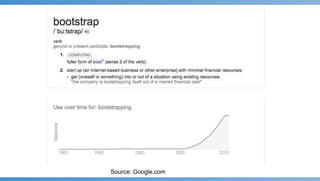

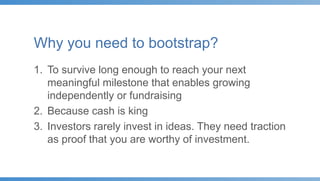

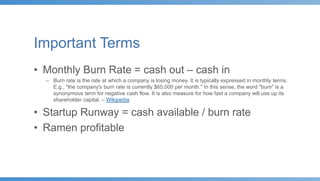

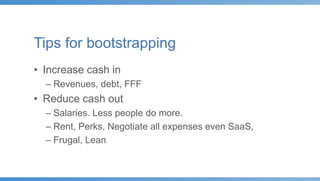

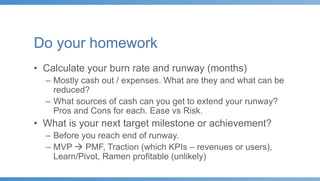

This document summarizes a presentation about bootstrapping startups. It discusses what bootstrapping means, why founders may need to bootstrap, when they can stop bootstrapping, important related terms like burn rate and runway, tips for bootstrapping like increasing revenue and reducing expenses, and the importance of doing homework like calculating burn rate and planning milestones to extend the startup's runway before fundraising. The presenter is the CEO of BasharSoft, a company he co-founded and bootstrapped for several years before raising a Series A round.