Embed presentation

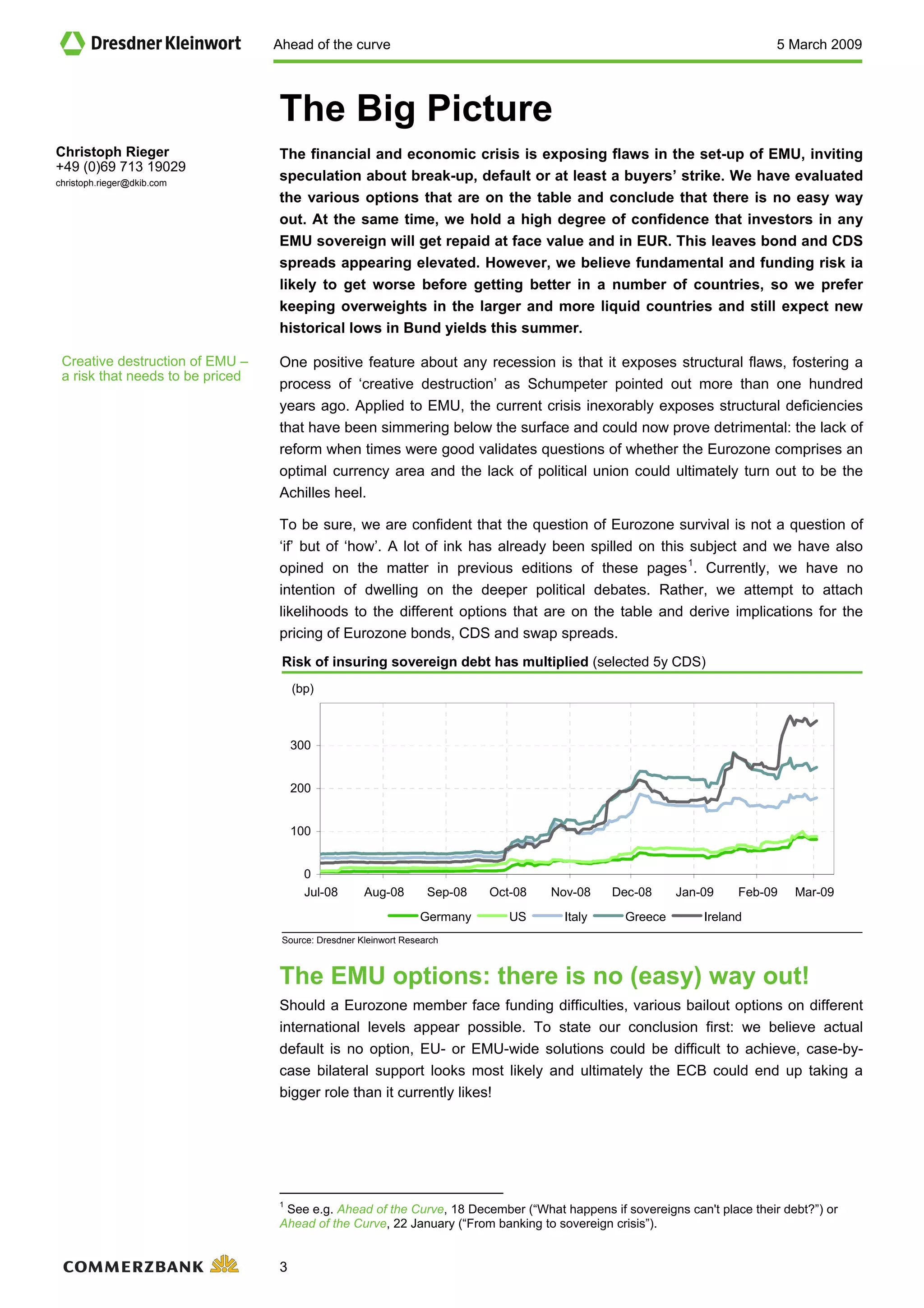

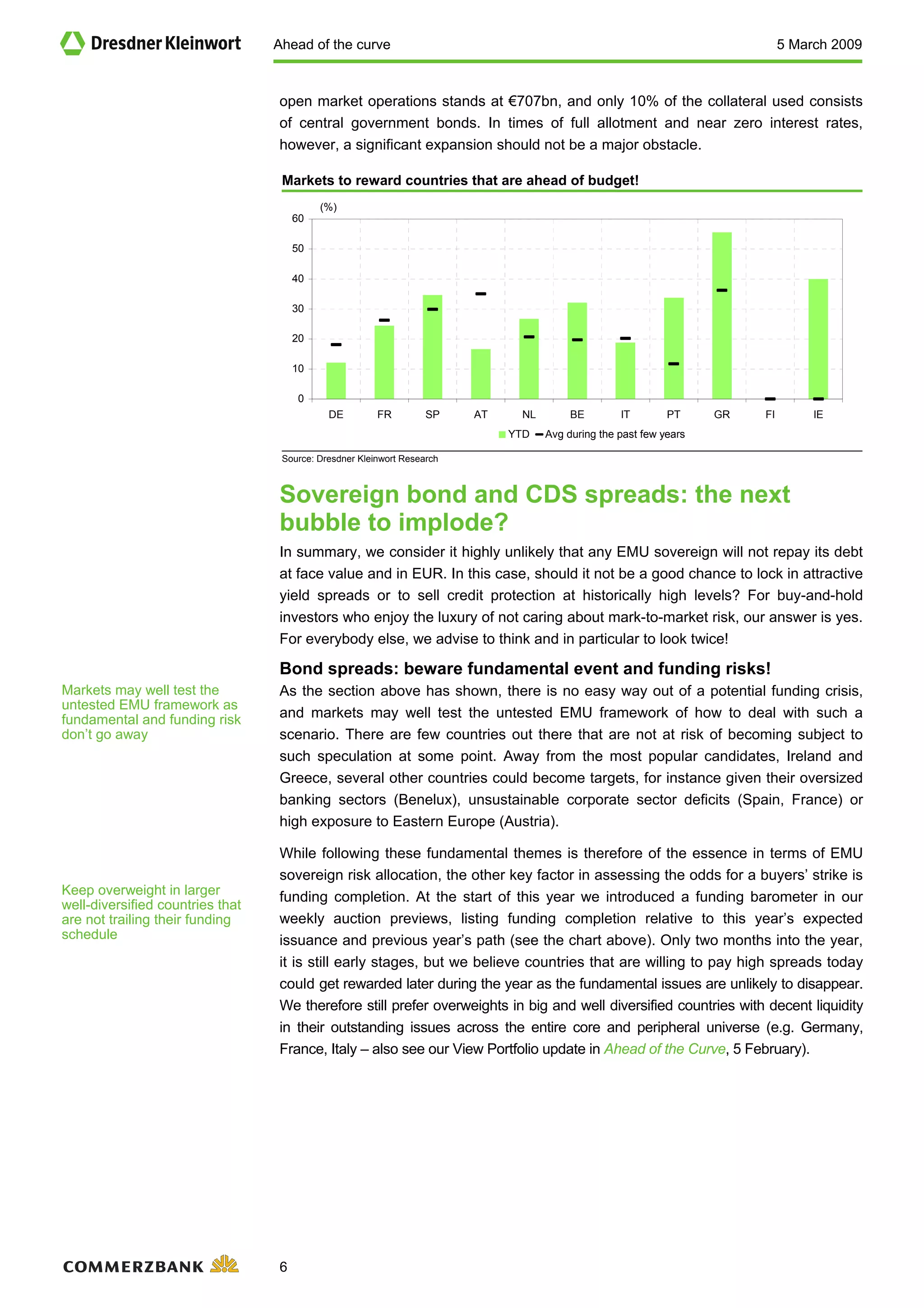

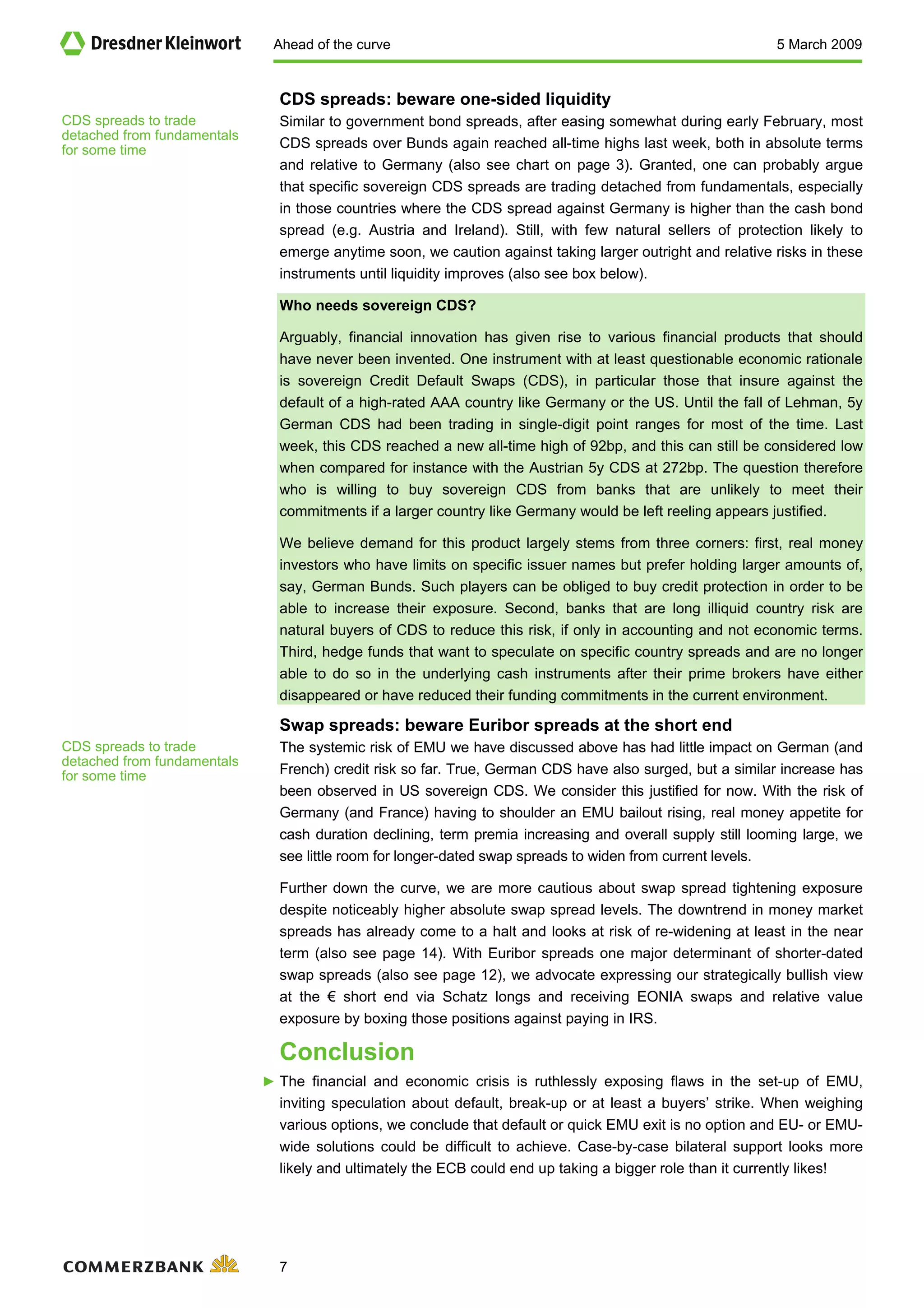

