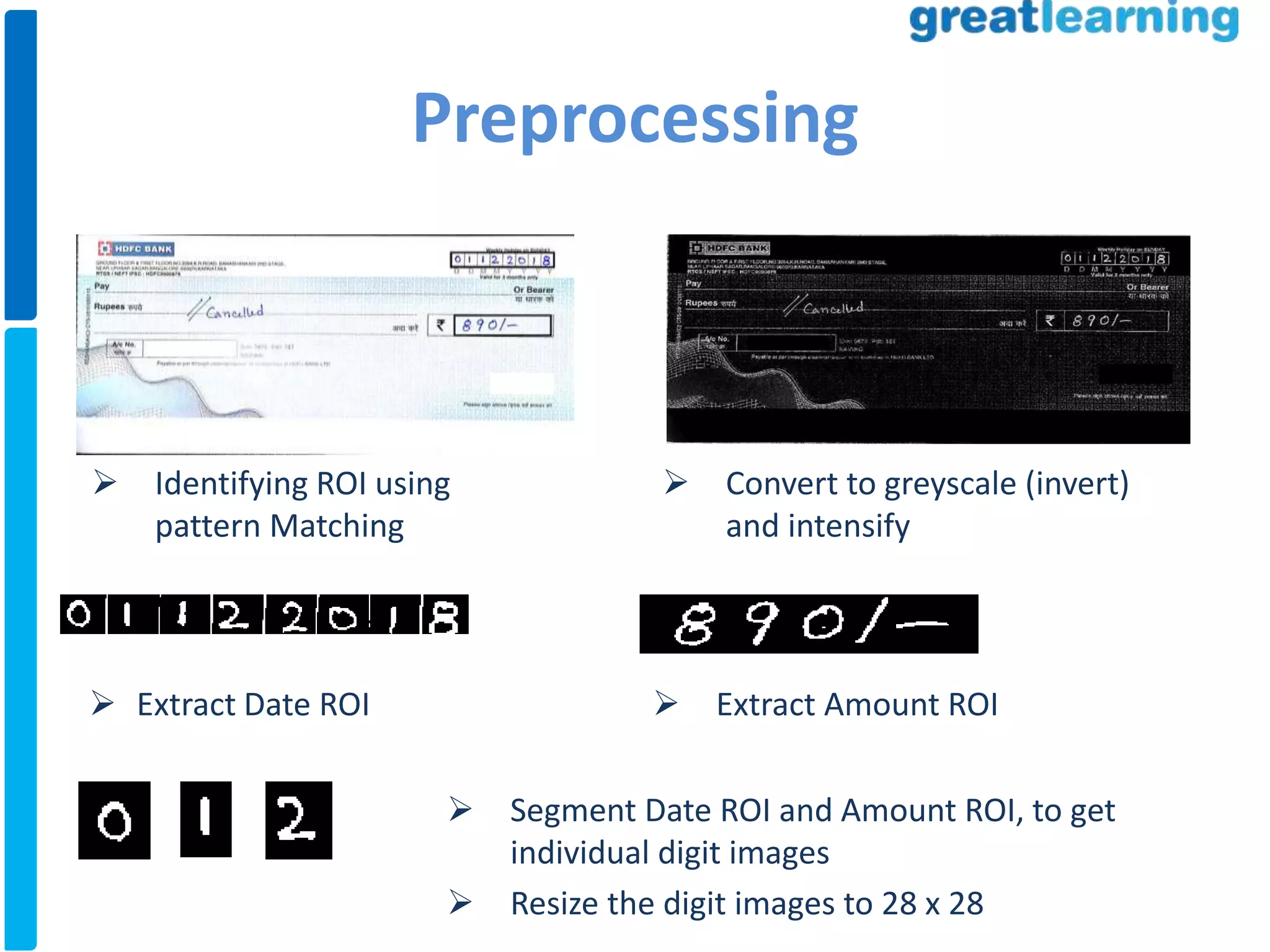

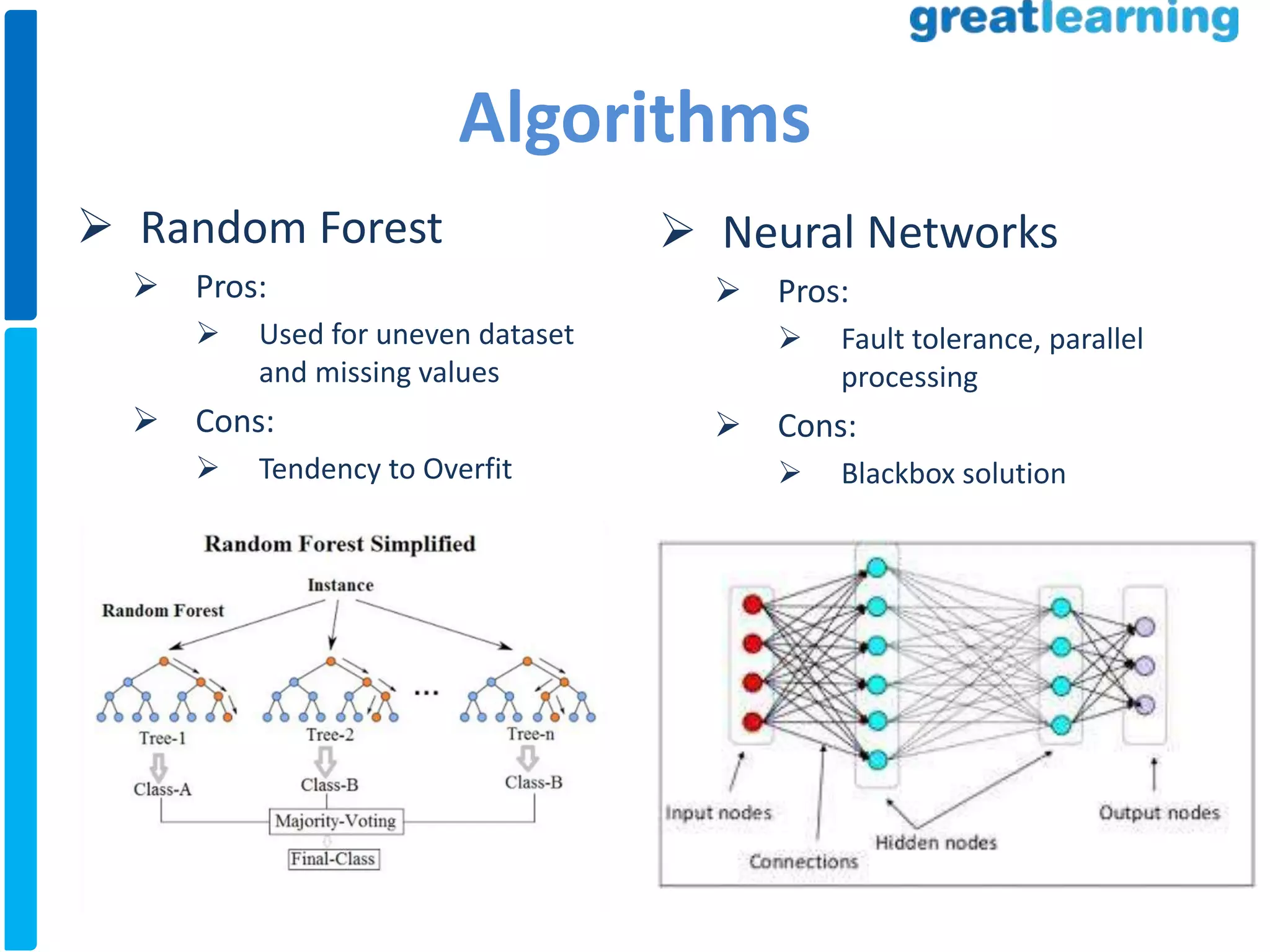

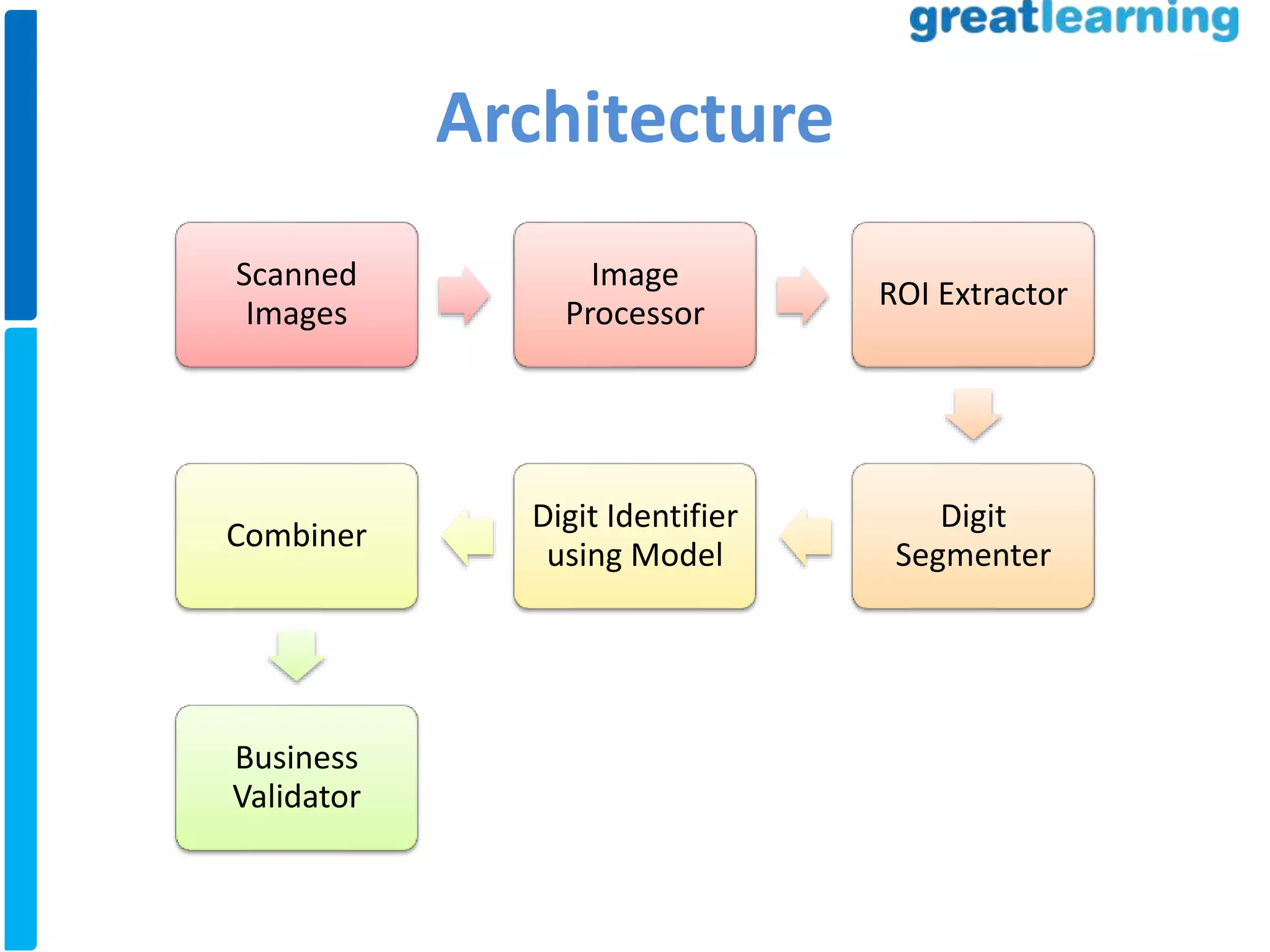

