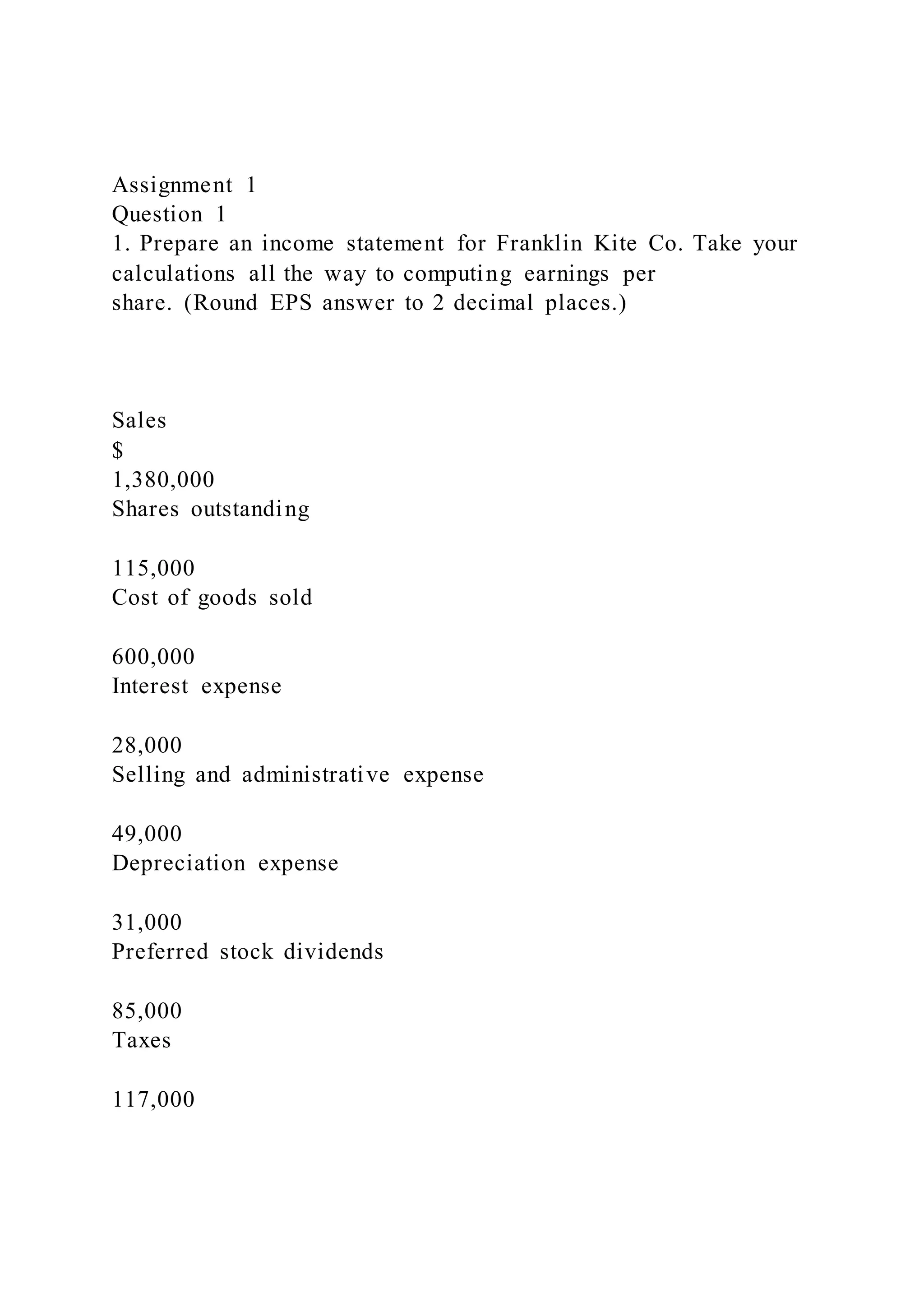

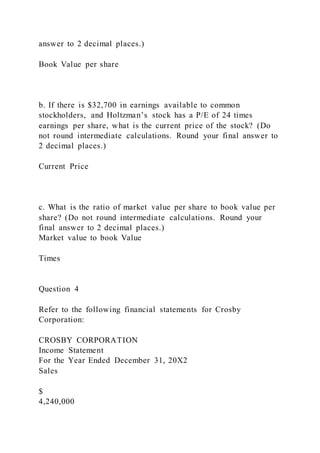

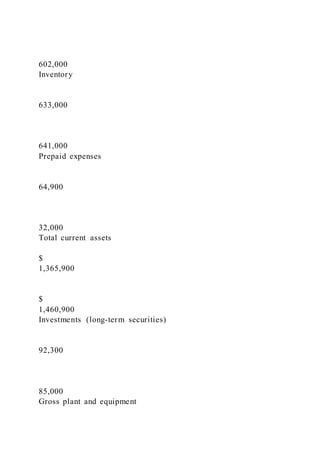

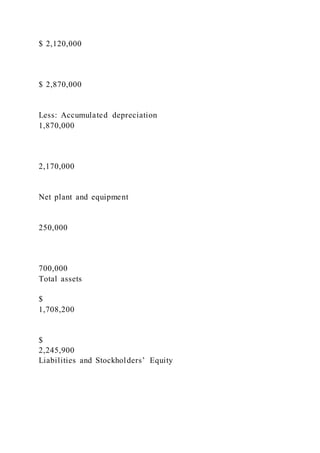

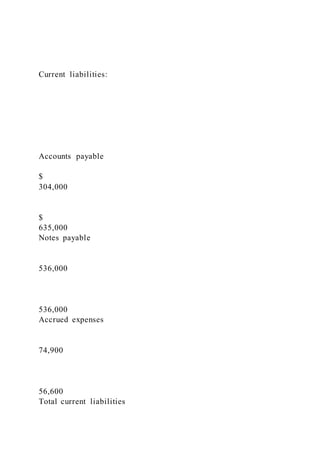

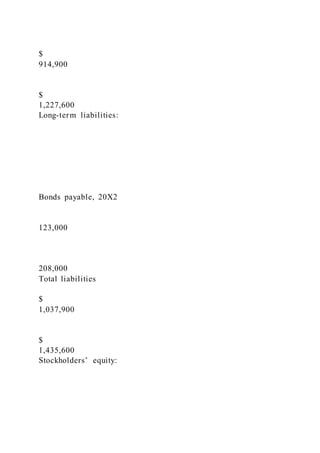

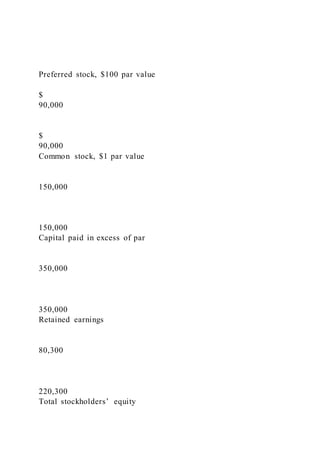

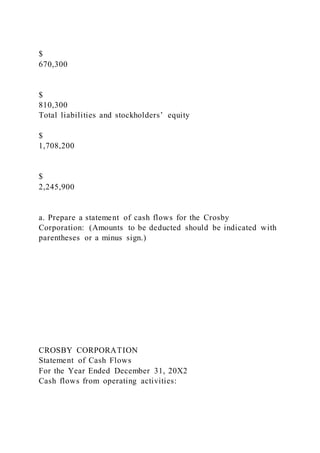

The document contains 7 questions related to financial statements and ratios for various companies. Question 1 asks to prepare an income statement for Franklin Kite Co. Question 2 provides financial information for Rogers Corporation and Evans Corporation and asks to calculate cash flow and the difference in cash flow between the two companies. Question 3 provides balance sheet information for Holtzman Corporation and asks to calculate book value per share, stock price based on P/E ratio, and the ratio of market value to book value. Question 4 provides extensive financial statements for Crosby Corporation and asks to prepare a statement of cash flows and calculate book value per share for two years. The remaining questions ask to calculate various financial ratios based on information provided for different companies.