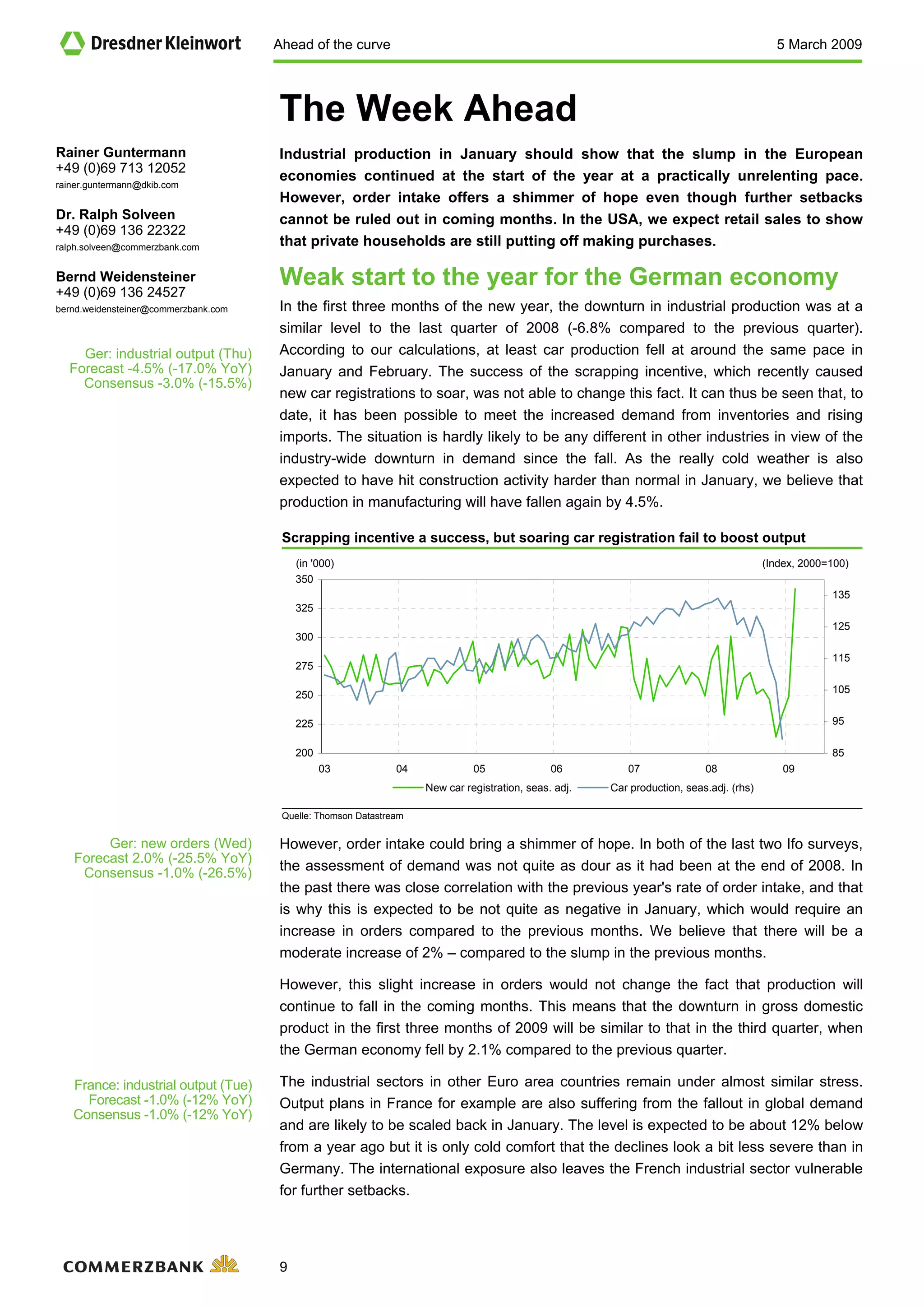

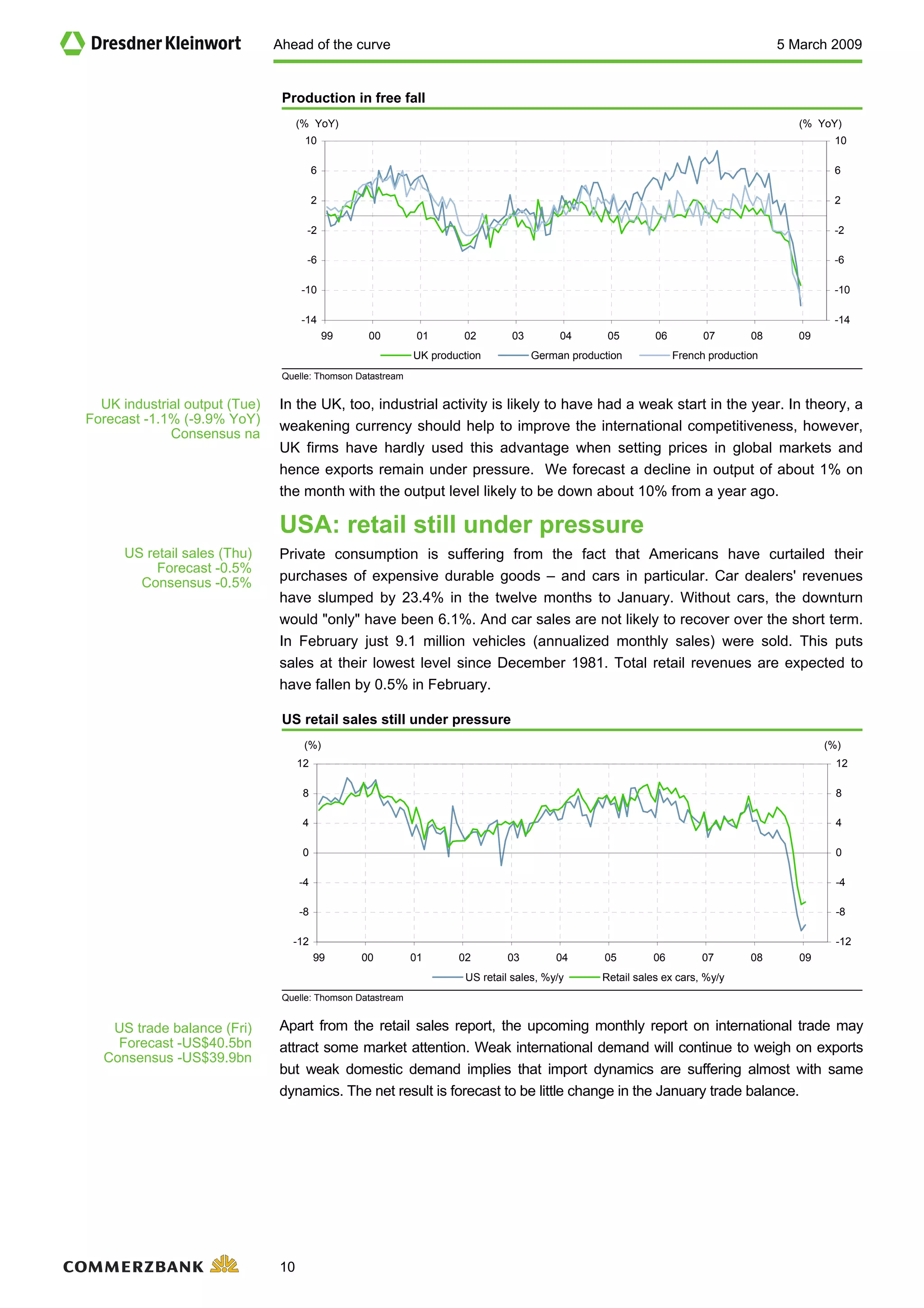

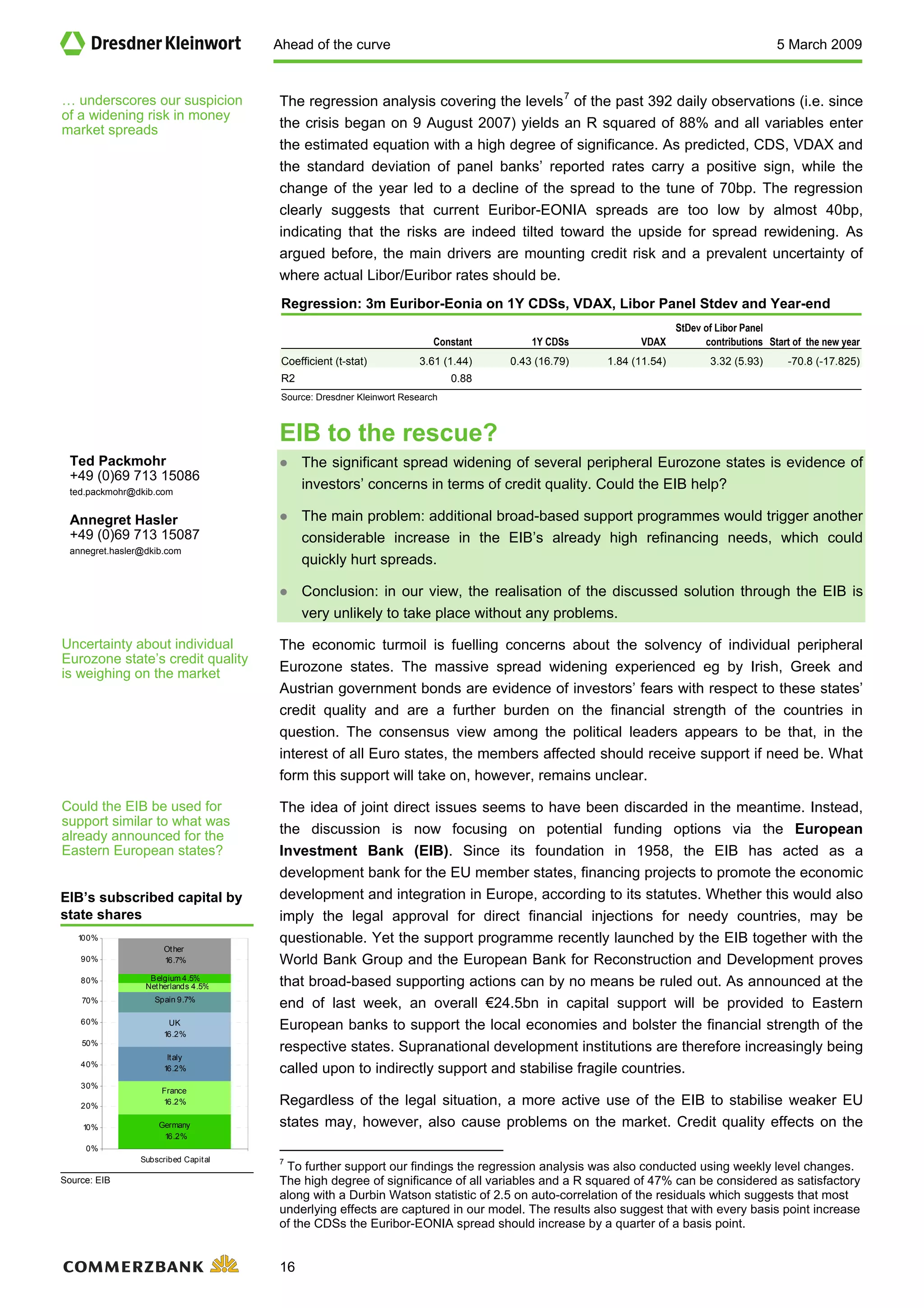

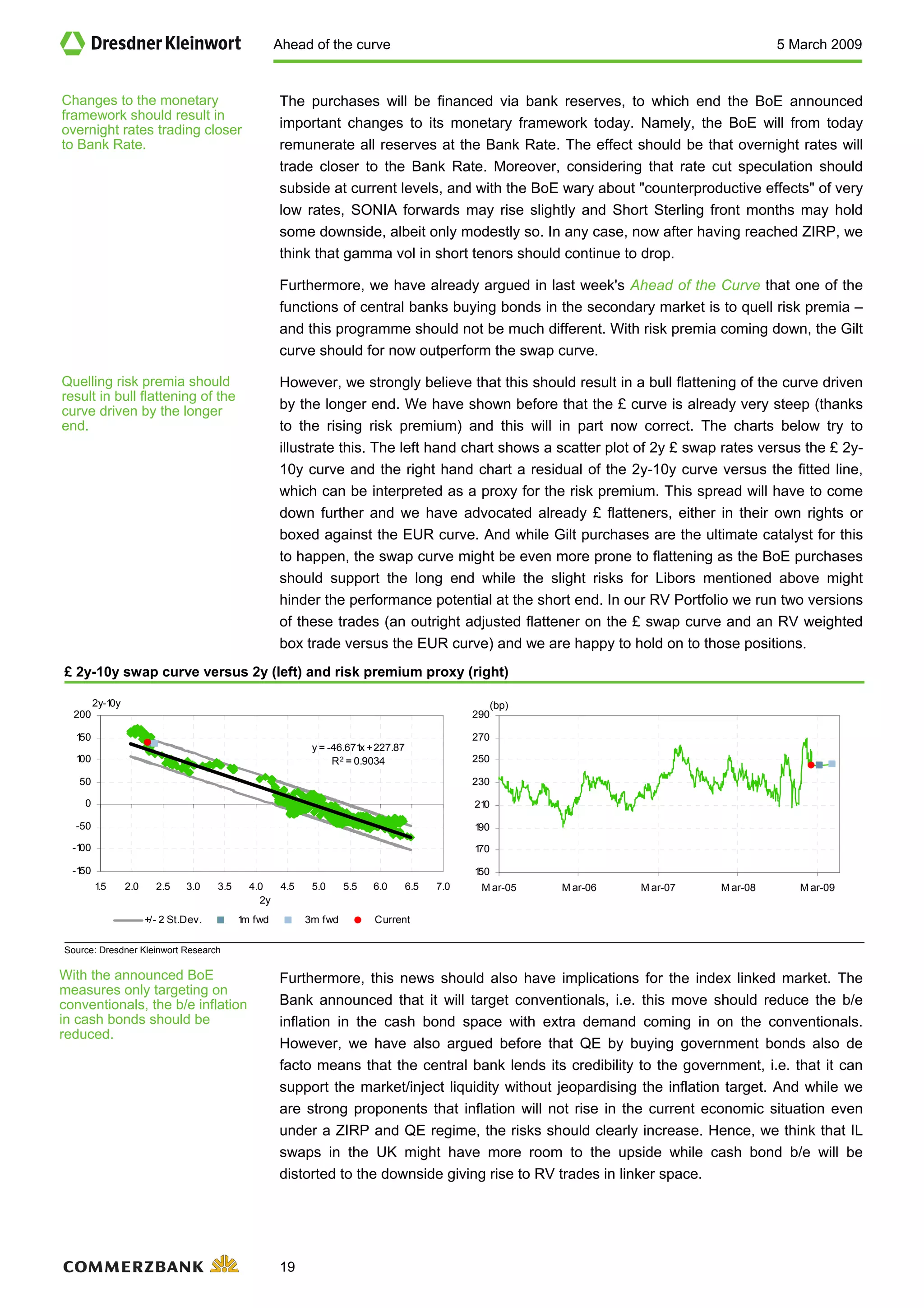

