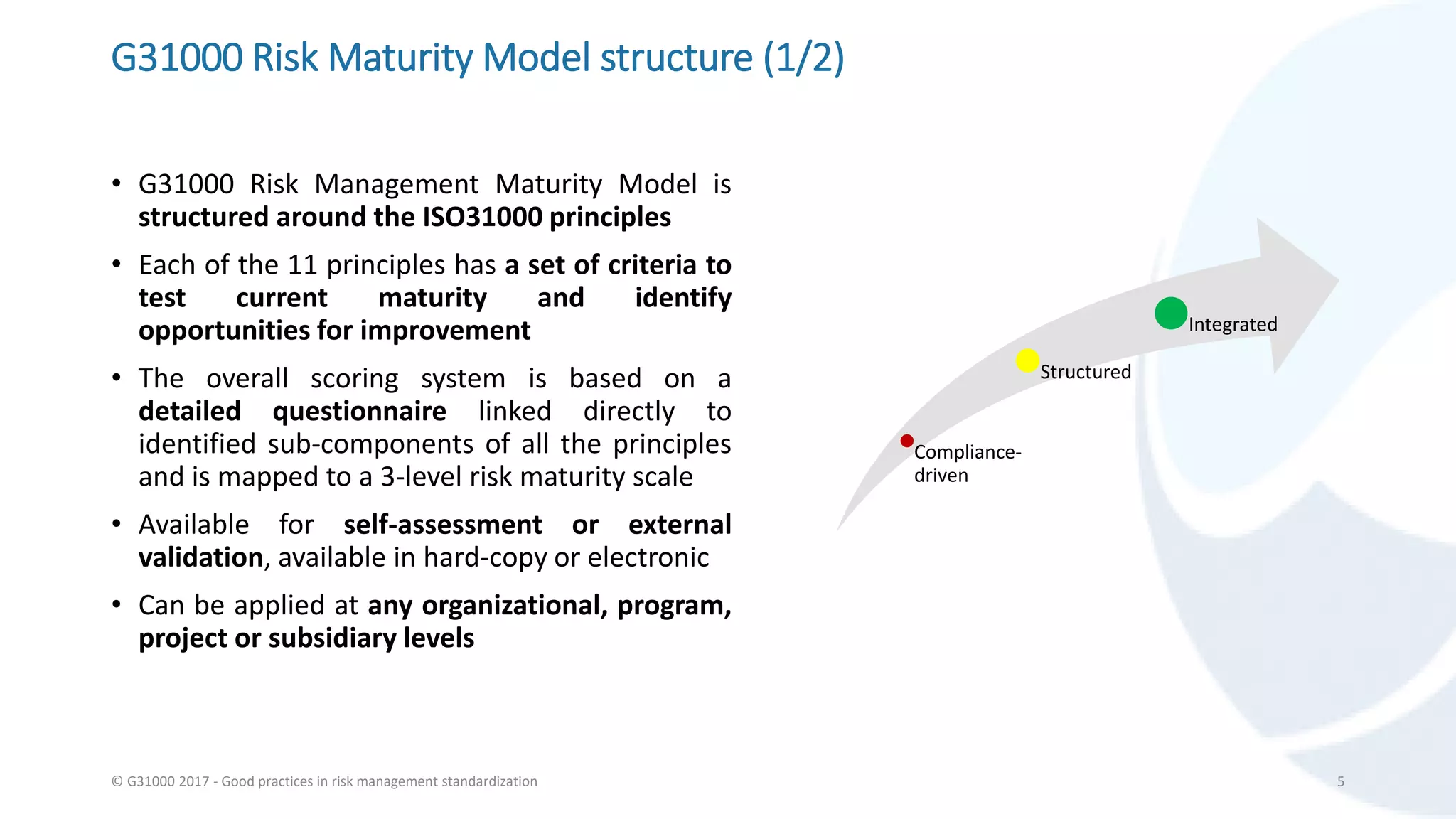

