This document summarizes recent major investments and deals in the logistics property sector in Asia. It discusses E-Shang Redwood securing Ping An Real Estate as a co-investor for its Japanese development projects. It also mentions China Logistics Property Holdings raising funds in a Hong Kong IPO and Frasers Logistics and Industrial Trust listing in Singapore. Additionally, it covers Blackstone Group's acquisition of logistics assets in Australia and other deals in Hong Kong and India.

![World News

6 | AsiaProperty July 2016

SocGen is in frame to buy Hotel particulier de Suez,

as Singapore fund continues to sell Parisian assets

GICpoisedtomake

twinofficecomplex

nextParisdisposal

Singapore’s sovereign wealth

fund is in talks with Société

Générale’s insurance business

to sell Hôtel particulier de Suez,

which consists of two adjacent

properties on Rue d’Astorg, for

€503m ($559m).

The 215,000 sq ft complex

houses law firm Clifford

Chance’s French headquarters.

GIC is also in the process of

seeking buyers for the Westin

Paris hotel, which could fetch

more than €600m.

The sovereign investor has

been selling assets in Paris in

recent years.

Last year, as part of a

consortium with APG and Host

Hotels and Resorts, it sold a

$470m portfolio of hotels,

including a Paris asset, to a joint

venture between Benson Elliot,

Walton Street Capital and

Algonquin.

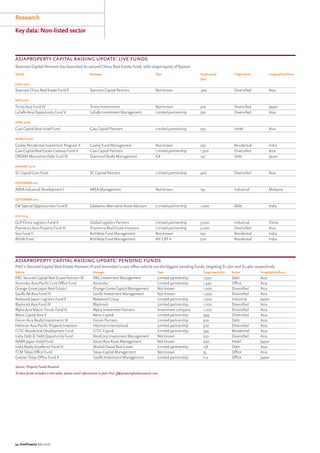

Investors’ interest in Paris has

been growing. Last year a total of

€18.8bn of commercial property

was sold in the city, up 7% from

2014 and making it the busiest

year since 2007, according to

JLL research.

Investment sales figures for

the first quarter of this year were

weaker than in the same period

last year, but JLL said it expected

total sales volumes this year to

be €15bn-18bn.

JLL said: “The Parisian

investment market still depends

heavily on the level of product

available on the market.

“At this time, there is a good

level of renewal of investment

opportunities in the major

transactions segment, whereas

we are seeing fewer products

in the intermediate segment

[€50m-100m].”

The broker expects office

rents to be fairly flat across

Paris’s major districts this year.

China’sAnbangInsuranceconsidersluxuryapartments

planfortrophyWaldorfAstoriaHotelinNewYorkCity

Chinese insurance company

Anbang Insurance is planning

to convert much of the Waldorf

Astoria Hotel in New York to

luxury apartments.

The company may be

planning to convert as many as

1,000 of the 1,400 hotel rooms

in the iconic Manhattan hotel to

luxury apartments, local media

reported.

Anbang bought the hotel

from Blackstone in early 2015

for $1.95bn.

The acquisition was the first

major real estate transaction for

Anbang.

The insurance company filed

papers reserving 70% of the

hotel’s space for residential use

last year.

However, a spokesman for

Anbang said the filing was a part

of the purchase process and the

large scale conversion wasn’t a

certainty.

“We continue to explore all

options and no definitive plans

have been finalised at this time.”

For Anbang to convert the

majority of the hotel into condos

it would have to file plans with

the state attorney general’s

office.

Last year New York City

Council banned hotels with

more than 150 rooms from

converting more than 20% of

their space to residential use.

However, some deals, such as

the Waldorf acquisition, were

granted exemption.

Britain’s departure from the

European Union will be positive

for US real estate, analysts claim.

A CBRE research report said:

“During the short term, US

gateway markets are likely to be

viewed with enhanced status as

havens for global capital, but

heightened uncertainty will

carry risks for both investor

sentiment and the real economy.

