Branding Banks For Shareholder Value 3.0 Customer Perceptions

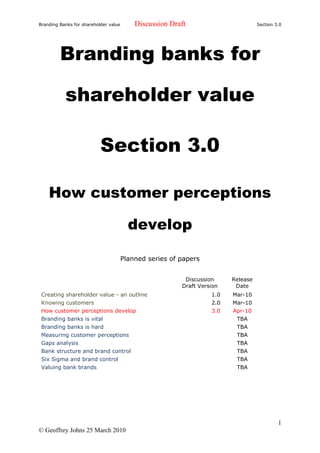

- 1. Branding Banks for shareholder value Discussion Draft Section 3.0 Branding banks for shareholder value Section 3.0 How customer perceptions develop Planned series of papers Discussion Release Draft Version Date Creating shareholder value - an outline 1.0 Mar-10 Knowing customers 2.0 Mar-10 How customer perceptions develop 3.0 Apr-10 Branding banks is vital TBA Branding banks is hard TBA Measuring customer perceptions TBA Gaps analysis TBA Bank structure and brand control TBA Six Sigma and brand control TBA Valuing bank brands TBA 1 © Geoffrey Johns 25 March 2010

- 2. Branding Banks for shareholder value Discussion Draft Section 3.0 Introduction This is the third in series of discussion drafts in which I attempt to trace the path from customer perceptions to shareholder value. The first covers shareholder value as a goal of the system and the analysis framework I use. The second is about knowing customers through segmenting on key characteristics. This section deals with understanding how customer perceptions develop. This understanding is crucial if banks are to have influence over how customers and non-customers think of their brands. Section 1.0 contains the general introduction to this series of papers. Personal experience trumps all other messages My first and perhaps most important observation about the development of perceptions in banking is that personal experience is more important than any external influence. I have interviewed more than one person still fuming about a bounced cheque twenty years ago. Advertising communication is accepted when it aligns with favourable beliefs The media is scanned for messages that confirm our The opinions of beliefs trusted advisors, colleagues, friends and family are sought. The perceptions of the individual largely shaped by experience Individual Peers Media Advertising 2 © Geoffrey Johns 25 March 2010

- 3. Branding Banks for shareholder value Discussion Draft Section 3.0 Banking is not top of mind in most people’s day to day lives. Adverse experiences, sometimes trivial to those who design bank processes, can sear themselves into people’s minds. An impression of a bank can settle itself in the heads of customers quite early in their lives. People screen out messages that do not gel with their preconception based on their experience.. They interpret messages that are not screened out to reinforce their preconceptions. They actively seek confirmation of their preconceptions in the environment about them. Marketing communications Media comment Trusted advice Contradiction Own Confirmation filtered experience sought reinterpreted Information Based on their experience customers construct stories in their heads where the elements of the stories are self-reinforcing. They are slotted into a pattern of cause and effect in which the customer justifies what is often a gut-feeling by a logic pattern imposed upon it. 3 © Geoffrey Johns 25 March 2010

- 4. Branding Banks for shareholder value Discussion Draft Section 3.0 Customers create stories in their heads about their bank. The exhibit below is developed from some of the attributes that are measured by the TNS Business Finance Monitor in Australiai. It shows how my qualitative research indicates that people construct stories that explain their perceptions. Tight knots are formed in people’s minds in this way. ‘My bank values me as a customer therefore they take the trouble to understand my business therefore they are (are able to be) helpful and supportive’. Sometimes researchers are concerned that statistically they are unable to distinguish the relative importance of such attributes in driving satisfaction. I suspect that this in part caused by the fact that attributes are rarely mutually independent. They are strung together in stories. Primary causality Positive feedback Responsive and flexible They value me Helpful and as a business supportive customer Helps Understands my businesses business achieve their business goals The knot tightens until an experience is powerful enough to cut through it cuts through it. 4 © Geoffrey Johns 25 March 2010

- 5. Branding Banks for shareholder value Discussion Draft Section 3.0 The process of disaffection is discontinuous The following set of exhibits is taken from my qualitative research of the deterioration of customer commitment in business banking. It illustrates the process of adverse experience cutting the Gordian Knot of inertia. You are a danger to my business You are Six steps to disaffection exploiting me I don’t trust you I can’t rely on you You don’t value my business You don’t know me 5 © Geoffrey Johns 25 March 2010

- 6. Branding Banks for shareholder value Discussion Draft Section 3.0 Each step requires its own impetus. At any stage it is possible with the right actions to arrest decline. But it takes an enormous management effort to put the process into reverse; there is a ratchet effect at work. To do this requires inculcating a whole new thinking framework into the minds of customers. You have to reach beyond responses to new experiences to attitudes and beyond attitudes to beliefs. It seems that we cannot easily retrace our steps. By contrast each step prepares the customer for the next one. In the story the customer is telling in his or her head the logic builds as each step is taken. „You don‟t value my business because you don‟t know me‟. On one occasion I was told, on joining a bank, that management consultants had estimated a net defection rate among business customers of 9% pa. I believe that what arrested this in the short run was mandating visits to customers by senior management to assure them their business was valued. However, improvement in measured satisfaction took two years of effort including integrated rebranding. You don’t You are a You don’t I can’t rely on I don’t trust You are value my danger to my know me you you exploiting me business business Mutual lack of contact Just being an account number Untailored communications 21 „You don‟t know me‟ is a common early warning sign that that the situation is prone to adverse surprises just around the corner 6 © Geoffrey Johns 25 March 2010

