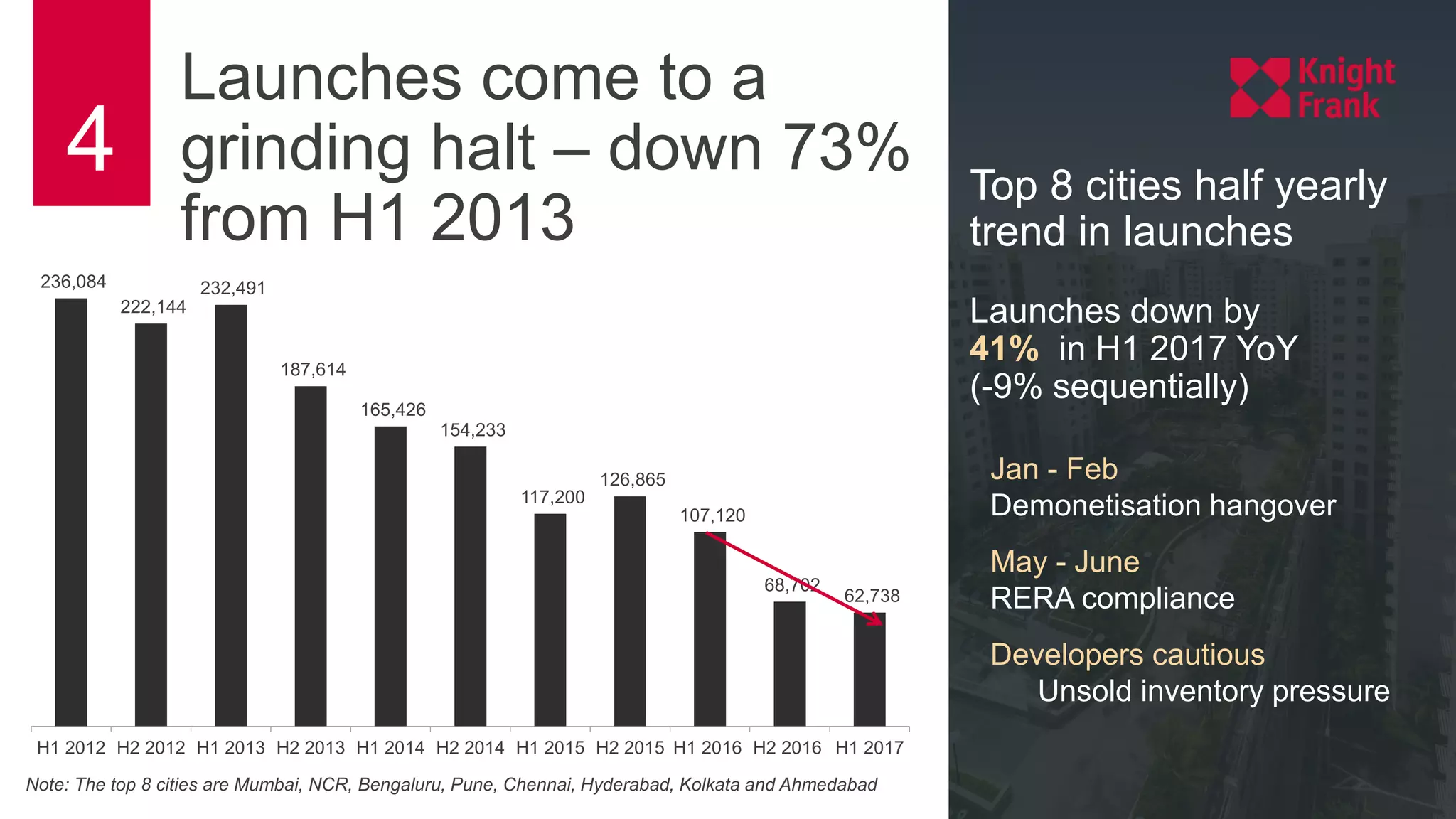

The real estate market in India experienced significant declines in residential launches and sales during the first half of 2017, reaching a decade low. Demonetisation and regulatory changes shifted focus towards affordable housing, with 71% of new launches priced below INR 50 lakh. Despite a drop in overall sales, the market showed signs of recovery in affordable housing segments, indicating potential for future growth.