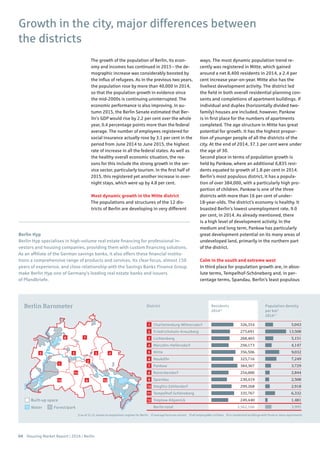

1) Berlin's housing market is still catching up to other major German cities, with lower purchasing power and asking rents, though the gap is narrowing. Rents in Berlin rose 5.1% in the first three quarters of 2015.

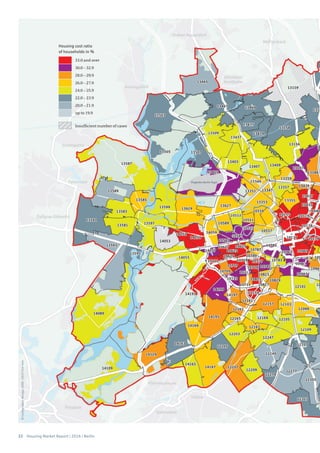

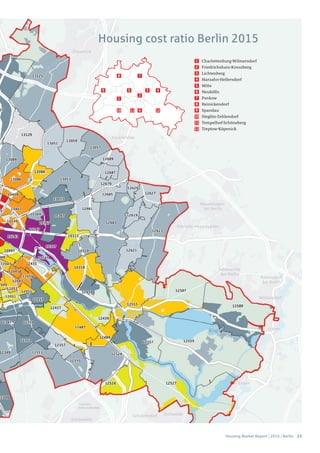

2) Housing costs take a large portion of household budgets in affluent areas of Berlin with large, expensive apartments, while lower-income neighborhoods generally have smaller, cheaper units.

3) The report finds double-digit price growth for condominiums and apartment buildings in Berlin, with increasing condominium supply from new developments but few apartment building owners willing to sell.

![72 Housing Market Report | 2016 | Berlin

10178 Hackescher Markt Mitte 13.70

10117 Unter den Linden Mitte 13.38

ots amer lat itte

[A] City

u ig irc lat arlotten urg ilmers

i toria uise lat em el of c ne erg

10787 Zoo Mitte 9.63

[B] City West

Koll it lat an o

avigny lat arlotten urg ilmers

ayerisc er lat em el of c ne erg

[C] Middle-class inner city areas

10783 Bülowbogen Tempelhof-Schöneberg 9.62

12051 Hermannstraße South Neukölln 9.45

10553 Beusselstraße Mitte 8.94

[D] Modest inner-city areas

c il ornstra e teglit e len orf

12555 Köpenick Treptow-Köpenick 8.50

13507 Alt-Tegel Reinickendorf 8.07

[E] Subdistrict centres

13597 Altstadt/Stresow Spandau 6.68

12057 Sonnenallee South Neukölln 6.74

itterfel er tra e ar a n ellers orf

[F] Mixed residential/commercial areas

annsee teglit e len orf

ro nau einic en orf

12589 Rahnsdorf Treptow-Köpenick 8.39

[G] Upmarket peripheral locations

r isc es iertel ast einic en orf

13593 Heerstr./Wilhelmstr. Spandau 5.76

rensfel e ar a n ellers orf

[H] Modest peripheral locations

1) median asking rent excl. utilities, all market segments in €/m2

/month

Area District Asking rent1)