- 7. Branding Banks for shareholder value Discussion Draft Section 3.0 You don’t You are a You don’t I can’t rely on I don’t trust You are value my danger to my know me you you exploiting me business business Lack of access to senior bankers Seemingly arbitrary account management decisions No proactive solutions Indifferent service Inflexible application of rules 22 „How can you value me if you don‟t know me?‟ Business people, at work are at the centre of their world. Do they feel that they are peripheral at best to the world of their bank? You don’t You are a You don’t I can’t rely on I don’t trust You are value my danger to my know me you you exploiting me business business Bank mistakes Inconsistent policies Poor processes These things relate more to poor management than Gaps in product/service offerings bad intentions Lack of banking skills Bank actions hard to predict Poor dispute resolution Changes to management team Inconvenient access Not keeping up with the market 23 7 © Geoffrey Johns 25 March 2010

- 8. Branding Banks for shareholder value Discussion Draft Section 3.0 It is important to understand that right up to this point the bank need not have done too much wrong. In a later paper, I shall discuss the importance to brand of relationship managers. For now I will say that a relationship can have reached this point without being revealed in any Key Performance Indicators. You don’t You are a You don’t I can’t rely on I don’t trust You are value my danger to my know me you you exploiting me business business Decisions based on bank not customer needs This is driven by a build up of the previous three. If you don’t Unprofessional know me and you don’t value my business and I can’t rely on Bankers lacking you, then I don’t trust you. understanding of business Media scandals Poor performance vs. competitors At this point, the bank is on the customer‟s „watch list‟. The bank, however, still might not realise this. In terms of commitment, which I described in the last paper, the search for alternatives is beginning. You don’t You are a You don’t I can’t rely on I don’t trust You are value my danger to my know me you you exploiting me business business Aggressive pricing Cost cutting This perception is more easily triggered Reduced functionality if the four previous perceptions are in No support place. 8 © Geoffrey Johns 25 March 2010

- 9. Branding Banks for shareholder value Discussion Draft Section 3.0 In the case uppermost in my mind is the case of Westpac Banking Corporation. In 1992 it came close to insolvency on the back of perhaps a dozen large property loan delinquencies. Westpac’s management of its SME customers in the years leading into the crisis had been among the best of banks. But at this point, increased pricing, reduced lending, greater security demands, more rigid terms, conditions and covenants were imposed on them. Sometimes relationship managers apologised to customers explaining it was because of corporate lending gone bad. The key thing felt by customers was that their account was being managed with no reference to or understanding of their own business. They felt completely out of control of events vital to them. On the spectrum of customer perceptions this is as bad as it gets. You don’t You are a You don’t I can’t rely on I don’t trust You are value my danger to my know me you you exploiting me business business Arbitrary, irrational and aggressive credit decisions Major disruptions to business processes Fear of being at a significant disadvantage to competitors that have a better bank The existence of the earlier perceptions will mean that these issues are nearly impossible to resolve. 26 Many customers will have defected or at least moved some of their business before this point is reached. One of the most common reasons I have heard for switching banks by business customers is not so much that that the reality of the situation was a rock bottom. It was more like they felt they ‘couldn’t live with themselves’ if they continued to let their bank treat them this way. Obviously, these same six steps don’t happen to every customer and some customers are more or less tolerant. Nevertheless it is a fair take out from my qualitative research 9 © Geoffrey Johns 25 March 2010

- 10. Branding Banks for shareholder value Discussion Draft Section 3.0 over many years. At each step the process becomes harder and less certain to reverse. This is because the bank begins to be seen in the mind of the customer as ‘Well they would do that, wouldn’t they, because that’s the people they are?’ In short it is a brand killer. Resistance to changing our minds There are lags too in how we change our minds. I am not a psychologist but I offer the exhibit below as a representation of how I think people test their perceptions in the world of experience. Beliefs Reframing feedback Attitudes (Reusable decisions) Needs Contextualisation feedback Expectations Choices Realignment feedback Experience (feedback) Outcomes The key seems to me to be expectations. Up to a point outcomes will be evaluated to confirm expectations rather than refute them. It is only when there is a rupture that a process of accommodation to new experience begins. Changes in expectations can lead to attitudes changing to contextualise the new experience. At this occurs before the walls of belief can be breached. But then sometimes something that matters to the 10 © Geoffrey Johns 25 March 2010

