This document provides an overview of auditing, including:

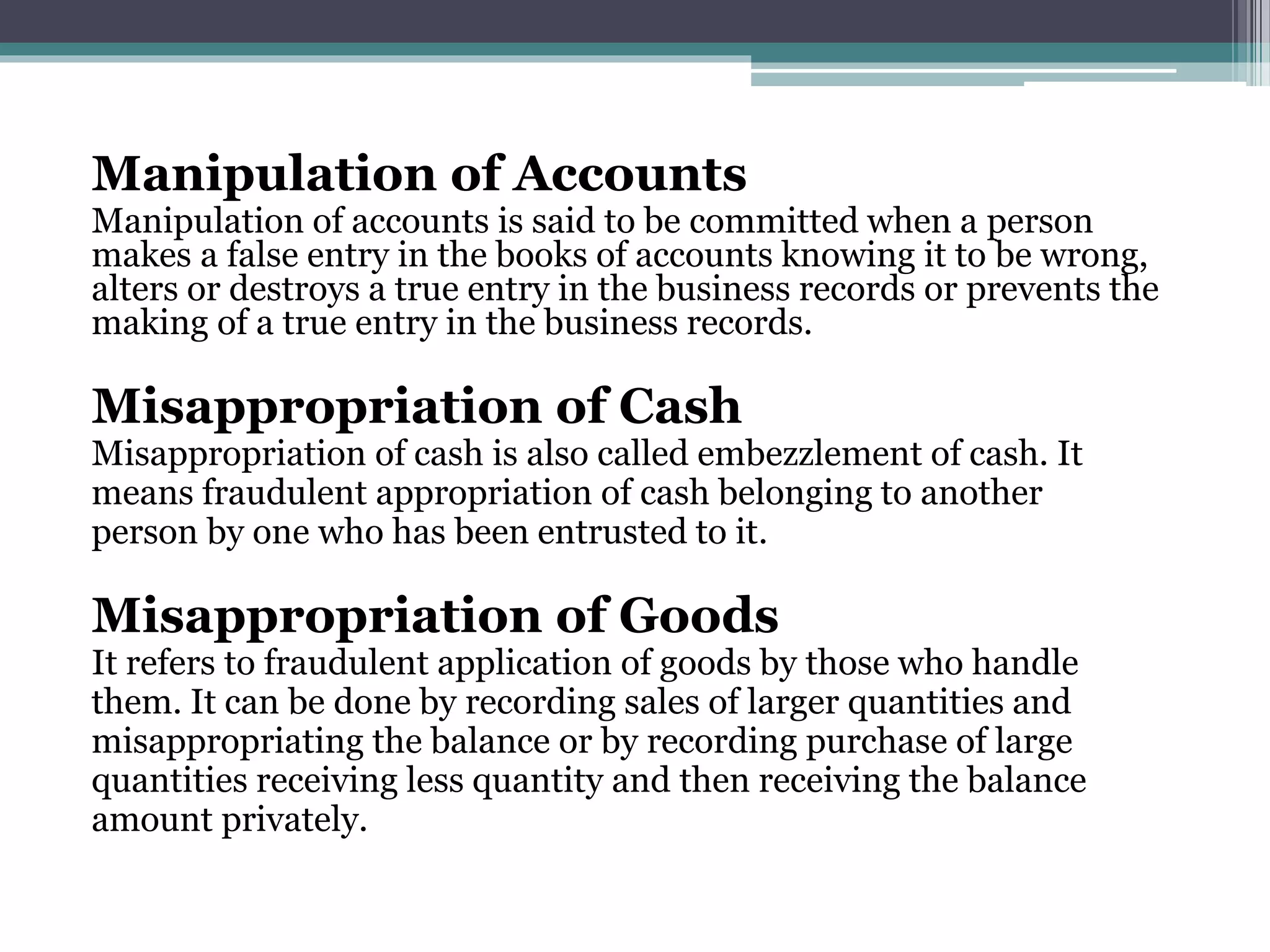

- The objectives and evolution of auditing from detecting errors and frauds to ascertaining if accounts are true and fair.

