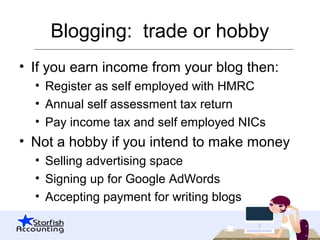

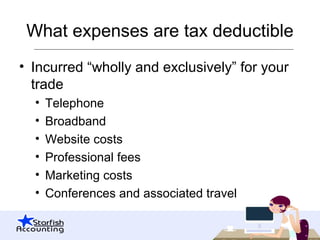

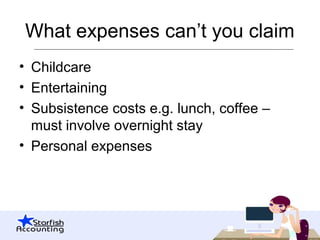

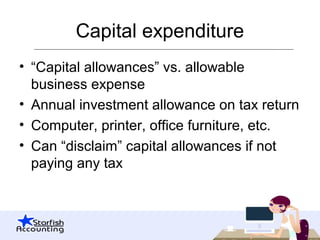

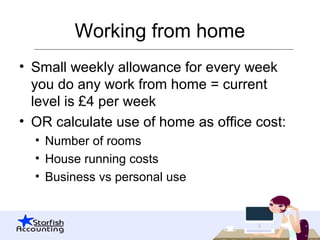

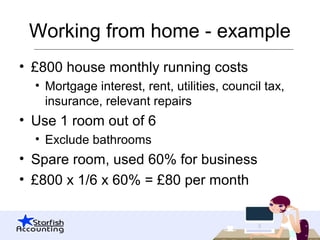

This document discusses tax considerations for bloggers. It explains that if a blogger earns income from blogging, they must register as self-employed and pay income tax and National Insurance contributions. It outlines expenses that can be deducted, such as website costs, marketing costs, and a portion of home office expenses. The document also discusses what income bloggers need to declare to tax authorities, including payments received in cash, in-kind, or from advertising.