- 11. Branding Banks for shareholder value Discussion Draft Section 3.0 person happens so out of line with expectations that the result can be a sudden reframing that is all the more powerful. The Conversion Model explaining discontinuity Let’s turn again to the Conversion model™ which I described in Section 2 of this series. The process of which the Conversion model takes a snapshot in time is in fact dynamic and ongoing. Loss of Need for new business product /service Lag Lag Enhanced perception of Increased alternatives ambivalence Lag Lag Increased importance of choice of bank Dissatisfaction Adverse experiences As dissatisfaction grows the customer’s search for alternatives intensifies. At the same time the customer’s perceived importance of the choice of bank is likely to grow. This is generally considered to be a stable characteristic; some people innately think this is more important than others. But it is also something that people rarely focus on. When they need to think about who they bank with the importance of the decision tends to increase. As the customer evaluates alternatives to their bank and these are seen positively dissatisfaction with the bank tends to increase. It may even be that the test alternatives 11 © Geoffrey Johns 25 March 2010

- 12. Branding Banks for shareholder value Discussion Draft Section 3.0 to the extent of actually having dealings with them. They are likely to meet with other bankers and to consult friends and business associates ii. The resulting increase in disposition to alternatives and increasing dissatisfaction with their bank heightens their level of ambivalence. Usually, what is then needed for the next step to be taken is a new banking need. People relatively rarely switch banks altogether. There is more a seepage as new needs arise. The picture tends to be one of rising disaffection leading to a mental break with the bank that may not be immediately apparent. The bank may not become aware until value shifts. Even then, if value shifts on a new product the bank may still be unaware of the relationship breakdown. Customer inertia in banking Much is said about customer inertia in banking. People tend to rarely move from one bank to another. In Australian business banking the ‘churn’ is less than 5% a year and of these, I guess that perhaps one and a half percentage points are pushed for reasons of risk or under-pricing for riskiii. In personal and business banking value seeps rather than switches. This usually happens when a new product is required or some life event (e.g. moving to another employer or town) occurs. There are several reasons for inertia. People have more important things to think about than banking. They tell themselves that all banks are the same. They think that if their bank compares unfavourably in some area (e.g. online banking) it will soon catch up. They tell themselves ‘if it isn’t broke don’t fix it’. They have life routines they are reluctant to change. They have got used to their bank and can predict how it will deal with them. There are lots of reasons for inertia and some of them are based on good sense. In a later paper in this series I shall offer a dollar quantification of its value to a bank. But strong as these ties are they can mask, until it is too late deep underlying reasons for change. The following exhibits draw some causal connections from a few qualitative studies I have done that touch on inertia. There has been an event that cast some light on inertia. As I say in Section 1.0 of this series there tend to be few breakthrough products in banking. However online banking was an instance where the breakthrough in customer needs was significant and where banks did not move simultaneously or with equal competence. The key events were roughly these. Banks offered some form of 12 © Geoffrey Johns 25 March 2010

- 13. Branding Banks for shareholder value Discussion Draft Section 3.0 electronic banking first to corporate customers and then to the SME market. This was because the customers were valuable and had a strong need. Next, online banking was offered to the personal market. There were economies of scale in development and reduced transaction costs. Development activity was channelled into the personal market. Meanwhile business online banking increasingly seemed out of date and clunky as customers compared it to their personal banking experience. Also business customers had often experience of dealing with more than one bank online and could make comparisons. Banks therefore began to reassign ICT resources to the business market but they were not all able to do this immediately. The illustration below describes the logic of inertia. Business customers are reluctant to The service change their ‘If it aint broke element of a new product is difficult banking don’t fix it’ - people learn to live to evaluate in arrangements with minor defects advance of and work around purchase Often any changes are hard to reverse There is a belief if they don’t work among businesses out that all banks are There can be a the same high opportunity cost in diverting effort from the core business to banking issues There are cogent reasons why customers are reluctant to change banks as shown in the exhibit above. Especially customers are reluctant to shift their transaction accounts as illustrated in the exhibit below. 13 © Geoffrey Johns 25 March 2010

- 14. Branding Banks for shareholder value Discussion Draft Section 3.0 Transaction accounts are important to business people and Transaction very sticky to shift accounts carry with them risks of fraud and default Transaction Day to day cash accounts are flow management An overdraft complicated and is the life blood of Often cash flows facility is highly messy to switch business are unpredictable prized by from bank to bank and volatile – businesses but many businesses tightly controlled are living on the by banks. Without edge one, cash flow control is of vital importance A window of opportunity opened and then closed again as laggard banks caught up but not before some loss of value. The window of opportunity closed again as inertia First movers have A window of many advantages reasserted opportunity even with less than itself opened perfect products On-line / internet It takes a seismic banking has shift to create irresistible appeal opportunity to to many switch customers businesses to new products Business customers are reluctant to change their banking arrangements 14 © Geoffrey Johns 25 March 2010