“Uncertainty surrounding the

timescale and mechanics of

Brexit will encourage investors,

particularly Asian high-net-

worth buyers, to plump for New

York over London.”

Edward Mermelstein, a lawyer

advising Asian investors, said:

“In the very high end of the

market in New York City we’re

seeing a spill off from individuals

and companies who were

previously looking to move to

London as a change of residence.

Many have reconsidered over

the past several months.”

David Scherer, principal of

Origin Investments, said:

“There is now going to be more

pressure on people to enter the

US. We’re just not as risky as

other economies.”

See Analysis, p8

Hong Kong tycoon William

Cheng has bought a London

hotel for £70.3m ($94.8m).

A group of three companies

controlled by Cheng announced

the acquisition of the Travelodge

Royal Scot Hotel a few days

after the UK voted to leave the

European Union.

The property, in King’s Cross,

has 408 rooms.

Cheng already owns hotels

with more than 2,300 rooms

in Hong Kong and Shanghai,

including three Best Western

and two Ramada hotels in Hong

Kong.

Cheng said the transaction

allowed him “to expand

and diversify into property

investment in the UK, which is

one of the world’s biggest tourist

destinations”.

He also said the acquisition,

which was financed from his

companies’ balance sheets,

could be potentially expanded

or refurbished.

Brokers suggested Cheng

will already have benefitted

from a fall of around 10% in the

value of Sterling in the run-up

to Britain’s referendum on UK

membership.

UK’sEuropean

exitoffersboost

toUSmarkets...

London’s Royal

Scot is Cheng’s

latest hotel buy

Malaysian developer SP Setia

said the UK’s vote to leave the

European Union would be

no more than an “accounting

effect” for its Battersea Power

Station project in London.

SP Setia, which is developing

the 39-acre site with Employees

Provident Fund and the Sime

Darby Group, told Bursa

Malaysia that the joint venture

partners had sold around 85%

of the 1,661 units launched for

Battersea in three phases so far.

...butnothreatto

Batterseaproject](https://image.slidesharecdn.com/837a2bad-336e-4de6-a267-d6ae045f9bcf-160831055707/85/AP-07-16-ISSUE-LOW-RES-6-320.jpg)

![Analysis

Roundtable: Brexit

10 | AsiaProperty July 2016

there is an election there next year. I could

buy a core building in Madrid, but you have

elections there and the government changes.

You have to spend a lot of time figuring out

what you think about the macro situation.”

Benson Elliot senior partner Joeseph de

Leo added: “The question of how you play

Germany is a really difficult one if more

capital is going to flow there, given how high

prices are already. Across Europe the question

becomes, if Brexit affects the outlook for

growth, the challenge will be to keep buildings

occupied and how long will it take to let vacant

space in the assets they’ve bought? It could

trigger sales by geared players down the line.”

Many of the panellists felt that increased

uncertainty would lead to reduced debt

availability for investors. Choi said: “There

will be less appetite for high LTV ratios,

margins will be higher and anything with a

development angle will be in the spotlight.

That said, we’re still open for business.”

However, Lee pointed out: “For alternative

lenders there will be opportunities. We had

already seen a pullback from lenders in the

past few months. For a business like ours,

we may have somewhat higher-cost capital,

but we are in the market, have appetite for

higher LTV ratios and are able to execute.

Some investors are already putting us ahead

of banks in their list of preferred lenders for

more challenging situations.”

Manns added: “We recently had a meeting

with our mezzanine fund investors and there

is a lot of interest in credit/debt strategies.”

However, Zac Vaughan, senior vice-

president at Brookfield Property, said credit

was still available for the best sponsors, even

for London office projects. “We are finalising

a financing for a major London office property,

which has not slowed down despite the vote,

so the idea that there is no liquidity in the

banking market doesn’t seem to be the case.”

Spry summed up the panel’s attitude, and

a good mantra for all investors in uncertain

times: “Everyone should be trying to separate

the cyclical effects from the structural.”

Those who can do that are likely to profit

handsomely in the next few years.

