Embed presentation

Download to read offline

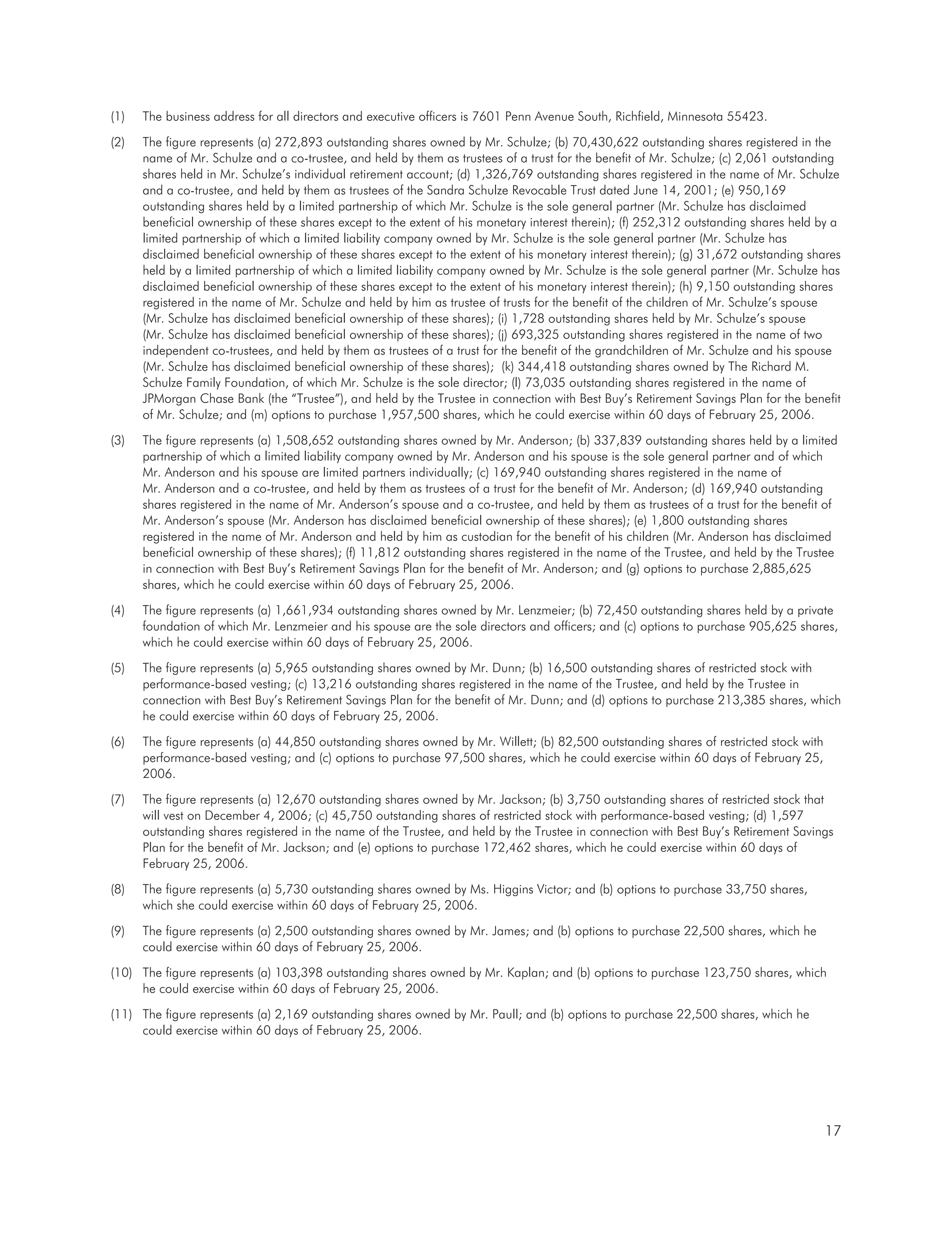

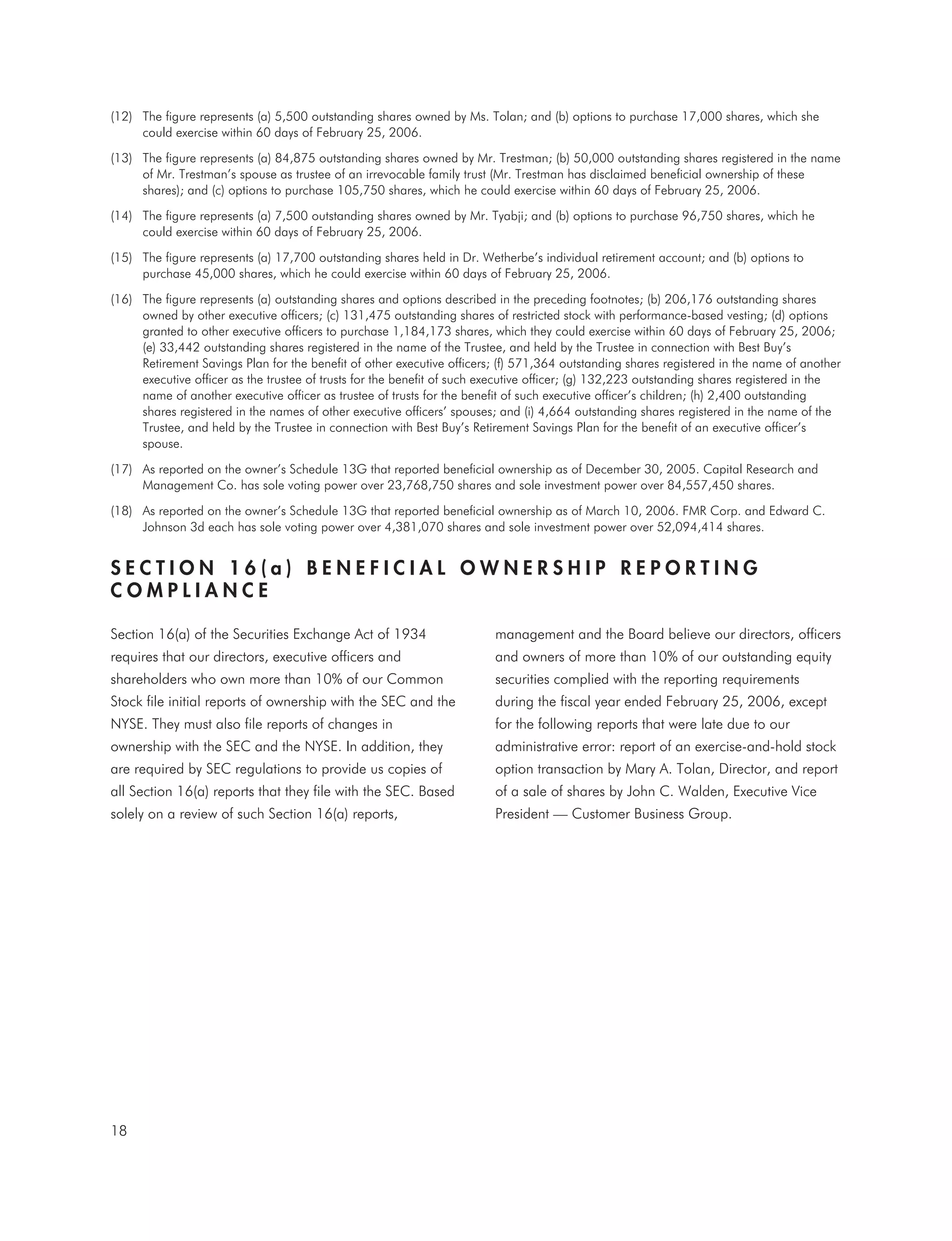

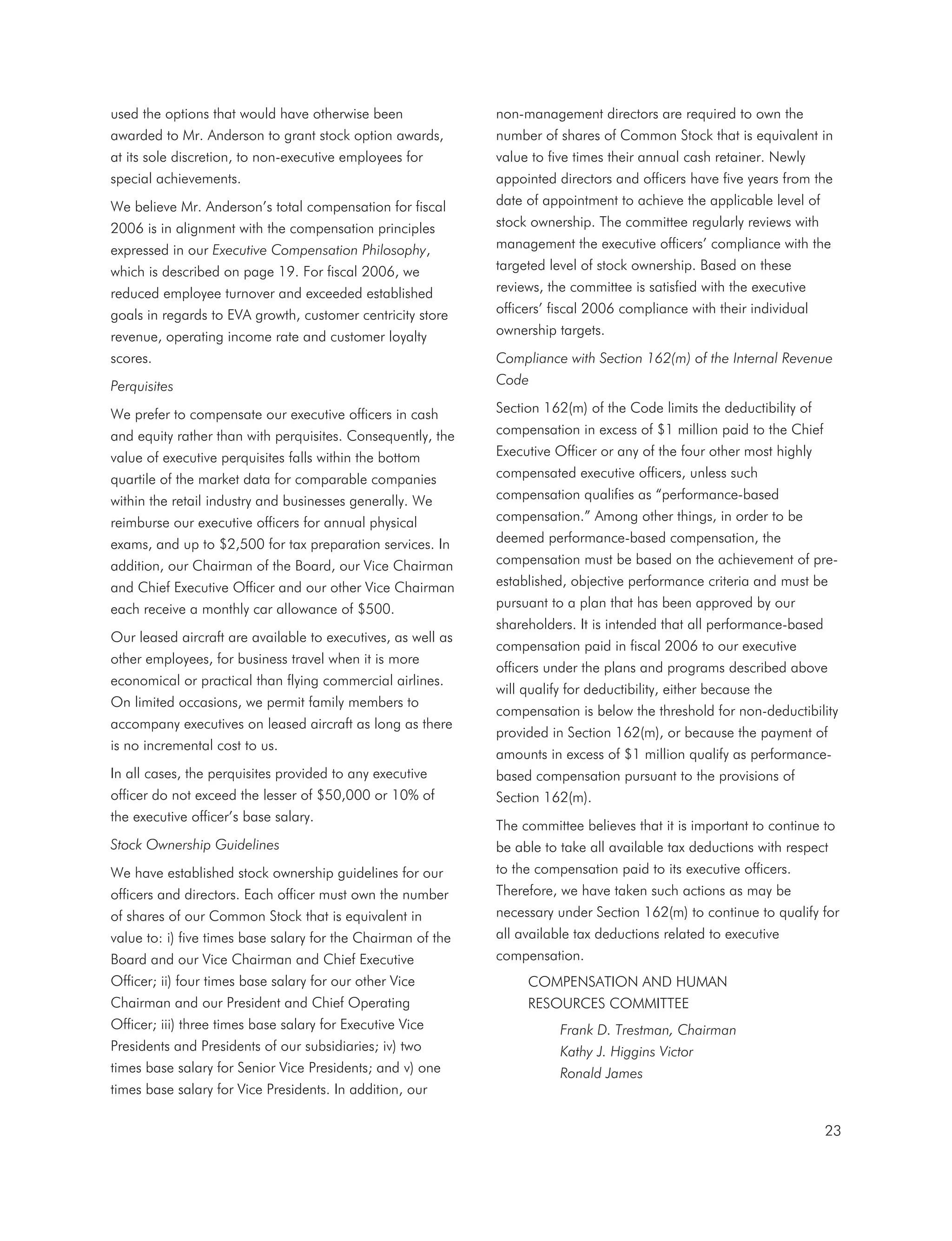