- 15. Branding Banks for shareholder value Discussion Draft Section 3.0 I see this as an example of a situation favouring customer inertia suddenly becoming more liquid but then refreezing. What loosening of inertia we can expect to see in banking is most likely to come from ICT developments or from financial crises. I see these as always being temporary followed by the reassertion of inertia. Kano analysis and its implications for measurement Around 1980, Noriaki Kanoiv threw a sizeable spanner into the works of measuring satisfaction. In doing so he adds another layer of complexity to my analysis. Perceived satisfaction Neither satisfied nor dissatisfied Actual needs fulfilment 22 Kano distinguished between the varied ways in which different aspects of a product or service cause our satisfaction level to respond in different ways. In the exhibit above the green line shows satisfaction to rise in line with the extent to which we perceive our 15 © Geoffrey Johns 25 March 2010

- 16. Branding Banks for shareholder value Discussion Draft Section 3.0 needs to be met. This can be considered the norm. The more you meet customer needs the happier they are. Perceived satisfaction Actual needs fufilment But in other aspects of the product or service there are some things (the orange line in the exhibit above) that are expected. Customers are not satisfied when they are well performed but become angry when they fail. A while back I worked with a firm that provided pension funds with administrative service such as filing financial statements and also high level tax and investment advice. Failure to lodge financial statements with the supervisory authorities on time could result in fines for the fund trustees. These expected parts of the service if they were unfulfilled would leave their clients highly dissatisfied. Correspondingly those parts of the service that were intended to add value the supported funds and which could have delighted their clients would never get off the ground in their clients’ perceptions. Kano analysis also identifies elements of the product or service that delight customers. They are not expected and are all the more powerful in their effect. As an example there is the relationship manager I knew who drove out to the airport at night to personally deliver a replacement MasterCard to a client about to board a plane. 16 © Geoffrey Johns 25 March 2010

- 17. Branding Banks for shareholder value Discussion Draft Section 3.0 There are some important implications for measuring satisfaction. The first is that you cannot simply add up or average the ratings of a number of attributes where some are expected, some are normal and some ‘delight’, in Kano’s termsv. They are different and in a sense exist on different scales measuring quite different things. Moreover, they are connected. Failure in an expected part of the product or service can lead to a completely different view of performance in a ‘delight’ factor. In effect this means that a group of customers that were distinct in that a bank had failed them on the expected factors when compared to a group of customers where this was not so would have given different ratings to the delight factors. The implication of this is that, for example, to derive customer ratings of attribute importance statistically as opposed to customer stated importance can be misleadingvi. An experimental retro-fit of Kano analysis Sadly, I have never been asked by a client to conduct a Kano analysis. Were I to do this it should ascertain the Kano classification of attributes by a qualitative study, ideally supported by a quantitative study before the main study. However, Gary Lembit (already recognised in Section 2.0 of this series) and I did attempt to assess how Kano analysis might reinterpret an analysis of the business banking sector. I am aware that such a retro-fit after the event is, in multiple ways unsatisfactory but, nevertheless, i found the results interesting and will share them with you here. The attributes listed below are similar to but not identical with those used in the TNS Business Finance Monitor cited in Section 2.0. We then classified them according to Kano analysis as sown in the table below. We used a separate classification for price because, candidly, we didn’t know where to put it. 17 © Geoffrey Johns 25 March 2010

- 18. Branding Banks for shareholder value Discussion Draft Section 3.0 Pricing Expected Satisfiers Delighters a Understands my future needs b Flexible solutions c Recognition for my business d Provides ideas on financial management e Understands my business and history f Outcome adds value to my business g Responds quickly h Knowledge and expertise i Offers sound advice j Helps me avoid risks k Comprehensive product range l Value for money m Prepared to negotiate n Accurate o Access to specialists p Efficient branch network q Latest electronic services r Easy to use systems s Competitive pricing Next, using the results of the work already completed. We created a matrix of scores given for each attribute against statistically derived importance. Note here my earlier caveat concerning statistically derived importance. Here we had no option, of course. The matrix below shows the outcomes. The data points are cloud coded: Pricing Expected Satisfiers Delighters Pricing as might be expected fall into the low performance quadrant but it is also the low importance quadrant. Customers didn’t like it but it did not matter to them that much vii. The high performance / low importance quadrant contain nearly all the ‘expected’ (the satisfier) attributes. As Kano would predict, they were done well but this was not seen as important. Kano would also predict that they would become important if they were done badly but our data didn’t give us a data point to verify this with. 18 © Geoffrey Johns 25 March 2010

- 19. Branding Banks for shareholder value Discussion Draft Section 3.0 a. Understands my f uture LOW PERFORMANCE HIGH PERFORMANCE needs HIGH IMPORTANCE HIGH IMPORTANCE b. Flexible solutions c. Recognition f or my business a b d. Provides ideas on f inancial management e. Understands my c business and history f. Outcome adds value to d e g. my business Responds quickly f h. Knowledge and expertise g i. Of f ers sound advice h j. Helps me avoid risks j i k. Comprehensive product range k l. m. Value f or money Prepared to negotiate mo l n n. o. Accurate Access to specialists p q p. Ef f icient branch r network q. Latest electronic services r. Easy to use systems s. Competitive pricing s LOW PERFORMANCE HIGH PERFORMANCE LOW IMPORTANCE LOW IMPORTANCE 26 In the low performance / high importance quadrant we find most of the ‘delighters’ they unexpected features that come as a nice surprise to the customer. Customers are responding to the survey with – ‘yeah that would be good – I don’t get it though’. Finally, the ‘satisfiers’ the routine things that are part of the expected service fall in the high performance / high importance quadrant. This is doing well at getting the basics right. Overall, while I am fully aware this is by no means a definitive study on the application of Kano, I do believe that it offers a strong suggestion that Kano analysis does have something important to say. It should be deployed more often in banking studies. 19 © Geoffrey Johns 25 March 2010