Examples of locations and rent levels

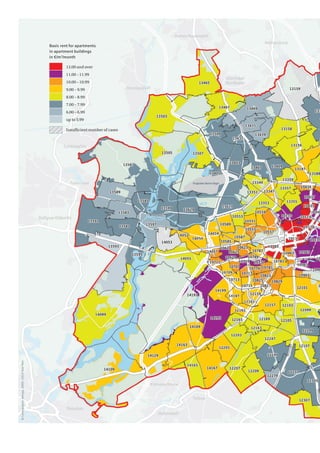

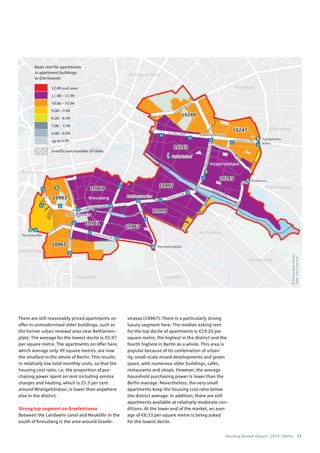

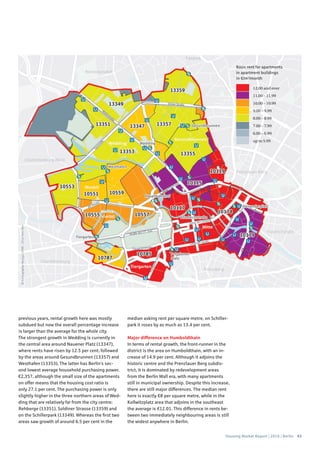

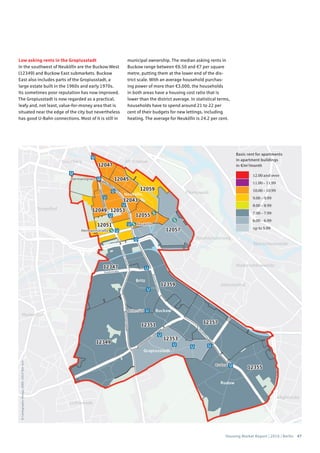

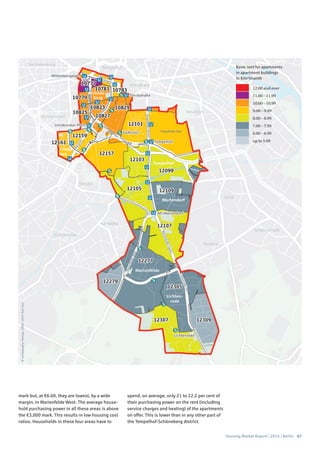

The map shows the levels of asking rents in the

190 postcode areas in Berlin, illustrating the dif-

ferences between the city centre and the periph-

ery. However, distance from the centre is not the

only criterion affecting rents. In fact, many areas

of Berlin can rather be classified in specific types,

with characteristic levels of rent, types of prop-

erty and environmental qualities.

The centre of Berlin [A] is, by a wide margin, at

the peak of the rental scale. What counts here are

the famous addresses, fast and easy access to im-

portant political, economic and cultural institu-

tions, and excellent transport links.

City West [B] around Kurfürstendamm is a focus

of shopping and services, situated close to the

Tiergarten park and with good links to the city

centre. Some parts are affected by traffic though,

or dominated by post-war buildings.

Middle-class inner city areas [C] predominantly

have generously sized, lavishly refurbished Impe-

rial era buildings. Some of them are more expen-

sive than City West. The residential environment

is lively but also well maintained.

Modest inner-city areas [D] are dominated by ba-

sic older and post-war buildings. Some of them

are badly affected by traffic and industry. Because

of the central location, the rents per square metre

are no longer low but the apartments are often

small, which limits the total housing cost.

The subdistrict centres [E] are akin to the centres

of smaller cities. They have good local amenities

and transport connections and are very densely

developed in parts, although they are often close

to green recreational areas.

In mixed areas outside the inner city [F], resi-

dential and commercial/industrial properties

are often interspersed. The surroundings are

sometimes austere but some residents enjoy liv-

ing close to their places of work and the calm at

weekends.

Upmarket peripheral areas [G] mainly comprise

“villas” and detached houses, although there

are also properties to rent close to forests, riv-

ers and lakes. Those with no objection to living

a long distance from the centre can enjoy a very

high quality of life at moderate cost.

Modest peripheral locations [H] comprise high-

rise buildings from the decades after the war.

Some of them have less than adequate trans-

port connections and local amenities. For these

reasons, the housing cost burden is the lowest

in Berlin.

Rental value map: Berlin’s price levels and location

profiles at a glance](https://image.slidesharecdn.com/berlinmarket-160511084913/85/Berlin-market-by-CBRE-73-320.jpg)