The document discusses budget management and outlines the key concepts, including:

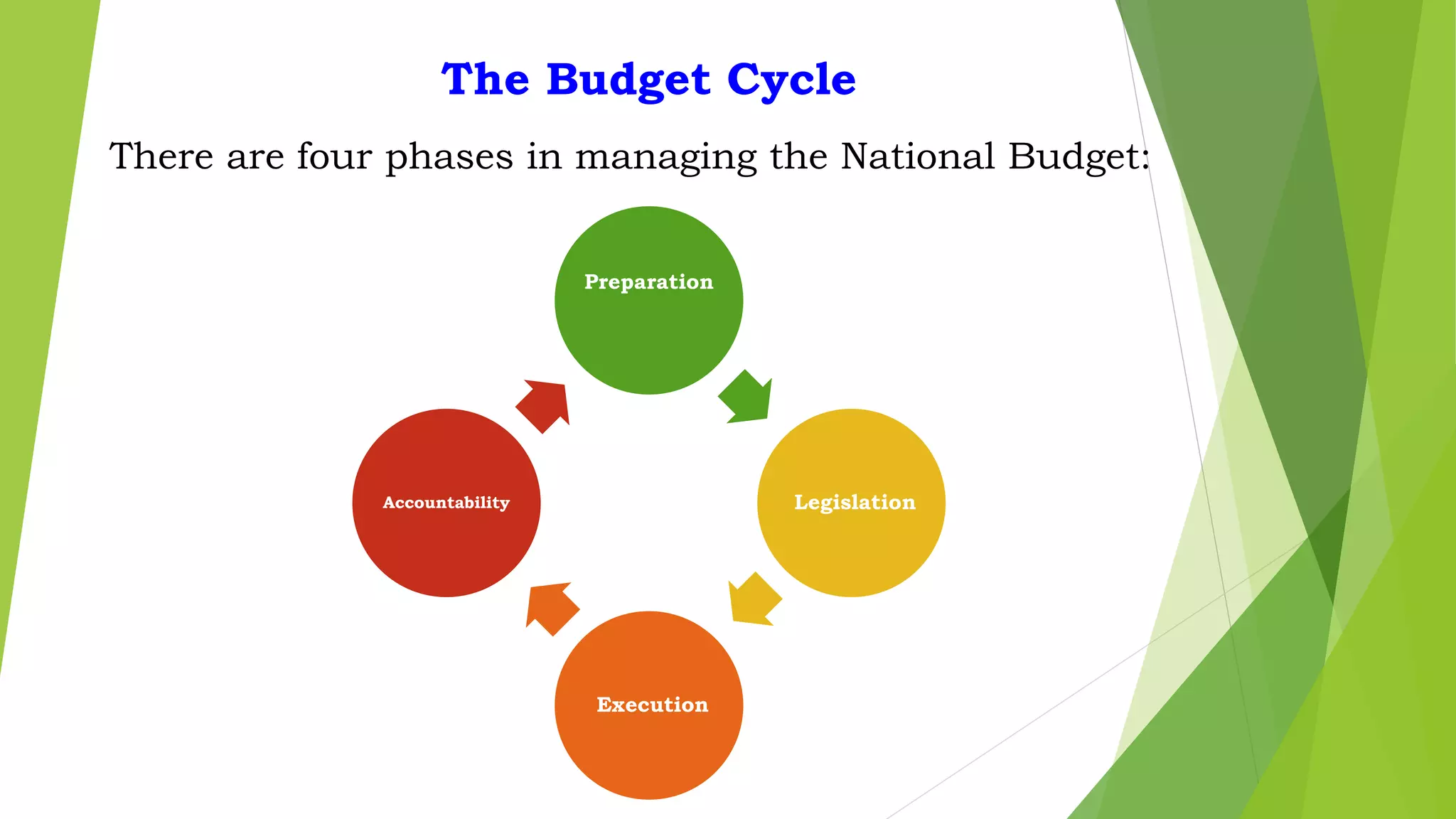

1) The four phases of the budget cycle: preparation, legislation, execution, and accountability.