- 20. Branding Banks for shareholder value Discussion Draft Section 3.0 Lags in management response I have talked about lags in terms of the how people respond to their experiences. Lagsviii also occur in how banks respond to customer disaffection. Chief Executives in banking talk often about it being like changing course on an ocean liner. 2008 New regime operating 2008 2009 Implement most clients experience improvement 2007 2009 prepare inplementation all clients experience improvement 2010 2007 results noticeable in surveys decide what to do 2006 Recognise problem 2006 Problem occurs 2007 2008 2009 2006 2010 The exhibit above is based on my experience of major change programmes in a couple of banks. It is of course illustrative. If anything I think it understates the time lag. It also assumes that the change is successful. This isn’t always the case. Measurable client responsiveness to improvement in the business system lags for several reasons. First, even improvements can have adverse short term consequences. From about 2003 all Australian banks began to improve the incidence of relationship management. Generally smaller portfolios lead to greater customer satisfaction and eventually commitment. However, in the short term several adverse consequences arise: Some customers must be moved to the portfolios of new managers. If the average portfolio size is being reduced from 100 to 80 this means 20% of them. Qualitative research shows customers rarely like this and the results can be expected to show in surveys. 20 © Geoffrey Johns 25 March 2010

- 21. Branding Banks for shareholder value Discussion Draft Section 3.0 Some relationship managers are promoted prematurely and find trouble finding their feet. Some customers can be expected to perceive deterioration in service because of this. Some managers are new hires from outside the bank and they take time to learn how the system works. Some of them may not be good recruitments anyway. The management style among the next tier of managers has to change this transition if quite difficult as senior managers have to become more hands on ix. Times of change often involve new initiatives coming at front line managers from different directions. For example if the Chief Risk Officer wants portfolios cleaned up at the same time as the sort of initiative I have described above the difficult of change management is compounded. Similarly, new front line ICT systems may be introduced. Customers can interpret good intentions unkindly, especially if they tend already to disaffection. Increased intensity of account management meant to strengthen relationships can easily be seen a intended to promote tighter risk control. Going beyond the unintended adverse consequences of improvement there are other reason why change seems slow to achieve results: Customers take a while to become aware that a change has occurred. Customer reviews are often infrequentx. New customer needs are often infrequent so the satisfaction experience by a product / service need being well handled takes a while to come through as does the financial measurement of the sale. Let me conclude this discussion with a vignette from my own experiencexi that illustrates a couple of the point made above. At one time I was closely involved in a major switch towards relationship management. I ensured through direct mail that each customer knew who their relationship manager was, how to contact them and what their role was i.e. to solve customer problem. Meanwhile the branch network was also undergoing change as part of the same overriding initiative. One outcome intended or otherwise was that the branch network was shifting its focus away from small business towards home mortgage lending. It’s amazing what changing objectives and rewards can do in a well-disciplined 21 © Geoffrey Johns 25 March 2010

- 22. Branding Banks for shareholder value Discussion Draft Section 3.0 work force. So newly appointed relationship managers were inundated with complaints, questions and problems connected with branch service over which they had no control. I was inundated by complaints from relationship managers! All of this was pretty much unforeseen and all of it was completely unavoidable within the commonly accepted world view of the organisation. So lags, discontinuity and volatility are natural to the system and we have a new system element to consider. I illustrate this below. The system displays unpredicted lags and volatility Lag Lag Management tampers with the system I am fairly certain that I witnessed more than one purposeful management change that would have succeeded had the corporate suite shown more patience and wisdom. In the words of one top executive I have known. If they (divisional heads) can’t do it we’ll find someone (management consultants) to help them and if they still can’t do we’ll find someone who can! Well good luck! I should say. Because that process takes about three years in my experience and that’s time you never have. 22 © Geoffrey Johns 25 March 2010

- 23. Branding Banks for shareholder value Discussion Draft Section 3.0 The word ‘tampering’ in the exhibit above, I have taken from Edwards Deming xii. To quote him at greater length: We may now formulate two sources of loss from confusion of special causes with common causes of variation: 1. Ascribe a variation or a mistake to a special cause when in fact the cause belongs to the system (common cause); 2. Ascribe a variation or a mistake to the system (common causes) when in fact the cause was special. Over-adjustment is a common example of mistake No. 1. Never doing anything to find a special cause is a common example of mistake No. 2. To my mind this is one of the most profound statements on the subject of management that has ever been made. I have, in this paper described a number of sources of variation in the development of customer perceptions of a bank. How management respond to these in business system design can bring the system under control or can exacerbate the volatility. In responding to perceptual feedback to management change making the wrong choices great damage can be done to brands as I shall discuss in the forthcoming section on brands and bank structures. The exhibit below outlines some of the connections between the models I have used in this paper. Business and personal customers Most of my illustrations above have been taken from business rather than personal banking. That is where the majority of experience has been. I should say that my view is that personal banking displays much the same behaviour except that it is more muted. I can tell you that almost exactly two thirds of business customers (from a Business Finance Monitor sample of over 10,000 respondents) rated the importance of the banking relationship as a 1 or 2 on a scale of 1to 5 where 1 means very important. I 23 © Geoffrey Johns 25 March 2010

