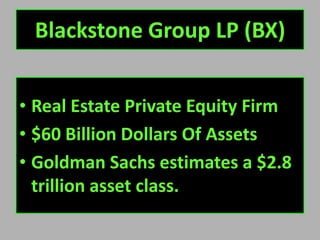

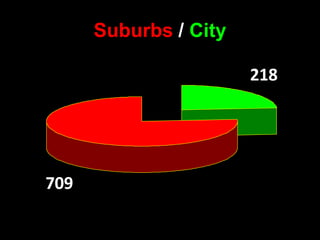

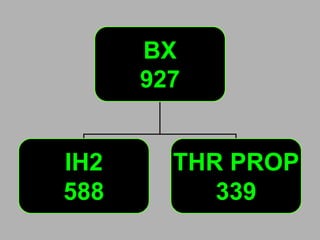

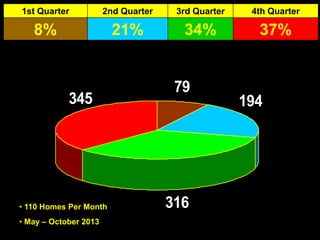

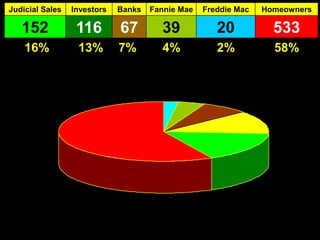

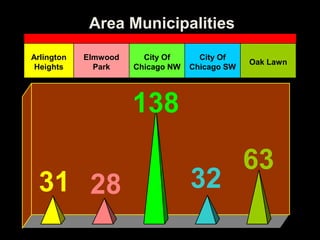

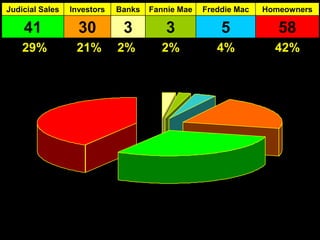

The document summarizes a Blackstone Group report on property acquisitions in Cook County between November 2012 and October 2013. It shows that Blackstone acquired 927 properties totaling $588 million, with the majority (58%) acquired from homeowners. It also lists the top US metropolitan areas and Illinois municipalities that were targets for acquisitions and provides data on acquisitions by quarter and area. The report considers options for an exit strategy and ways the public can support fighting illegal evictions.