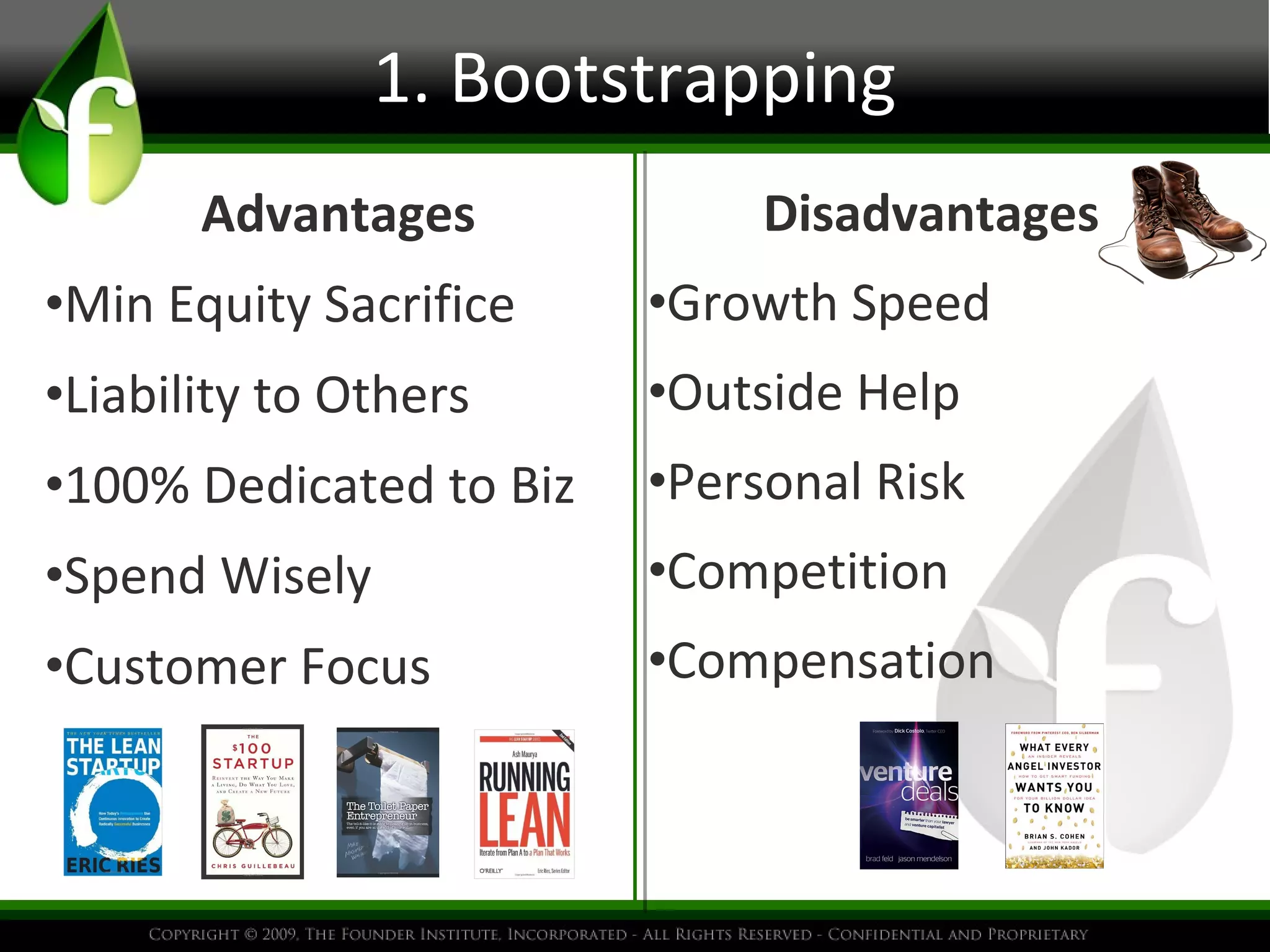

This document discusses various methods for bootstrapping and fundraising for a startup, including bootstrapping, friends and family funding, angel investors, venture capitalists, and banks. It provides advantages and disadvantages of bootstrapping, requirements for pitching to angels like projections and an MVP, differences between angels and VCs, and the importance of establishing milestones and an exit strategy. Contact information is provided for further resources.