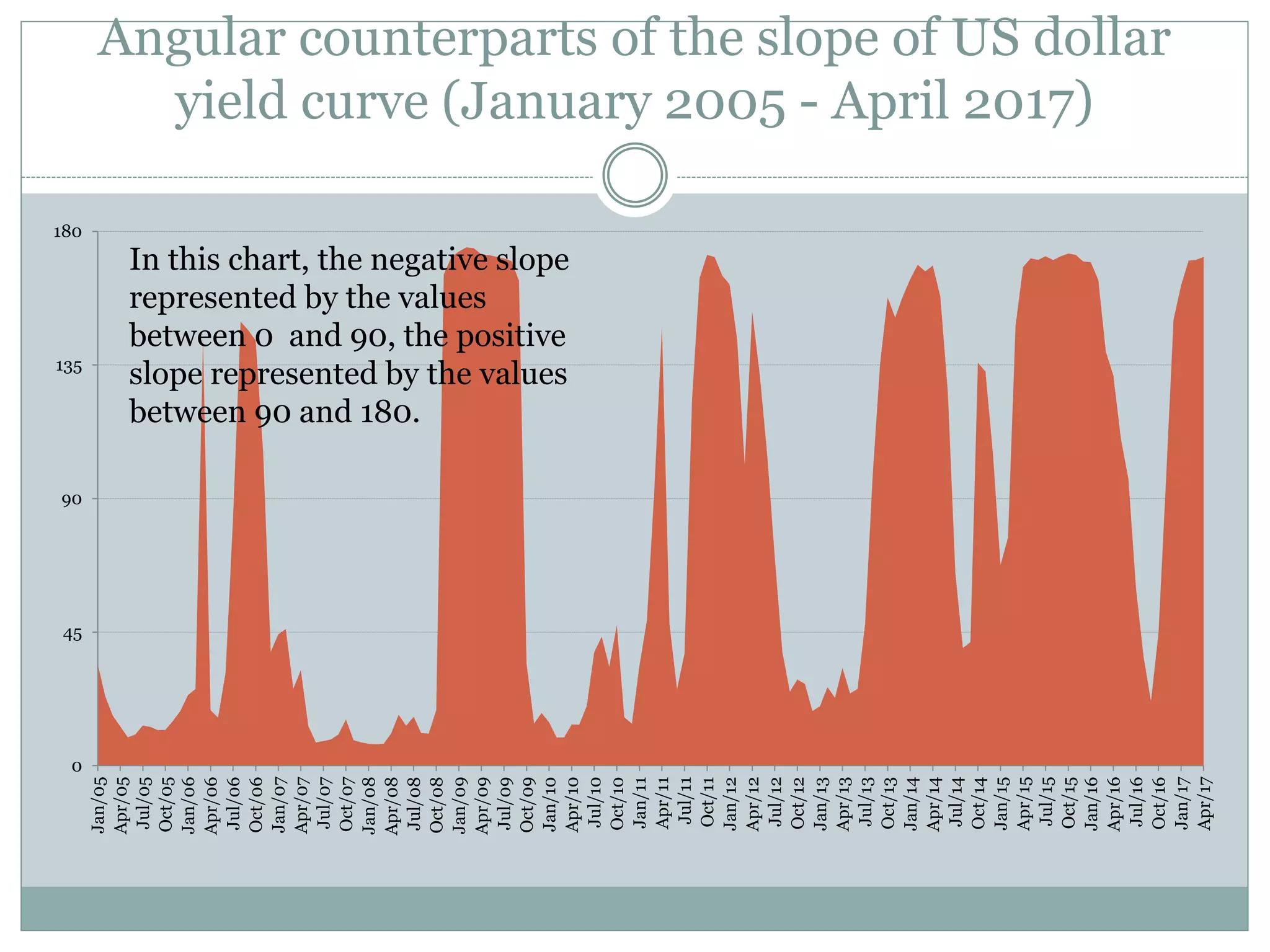

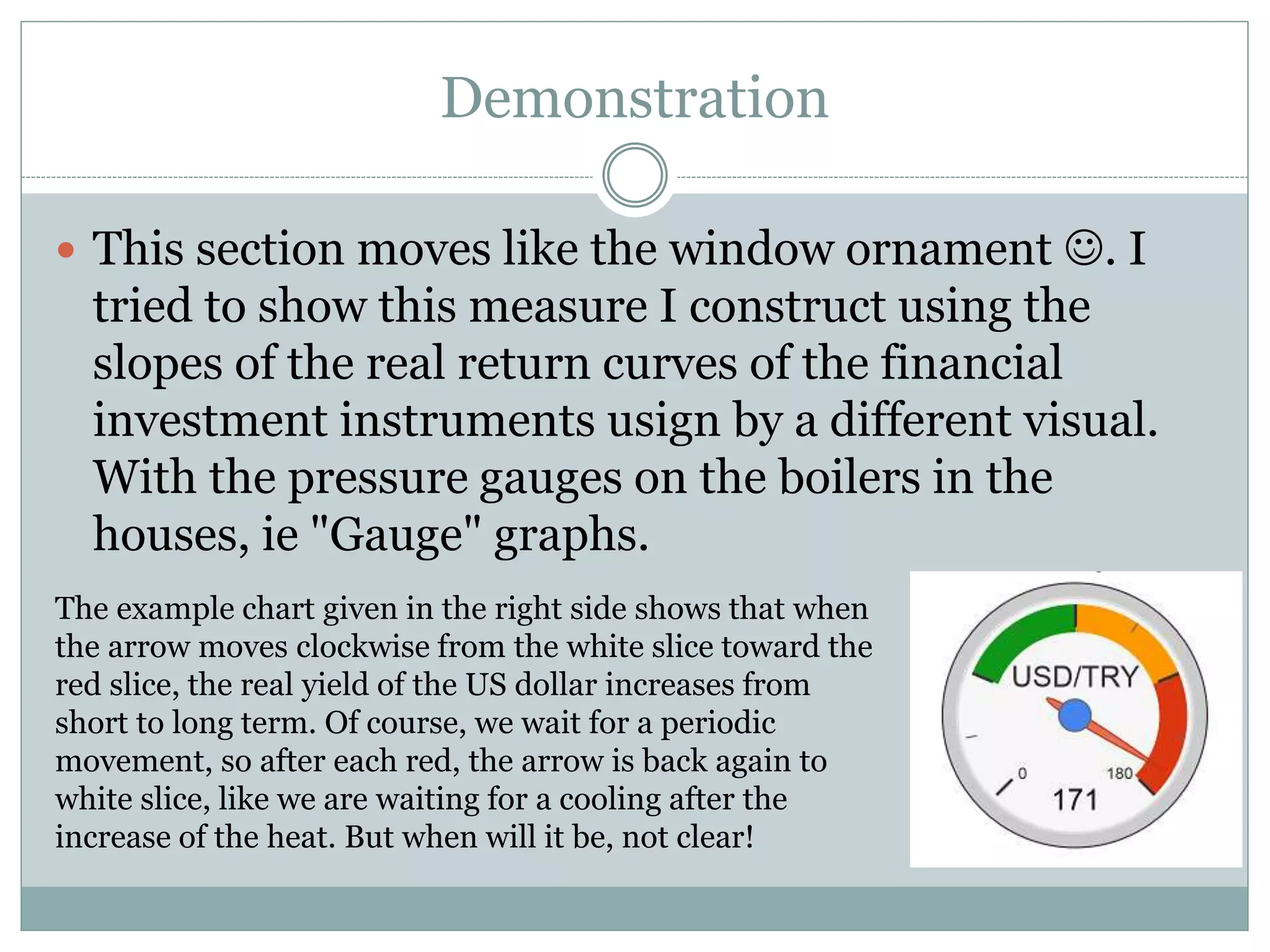

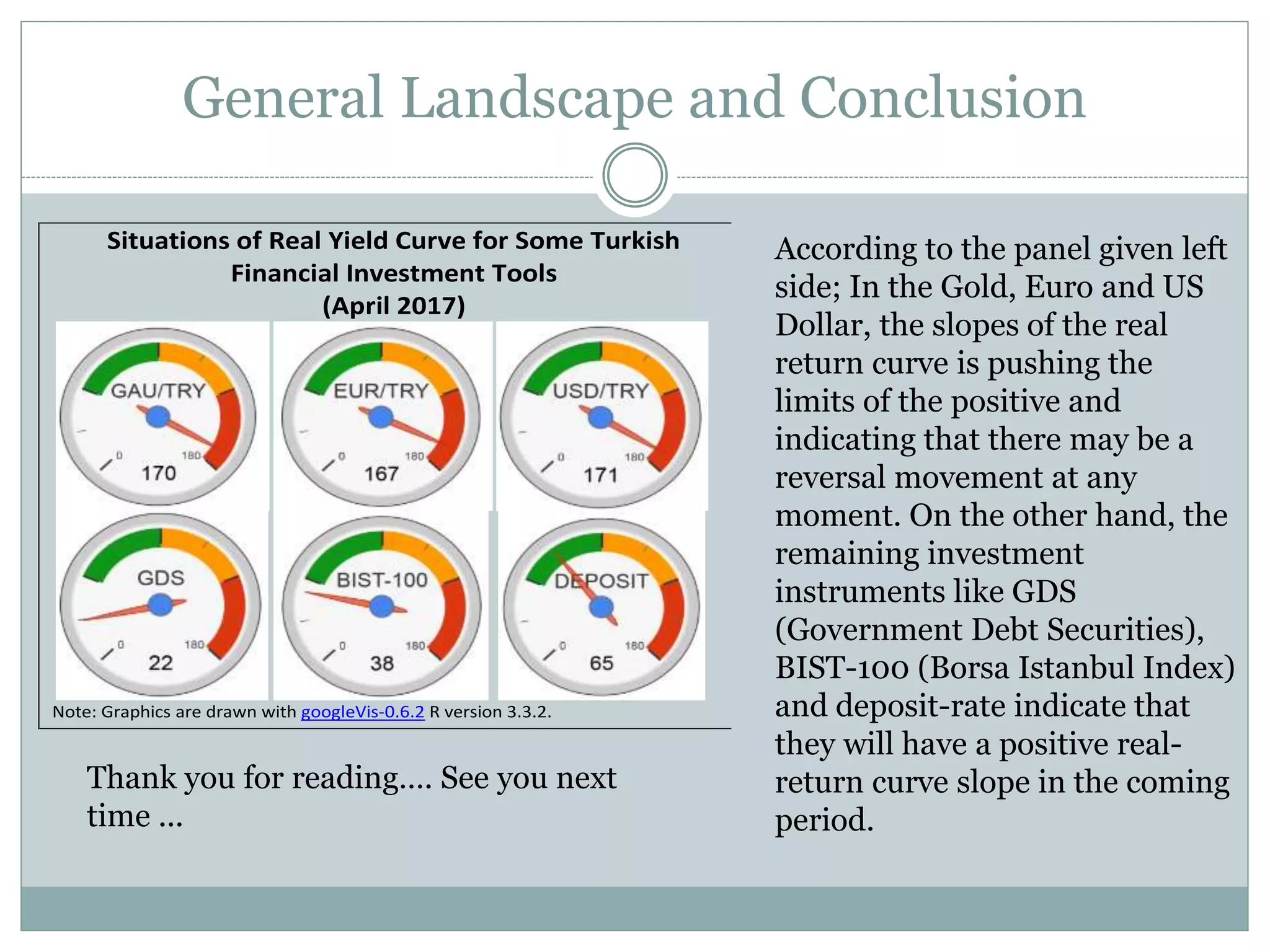

The document outlines a proposal for a warning mechanism based on the slopes of real yield curves of financial instruments, particularly focusing on the US dollar. It explains how to estimate these slopes and their angular counterparts to identify periodic cycles that forecast future yield movements. The analysis suggests potential reversals in the yield trends of various investment tools, emphasizing the importance of understanding these patterns for financial forecasting.