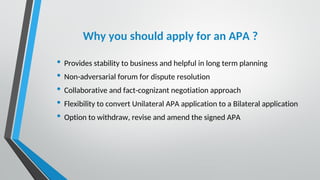

An Advance Pricing Agreement (APA) provides certainty on the transfer pricing methodology used to determine the arm's length price of international transactions between related parties. It is an agreement between a taxpayer and the tax authority that determines the appropriate transfer pricing methodology in advance. There are unilateral APAs between the Indian taxpayer and authorities and bilateral/multilateral APAs involving multiple countries. Since 2012, over 428 APAs have been signed, providing tax certainty to multinational companies operating in India.