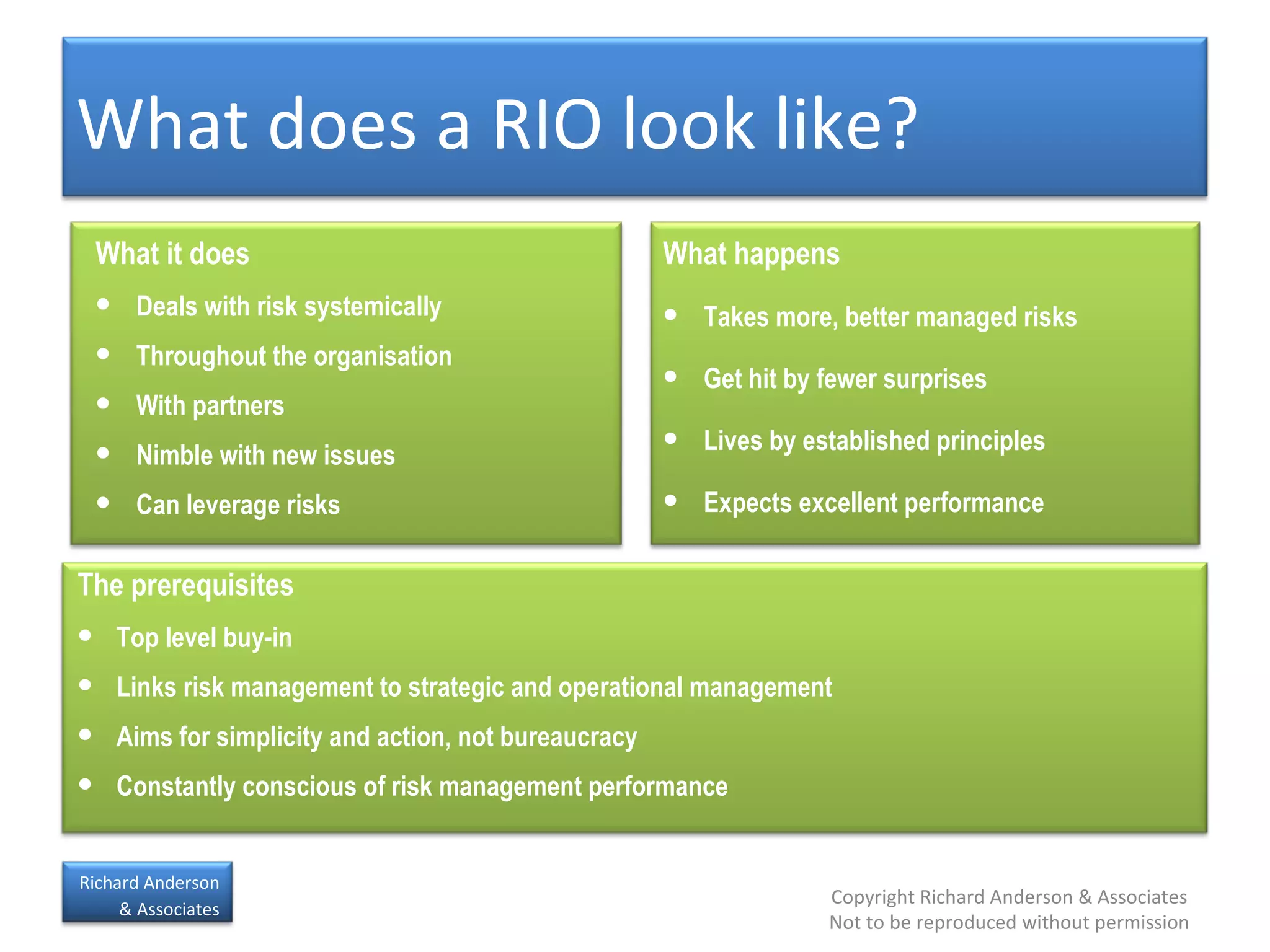

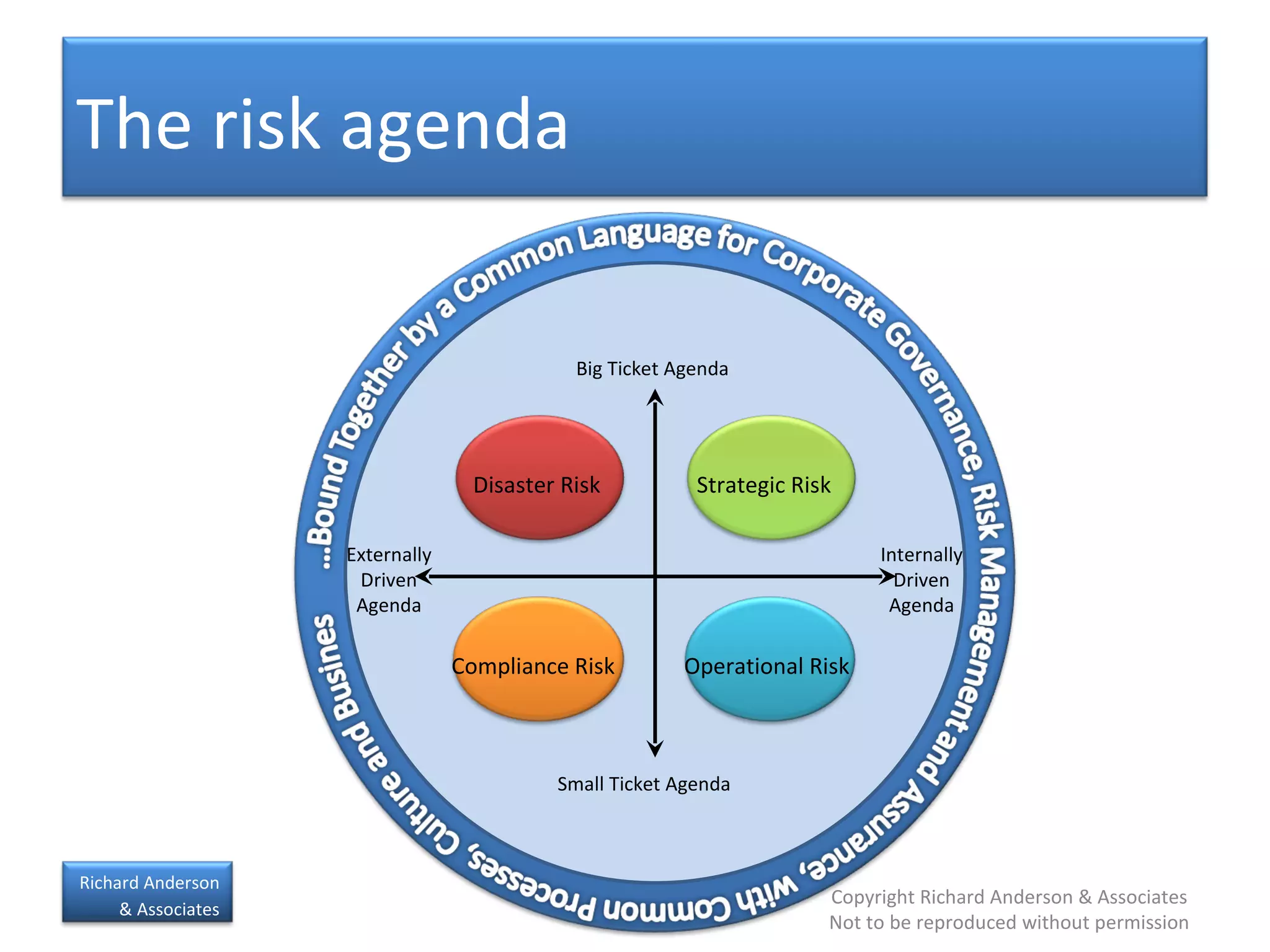

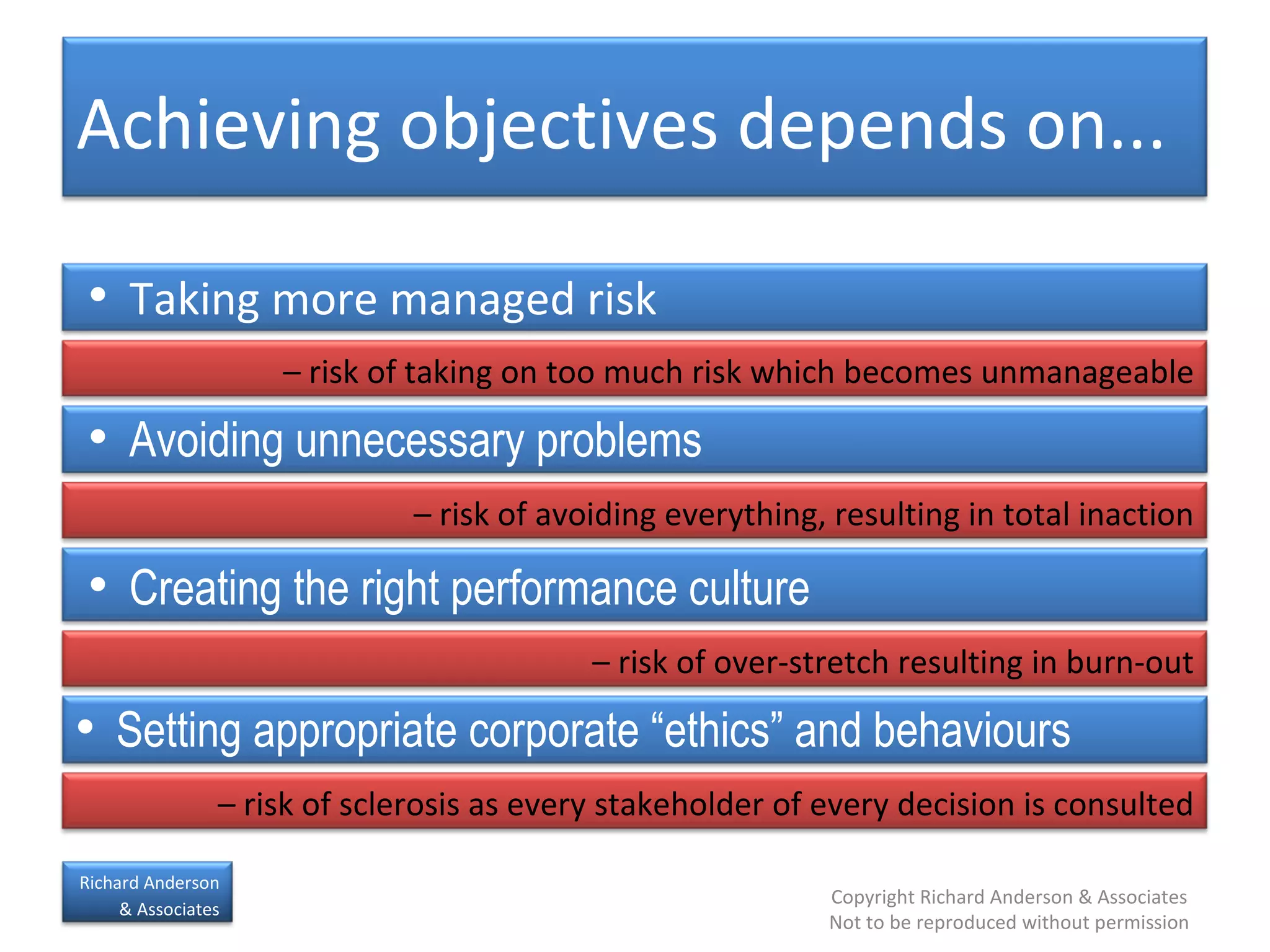

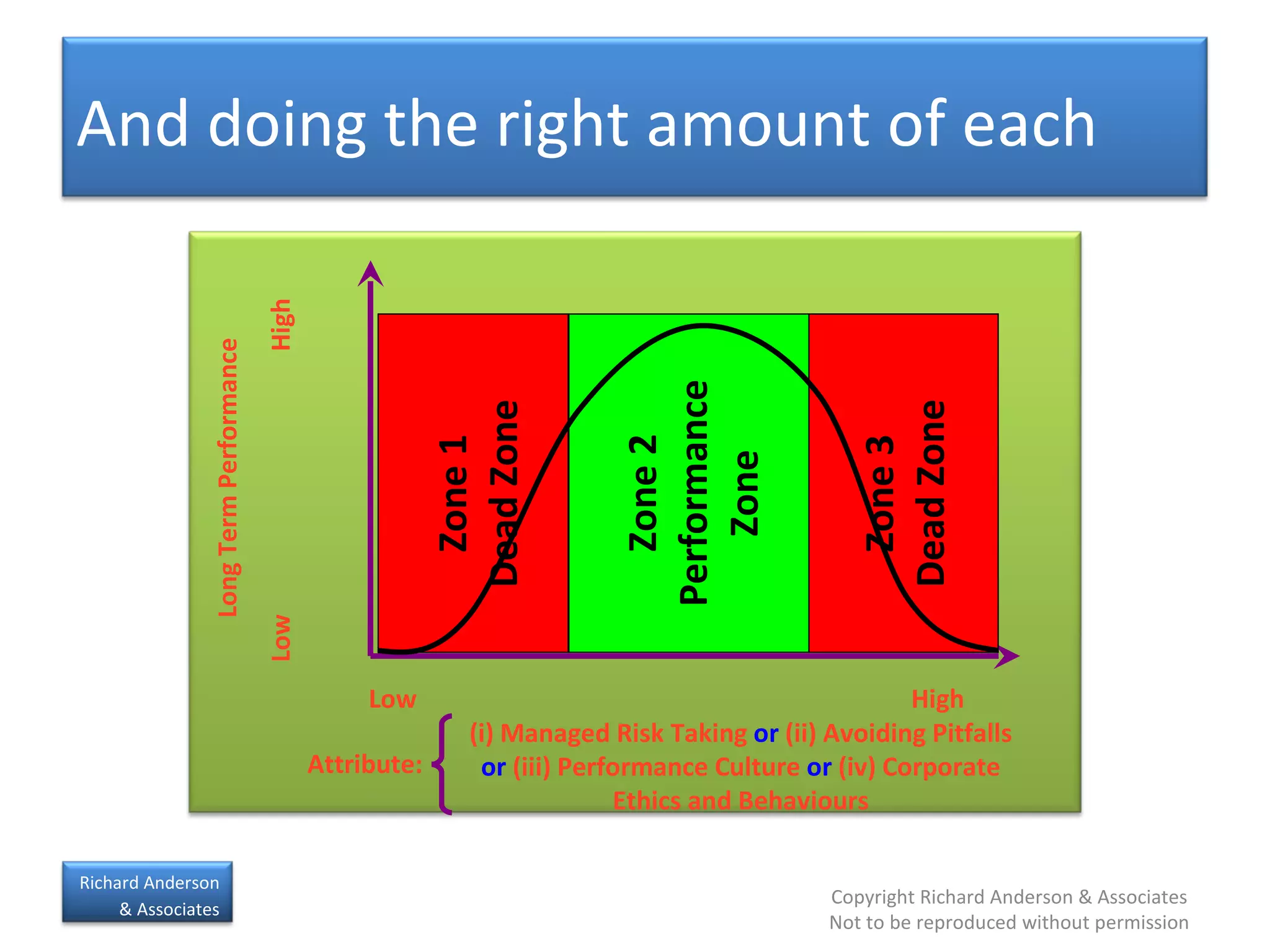

