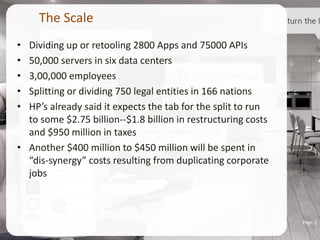

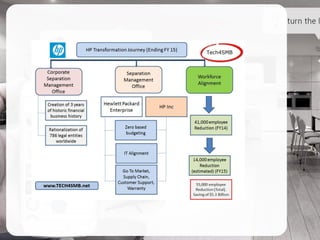

- HP is splitting into two new companies - HP Enterprise and HP Inc. through a massive undertaking that involves dividing 75,000 APIs, 2800 apps, 50,000 servers across 6 data centers, and 750 legal entities in 166 countries.

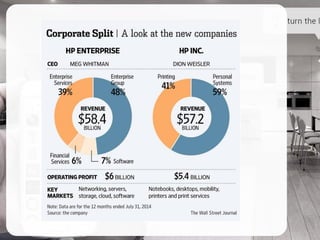

- The split will cost $2.75 billion and result in two $55 billion companies - HP Enterprise will focus on servers, storage, networking and enterprise services while HP Inc. will sell PCs and printers.

- The split leaves most of HP's $22 billion debt with HP Inc. and restricts the two companies from competing against each other or poaching employees for several years.