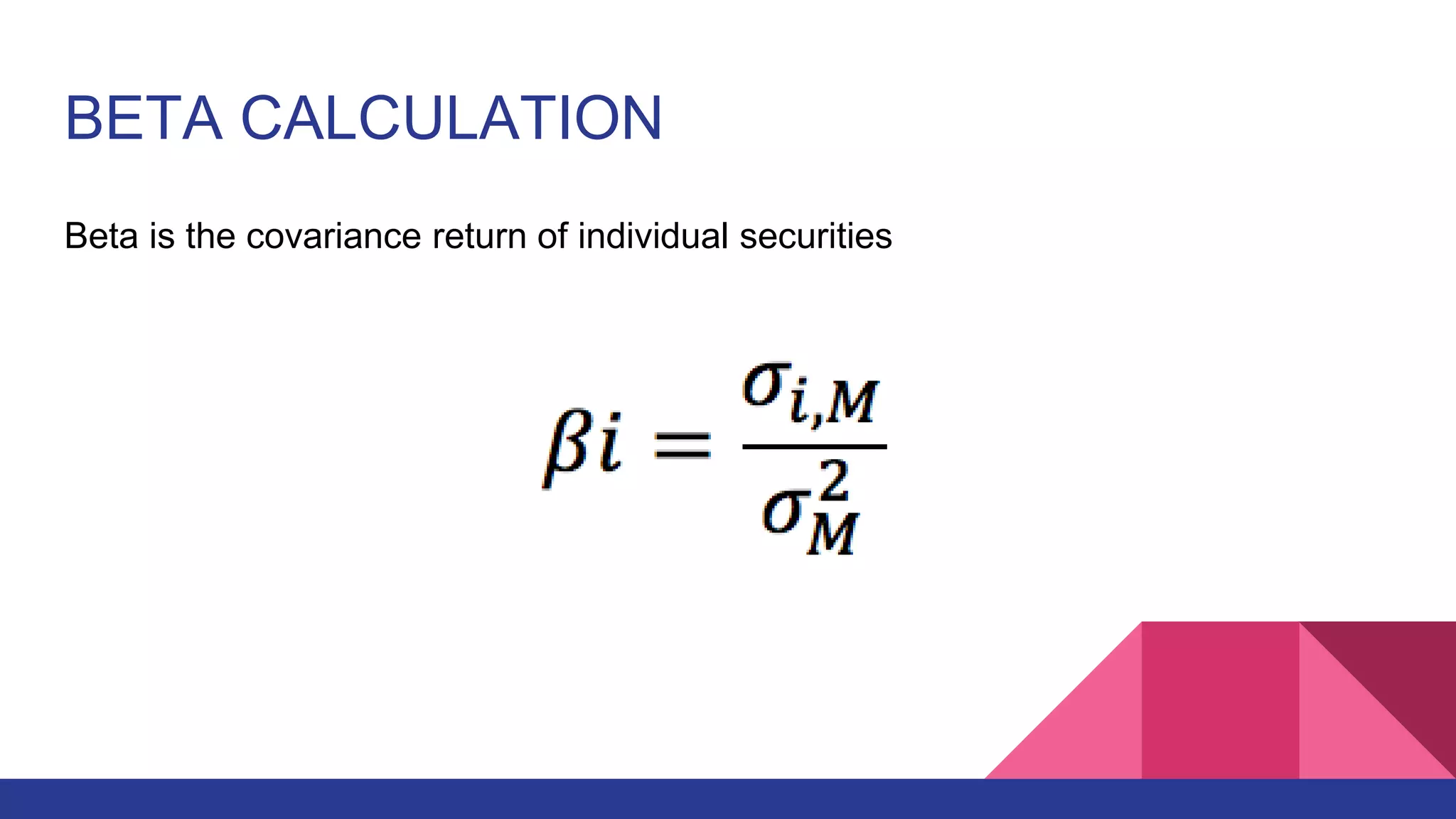

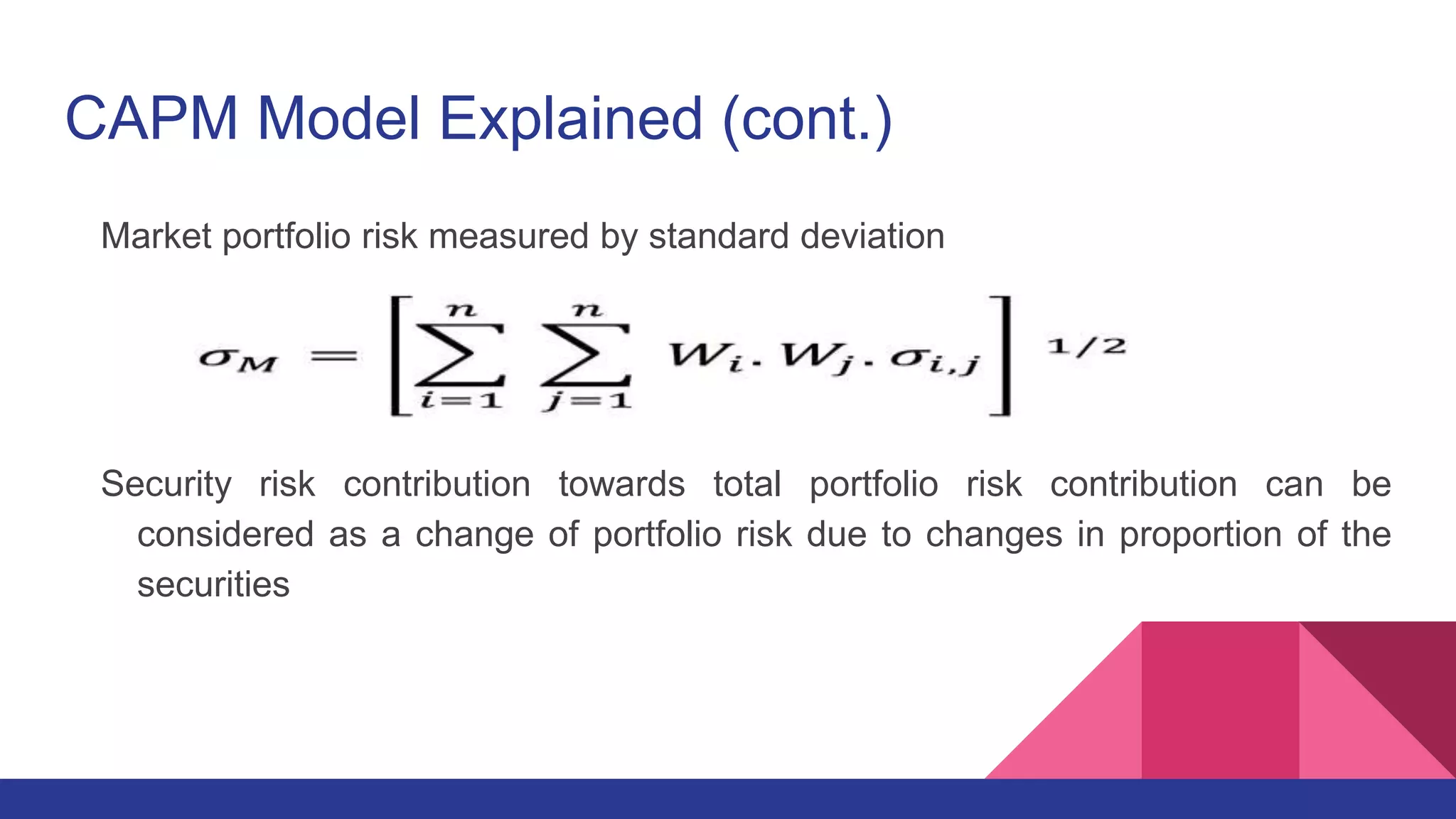

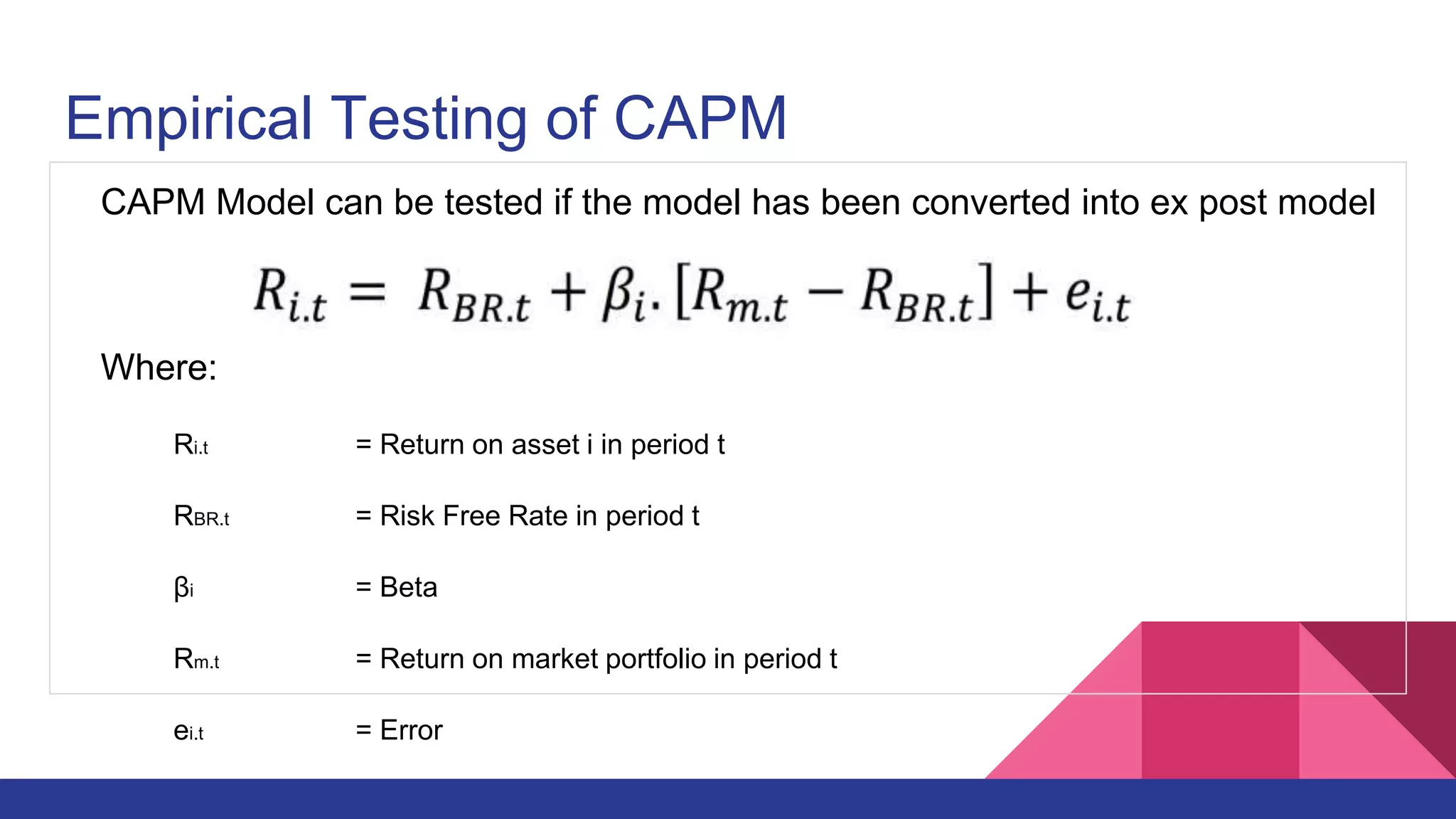

This document provides an overview of the Capital Asset Pricing Model (CAPM). It outlines the key assumptions of CAPM, including that investors aim to maximize returns based on risk. It describes how the capital market reaches equilibrium when there is no incentive to trade. It also defines concepts like the capital market line, securities market line, beta, and the CAPM formula. Examples are provided to demonstrate how to calculate expected returns using CAPM. The document concludes by discussing empirical testing of CAPM and common findings that its assumptions do not always hold in practice.