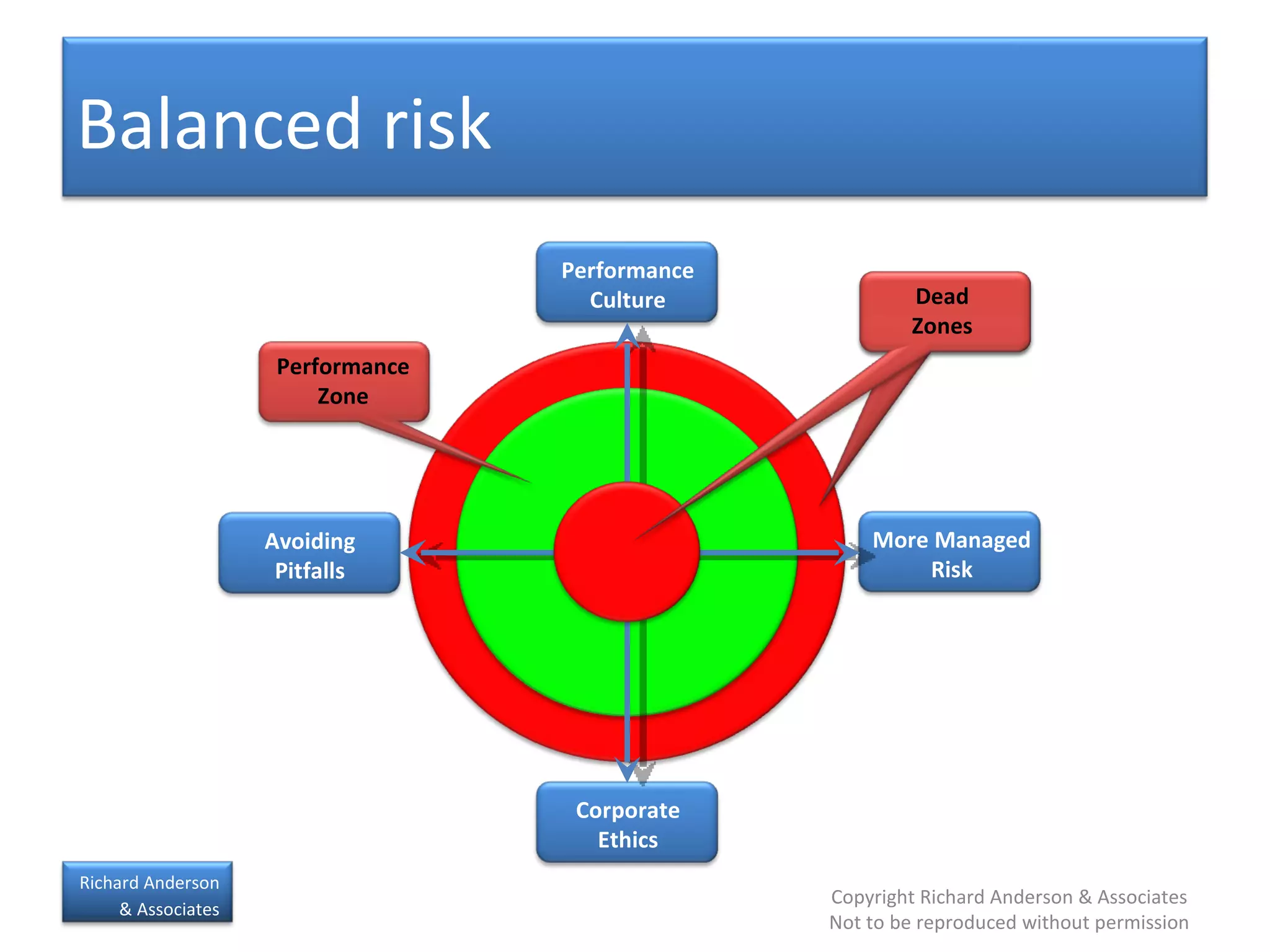

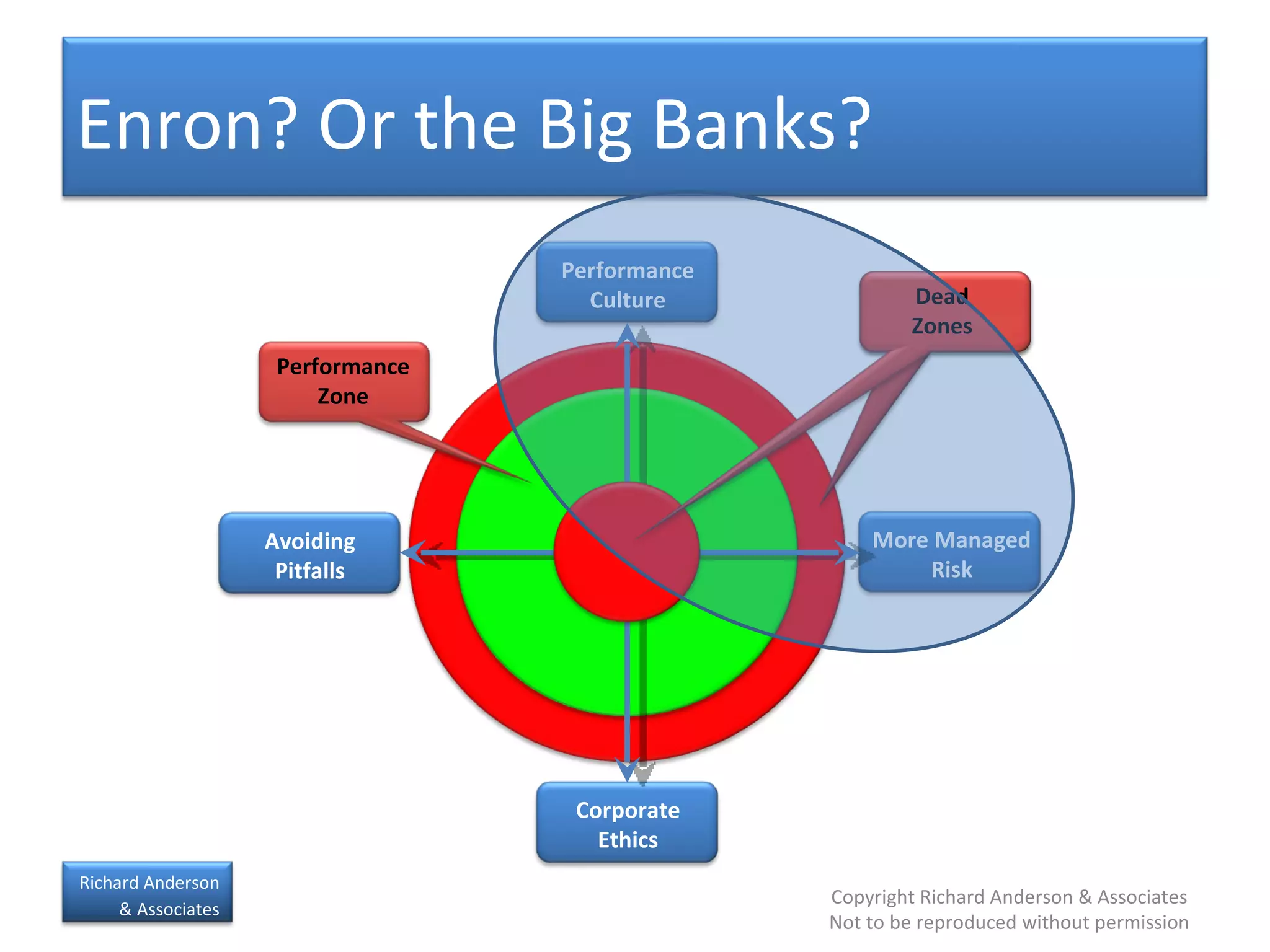

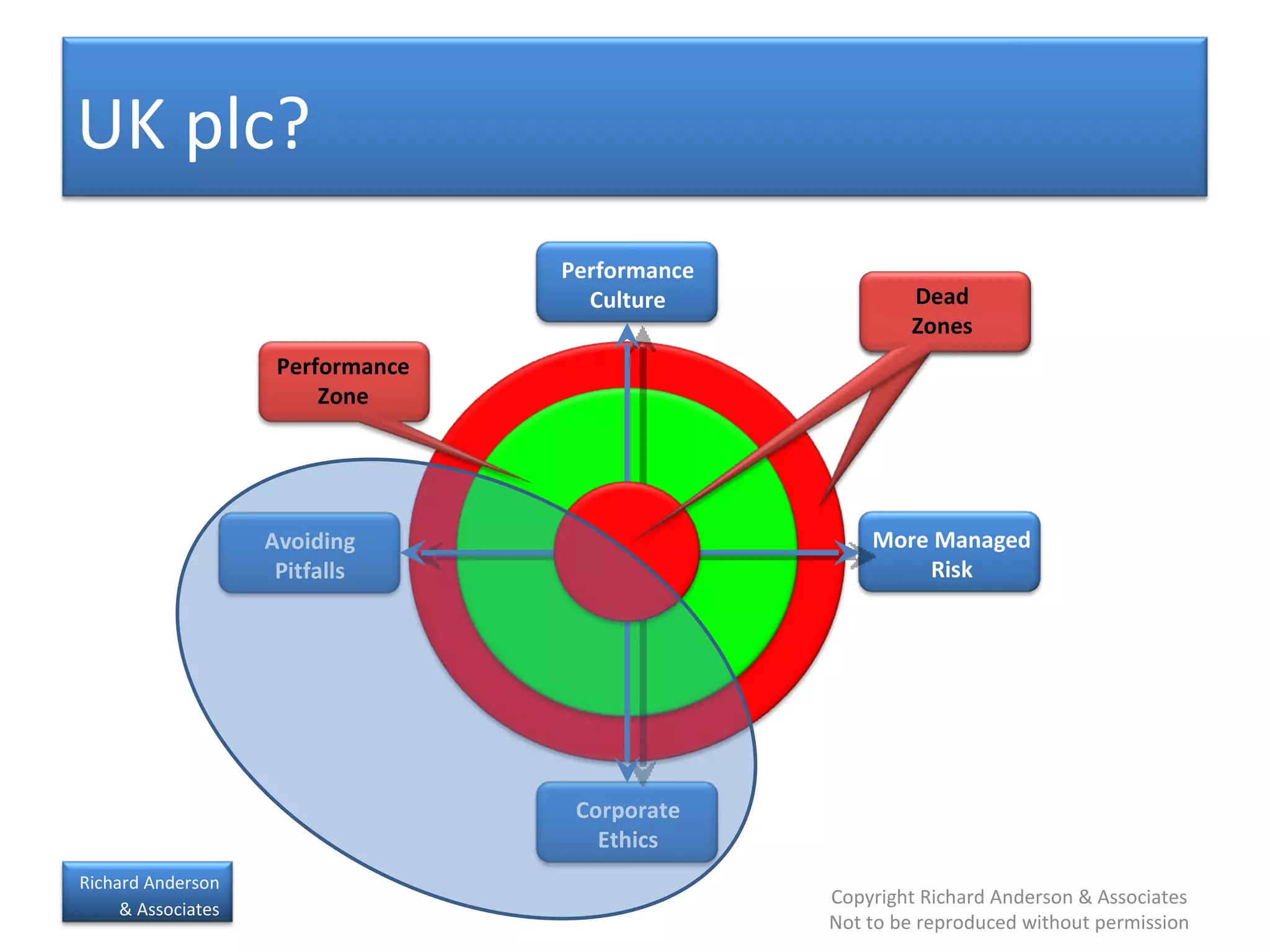

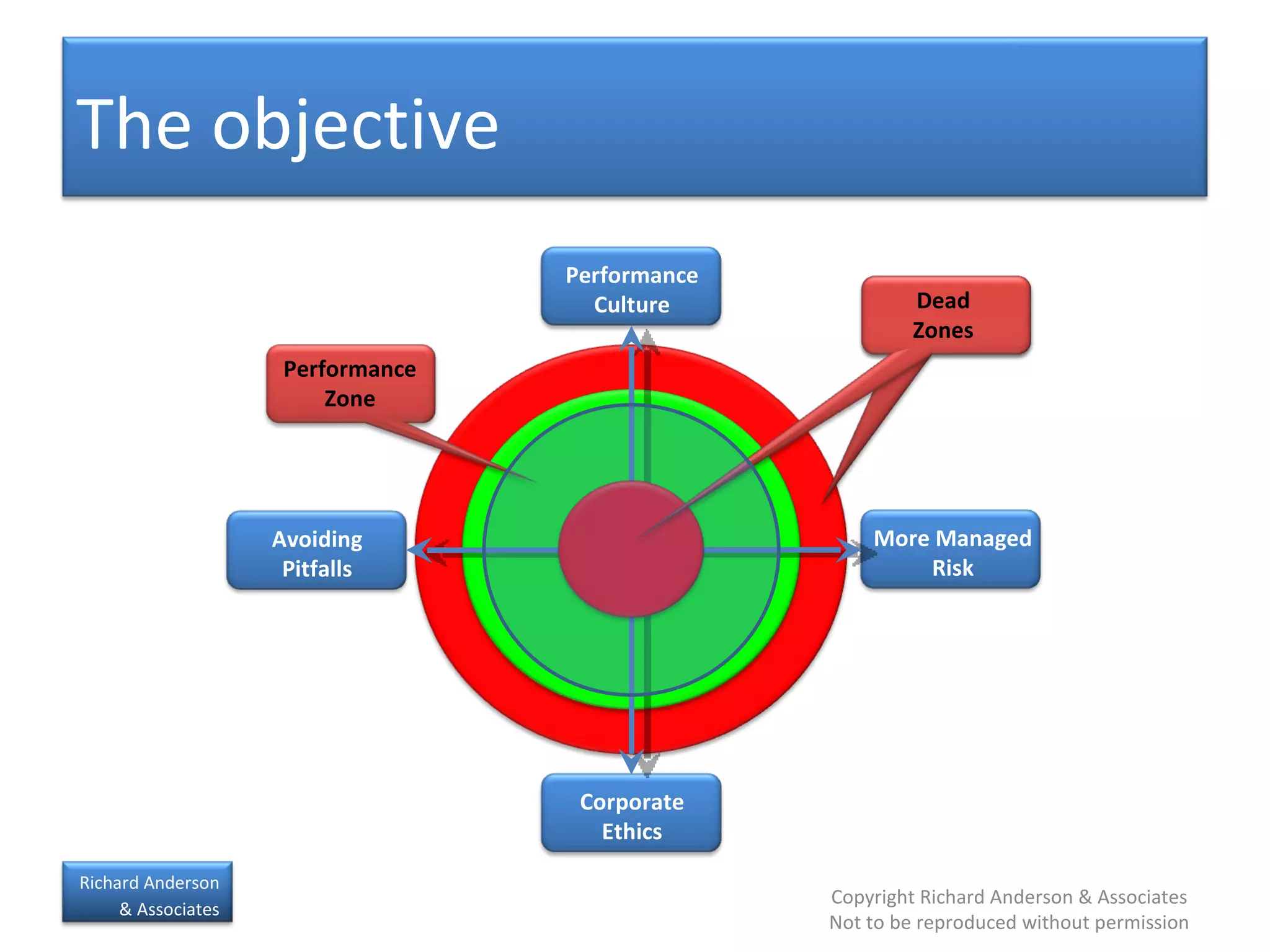

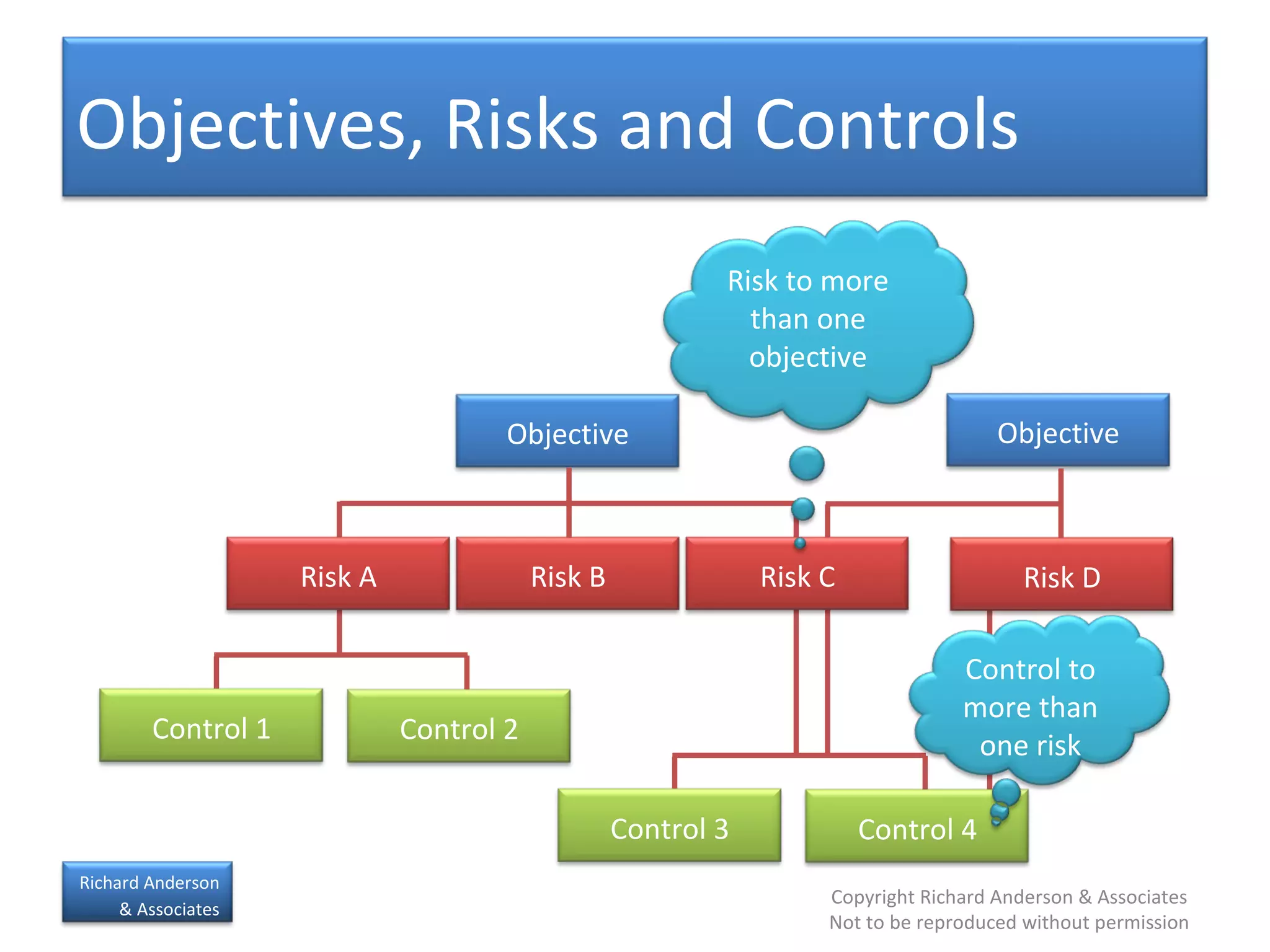

