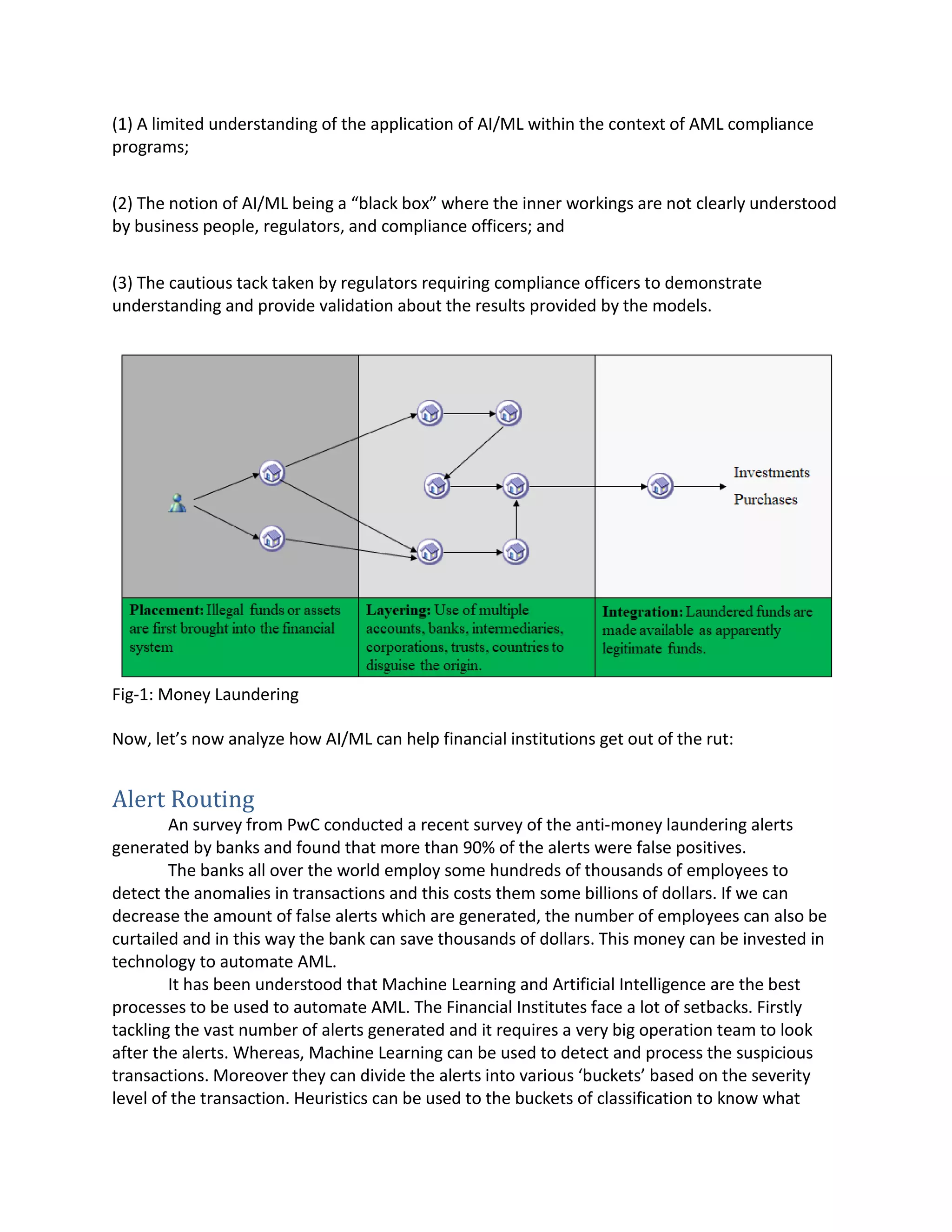

1) The document discusses how machine learning and artificial intelligence can be used to automate and improve anti-money laundering processes at financial institutions.

2) Key applications discussed include using machine learning for alert routing to reduce false positives, anomaly detection to identify unusual transaction patterns, and data aggregation to create a unified customer view.

