The document outlines 10 principles of the Bogleheads investment philosophy:

1. Develop a plan by living below your means, having a budget and savings plan, and writing down your investment policy statement.

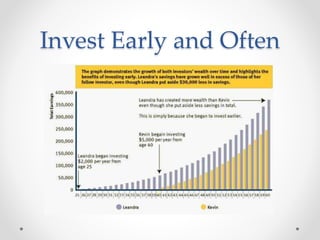

2. Invest early and often to take advantage of compound growth.

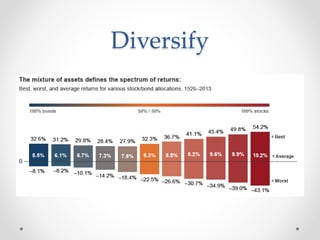

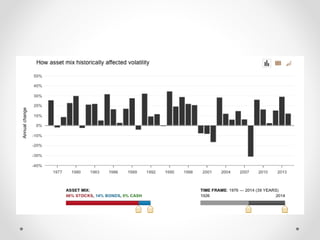

3. Never bear too much or too little risk by finding an asset allocation that suits your risk tolerance.

4. Diversify your investments across asset classes.

5. Never try to time the market which most investors do poorly at.

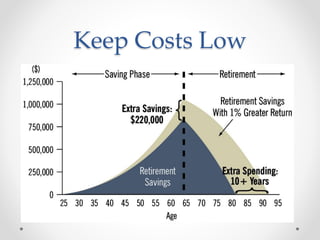

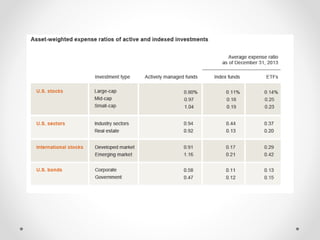

6. Use low-cost index funds to participate in market growth while avoiding excessive fees and taxes.

7. Keep costs low by choosing low-expense investments.

8