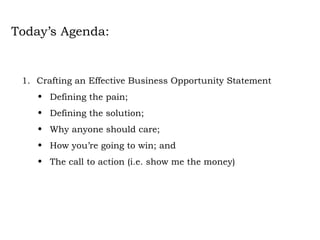

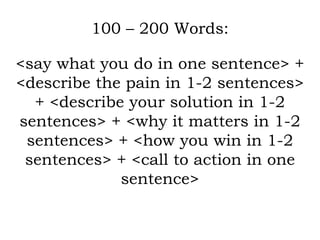

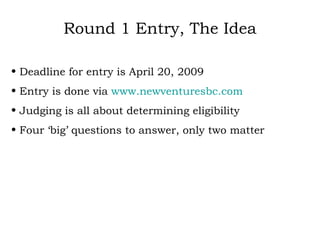

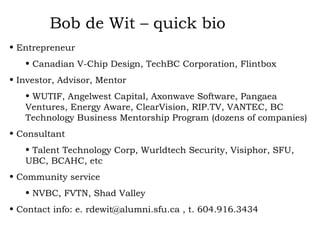

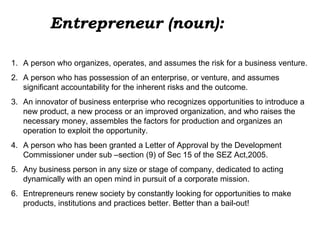

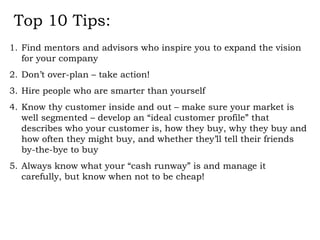

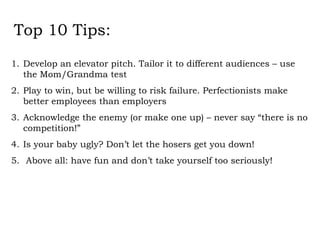

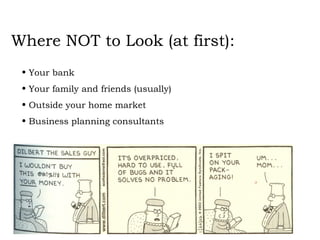

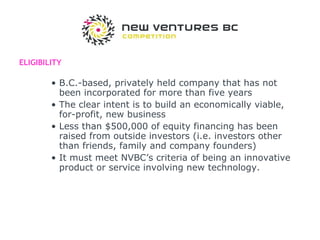

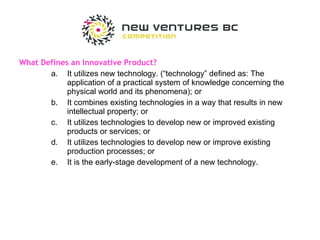

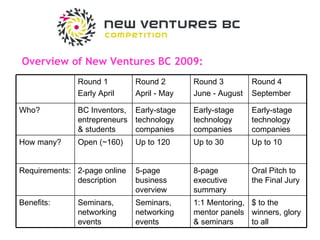

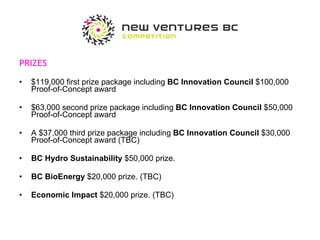

The document provides information about assessing business opportunities and preparing an effective business opportunity statement. It discusses defining the problem a business aims to solve, the proposed solution, why it matters, and how the business will succeed. It also summarizes New Ventures BC, a competition for early-stage technology startups that provides funding, education, networking and mentorship opportunities.

![For more information visit www.newventuresbc.com or email: [email_address] Join facebook group for updates (search for “New Ventures BC”) Questions?](https://image.slidesharecdn.com/assessingtheopportunity2009v2-124423304562-phpapp01/85/Assessing-The-Opportunity-2009-V2-28-320.jpg)