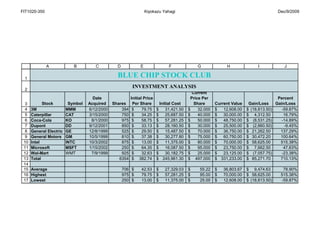

This document is an investment analysis of stocks in the Blue Chip Stock Club portfolio from December 9, 2009. It shows the initial price paid for each of 13 stocks, the current price, the dollar and percentage gain or loss. Overall, the portfolio had gained $85,271.70 for a 710.13% return. On average, stocks had gained $9,474.63 or 78.9%. The highest percentage gainer was Intel at 515.38% while the biggest loser was 3M at -59.87%.