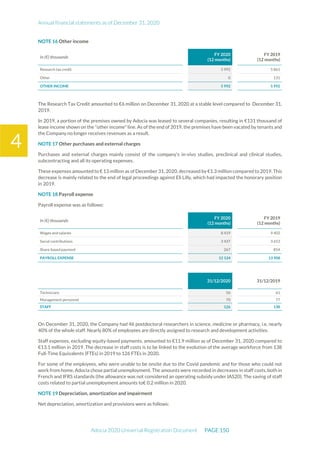

The document is the English translation of the Universal Registration Document for Adocia, a French corporation specializing in innovative treatments for diabetes and metabolic diseases, filed with the AMF. It includes details about the company's financial statements, corporate governance, activities, and risk factors for the fiscal year ended December 31, 2020. Additionally, it describes the company's technological platform and pipeline, including various clinical and preclinical products.

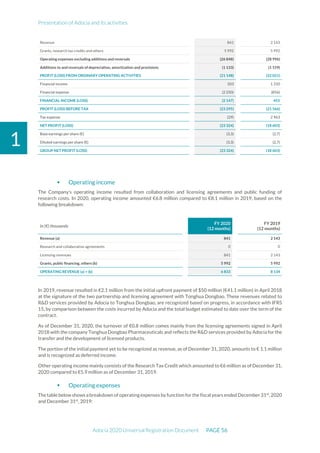

![Presentation of Adocia and its activities

Adocia 2020 Universal Registration Document PAGE 50

1

crystal API, regular recombinant human insulin injection Gansulin R, isophane protamine recombinant human insulin

injection Gansulin N,30/70 mixture recombinanthuman insulin injection Gansulin 30R, 3 50/50 mixture recombinant

human insulin injection Gansulin 50R, 40/60 mixture recombinant human insulin injection Gansulin 40R, Zhen Nao

Ning capsules and Dongbao Gantai tablets, among others. Tonghua Dongbao Pharmaceutical Co., Ltd. also provides

medical instruments. The Company distributes its products within domestic markets and to overseas markets.

Litigation

Arbitrations

In October 2017, Adocia announced in a press release its filing of an arbitration claim against Eli Lilly & Co related to

a research and licensing agreement signed in 2014. This proceeding concerned some $11 million and other specific

compensation for changes made to the development plan during the collaboration. The arbitration court found in

favor of Adocia in the first phase of arbitration against Eli Lilly in August 2018 and Adocia announced via a press

release the same month that the company would separately seek interest, litigation fees and costs in addition to the

damages awarded. In October 2018, the arbitration court granted Adocia fees’ interests on the amount cited above

accruing from March 30, 2017.

In February 2018 Adocia announced additional arbitration claims against Eli Lilly & Company arising out of Lilly’s

misappropriation and improper use of Adocia’s confidential information and discoveries as well as Lilly’s breaches of

several collaboration and confidentiality agreements. Adocia was seeking monetary damages in excess of $1.3 billion

(before taking into account the interests pre-and post-judgement) as well as others specific relief. In the second phase

of this arbitration, Lilly filed counterclaims against Adocia seeking approximately 188 million including prejudgment

interest. These counterclaims were based on an allegation that Adocia concealed its discoveries and confidential

information which were at issue in Adocia's claims. Adocia denied Lilly's claims.

In August 2019, the American Arbitration Association Panel rejected the additional claims submitted by Adocia as

well as the counterclaims of Eli Lilly.

On September 30, 2019, Adocia announced receipt of the payment of USD 14.3 million corresponds to the USD 11.6

million in damages plus interest awarded to Adocia in August 2018 by an American Arbitration Association Panel

presiding over Adocia’s arbitration claims against Eli Lilly as compensation of a contractual milestone payment

disputed by Lilly.

The arbitration procedure is now finalized.

Civil Action

Eli Lilly and Company (“Lilly”) filed a complaint against Adocia in the United States District Court of the Southern

District of Indiana on October 9th, 2018. Lilly’s complaint seeked a declaratory judgment that “the designations of

inventorship currently appearing on [Lilly’s] United States Patent Nos. 9,901,623 and 9,993,555 are complete and

correct, as required by the patent laws of the United States.” US Patent No.9,901,623 is entitled “Rapid-acting insulin

compositions” and was issued on February 27, 2018. US Patent No 9,993,555 is entitled “Rapid-acting insulin

compositions” and was issued on June 12, 2018. Lilly contended in its complaint that it filed the action because Adocia

had asserted that Lilly’s patents reflected Adocia’s inventive contributions.

In September 2019, Adocia and Eli Lilly agreed together to file a consent judgment to conclude the civil litigation

initiated by Eli Lilly at the Court of the Southern District of Indiana in October 2018. The consent judgement was

registered by the Court of the Southern District of Indiana in October 2019 and concluded this litigation. Each party

will cover its own legal fees and associated costs, without any further financial consequence.

Consequently, the litigation in the Court of the Southern District of Indiana is now fully concluded.

Insulin supply agreements

Adocia and Tonghua Dongbao Pharmaceuticals Co. Ltd announced on June 1st

, 2018 an expansion of their strategic

alliance see section 1.3.8.2 « Licences granted by Adocia toTonghua Dongbao Co.Ltd » above) by signing with the Chinese

company two supply agreements in insulin. Under the terms of the agreements, Tonghua Dongbao Pharmaceuticals

Co. Ltd will manufacture and supply insulin lispro and insulin glargine APIs to Adocia worldwide, excluding China in

accordance with Adocia’s specifications and established quality standards.](https://image.slidesharecdn.com/adociaurd2020engvf-210430133434/85/Adocia-Universal-Registration-Document-2020-50-320.jpg)