“The possible outcomes are

so wide ranging – it could

be completely benign or

cataclysmic. That makes it hard

to navigate, so investors will turn

away from risk and go back into

buying super-core assets”

Peter Reilly, JP Morgan AM

“Across Europe the question

becomes, if Brexit affects the

outlook for growth, the challenge

will be to keep buildings

occupied and how long will it

take to let vacant space in the

assets they’ve bought? It could

trigger sales by geared players

down the line”

Joeseph de Leo, Benson Elliot

“We are finalising a financing for

a major London office property

which has not slowed down

despite the vote, so the idea

that there is no liquidity in the

banking market doesn’t seem to

be the case”

Zac Vaughan, Brookfield Property

“”

Event sponsored by:

“we recently had

a meeting with

investors in our

mezzanine fund

and there is a

lot of interest

in credit/debt

strategies”

Noel Manns,

Europa Capital

super-core assets. For opportunity funds,

that’s good, as there will be less capital

chasing the more risky assets we typically buy.”

The debate turned to whether London is

still a safe haven and the impact on the city

of the Brexit vote. “I think London will still

be a safe haven for investors because of the

potential repricing,” said Wilson Lee,

founding partner at Cale Street Partners.

“If you’re looking to invest for 10 or 15 years,

then prime yields in London moving from

3.5% to 5% make it very attractive.”

Reilly added: “I think London offices had

already repriced by 10% before Brexit. If it

goes down another 10%, combined with the

currency decline, you would be able to find

10 buyers for a good-quality asset. If it stays at

the level it is at now, there are still buyers. The

trouble is, at the moment, nothing is for sale.”

In terms of the impact on both values and

occupancy levels, Choi said: “The listed

markets are implying that London office

values will fall about 20% – you have to work

out whether that is overdone. On the

occupancy side, negotiations on financial

passporting are crucial, as that will determine

how many jobs are moved from London.”

Office market looks resilient

It was agreed that while there would be

short-term pressure on office occupancy

levels, in the longer term it would remain

resilient. “You are already hearing rumours

of spec office development schemes being

mothballed,” said John Ruane, Partner at

Ares Management’s Real Estate Group.

“This comes at a time when you might

expect some drop-off in demand, but the

fundamentals in Greater London remain

strong since there has not been overbuilding

and the supply side, as well as London’s

infrastructure, continue to look good. By

infrastructure I don’t just mean real estate

and transport, but the human capital that is

already settled in this city, which is incredible.”

Tristan Capital Partners’ Spry added: “You

could have a situation [in London] where

when the demand side recovers you are in

an undersupplied market.”

In terms of where will do well out of a

Brexit vote in terms of increased occupier

demand, on top of the obvious choices of

Frankfurt and Paris, Dublin was cited as an

English speaking city within the Eurozone.

But the participants in the event were less

sure about what now represents a safe haven

in the volatile European political climate.

“You have to ask what is safety today,”

Kohalmi said. “Everyone says Germany, but](https://image.slidesharecdn.com/837a2bad-336e-4de6-a267-d6ae045f9bcf-160831055707/85/AP-07-16-ISSUE-LOW-RES-9-320.jpg)

![28 | AsiaProperty July 2016

Survey

Residential: China

understood to be looking into these types of

distressed deals, but none have yet gone

public with details.

Collaborations are an emerging trend; for

example, a “strategic partnership” was

agreed between Chinese real estate giants

Vanke and Dalian Wanda last year.

Critics said the move was a response to

slowing sales growth and reduced profit

margins in China’s property sector over the

past two years. However, Dalian Wanda

founder Wang Jianlin said in a statement

that with demand slowing, Chinese

developers needed a “new line of thinking

and a new model.”

While this team-up isn’t a merger, it is

understood that the two developers may

bring some existing projects together.

Vanke is also working on proposals to

acquire Shenzhen Metro’s property projects,

a deal that is proving divisive among its

shareholders, but would give it access to land

above subway stations in the tier-one city.

