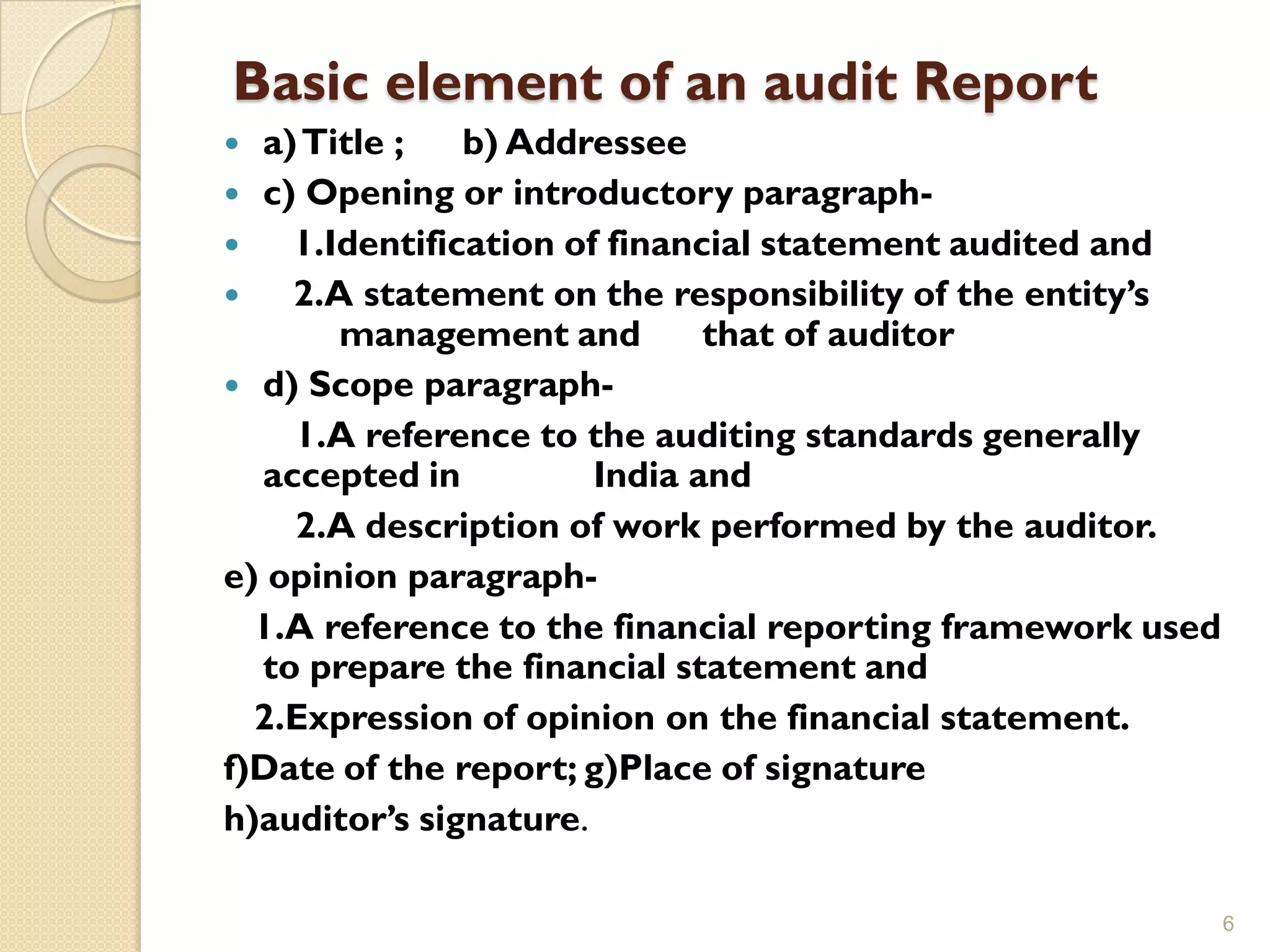

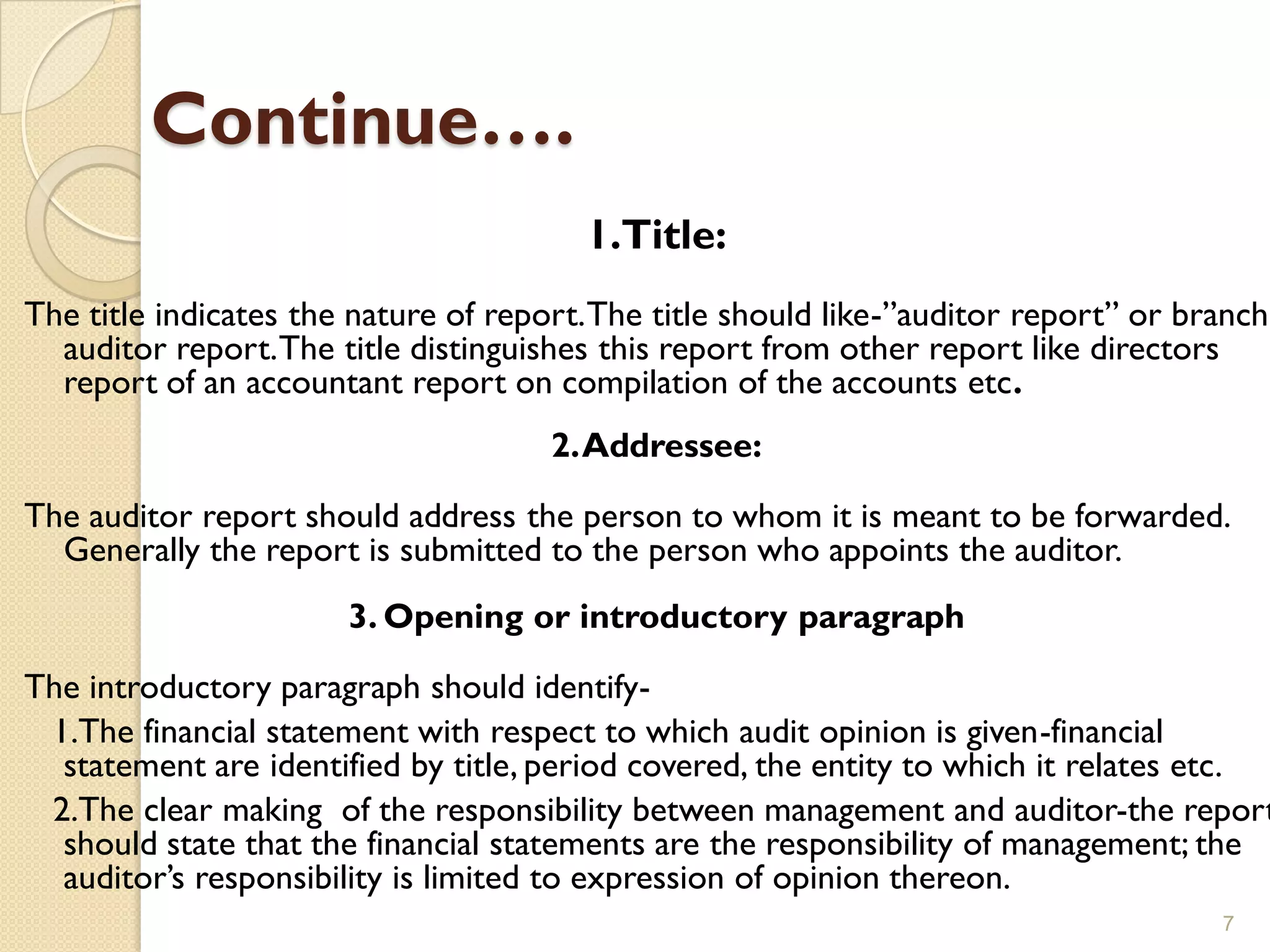

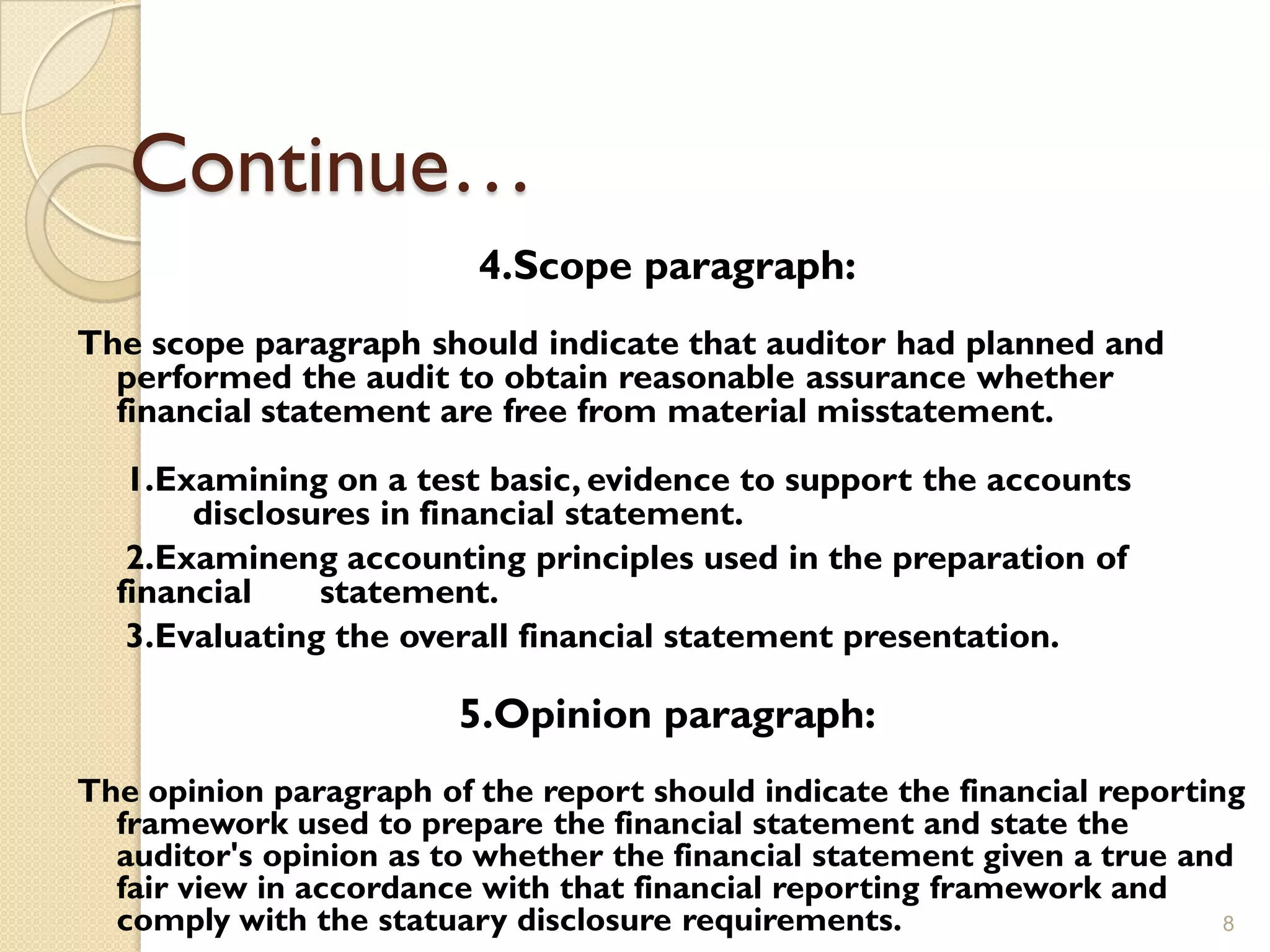

An audit report summarizes an auditor's examination of a company's financial statements. It assesses whether the statements are fairly presented in accordance with accounting standards. The report includes an introduction stating management and auditor responsibilities. It describes the audit scope and provides an opinion on whether the financial statements achieve a true and fair view. The report is addressed to shareholders and dated and signed by the auditor.