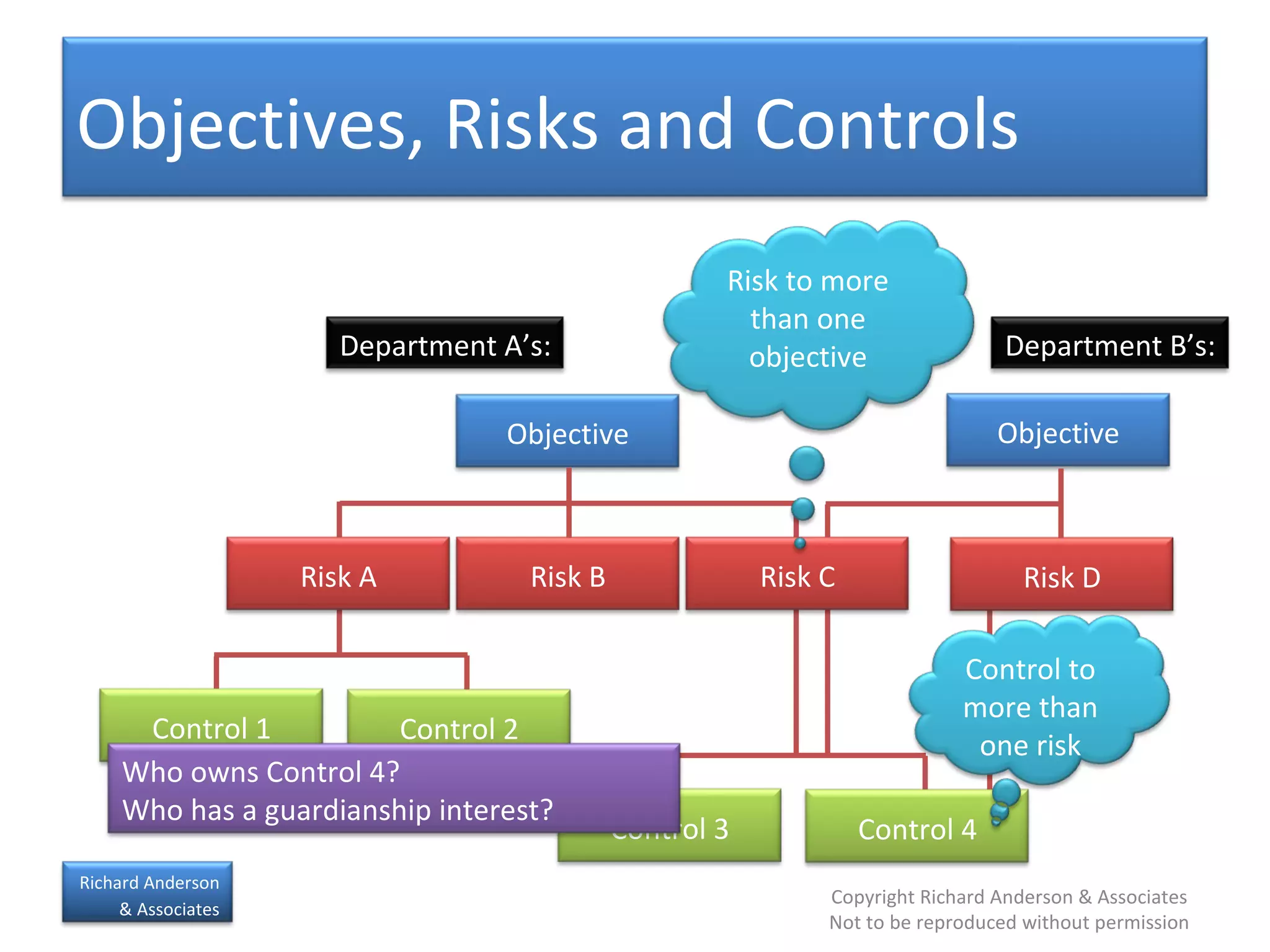

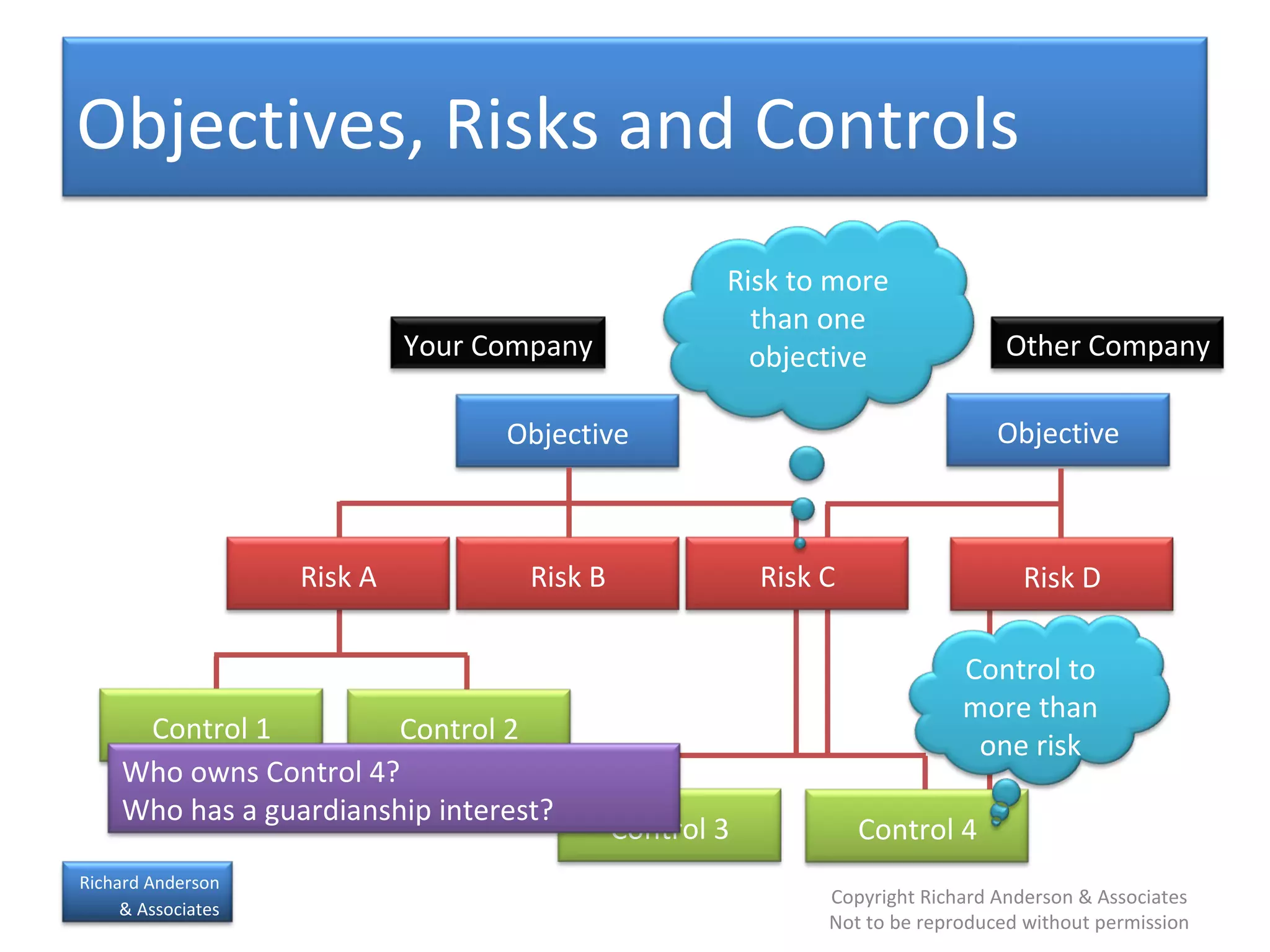

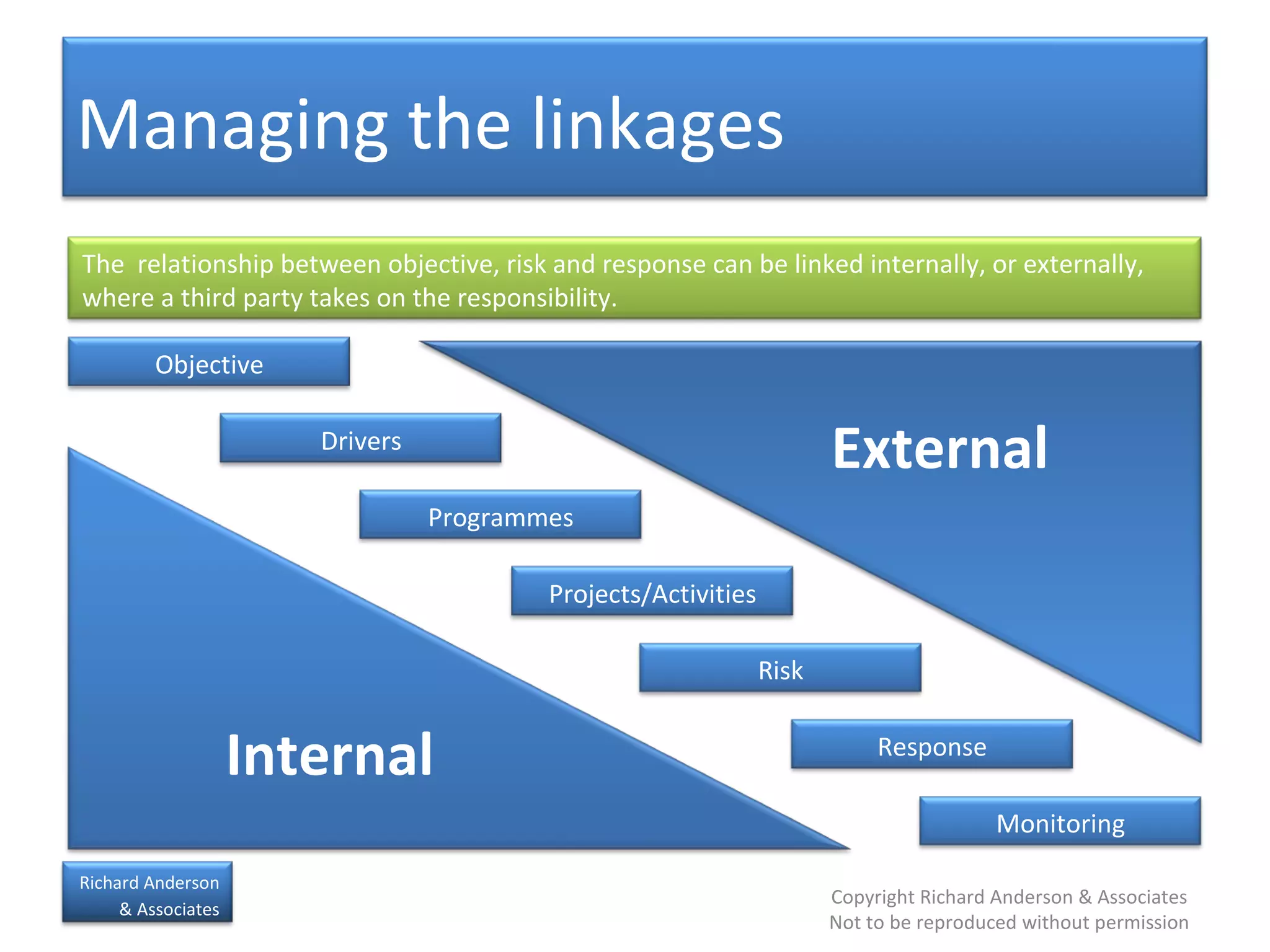

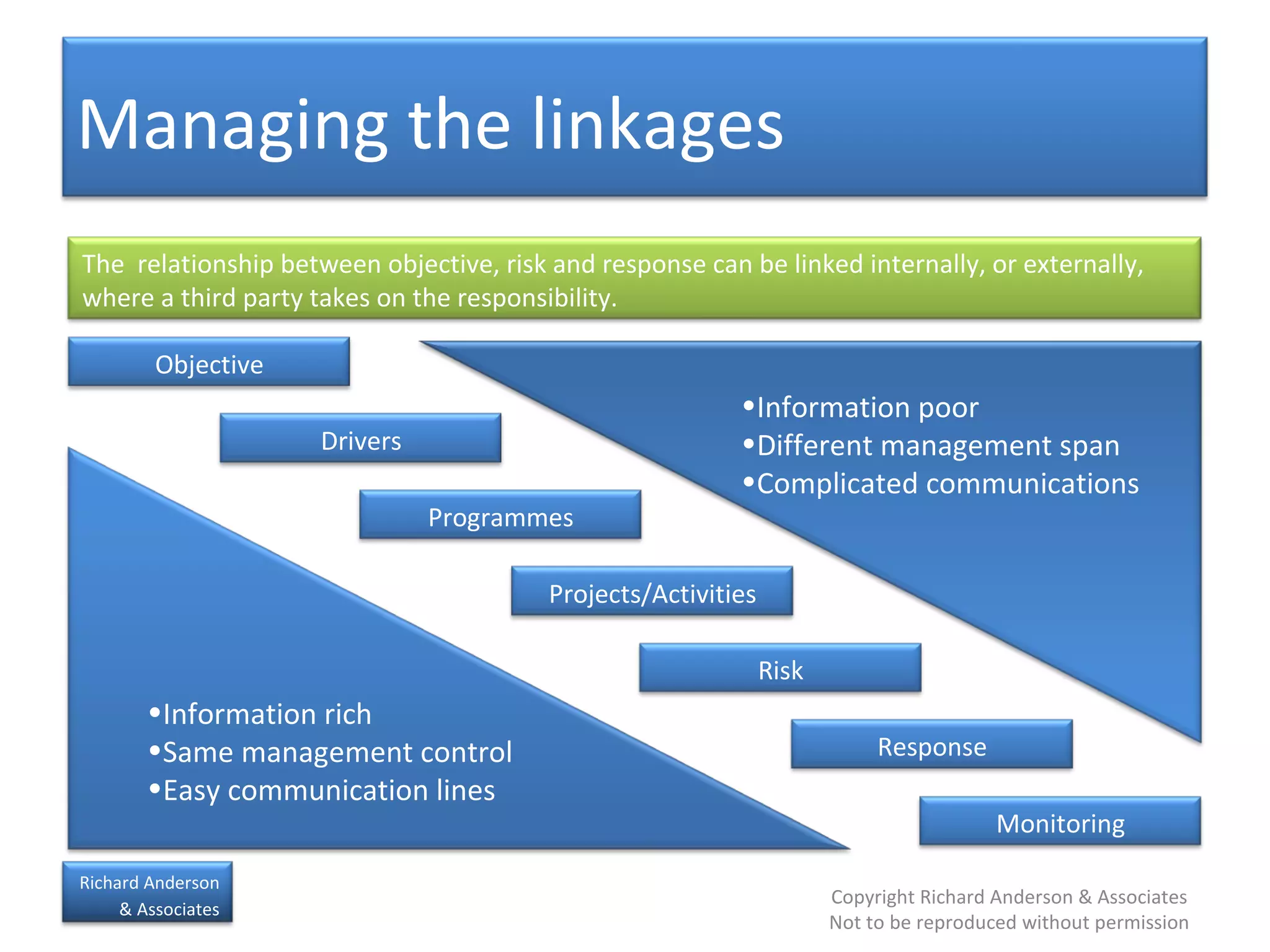