“We think the collaboration with

Shenzhen Metro, if successful, would

provide Vanke with a new acquisition

channel of land in a prime location at a

lower price than the public auction market,

due to more limited competition,” said

Morgan Stanley in a research note.

Developers avoid third-tier cities

As auction prices continue to soar, more

developers are looking at more creative ways

to access land. Savills’ Lau says: “Developers

are still quite keen to buy land but are more

selective now; they are not going to third-

tier cities to invest, they are focussing their

capital on tier one, where the economy is

still moving and people still have jobs.

“However, in these cities, getting land is

very difficult – it’s like fighting a war. It’s

hard for foreign developers to get in, but

they do have some advantages, as they often

have more expertise and that might give

them an advantage in competing for land.”

The changing market and tightening

margins on residential property have

prompted many foreign investors to seek

acquisitions in other, non-residential

sectors, particularly logistics.

“We noticed that many international

developers, or even private ones, are leaving

the market, with the highest-priced land

auctioned entirely by state owned enterprises,”

says Zhu Ning, professor of finance at

Shanghai Advanced Institute of Finance.

“This is a bit concerning, as it reminds

one of the ‘kiertsu’ [groups of interlinked

companies] during the Japanese bubble,

when enterprises and banks pretty much

created a ‘colluded’ land market to push up

land prices and property prices.

“It is primarily the subsidiaries of the

large national state-owned enterprises that

are still very bullish and pushing the market

further up. Because of their bank and

government backing, such companies can

still keep playing the game, maybe even for

some protracted period.”

New rail links have become a central

indicator in understanding where prices

will rise. In Shanghai, for example, where

demand is high and prices even higher,

many buyers are looking to nearby cities with

excellent high-speed rail links to the city.

“There are three primary challenges

facing China’s residential market,” Zhu

concludes. “Firstly, there is a lot of over-

supply in many parts of the country, which

would take years, if not decades to sell.

Secondly, the market has turned into a

complex, panicky, expectation-driven

market. Investors only buy apartments

feverishly when prices rise and when they

expect the prices to rise again.

“And thirdly, housing prices have become

so high that they are not relevant to new

migrants anymore, whereas urbanisation

has been used as the major force for future

housing market development. When prices

reach a tipping point, all bets are off and we

really do not know what will happen.”

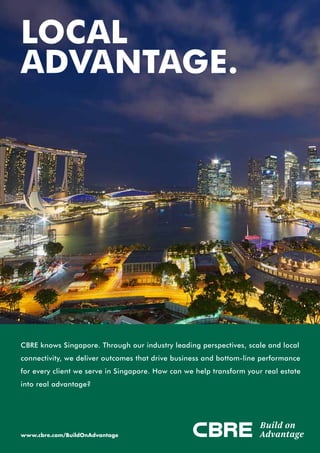

Shenzhen house price increase, March 2011-Mar 2016

Prices in Shenzhen have bounced back from a fall in 2014 to rocket again since June 2015

Mar2011

Jun2011

Sep2011

Dec2011

Mar2012

Jun2012

Sep2012

Dec2012

Mar2013

Jun2013

Sep2013

Dec2013

Mar2014

Jun2014

Sep2014

Dec2014

Mar2015

Jun2015

Sep2015

Dec2015

Mar2016

60

50

40

30

20

10

0

-10

%

Source: Bloomberg

House price changes in 70 major Chinese cities, May 2011- May 2016

Prices have been rising since mid 2015 and this May increased in 60 out of the 70 cities tracked

%

May2011

Aug2011

Nov2011

Feb2012

May2012

Aug2012

Nov2012

Feb2013

May2013

Aug2013

Nov2013

Feb2014

May2014

Aug2014

Nov2014

Feb2015

May2015

Aug2015

Nov2015

Feb2016

May2016

•MoM decrease

•MoM no change

•MoM increase100

80

60

40

20

0

Source: National Bureau of Statistics](https://image.slidesharecdn.com/837a2bad-336e-4de6-a267-d6ae045f9bcf-160831055707/85/AP-07-16-ISSUE-LOW-RES-23-320.jpg)

![Survey Survey

July 2016 AsiaProperty | 3130 | AsiaProperty July 2016

Residential investment in a nation with a

shrinking population seems counter-

intuitive, but Japan offers a number of

opportunities in the housing sector.