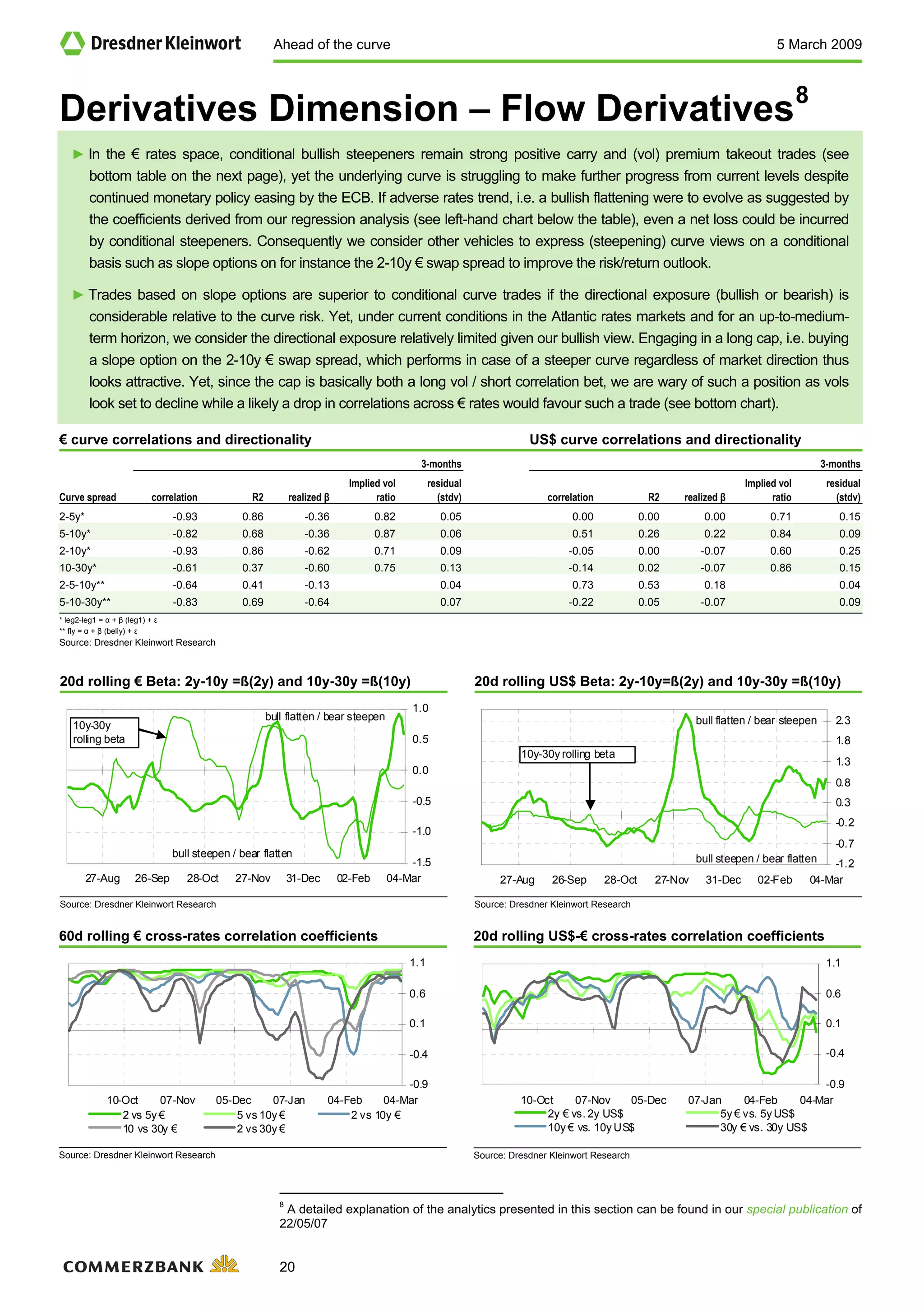

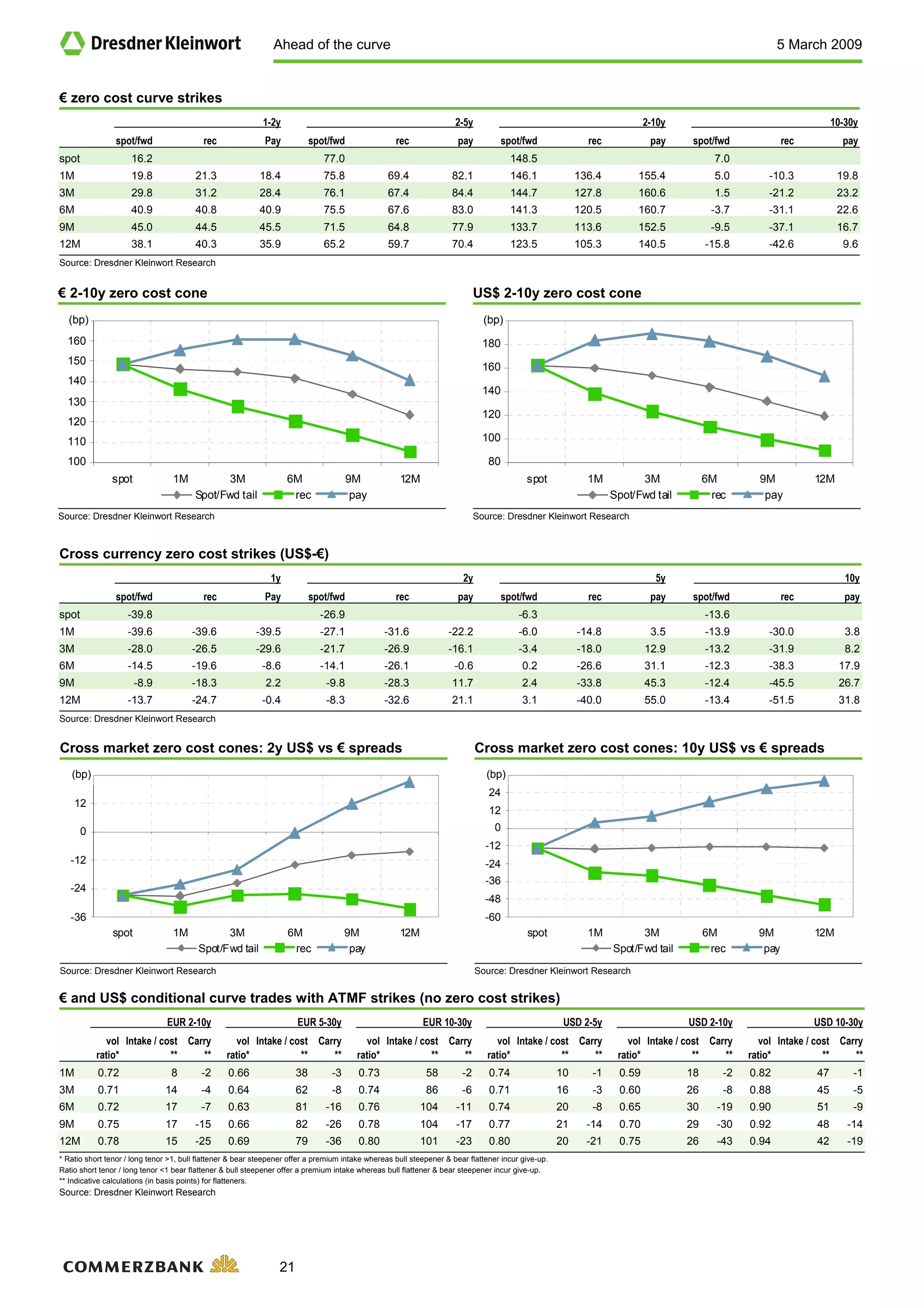

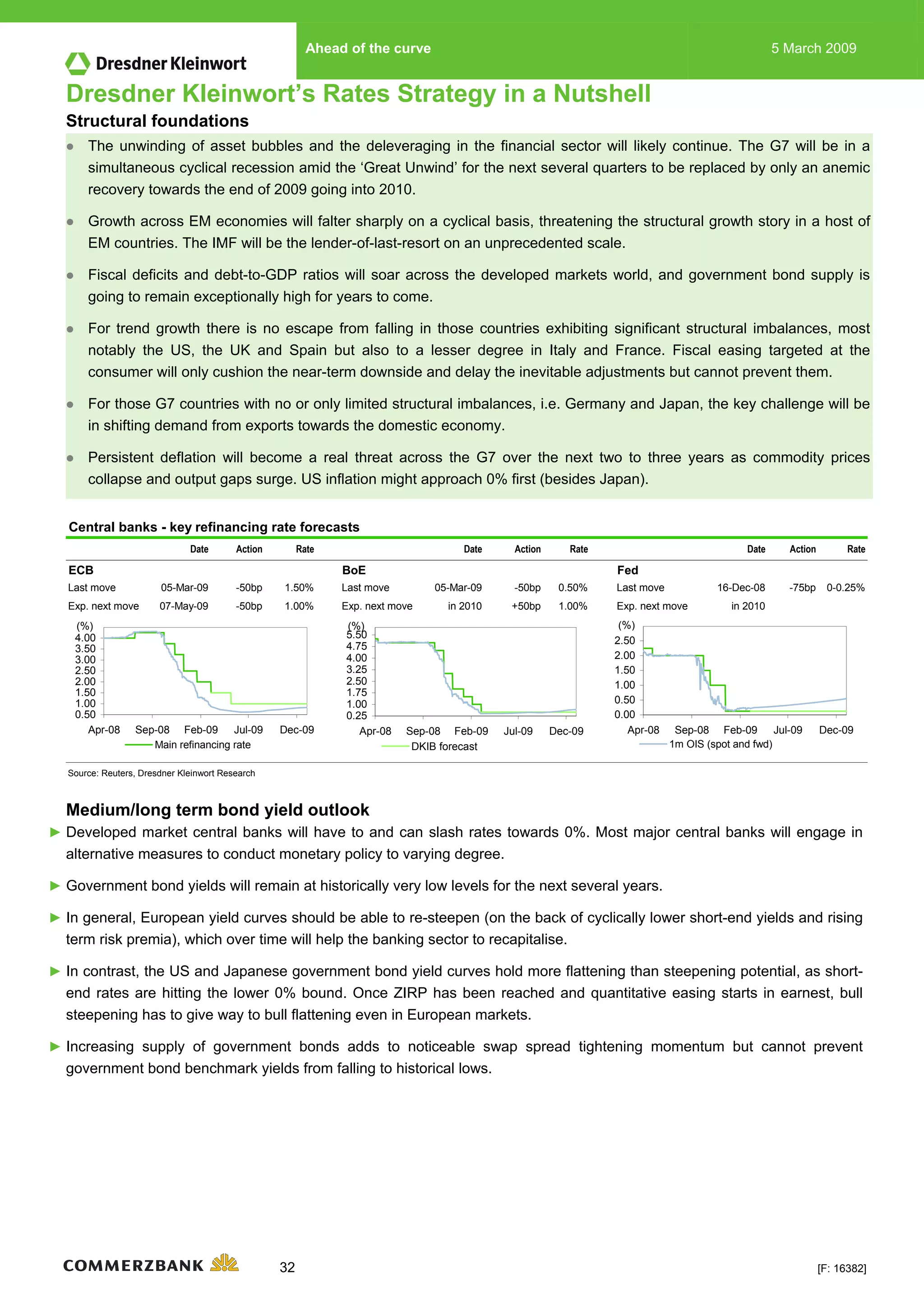

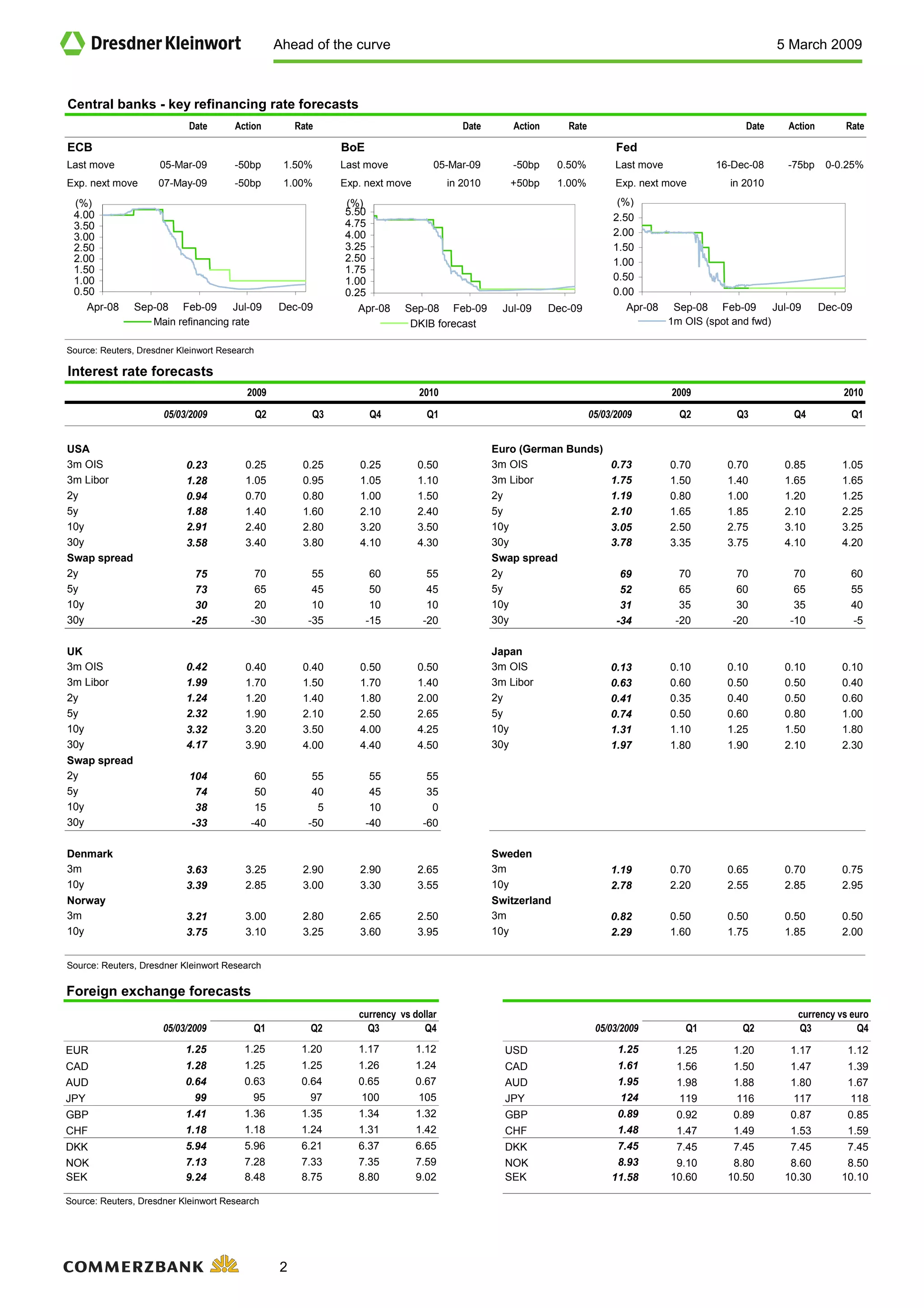

