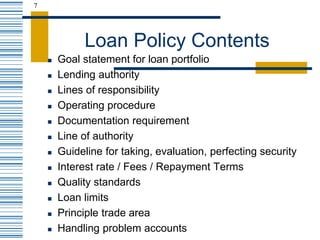

Bank lending is the primary function of banks, providing loans to customers to fund consumption, investment, and government activities. Loans are a major source of bank profit but also carry risk depending on borrower creditworthiness. Banks establish lending policies to guide individual loan decisions and shape their overall loan portfolios, outlining goals, authority levels, procedures, documentation standards, interest rates, and handling of problem accounts. Regulators monitor bank loan portfolios and policies to ensure sound underwriting and quality standards.