Residential assets are already popular

with Japanese REITs and a small number

of foreign investors have dipped a toe in the

sector. Blackstone Group has been the major

overseas player in the market so far.

Koichiru Obu, head of alternatives research,

Asia Pacific, at Deutsche Asset Management,

says: “Japan’s residential sector is unique in

Asia in a number of ways. It is the only

country to have an active multi-family

investment sector, with a number of active

REITs, which gives investors a potential exit

and encourages liquidity.

“Multi-family residential assets also tend

to be higher-yielding than commercial ones,

which contrasts with the circumstances in

other major global cities.”

JLL data show that prime Tokyo multi-

family housing assets trade at 4.5%, a 120bps

premium over grade A offices, while multi-

family/residential assets elsewhere offer a

yield spread to offices ranging from +25bps

in New York to -239bps in Shanghai.

Japan’s residential market is not volatile:

JLL says the 10-year standard deviation of

rents is just 2.7%, compared with 7.7% for

offices. Thanks to the sector’s ‘safe haven’

reputation, rental growth expectations,

expected wage increases and cheap debt

costs, JLL predicts investor interest to

continue and claims yields could fall to 4%.

Tokyo is also the world’s largest residential

market outside of the US, with transaction

volumes exceeding ¥2.1trn ($20.7bn) over

the 2010-2014 period, JLL says.

Japan’s ageing and shrinking population

is a negative factor for the nation’s residential

market overall; the 127m population is

predicted to shrink to 87m by 2060, although

the government hopes to be able to stabilise

the population at 90-100m.

Population still growing in key cities

But Obu says: “Despite Japan’s overall

demographic picture, Tokyo and a few other

major cities are seeing population growth,

which will support the residential market.”

Statistics from Tokyo Metropolitan

Government show the population of Tokyo

Prefecture as of March 2016 was 13.5m, up

12% since 2000. Notably, the population of

Tokyo’s 23 wards was 9.3m, or about 68% of

the total population in the prefecture. This

reflects a 14% rise over the past 16 years.

Urbanisation is one of the largest factors

contributing to this trend. The population in

the central five wards grew to 1m in March,

up around 34% over the past 16 years.

Savills has analysed how rents in different

Tokyo districts compare with the city average.

have much scope to improve the leasing

profile of their properties.”

A significant factor in the sector’s

popularity is the cost and availability of debt.

Private equity buyers such as Blackstone

have been able to borrow 80% of asset value

at a low all-in cost compared with other

markets, leading to an attractive cash on

cash yield for their investment.

Blackstone made its big splash into Japan

residential in 2014, first reported in

AsiaProperty, buying GE Japan Corporation’s

100% owned residential real estate business

for more than ¥190bn. The business owned

and operated more than 200 residential

properties, consisting of over 10,000 units

mainly in Tokyo, Osaka, Nagoya and Fukuoka.

Blackstone a strong believer in resi

“We continue to believe strongly in the

residential sector’s fundamentals, especially

in Japan’s major cities,” Alan Miyasaki,

senior managing director at Blackstone, said

at the time of the deal.

The private equity firm followed the GE

deal in 2015 with the $450m acquisition of

Japan Residential Investment Company, a

fund listed on the London AIM market.

JRIC owned 59 residential properties worth

¥46bn in Tokyo, Osaka and Nagoya.

It has been rumoured that Blackstone plans

to exit its Japanese residential investments

Residential: JapanResidential: Japan

Investors adhere to Japan’s strong multi-family values

Overseas players are being drawn to invest in Japanese apartment blocks by yields that, In Tokyo,

outstrip those offered by offices, with urbanisation and cheap debt underpinning the sector’s appeal

In Q1 206, the central five wards had the

highest premium rate, at 15.2%.

