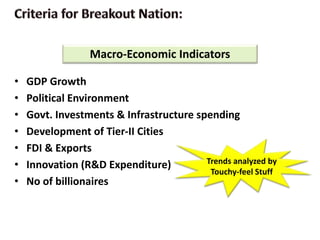

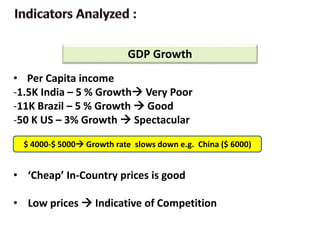

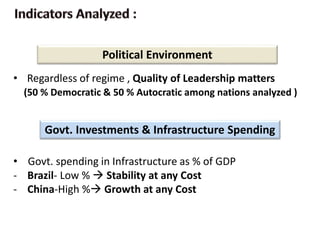

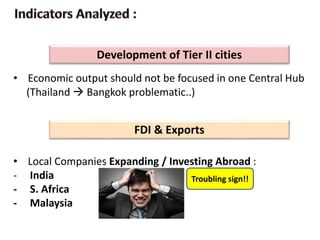

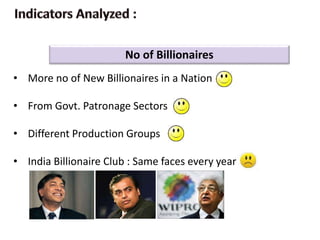

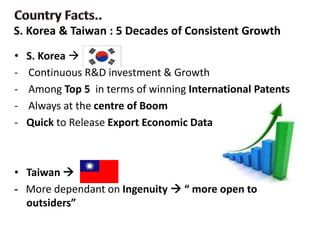

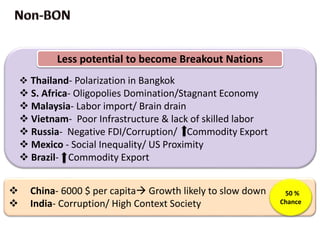

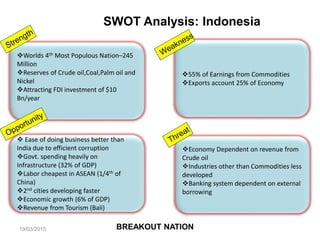

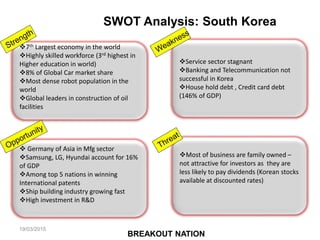

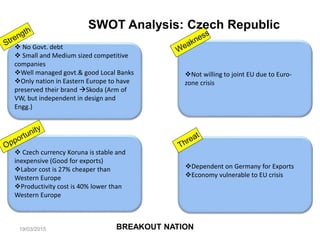

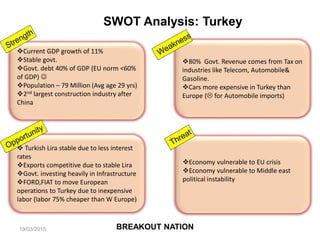

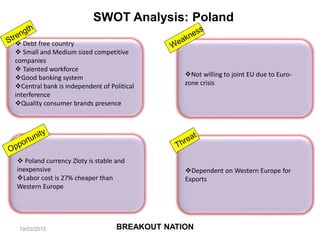

This document analyzes various countries and their potential to be breakout nations based on their economic growth and development. It provides SWOT analyses for several countries, including Indonesia, South Korea, Czech Republic, Turkey, and Poland. Indonesia is highlighted as a potential breakout nation due to its high FDI inflows, growing infrastructure spending, development of secondary cities, and young workforce. South Korea is also noted for its consistent growth driven by high R&D spending and innovation.