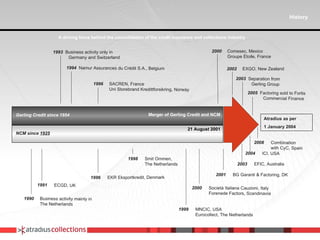

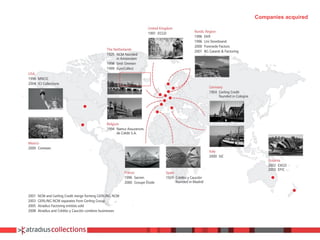

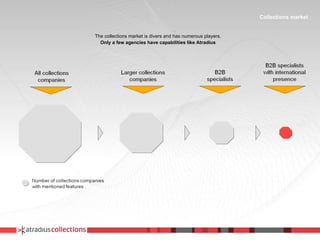

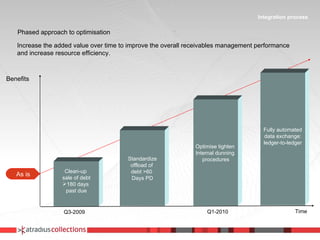

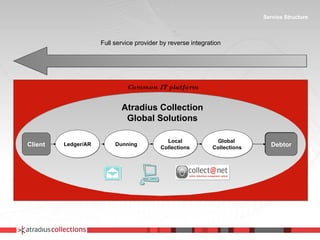

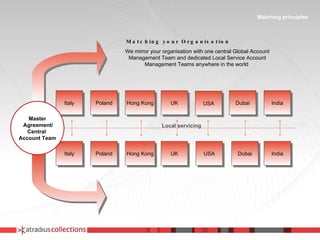

Atradius Collections is a global leader in debt collection and credit management with over 80 years of expertise. It has a presence in 52 countries with 4000 employees and annual revenues over $2 billion. The company aims to maximize cash recovery for clients through exceptional international services. It offers a single, unified global IT platform and centralized management to provide customized receivables management solutions to clients.