- 24. Branding Banks for shareholder value Discussion Draft Section 3.0 don’t know what the figure for personal banking is but I’d guess slightly lower. The comments I have made above I think would also be true for personal bank customers but perhaps somewhat muted. Where should we look for signs of sea change? I have argued that management failure to detect improvement in response to investment can lead to vacillation. What then can be done? First measuring process at a detailed level helps. Also it helps to measure activity and responses rather than only financial outcomes. For the Conversion Model I should look at three key transitions illustrated below. Customers Non- customers Committed Uncommitted Open Unavailable 3 Entrenched Average Weakly Strongly Shallow Convertible Available Ambivalent committed committed unavailable unavailable 1 2 I would expect to see early signs coming in roughly the sequence shown. It doesn’t have to be in that order. But you do need to dig for signs quite deep in the detail of whatever data you have. Next I should look at the attitudinal group we identified in section 2.0 that we then called leaders. Their perceptions of change may be more acute than the mass of customers. Therefore you might see changes in their commitment presaging that of customers as a whole. This follows a line of thinking that I was introduce to by Eric von Hippelxiii In Appendix 1, I reproduce my 2006 outline of how to deploy von Hippel’s ideas in research for innovation. They apply as much to understanding response to brand. 24 © Geoffrey Johns 25 March 2010

- 25. Branding Banks for shareholder value Discussion Draft Section 3.0 The role of brand What then is the role of brand in customer perceptions? A major theme of this paper has been that perceptions are strongly based on personal experience. Marketing communications are seen as have a weaker role. I shall discuss how such communication can be made effective later in this series of papers. BRAND Customer expectations The objective Customer quality of the perception of experience the experience I want to conclude this present section, however, by suggesting that a key role of banking brands is to modify the customer’s interpretation of experience. This is achieved by a cyclical process through which expectations themselves are modified. The secret of life is honesty and fair dealing; if you can fake that, you've got it made. Groucho Marx But, alas, contrary to the view of Mr Marx, it can’t be faked. 25 © Geoffrey Johns 25 March 2010

- 26. Branding Banks for shareholder value Discussion Draft Section 3.0 A tentative overview of this section Primary causality Positive Responsive and feedback People create logic to justify the outcome of experience Marketing communications flexible Media comment They value me Trusted advice Helpful and as a business supportive customer Contradiction Own Confirmation filtered experience sought Helps Understands my businesses business achieve their reinterpreted business goals Information It takes powerful experiences to change beliefs You are a danger to my business You are There are hurdles to changing beliefs Six steps to disaffection exploiting me Beliefs I don’t trust you Reframing feedback Perceived satisfaction I can’t rely on you Attitudes (Reusable decisions) You don’t Could reinforce good and mitigate bad experience value my Needs business You don’t Contextualisation know me feedback Actual needs fufilment Expectations Choices Realignment feedback Experience (feedback) There are cogent reason for inertia Minds are changed Outcomes Business customers are reluctant to change BRAND The service element of a new their ‘If it aint broke don’t fix it’ - Measurement is hard product is banking people learn to difficult to arrangement live with minor evaluate in advance of s defects and work around Customer expectations purchase Often any There is a belief The objective Customer changes are hard among quality of the perception of to reverse if they businesses that don’t work out all banks are the experience the experience There can be a high opportunity same cost in diverting effort from the core business to banking issues 2008 New regime operating 2008 2009 Implement most clients experience improvement 2007 2009 prepare inplementation all clients experience improvement 2010 2007 results noticeable in surveys decide what to do 2006 Recognise problem 2006 Inertia is overcome Problem occurs 2007 2008 2009 2006 2010 The bank responds A brand that conditions experience..... The system displays unpredicted lags and volatility But evidence can be inconclusive Lag Lag Customers Non- customers Committed Uncommitted Open Unavailable 3 Entrenched Average Weakly Strongly Shallow Convertible Available Ambivalent committed committed unavailable unavailable 1 2 Management tampers with the Leading to floundering system Summary and conclusions A main theme of this series of papers is that branding banks can only be attempted through a consistent pattern of decisions taken throughout the organisation at a process level of detail. In the first paper in this series I argued that: shareholder value should be the goal of the system; process design should take into account measurement of how changes in customer perception affect shareholder value; and this can occur through disciplined process design in a systems context. 26 © Geoffrey Johns 25 March 2010