The South and the Inner North recorded

4.4% and 1.8% premiums respectively. The

outer areas, meanwhile, had the lowest

premiums, the lowest figure being in the

Outer East, at -22.0%, followed by the Outer

North, at -13.3%, and West, at -7.4%.

Tetsuya Kaneko, head of research and

consultancy, says: “Notably, the Inner East,

consisting of Koto, Sumida and Taito Ward,

has a low premium of around 5.1%, but [this]

is gradually increasing and is projected to

keep improving, amid expectations with

regard to several plans to transform the area

before the Olympic Games in 2020.

“We expect further urbanisation to drive

strong demand in Tokyo’s central five wards,

especially for smaller household sizes. The

residential sector should remain stable for the

foreseeable future. We expect occupancy

rates to continue their strong trend, driving

stable rent revenues in this core sector.”

Landlords need to note that the leasing

market is weighed very heavily to tenants.

Most Japanese people who have lived in the

same apartment for a decade would have not

experienced a rent rise, although this is in

the context of an economy battling deflation.

Rent increases come from new tenancies.

Obu says: “Tenancy terms are very

favourable to the tenant, so investors do not

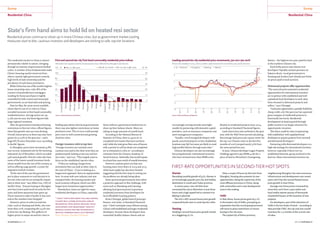

Japanese urbanisation rate

The rate is expected to near 75% by 2030

%

1980

1985

1990

1995

2000

2005

2010

2015e

2020e

2025e

2030e

50

75

70

65

60

55

Source: Statistics Japan, Demographia, Deutsche Asset Man.

Tokyo rent index v Tokyo condo price index, Jan 2010-Jan 2016

Condominium price rises have outpaced a more steady increase in Tokyo rents

Jan 2001 = 100

Jan2010

Jul2010

Jan2011

Jul2011

Jan2012

Jul2012

Jan2013

Jul20103

Jan20104

Jul2014

Jan2015

Jul2015

Jan2016

90

120

120

120

-Rent index in Tokyo 5 ku -Condo price index in Tokyo (12m rolling)

Source: Real Estate Economic Institute, LMC, Deutsche Asset Management

Migration inflow to key Japanese cities

Migration has peaked in Osaka, Nagoya and

Fukuoka but has continued in the capital

0000s

•Tokyo (l axis) -Osaka -Nagoya -Fukuoka (r axis)

0000s

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

0

80

60

40

20

0

12

9

6

3

Source: Statistics Japan, Demographia, Deutsche Asset Man.

through a J-REIT flotation. However, the

firm has begun to sell some of its residential

holdings. For example, it recently agreed a

deal with Comforia Residential REIT to sell

a 42-unit block in Sapporo for ¥1.25bn.

In October, Lone Star Funds bought

Singapore REIT Saizen for S$517m ($383.3m)

and with it acquired a portfolio of 136

Japanese residential assets. Other private

equity players are understood to have picked

up individual multi-family buildings for

highly-leveraged opportunistic strategies.

Last month Singapore’s Straits Trading

bought an Osaka apartments portfolio from

Chinju for ¥6.2bn – the listed group’s first

investment in Japanese residential property.

“The acquisition will complement Straits

Real Estate’s existing investments in Asia

Pacific and is in line with its strategy of

tapping into higher-returning real estate

investment opportunities,” says Desmond

Tang, CEO of Straits Real Estate.

“We are very pleased to enter the Japan

residential market and will look to add

similar assets in Tokyo and Osaka to the

portfolio. The strategy takes advantage of

continuing urbanisation led by young workers

and professionals. We expect this trend to

continue in the foreseeable future, sustaining

demand for good-quality, affordable rental

housing at convenient city-centre locations.”