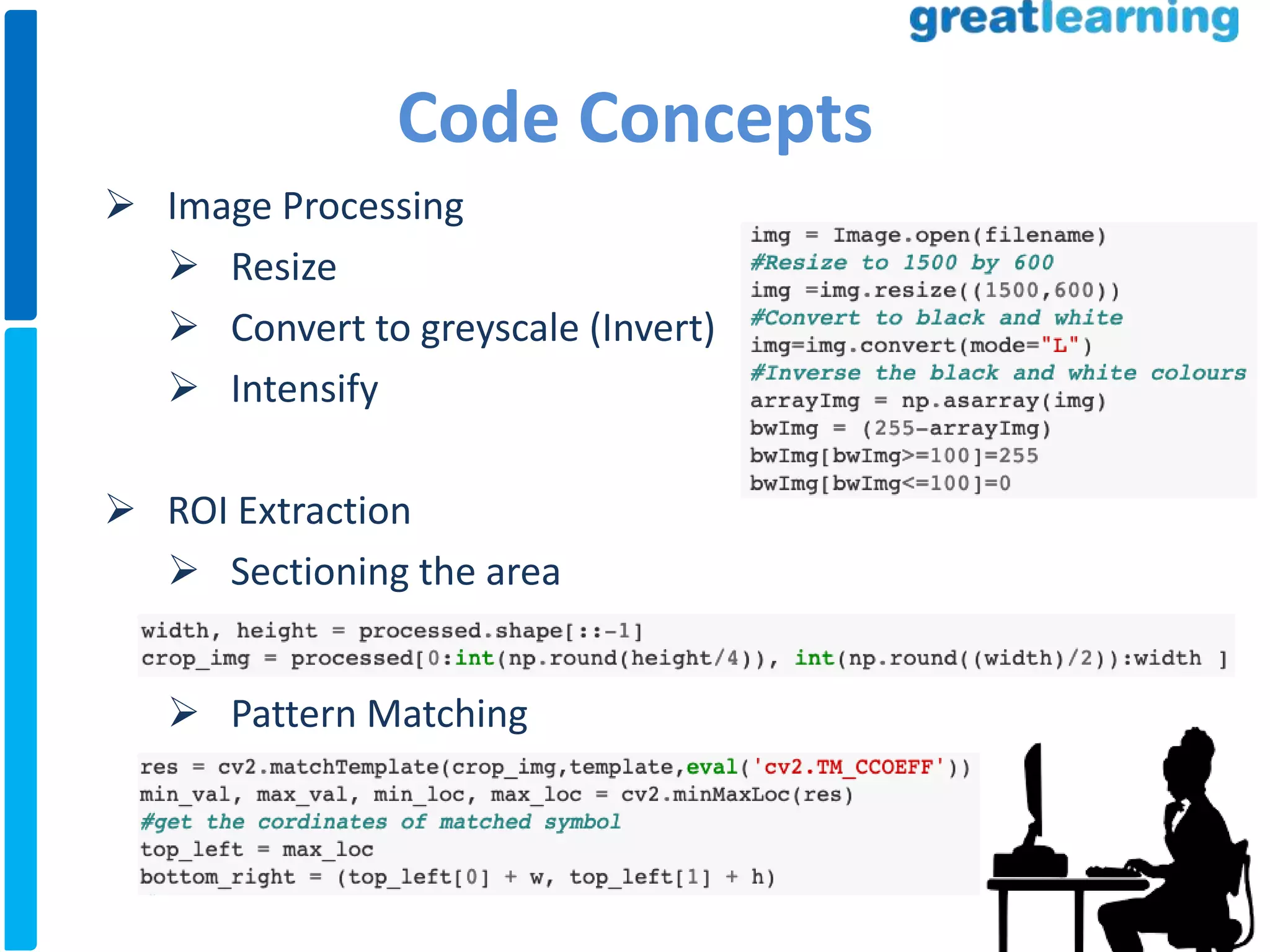

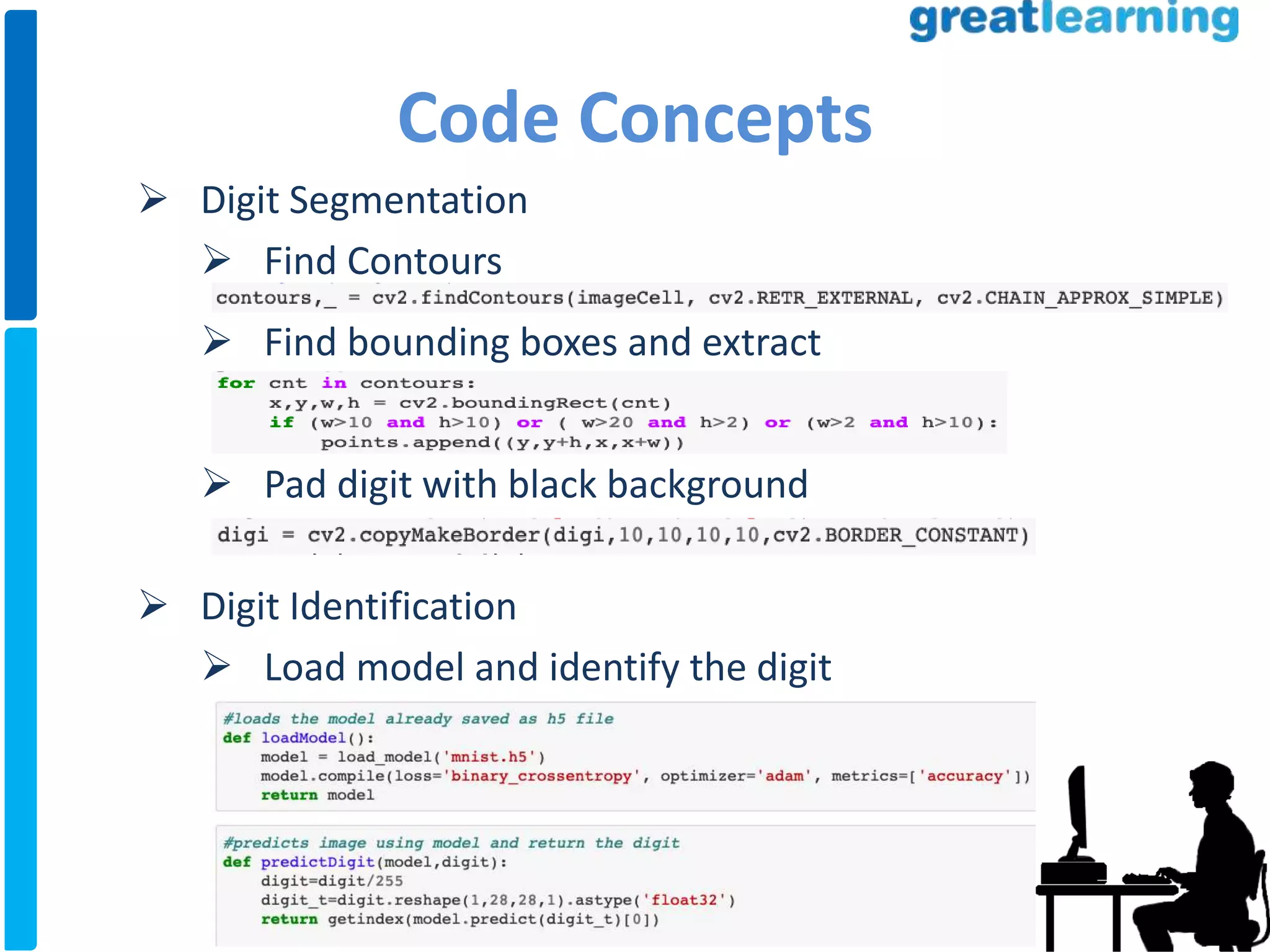

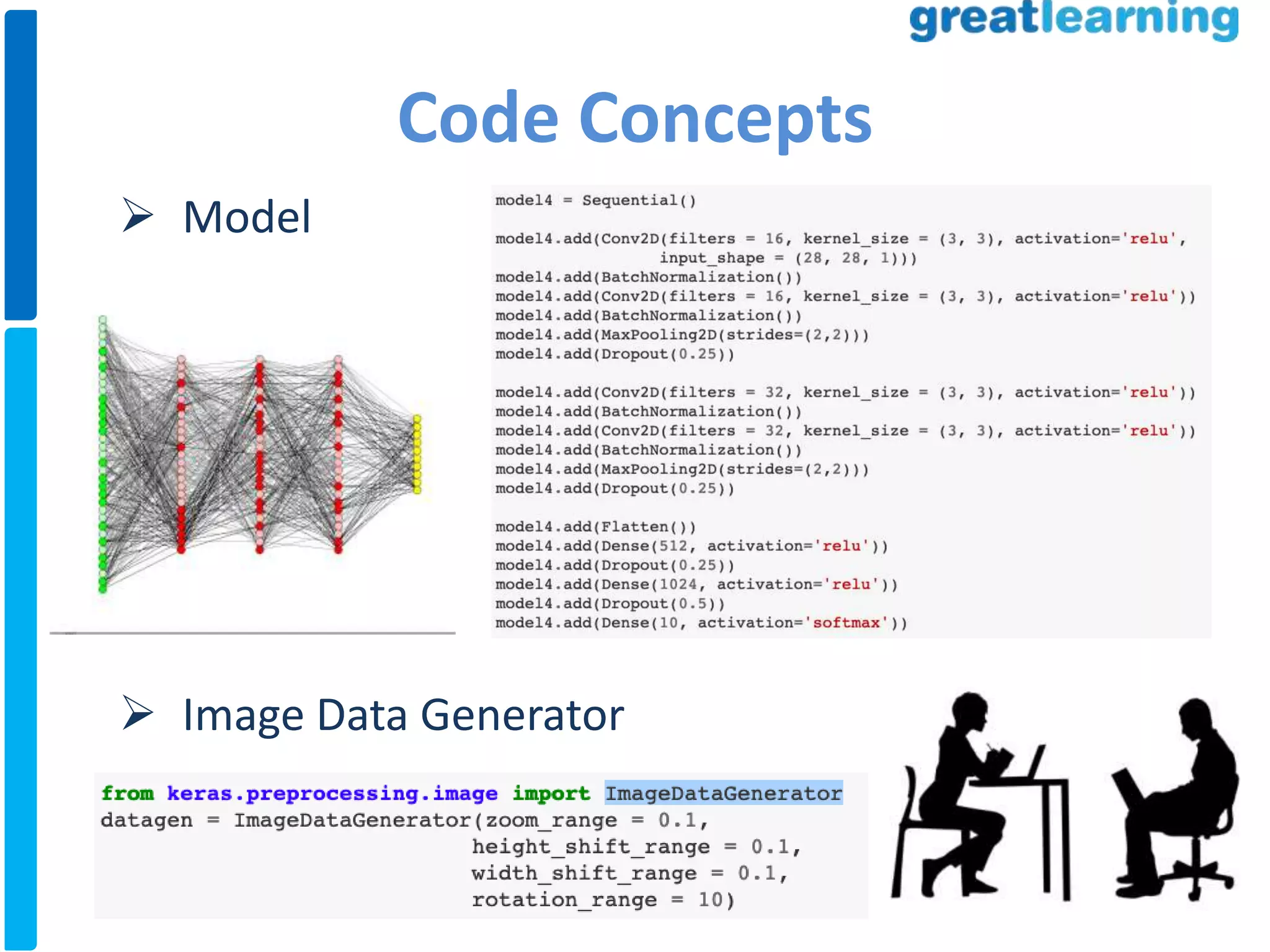

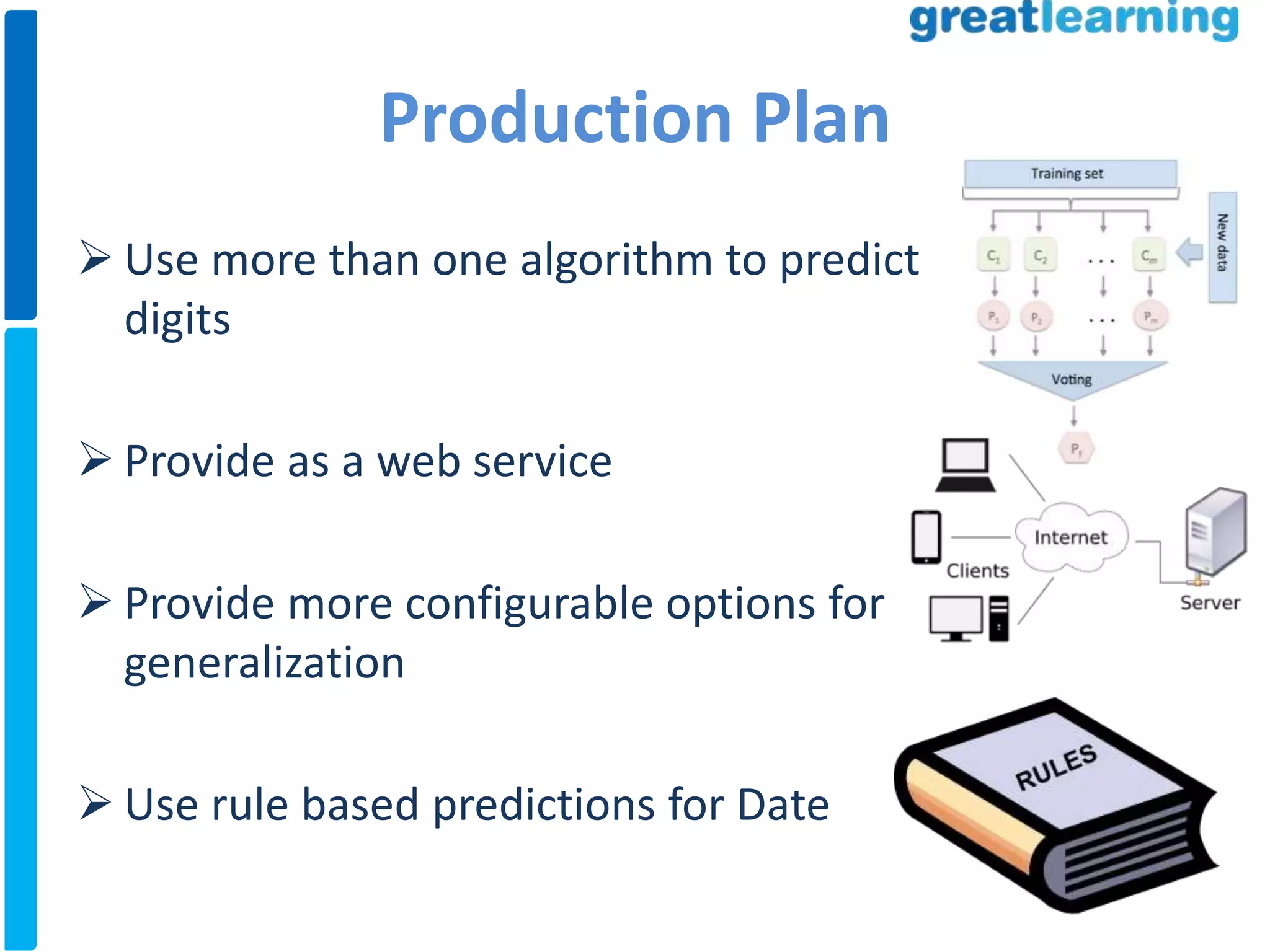

This document discusses developing an automated system for processing handwritten Indian bank cheques. It outlines some of the key challenges with manual cheque processing including human errors, expenses, and delays. The proposed solution is to automate cheque processing using computer vision and deep learning techniques. This includes extracting regions of interest from scanned cheque images, segmenting handwritten digits, identifying digits using neural networks, and integrating the system as a web service for digitization and auditing of cheque transactions. The system achieves overall accuracy of 95-98% but continues to face challenges with issues like joined digits, image quality, and decimal values.