- 27. Branding Banks for shareholder value Discussion Draft Section 3.0 In the second paper, I argued that: customer’s should be managed as ‘segments of one’; customer behaviour, commitment and value should be independently measured by systematic but flexible segmentation strategies; commitment, as defined by the Conversion Model™, is the primary measure of customer satisfaction that should be used by a bank; In this paper, I describe how: personal experience if the main driver of perception of a bank; customer banking behaviour is affected by discontinuities in their perceptions that are sometimes difficult to understand, measure and predict; and these discontinuities are caused by breaking inertia in the mindsets of customers. management response can easily allow the natural variation in perceptions of the brand; My conclusion is that this kind of issue is inevitably part of the nature of banking unless deeply held mental models are changed. Part of the purpose of this series of papers is to contribute towards that change. In the next paper in this series I shall focus on brand itself and why effective branding is essential for banks. 27 © Geoffrey Johns 25 March 2010

- 28. Branding Banks for shareholder value Discussion Draft Section 3.0 Appendix 1 Research for Innovation Geoffrey Johns January 2003 "Business has only two basic functions: marketing and innovation. Marketing and innovation produce results. All the rest are costs." Peter Drucker Does Market Research have a Part to Play in Innovation? We often hear of successful product innovations that took place without any market research. Akio Morita, The Chairman of Sony, is quoted as saying that the Walkman would never have been launched had they relied on market research. Probably, this would go for many other product innovations from fax machines to mobile 'phones. Nobody saw the need until they were out there in the market. The magazine "Fast Company" tells the stories of many firms with "skunk works" or "chief ideas officers". Mostly, they work towards innovation from an understanding of the developing capabilities of technology. Firms try to generate as many viable projects as possible while limiting the role of users in development to the sifting and evaluation technology process. Indeed this is how the market research is traditionally seen in the product development cycle. The exhibit below sets out a traditional view of the product development cycle. Users are traditionally involved in the testing stage. Once a prototype has been developed, potential users evaluate it. This has some sense to it. It is difficult, in many cases, for existing users to predict how they will react to circumstances that are barely on the radar screen. For example, 1970s users of landline telephones would not readily have predicted text messaging. The product development OPPORTUNITY IDENTIFICATION cycle Market definition (Source: Urban and Hauser) Idea generation Professor Eric Von Hippel‟s DESIGN commentary Consumer measurement Perceptual mapping Product positioning TESTING Forecast sales Advertising and Marketing mix product testing Pretest market forecasting Test marketing INTRODUCTION Launch planning Tracking the launch Innovative Innovative Traditional PROFIT customer MANAGEMENT customer customer involvement Decision support involvement involvement system Market response analysis Innovation at maturity Profit portfolio Management 28 © Geoffrey Johns 25 March 2010

- 29. Branding Banks for shareholder value Discussion Draft Section 3.0 How then can market research help managers in the innovation process? The answer, or part of the answer, lies in lead user research. Lead User Research Lead users (sometimes called "lead steers" because they are the people who both predict and guide the movement of the "herd lead the followers towards new concepts and ways of meeting their needs. Lead User research was pioneered by Eric von Hippel, Professor of Technology at the MIT Sloan School of Management in 1986. I have developed this work for use as a market research tool that offers a systematic approach to innovation. This is not the only approach for every business. Some businesses will launch many products and invest in developing the ones that work. Others will watch the success of smaller and nimbler competitors and buy the ones that succeed. Still others will bet the business on a single bright idea. Having said that, the approach we describe in this paper should be considered by many businesses. This is especially of businesses that have a powerful brand that must be nurtured. They have less scope for constant experimentation. It is also true of complex, multifaceted businesses where the management functions of control and coordination make a freewheeling corporate culture harder to integrate. Who are lead users and why do they matter? The Exhibit below is based on Everett Rogers' conceptual illustration of the diffusion of an innovation in the marketplace (Diffusion of Innovations 1995). To Rogers' diffusion segments I have added Von Hippel's concept of Lead Users. It is important to understand that Lead Users differ from Early Adopters in important ways. An Early Adopted will see an innovation and think "Yes, that's for me!" A lead User, however, has already begun to develop the product in his or her own mind. Indeed often they will have developed a prototype or perhaps a "work around" solution to their needs. The key fact about a Lead User is that their need for a solution is so great that they have already begun to imagine solutions. They have "one foot in the future" already. Note: it is the need that matters more than they specific solution. But it should be a need that can be articulated so strongly that the passage towards the solution becomes almost seamless. 29 © Geoffrey Johns 25 March 2010

- 30. Branding Banks for shareholder value Discussion Draft Section 3.0 Early adopters Mass market Adoption (followers) Laggards Lead users Time Lead users matter for two reasons: What they want today Early Adopters may want tomorrow and the Mass Market the day after; and They can help us build a viable solution. Often we can survey the traditional market broadly and find that a big majority are quite happy with what they have now. The trick is to home in on those that demand something more. Why not ask all users what they need? Most importantly because they don't know. They great majority of people cannot imagine the products and services that they will require in the future. In research studies, people will mostly try to be helpful. However, they will think within the box of what they get now. If they articulate requirements at all it is along the lines of - the same but faster, cheaper, better. That road leads to commoditisation and trench warfare against competitors trying their hardest to do pretty much the same. Shortly, we will describe how to discover Lead Users and deploy their skill and understanding. Before this, however, we must introduce the concept of "commitment" based on TNS's proprietary methodology The Conversion Model™. 30 © Geoffrey Johns 25 March 2010

