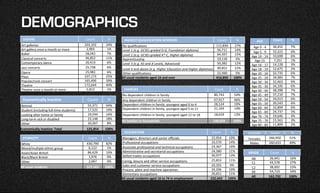

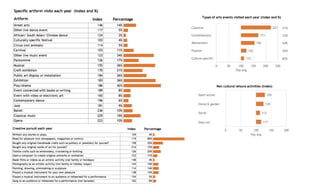

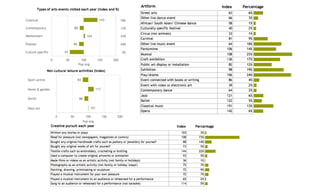

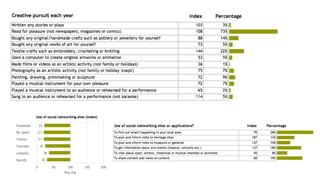

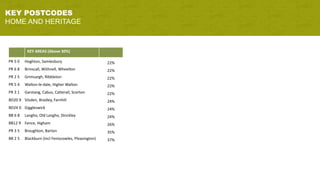

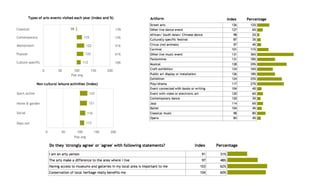

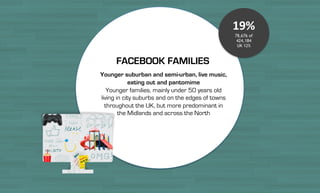

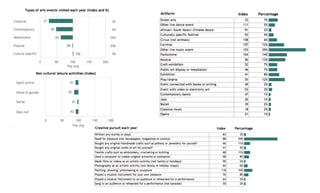

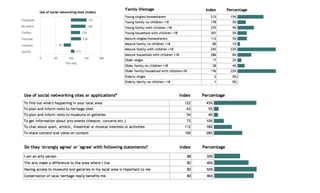

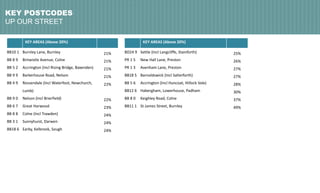

This document provides demographic and behavioral data about the audience segment called "Commuterland Culturebuffs", who make up 8% of the total UK population. They are affluent, well-educated older families and singles who live in commuter towns and have high engagement with cultural activities. They are frequent attendees of theaters, concerts, and museums. They are also active participants in the arts through activities like singing, playing instruments, and crafts. As loyal and frequent attendees, they are willing to pay premium prices for high-quality cultural experiences.