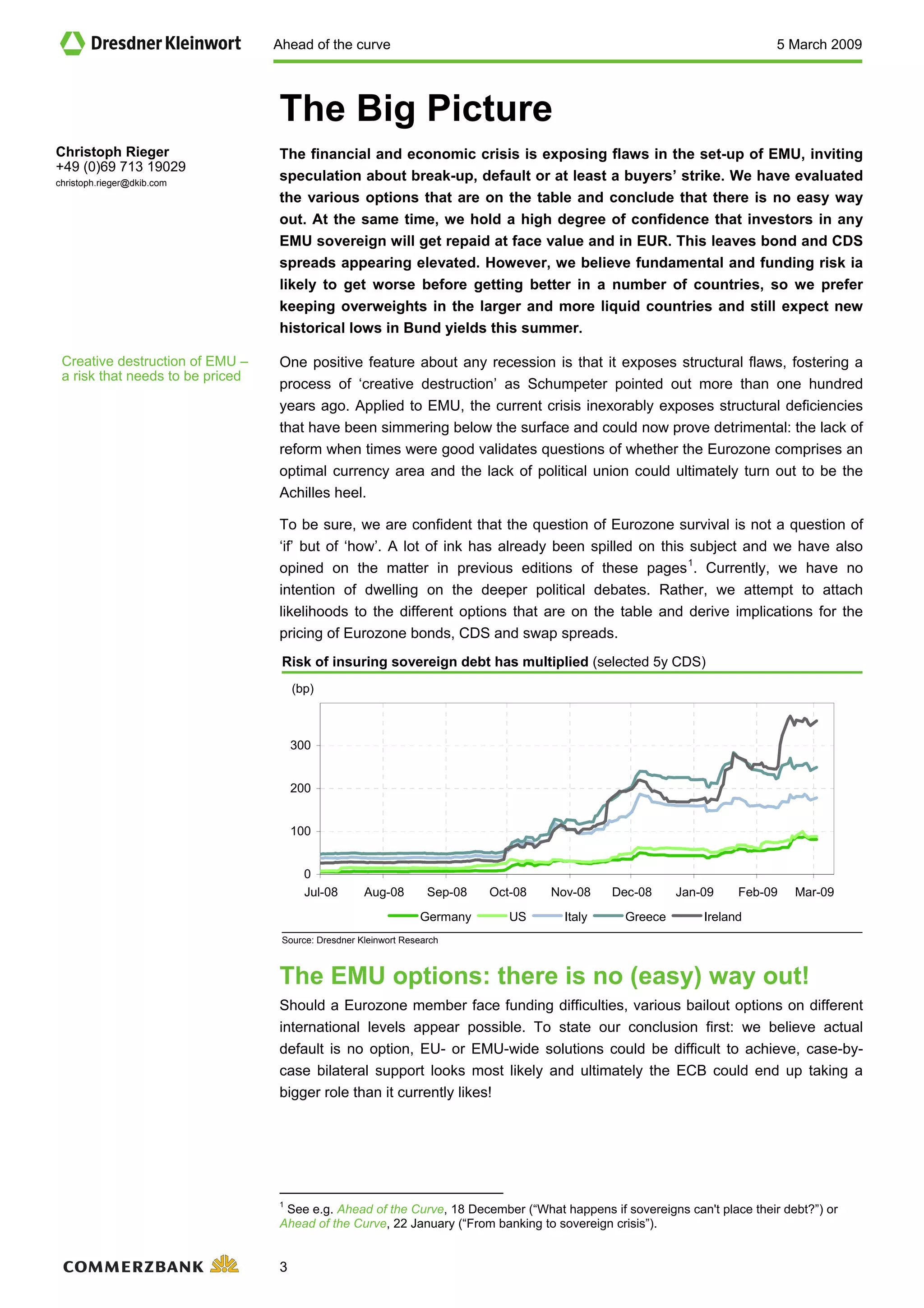

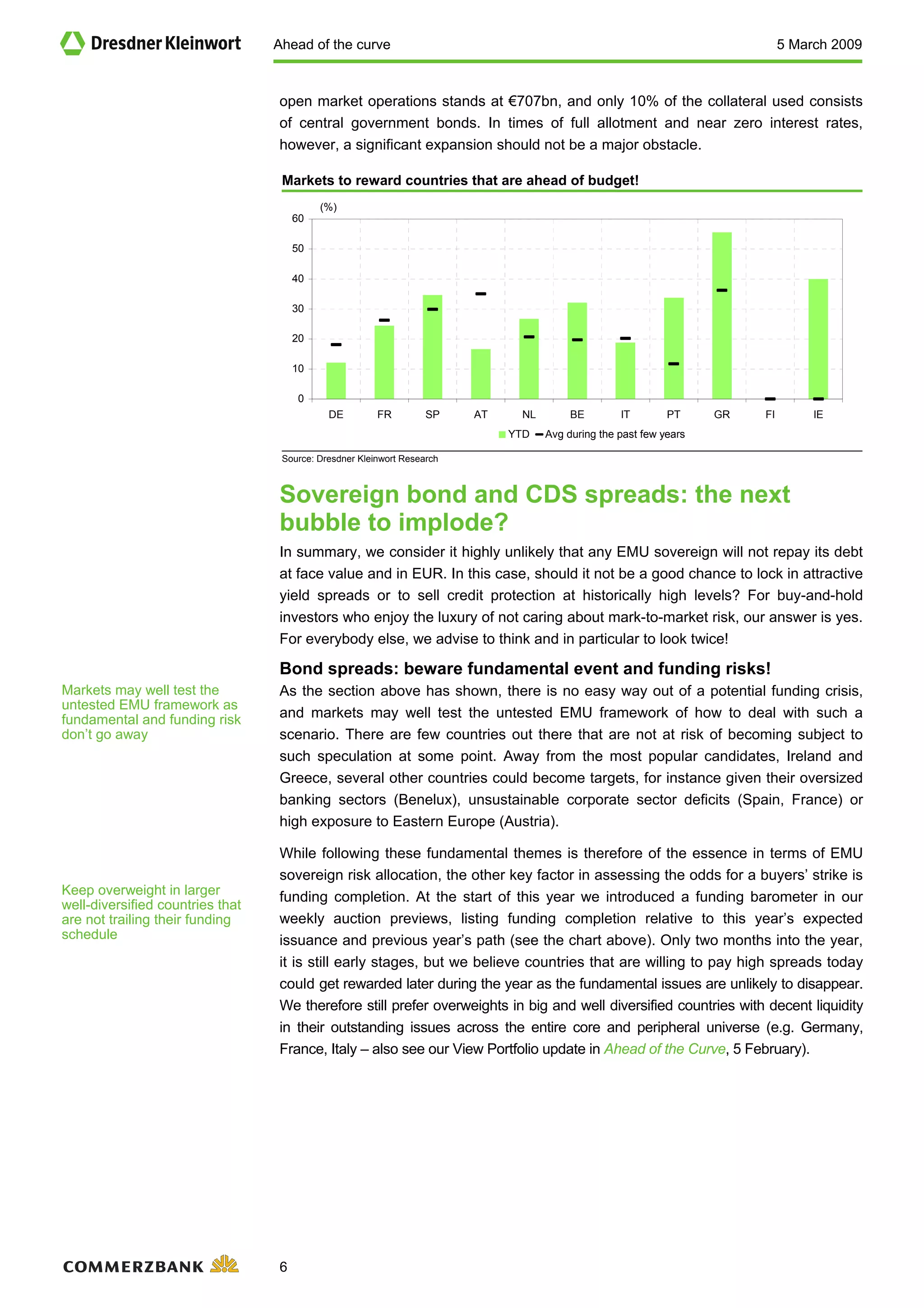

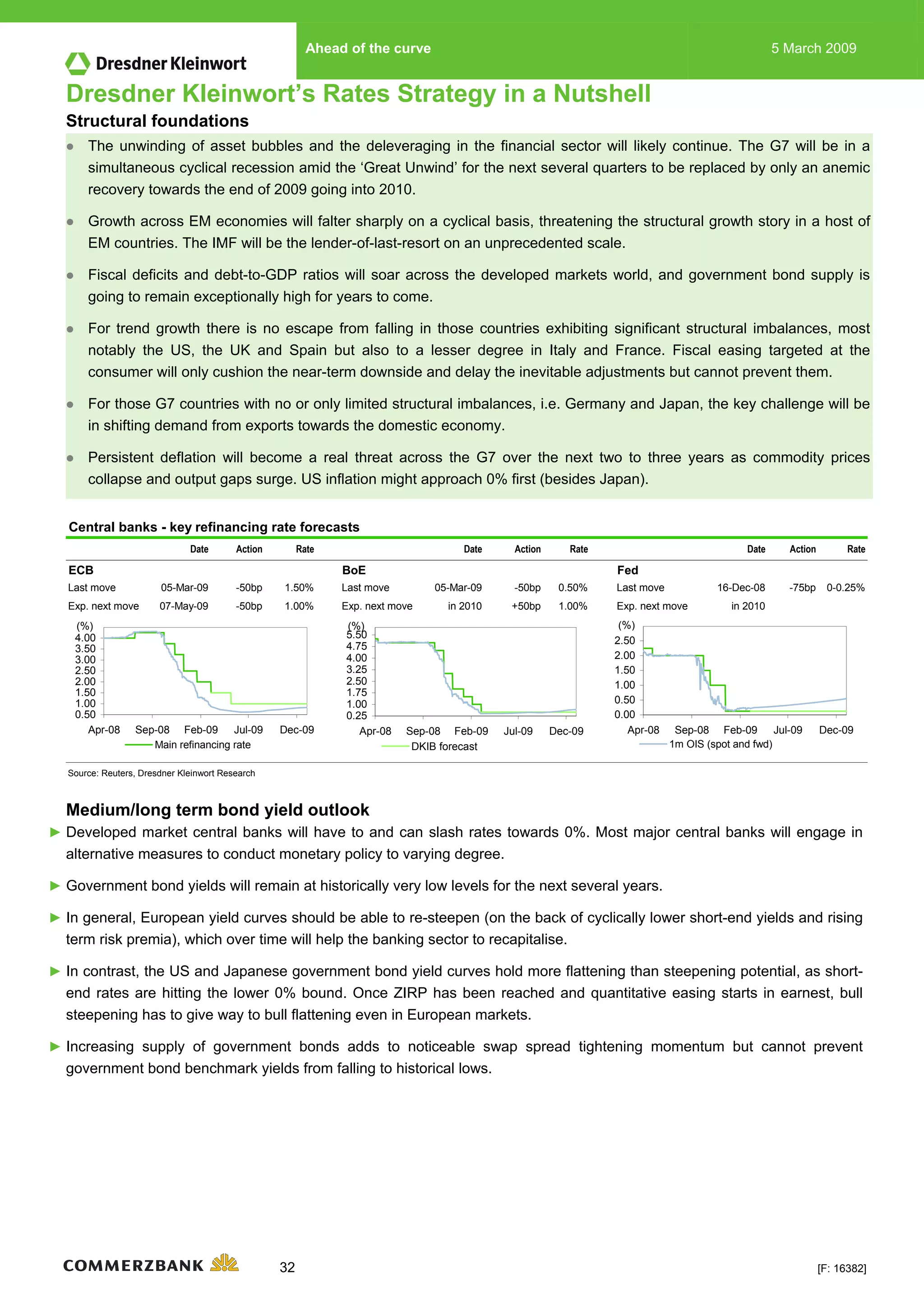

This document provides an analysis of the European Monetary Union (EMU) and options available amid the ongoing financial and economic crisis. It concludes that while there is high confidence that EMU sovereigns will repay debt at face value, bond and credit default swap spreads appear fundamentally elevated. The crisis has exposed structural flaws in the EMU framework. There is no easy solution, and tensions are likely to increase before improving. The document maintains overweight positions in larger EMU countries and expects new lows for German bund yields this summer, while recognizing funding risks may worsen in some countries before improving.