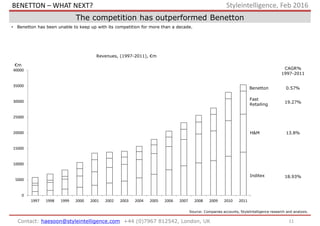

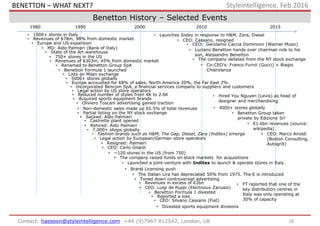

Benetton was hugely successful in the 1970s and 1980s but has struggled since the mid-1990s as competitors adopted fast fashion strategies. The report analyzes Benetton's current position and makes recommendations in three key areas: strategy, marketing, and technology. It suggests integrating marketing and strategy by hiring a non-Italian and non-male CEO to better reflect its diversity messaging. For marketing, it proposes collaborating with celebrities on capsule collections and identifying niche Italian trends. In technology, it recommends advancing fabric technologies like antibacterial fabrics.