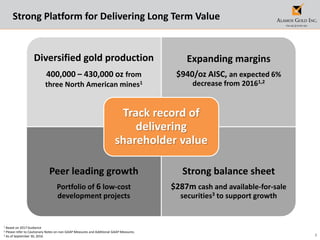

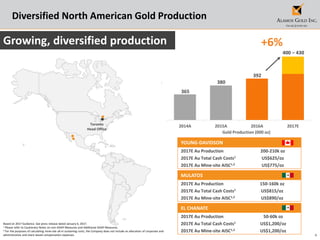

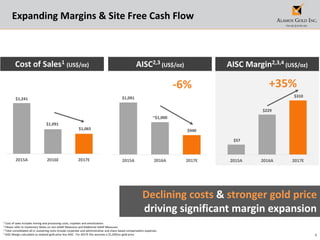

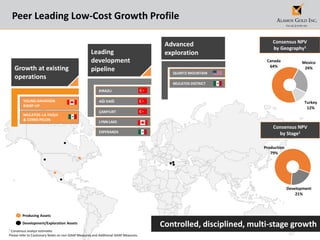

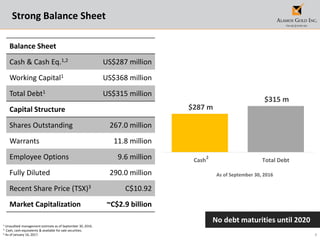

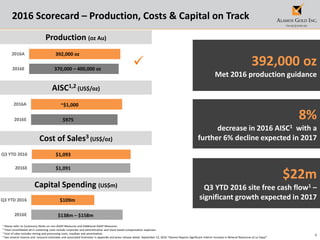

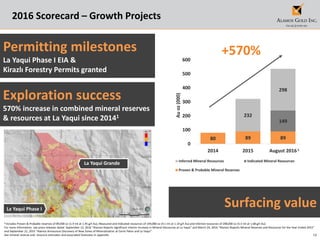

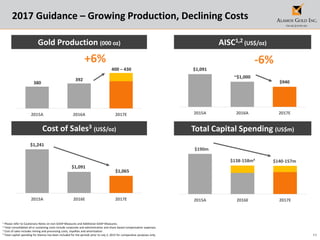

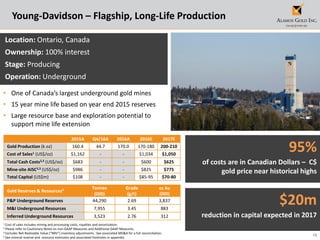

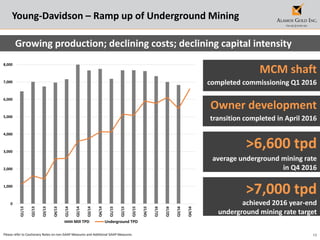

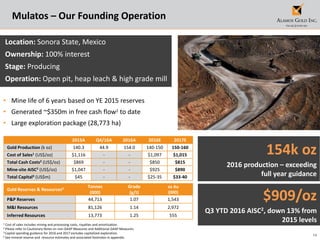

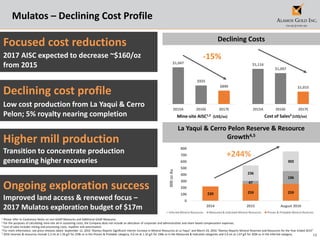

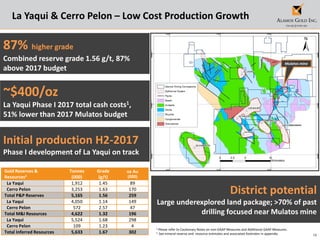

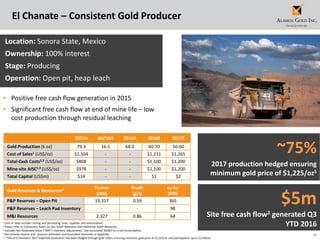

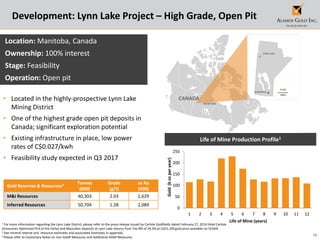

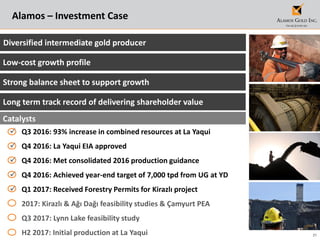

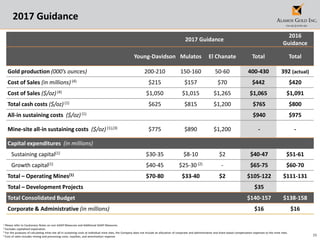

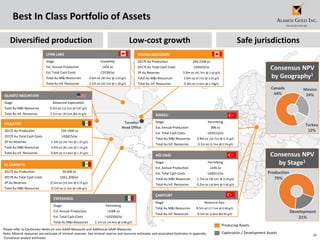

This January 2017 corporate presentation from Alamos Gold provides an overview of the company and cautions readers that certain statements in the presentation constitute forward-looking statements. It notes key highlights including expected 2017 gold production of 400,000-430,000 ounces from three North American mines, expanding margins with an expected 6% decrease in all-in sustaining costs per ounce to $940, and a peer-leading growth portfolio including six development projects. The presentation also provides cautionary notes on the use of non-GAAP measures and additional GAAP measures.