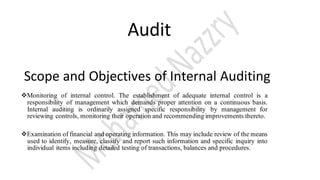

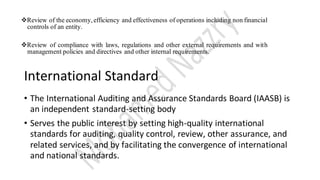

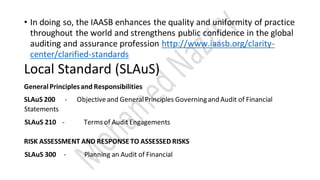

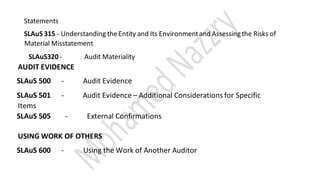

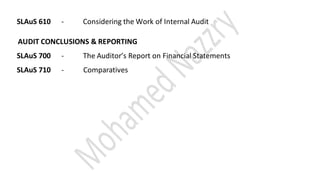

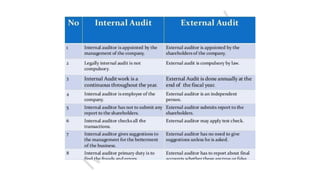

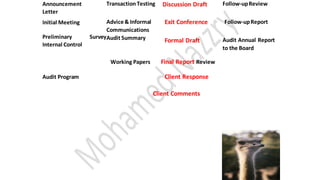

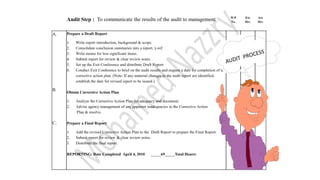

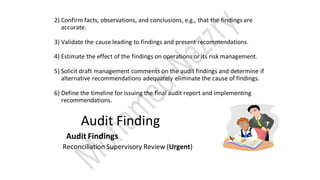

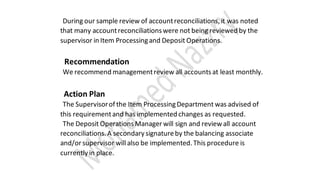

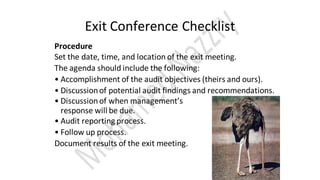

The document discusses the scope and objectives of internal auditing, which includes monitoring internal controls, examining financial and operating information, reviewing the economy, efficiency and effectiveness of operations, and reviewing compliance with laws, regulations, policies, and directives. It also discusses international and local auditing standards, the audit process, planning an audit, conducting an audit exit conference, drafting and issuing the audit report, obtaining client responses, and following up after an audit is completed. The auditor aims to evaluate controls, ensure compliance, and recommend improvements through thorough planning, examination of documentation and processes, and open communication with clients.