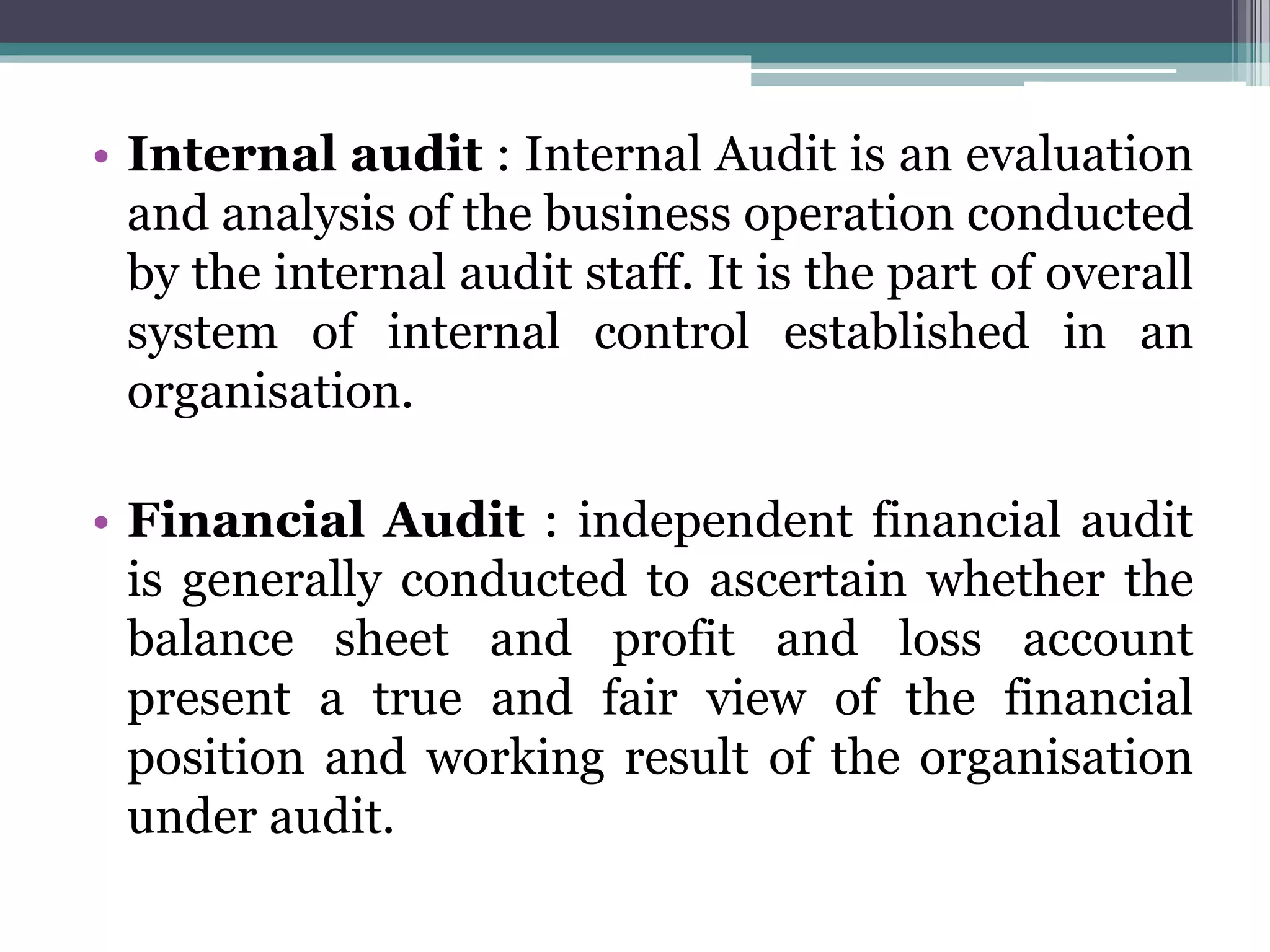

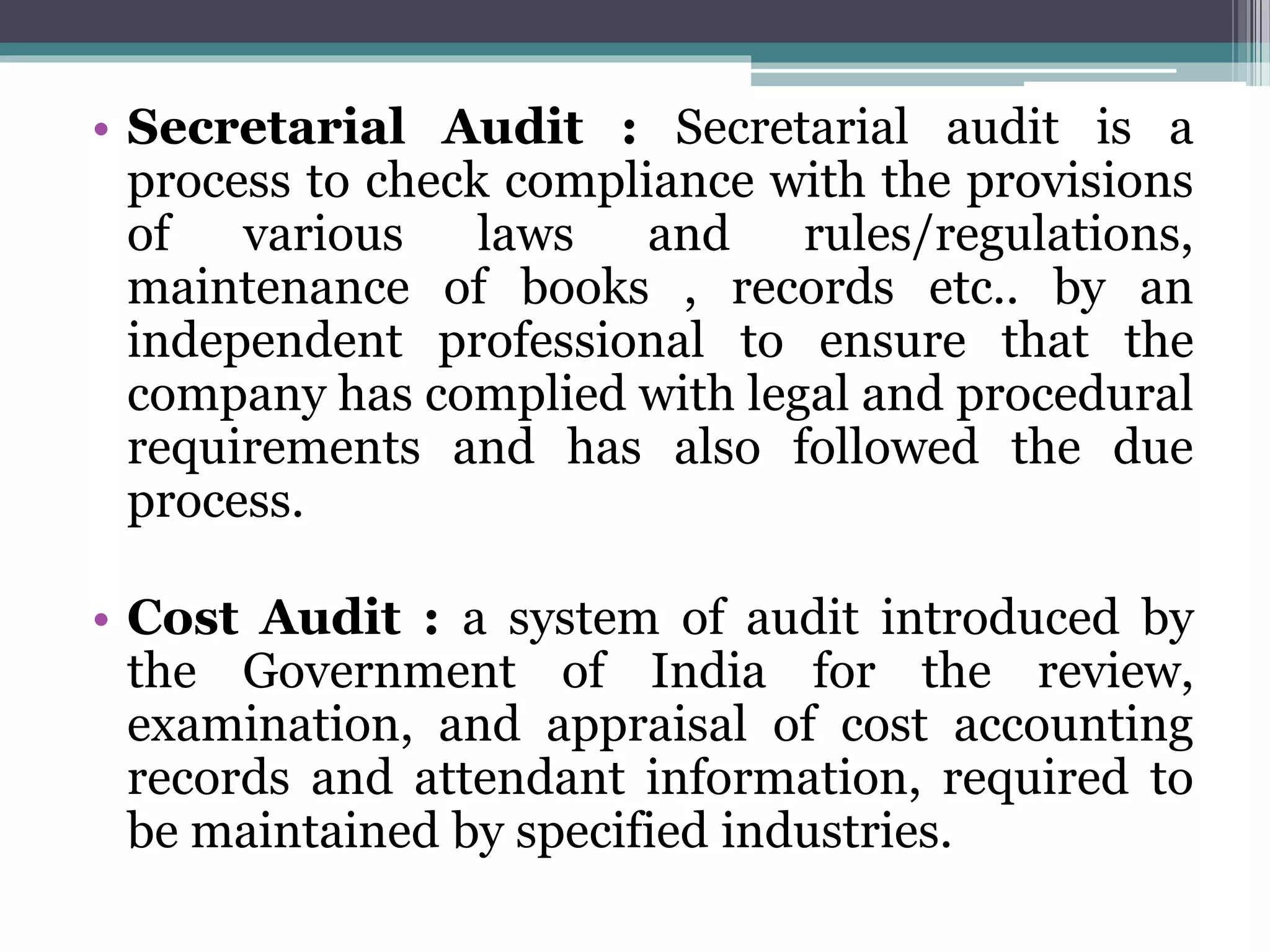

- Key definitions including that auditing is a systematic and independent examination of data, statements, records, operations and performance for a stated purpose.

- The features and objectives of auditing including verifying financial statements exhibit a true and fair view, and expressing an opinion on the statements.