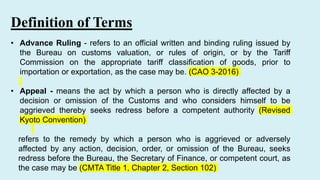

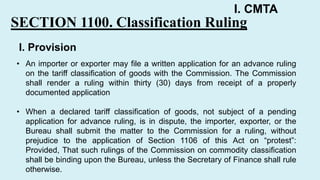

This document discusses administrative and judicial procedures related to advance rulings and dispute settlement in customs law. It defines key terms like advance ruling and appeal. It then outlines provisions in the Customs Modernization and Tariff Act (CMTA) related to classification rulings, valuation rulings, rulings on rules of origin, conditions for advance rulings, and administrative and judicial appeals processes. Advance rulings can be requested on classification, valuation, or rules of origin. Rulings are binding unless appealed, and appeals can be made to the Customs Tariff and Audit Commission or Secretary of Finance.