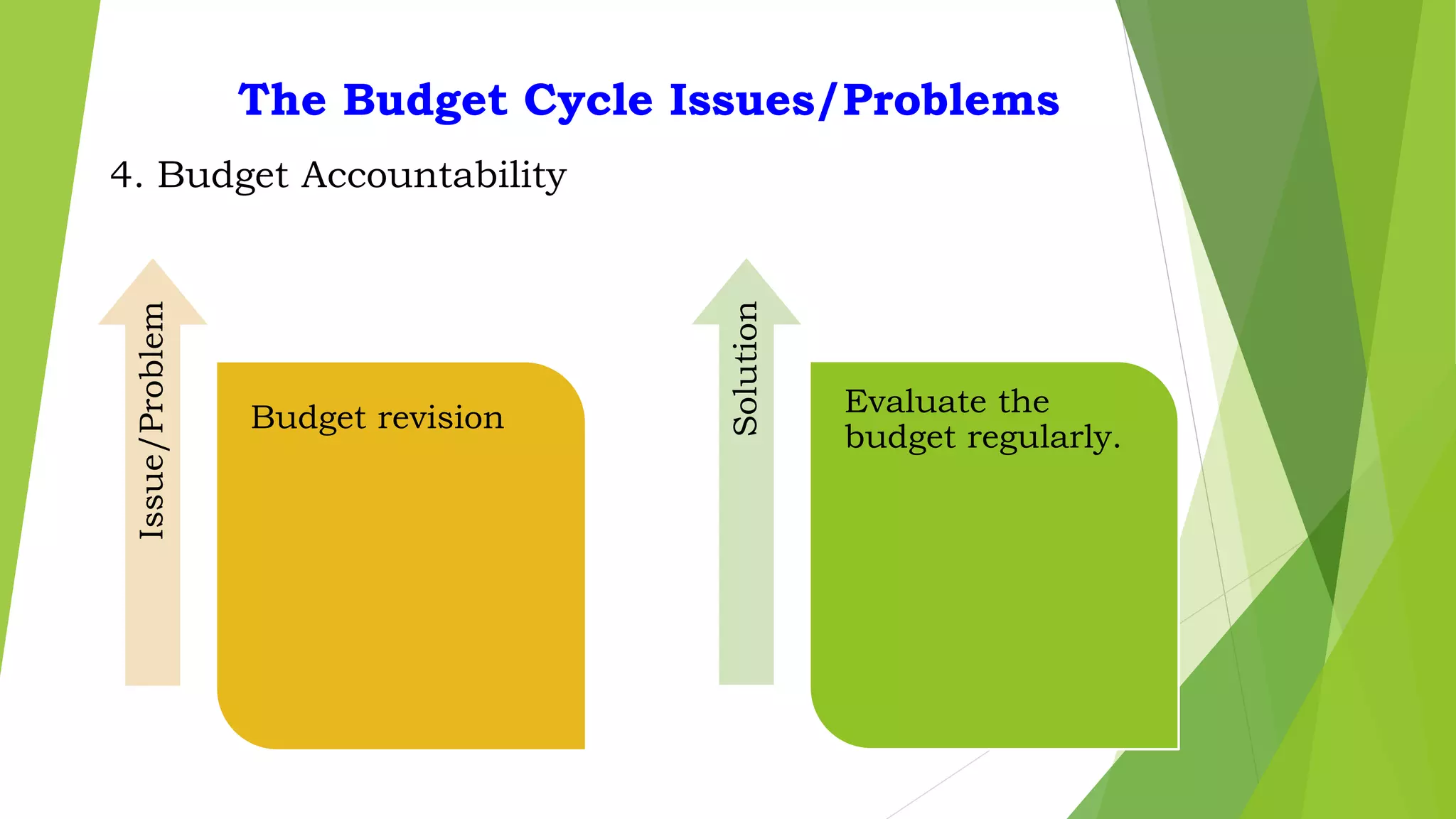

2) Issues that can arise in each phase, such as lack of resources for preparation or political influences in legislation.

3) How the national budget is allocated across government programs, operations, salaries, and debt payments, aimed at fiscal discipline, efficiency, and strategic priorities.