Hong Kong-based Look’s Asset

Management is taking a different approach

to Tokyo residential investment, hoping to

capitalise on rising residential prices and

increased tourism in what might be termed

a hybrid hospitality/residential strategy. It

plans to raise $50m-100m to invest in Tokyo

residential properties to be rented out on a

short-term basis up until the 2020 Tokyo

Olympics, after which the assets will be sold.

Grosvenor backs “the London of Asia”

UK private real estate group Grosvenor

has been a long-term investor in Japanese

residential and believes Tokyo will become

“the London of Asia” due to its status as a

centre of both business and culture.

Its latest Tokyo residential project, The

Westminster Nanpeidai, a 52-unit refurbished

apartment building in Shibuya, was recently

launched for sale in international markets

including Hong Kong, Taiwan and Singapore

– cities where wealthy investors are keen to

acquire Japanese residential assets due to a

favourable exchange rate and the popularity

of Japan as a tourist destination. Grosvenor

has also developed high-end residential

properties for rent.

Japan has also become more popular with

wealthy Chinese private investors, which is

expected to provide a further outlet for sellers

of residential in major cities, particularly

Tokyo and Osaka.

Japanese REITs’ residential assets

under management by region

Tokyo accounts for around two thirds of J-REITs’

investments in the domestic residential sector

Tokyo 5-ku (32.3%)

Tokyo 23-ku (36.1%)

Greater Tokyo (9.5%)

Greater Osaka (8.9%)

Greater Nagoya (5.1%)

Others (8.1%)

Japanese REITs’ assets under

management by sector

Japanese REITs have invested strongly in the

country’s multi-family housing sector

Retail (18.5%)

Apartment (16.1%)

Industrial (10.7%)

Hotel (3.6%)

Other (0.5%)

Office (50.6%)

Source: Association for Real Estate Securitizaton in Japan,

Deutsche Asset Management

Source: Association for Real Estate Securitizaton in Japan,

Deutsche Asset Management](https://image.slidesharecdn.com/837a2bad-336e-4de6-a267-d6ae045f9bcf-160831055707/85/AP-07-16-ISSUE-LOW-RES-25-320.jpg)

![July 2016 AsiaProperty | 33

Research

Key data: occupiers

Fintech firms drive demand for flexible workspace in Hong Kong Tianjin’s logistics sector grows rapidly

HongKongofficeswillridefintechwave

The growth of the financial

technology (fintech) industry

will create opportunities for

both core and secondary office

locations in Hong Kong, Colliers

International claims.

Its Fintech: Strategies for the

Surge report also suggests fintech

firms will be more inclined to

seek flexible workspace rather

than conventional offices.

Fintech has emerged as a

way of using technological

innovations to enhance or

replace traditional banking

operations. The industry is

growing rapidly with increasing

interest from private investors

and established financial

institutions.

Hong Kong lags behind in

financial technology innovation

compared to other global

financial hubs; only 11 of the

top 20 fintech companies have

offices in Hong Kong. Singapore

has 15 such offices, while

London and New York have

19 offices each.

However, Hong Kong’s

government is taking significant

steps to increase Hong Kong’s

fintech competitiveness. Last

year it outlined a plan to establish

an Innovation and Technological

Bureau and set up a HK$2bn

($257.7m) fund to encourage

technology and innovation.

Yasas Wickramasinghe, a

Colliers analyst, research and

advisory, said: “The rise of

fintech companies will create

demand for office space in core

and fringe central business

district (CBD) areas and

decentralised locations.

“While we expect companies

that mainly service Hong Kong’s

finance industry to attempt to

locate in the core or fringe CBD,

the demand for decentralised

locations is likely to come from

regional operators.

“Fintech start-ups rely mainly

on flexible workspace and other

low-cost office solutions.

“Therefore, with growing

interest in promoting fintech

innovations, fintech start-ups

could well become a primary

demand driver for coworking

spaces and non-prime buildings

in the core and fringe CBD in

coming years.”

