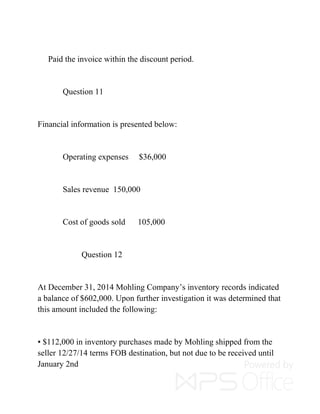

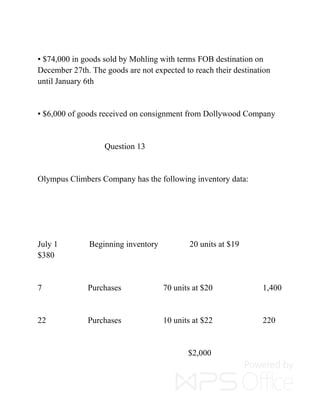

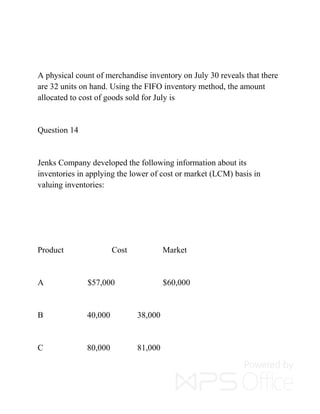

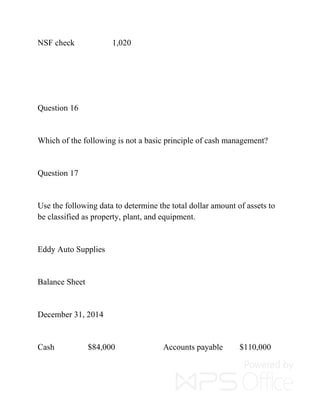

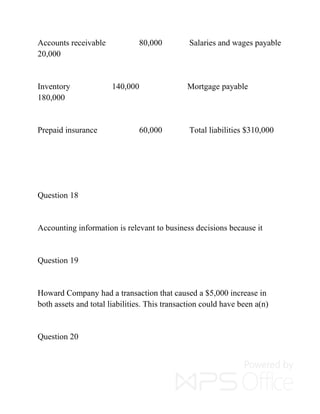

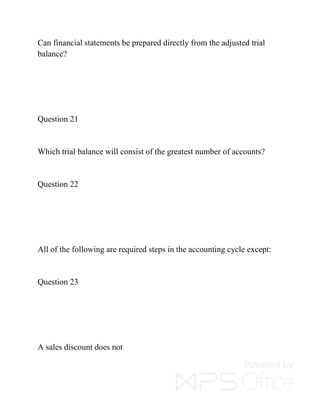

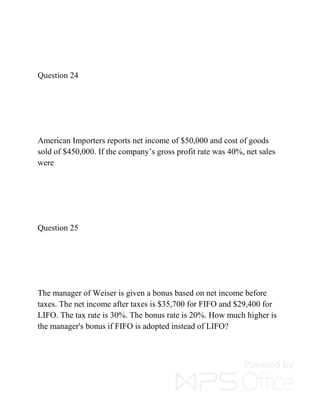

The document outlines the ACC 290 course curriculum, including weekly assignments, discussions, and final exam guides. It provides a variety of accounting problems related to financial statements, inventory methods, and financial analysis. The content is designed to assist students in understanding accounting principles and preparing for assessments.