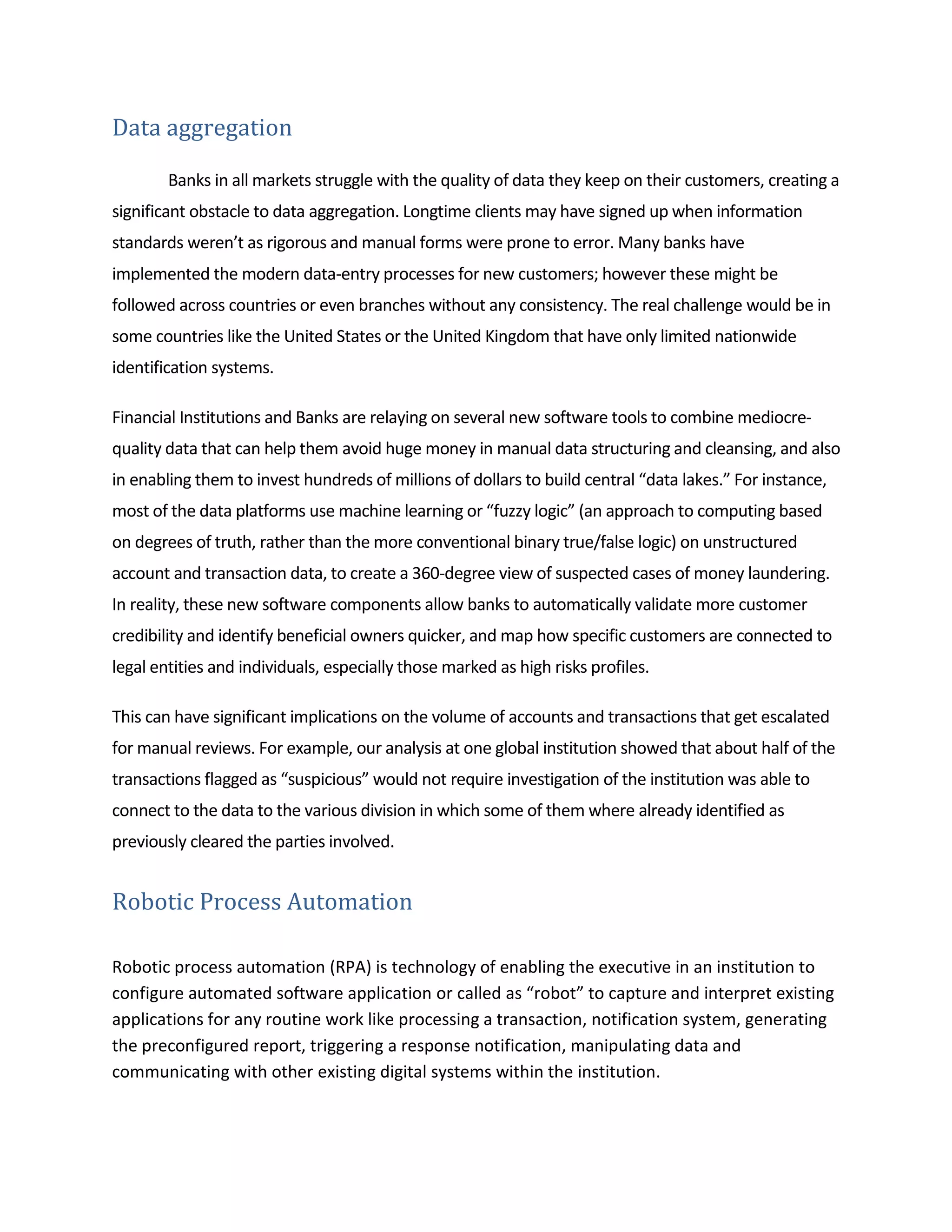

3) The document also discusses how robotic process automation can be used to automate know-your-customer checks and other compliance processes but has limitations that machine learning may be better suited for.