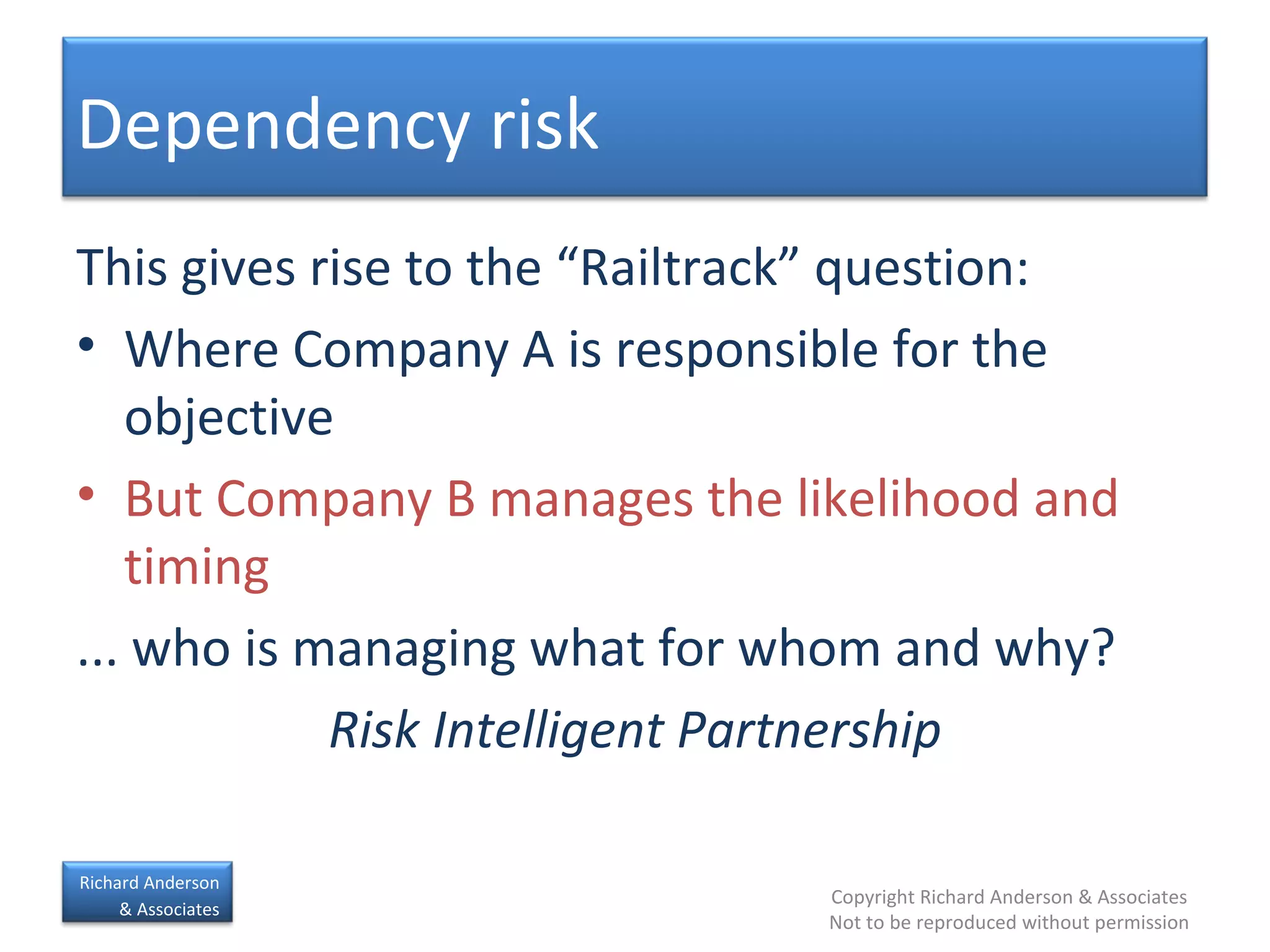

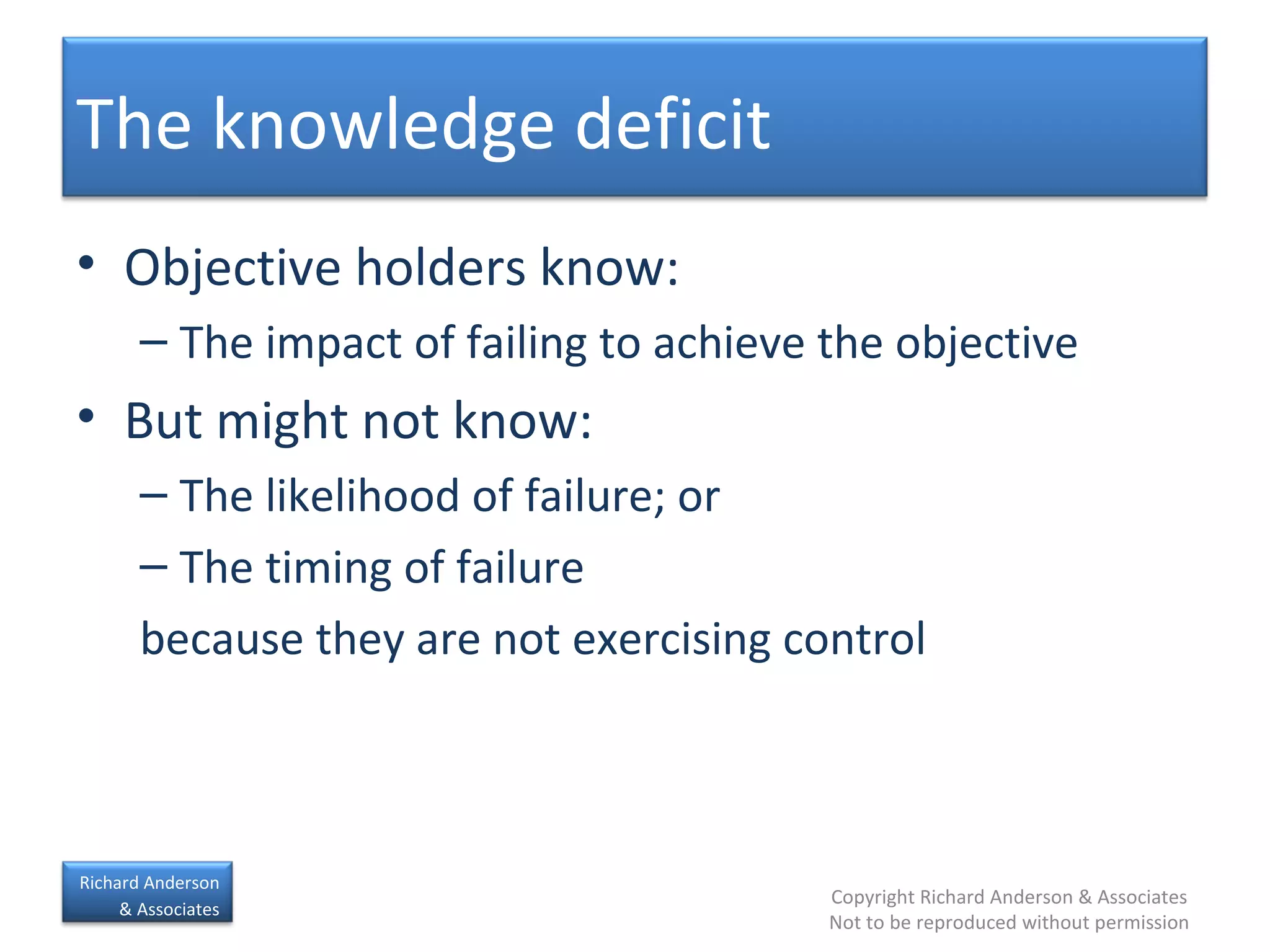

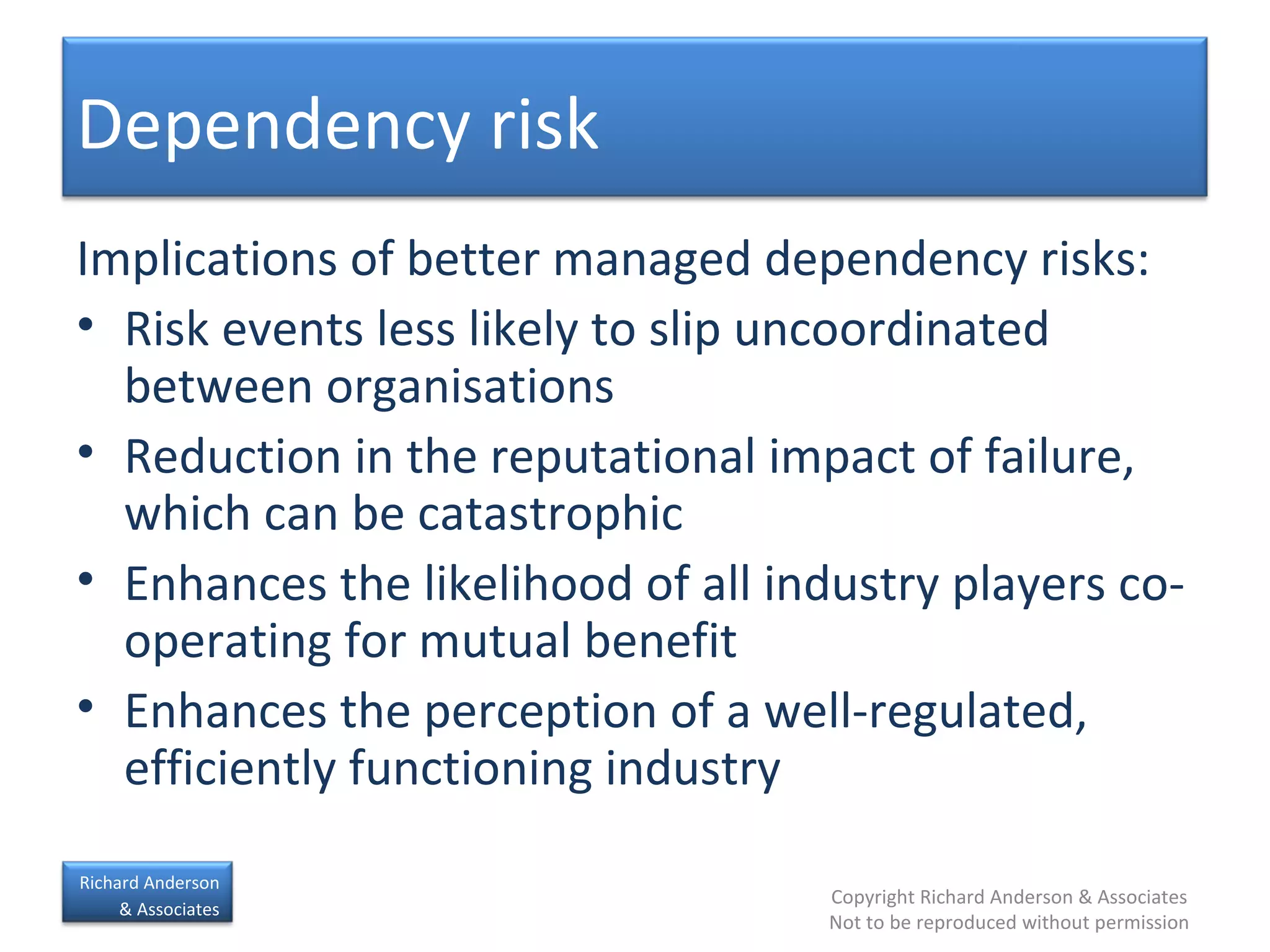

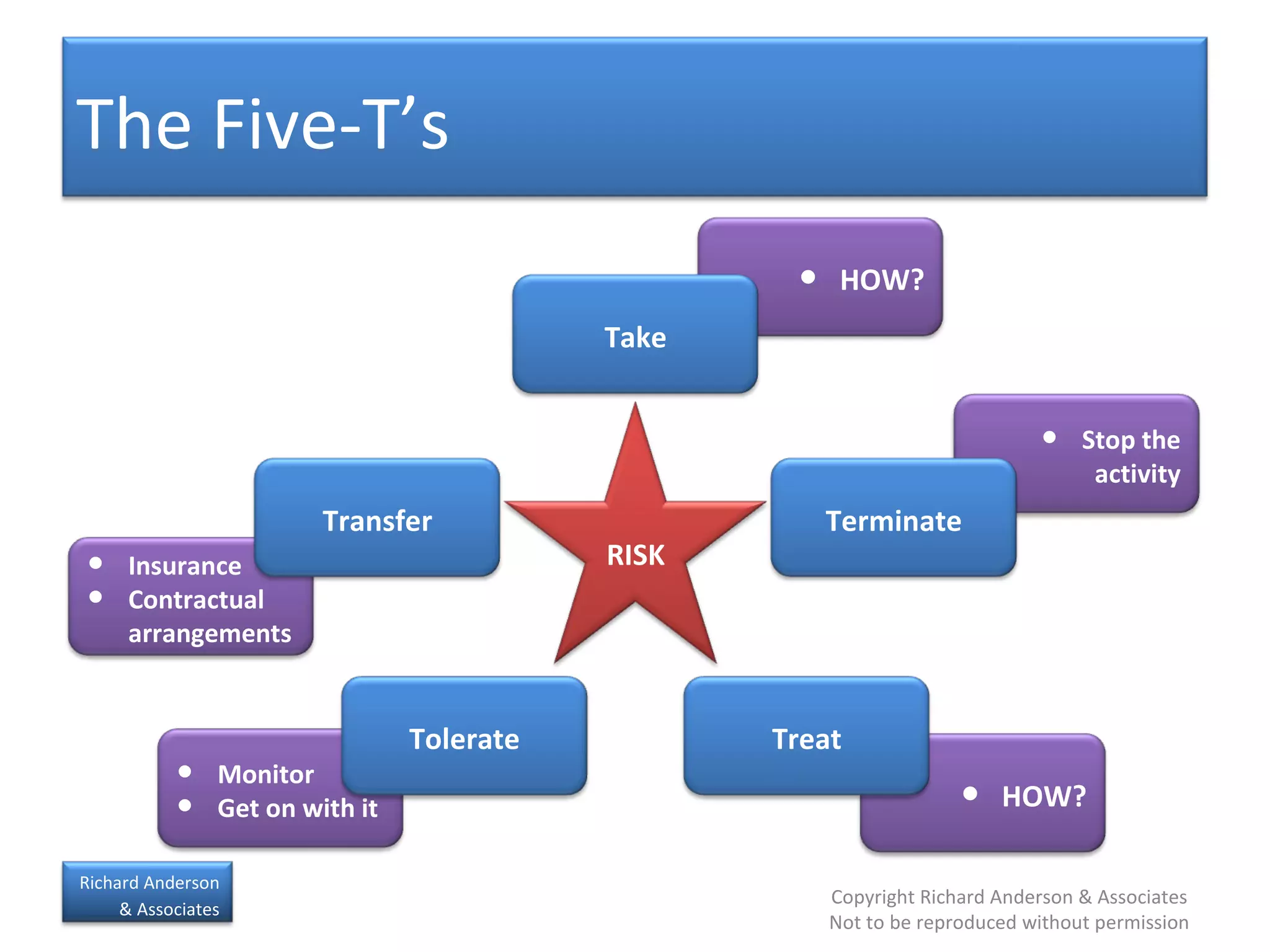