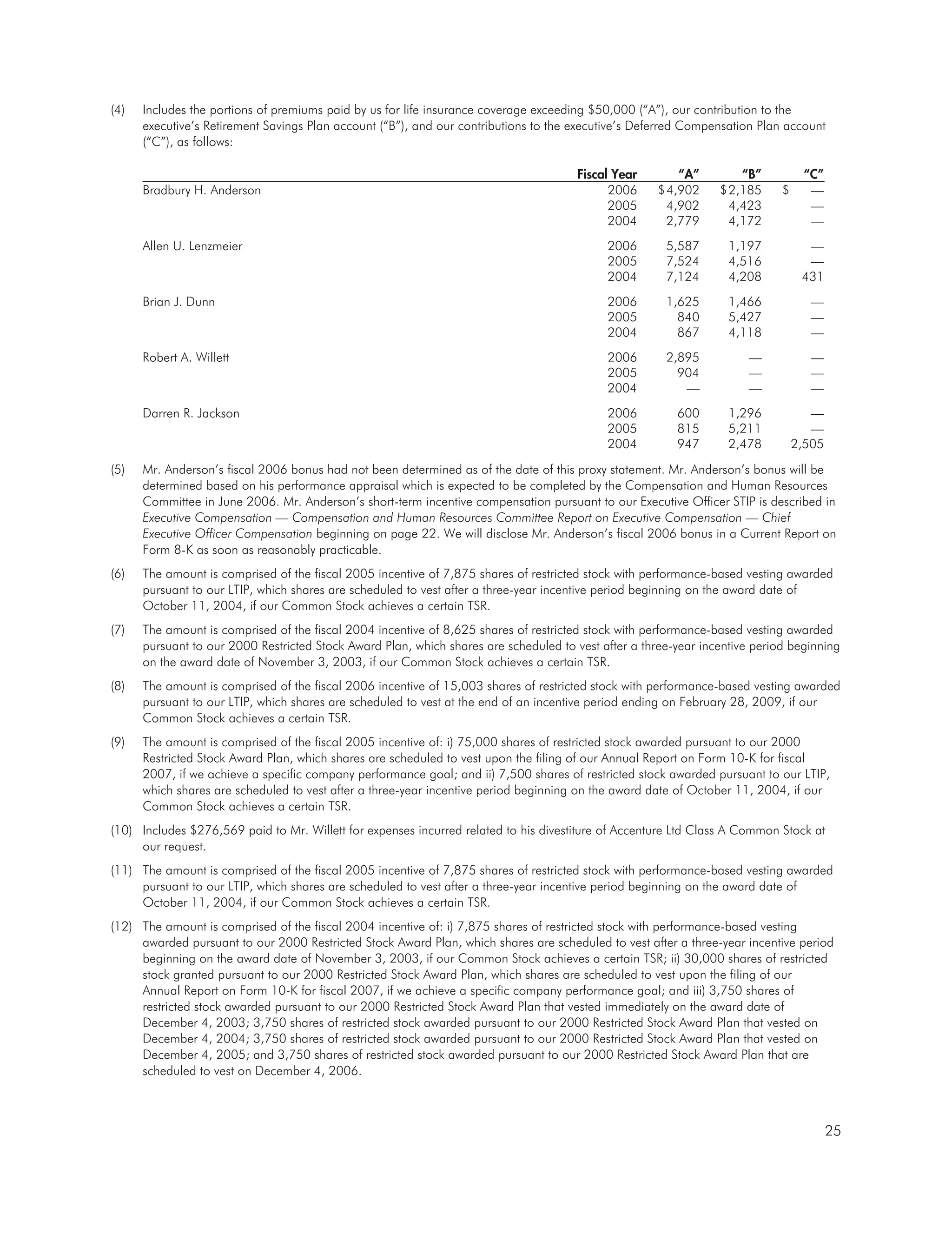

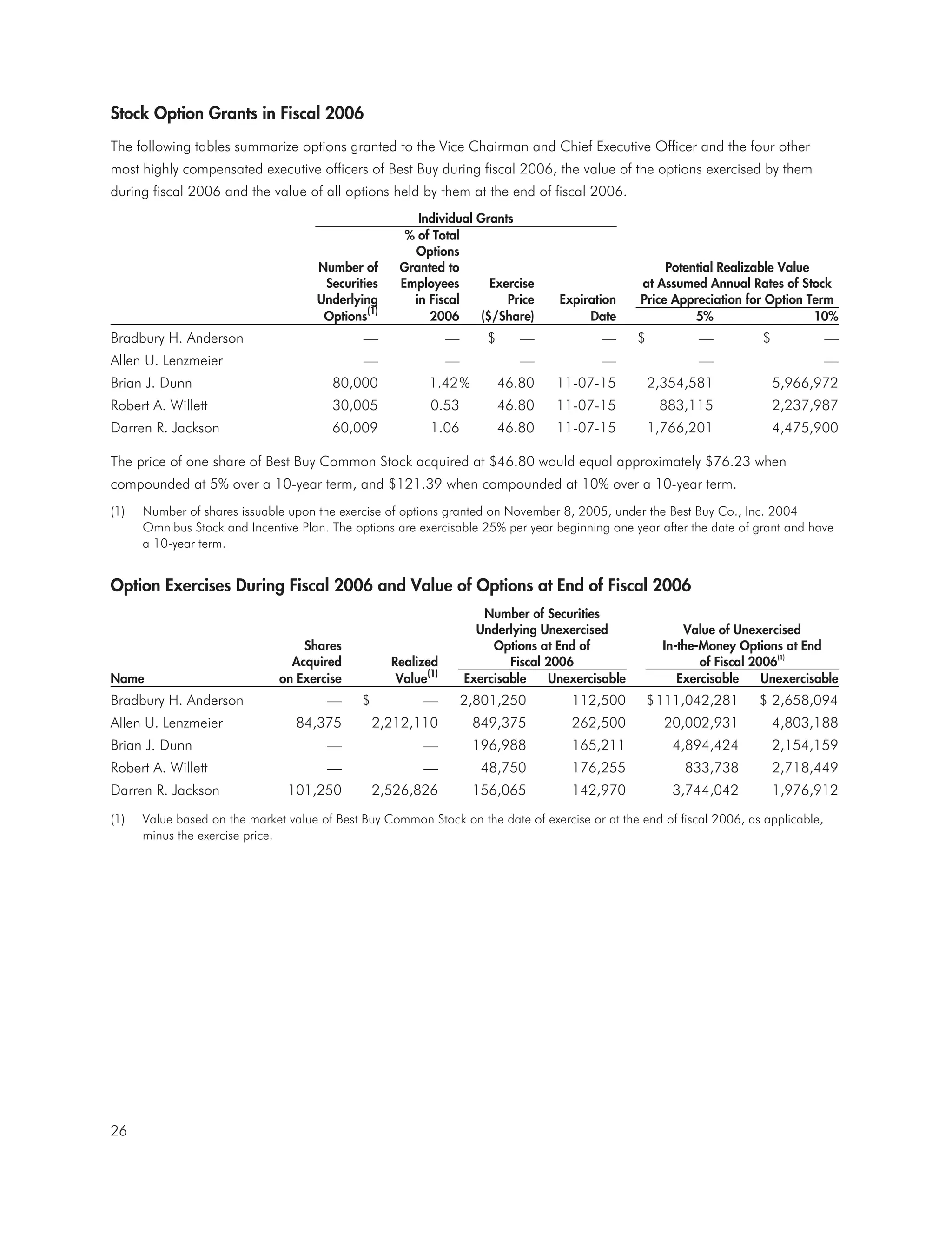

This document announces the 2006 Regular Meeting of Shareholders of Best Buy Co., Inc. to be held on June 21, 2006 at their corporate campus. The meeting will address three items of business: 1) Electing four Class 1 directors to serve two-year terms on the board, 2) Ratifying the appointment of Deloitte & Touche LLP as the company's independent registered public accounting firm for the current fiscal year, and 3) Any other business that may properly come before the meeting. Shareholders as of April 24, 2006 are eligible to vote, and may do so by proxy via mail, phone or internet in advance of the meeting or in person at the meeting.