Jonathan Wright, associate

director, office services added:

“We certainly expect fintech

companies to drive some of the

demand for flexible workspace

and serviced offices, which are

growing exponentially in

footprint in Hong Kong.”

OFFICE RETAIL

City Currency Measurement/period Rent Yield (%) City Currency Measurement/period Rent Yield (%)

Sydney A$ m2

/year 1,091 5.13 Sydney (high-street shops) A$ m2

/year 13,975 4.75

Hong Kong (core Central) HK$ sq ft/month 166.00 2.80 Hong Kong (high-street shops) HK$ m2

/month 1,200.00 3.30

New Delhi (CBD) INR sq ft/month 400.00 8.23 Delhi (shopping centre) INR sq ft/month 1,250.00 10.50

Mumbai (BKC) INR sq ft/month 308.00 9.43 Mumbai (shopping centre) INR sq ft/month 700.00 12.50

Singapore (Raffles Place) S$ sq ft/month 11.00 3.50 Singapore (shopping centre) S$ sq ft/month 52.00 4.95

Kuala Lumpur MYR sq ft/month 14 6.00 Kuala Lumpur MYR sq ft/month 150.00 6.00

Beijing (CBD) RMB m2

/month 700.00 4.80 Beijing (shopping centre) RMB m2

/month 4,100.00 4.75

Shanghai (Puxi) RMB m2

/month 395.00 4.25 Shanghai (shopping centre) RMB m2

/month 2,890.00 4.45

Shanghai (Pudong) RMB m2

/month 510.00 4.25 Tokyo (high-street shops) ¥ tsubo/month 400,000 3.00

Tokyo ¥ tsubo/month 45,100.00 3.25 Taipei (high-street shops) NTD ping/month 11,338 2.90

Taipei (XinYi) TW$ ping/month 3,350.00 2.35

prime asian rents and yields, q1 2016

Office rents rose quarter on quarter in Hong Kong Central and Sydney, with the latter also seeing an increase in high-street shop rents

Source: CBRE

GrowingTianjinlogisticsmarketnowChina’ssecondbiggest

E-commerce is driving Tianjin’s

logistics market, which is now

the second largest in China.

JLL research shows Tianjin, a

major seaport, has moved up the

rankings as a modern logistics

hub in recent years. In 2015, the

city increased its supply by more

than half of the 2014 level to

reach 2.9m m2

of total stock,

making it the nation’s second-

largest logistics market, behind

Shanghai.

A steady stream of new supply

will enable it to retain its place.

“The huge amount of new

supply caused Tianjin’s vacancy

rate to jump to 21.3% at the end

of 2015 and subsequently 20.6%

by the end of Q1 2016, but a

sizeable proportion of the supply

was in emerging Wuqing,

doubling the stock total for

the city’s most strategic and

promising logistics submarket,”

said Chelsea Cai, JLL’s head of

Tianjin research.

Wuqing, 80km from Beijing,

has been hugely popular with

e-commerce firms and

traditional retailers, Cai added.

“While traditional manufacturing

demand remains a significant

part of the market, the

e-commerce boom has been a

boon for Tianjin logistics.

“E-commerce firms, retailers

and third-party logistics service

providers have eagerly entered

warehouses, using the city as a

base to streamline distribution

channels, and move goods to

and from factories and retail

stores across the region and

country, or even abroad.

“Online sales for Tianjin and

Beijing together totalled

RMB226bn [$33.9bn] in 2015,

40%-plus higher than in 2014.”

She said a growing middle

class – half the 40m population

of Beijing and Tianjin earn more

than RMB30,000 a year – would

support future growth.

Fashion retailer Bestseller and

Chinese supermarket Renrenle

were among the latest to set up

North China distribution centres

in Tianjin, joining earlier arrivals

such as Amazon and Alibaba.](https://image.slidesharecdn.com/837a2bad-336e-4de6-a267-d6ae045f9bcf-160831055707/85/AP-07-16-ISSUE-LOW-RES-27-320.jpg)