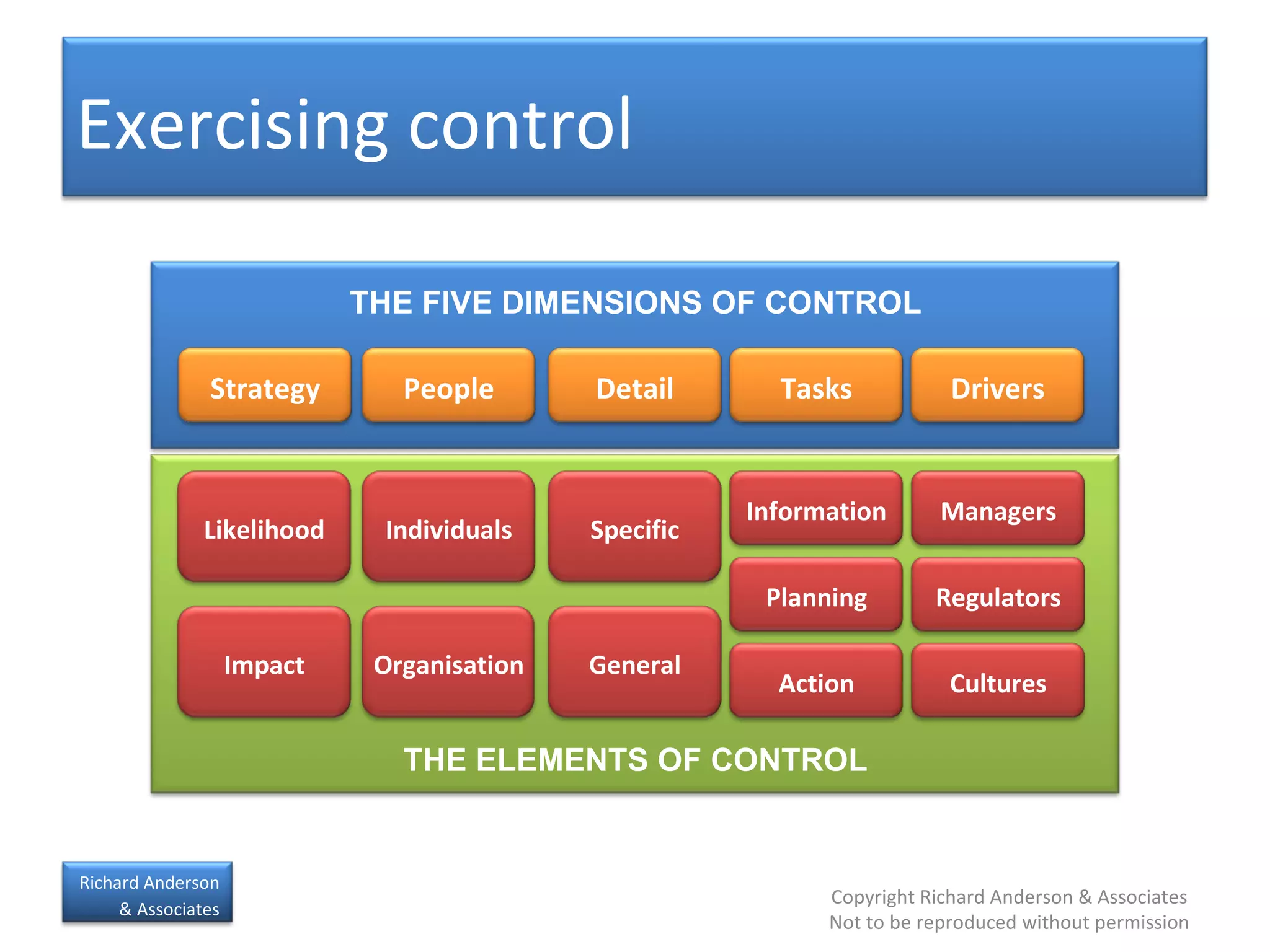

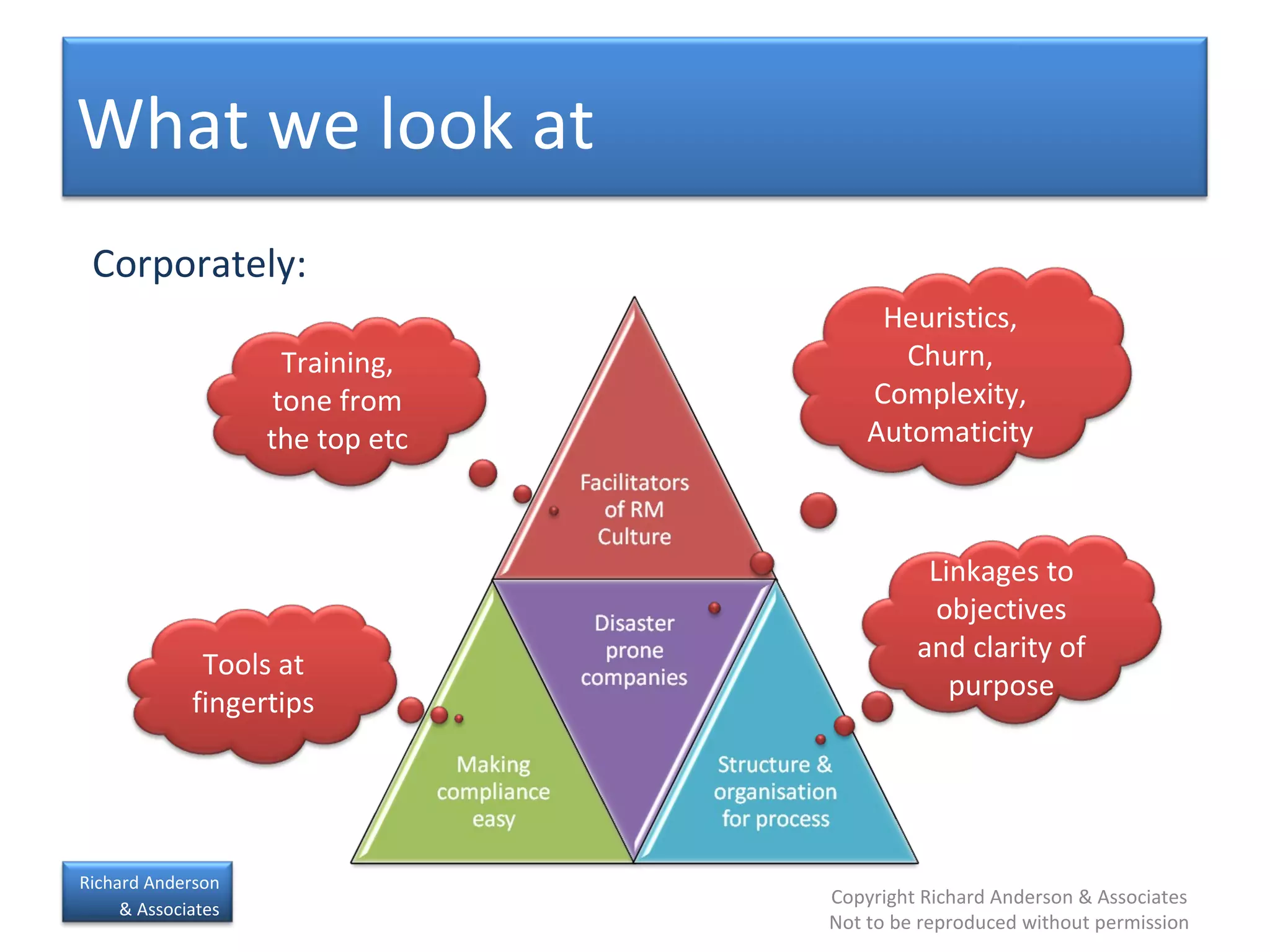

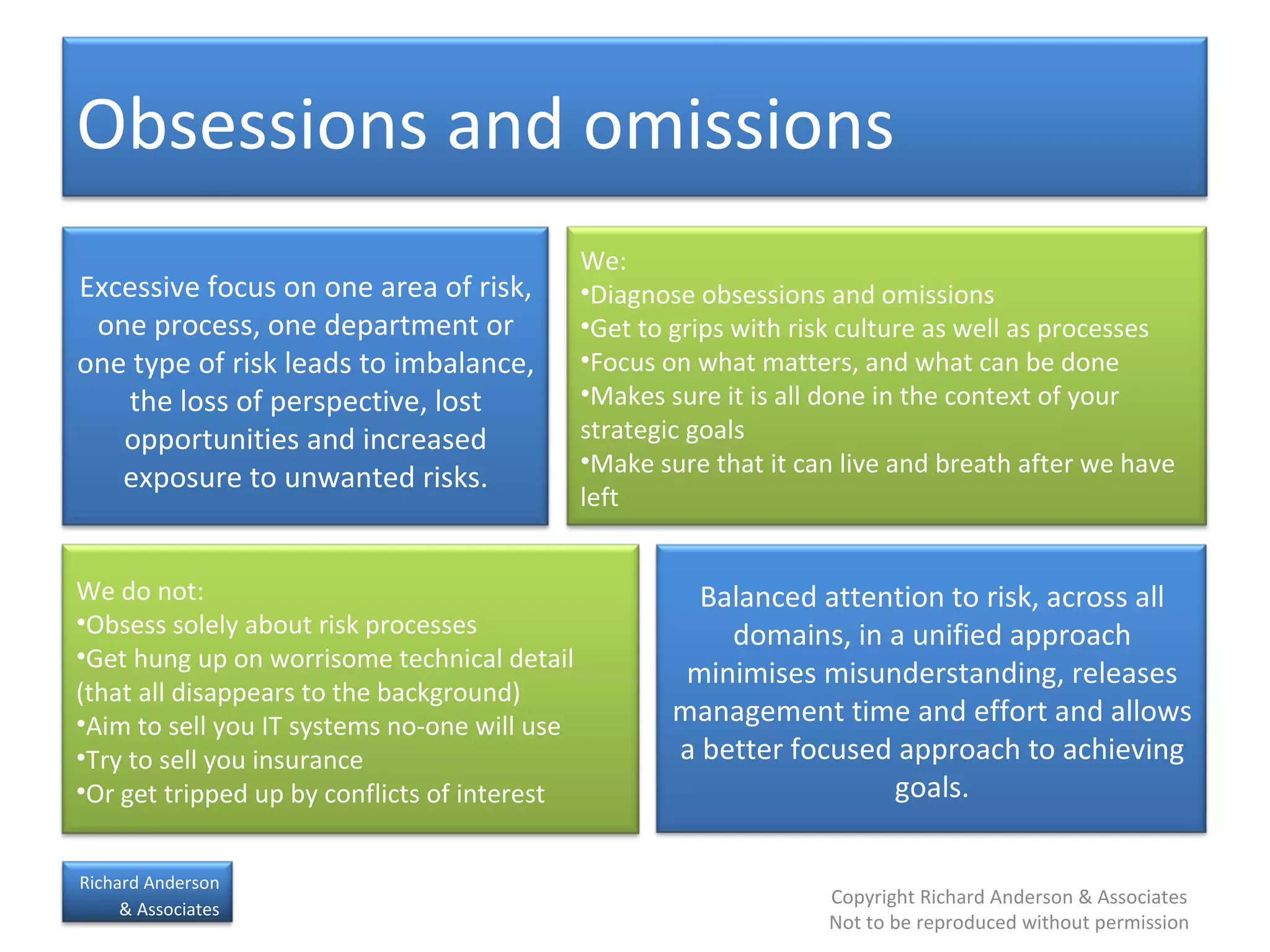

The document discusses key concepts in risk management for organizations. It emphasizes taking a balanced approach to risk management that focuses on prioritizing work, facilitating communication, and managing rather than avoiding risks. An effective risk management program deals with risks systematically across an organization and with partners, and remains nimble to address new issues while leveraging opportunities from risks.

![Contact details [email_address] www.randerson-assocs.co.uk +44 (0)7703 503196 Richard Anderson](https://image.slidesharecdn.com/KeyslidesLi-123667848615-phpapp01/75/Key-Slides-33-2048.jpg)