- 31. Branding Banks for shareholder value Discussion Draft Section 3.0 Introducing Commitment Segments into the Innovation Research Model Do Lead Users tell the whole story? No, not if we want to understand the rate of take up of the new offering. Understanding the needs of Lead Users can help us design a product. However, financial evaluation requires that we make some estimate of the spread from the small number of Lead Users to Early Adopters and from them to the Mass Market. The rate of take up is crucial. Rogers' stylised adoption curve shown above is only a generalisation of the experience of some typical markets. In any given case we know little about how take up might spread from Lead Users to Early Adopters and from them to the Mass Market. We need to understand the responses of committed and uncommitted customers to measure and manage take up. Commitment is a concept used in the TNS Conversion Model. This is a methodology used to measure the shift in customers between alternative brands and products. In this model a committed customer is one that: is satisfied with the brand they use at present; does not rate alternative brands highly; show no ambivalence between brands; and is involved in the decision, in that it matters to them which brand to choose. The exhibit below illustrates the segments into which we group a brand's customers and non-customers according to their commitment. While we usually focus on brands we have also analysed other aspects of a category, for example, various distribution channels. Two questions are relevant here. If users want the innovation, do they want it from your brand? And How quickly will take up spread from more to less committed customers. Customers Committed - Committed - Uncommitted - Uncommitted entenched average shallow convertible Weakly Strongly Available Ambivalent unavailable unavailable Non customers 31 © Geoffrey Johns 25 March 2010

- 32. Branding Banks for shareholder value Discussion Draft Section 3.0 A committed customer is more likely to: stay with the brand longer; be less price sensitive; buy more of the brand's product / service set; and be more aware of and give more consideration to the brands marketing communications. For our present purpose, a committed customer is more likely to accept an innovative product. In the present context, therefore committed customers are more likely to accept the new product offering. Moreover, they are more likely to accept the new product offering under the brand under consideration. We need to include both high committed and uncommitted customers in our focus groups. Committed customers are likely to be early adopters of the proposed products but may be unrepresentative of other customers. By using the Conversion Model to segment existing and potential customers by their level of commitment, we can better predict rates of take up. Committed followers will Committed be influenced by If this group accepts the commited leaders. The concept they will be the rate of penetration will earliest adopters depend on the leaders' span of influence Uncommitted Acceptance by committed leaders will allow some penetration Uncommitted followers of uncommitted leaders. are likely to be laggards The rate of penetration will depend on the strength of the offering Followers Leaders 32 © Geoffrey Johns 25 March 2010

- 33. Branding Banks for shareholder value Discussion Draft Section 3.0 Each of the groups illustrated above will have a different rate of "take up". Each will be influenced by the others. To get a better view of the rate of take up, we need to understand the unique perceptions and behaviour of each. Digging deeper into rates of take-up I have developed a conceptual model to help us organise research information about the commitment segments. The framework is shown in the exhibit below. Attractors Triggers Behaviour Enablers Repellers Attractors are factors that draw users towards an innovation. They can include, for example: Superiority over existing offerings. Fit with lifestyle, aspirations, self-image. Repellers are factors that drive users away from an offering. They can include, for example: Perceived risk. Switching costs, including time, money and perceptions of sunk costs. Triggers are factors that can prompt adoption. They can include for example, for example: Opportunities to trial. 33 © Geoffrey Johns 25 March 2010

- 34. Branding Banks for shareholder value Discussion Draft Section 3.0 Opportunities to observe successful users. Enablers are things that must be available to the potential user for them to adopt the innovation. For, example, in the case of on-line banking, these include ready access to an Internet connected PC. Research into this adoption model fleshes out the drivers behind the commitment segments and allows take up rates to be modelled more effectively. The forces we describe above are not necessarily objective reality. We are concerned only with the users perception of them. The search for Lead Users How do we select the sample? There is no one answer for every study. We need to redefine the selection criteria a little differently each time. As a guide, however, Lead Users meet the following criteria. They are: Successful. Respected by their peers. Opinion formers. Good networkers. Sophisticated users of products in the category in question. Early adopters of new products. able to think outside the square. people who seem to have one foot in the future already. demanding and driving clients. And, for business users. also highly in touch with the needs of their own clients (where they are businesses). committed to their own success and the growth of their businesses. people who are building an organisation rather than just running a business. But, above all else, what we are truly seeking are users who: Have needs that foreshadow general demand - that is to say they are pushing the envelope of what the existing products offer them. Expect to get high benefit from solving those needs so they are inclined to invest their time, energy and money in innovative solutions. “It was something I needed at my work” Tim Berners-Lee 34 © Geoffrey Johns 25 March 2010