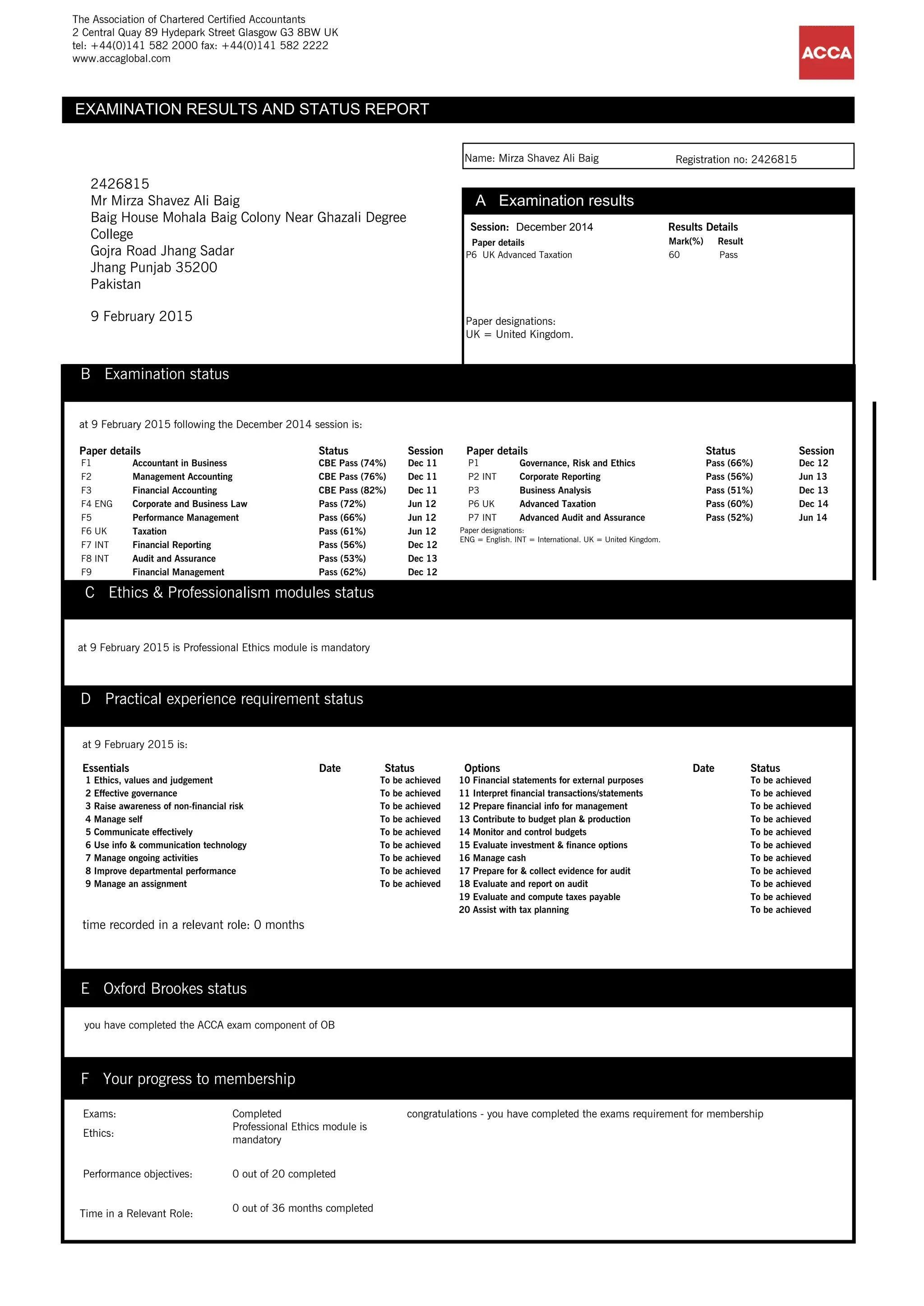

This document provides Mirza Shavez Ali Baig's examination results and progress toward ACCA membership. It shows that he passed the UK Advanced Taxation paper in December 2014 with 60%. It also lists the results of all his previous ACCA papers, and indicates he has completed the exam requirement but still needs to pass the Ethics module and gain relevant work experience to fulfill the remaining membership requirements.