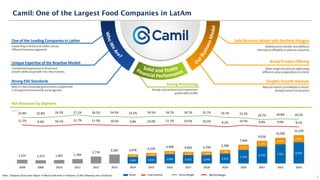

Camil Alimentos, founded in 1963, is one of the largest food companies in Latin America, focusing on a diverse range of products including grains, sugar, and pasta. The company operates across five countries with a robust distribution network and has maintained solid financial performance even amid economic challenges in Brazil. This presentation summarizes Camil's financial results in accordance with international standards, emphasizing the company's strategic growth through acquisitions and its commitment to stable margins and corporate governance.