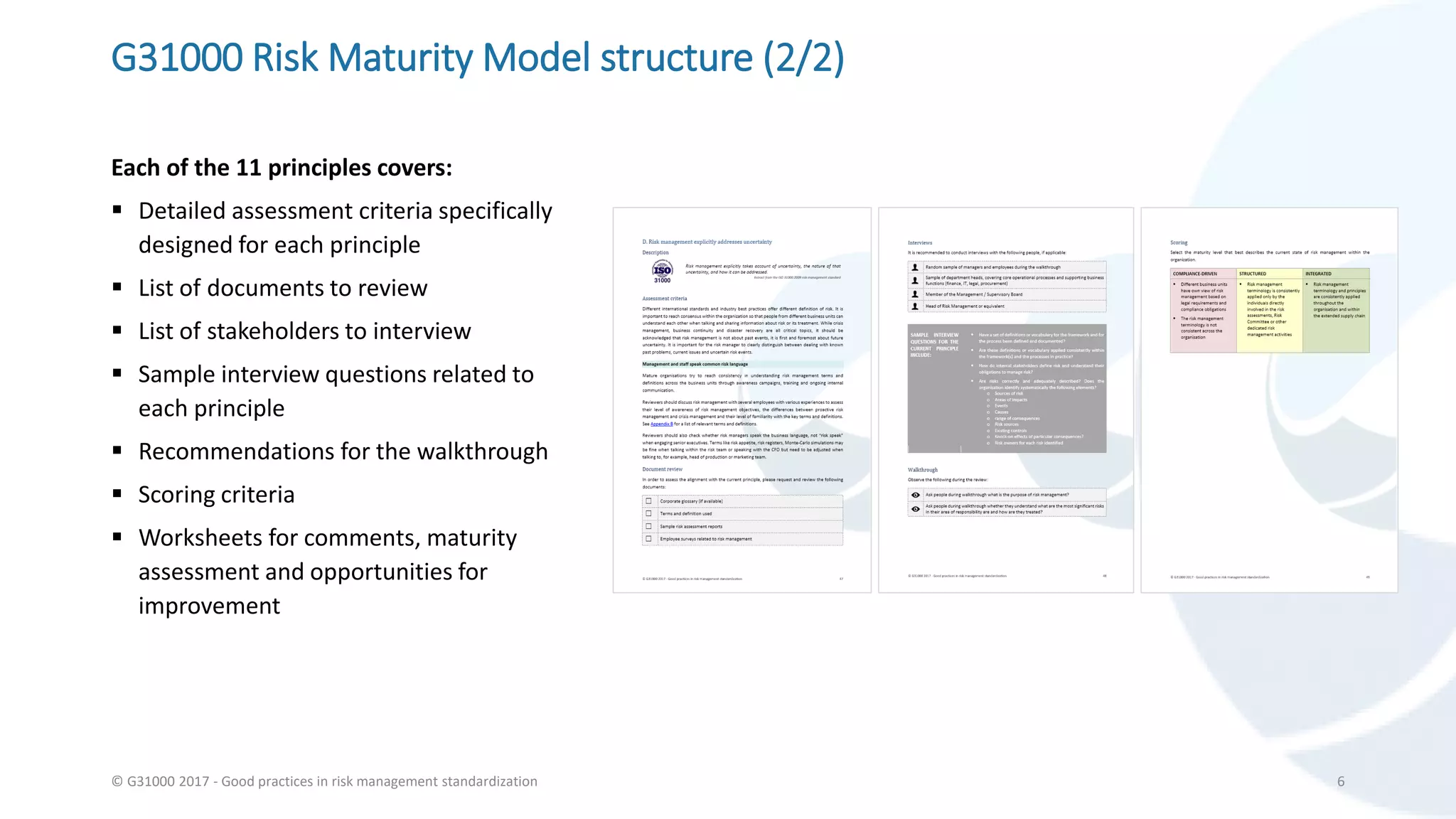

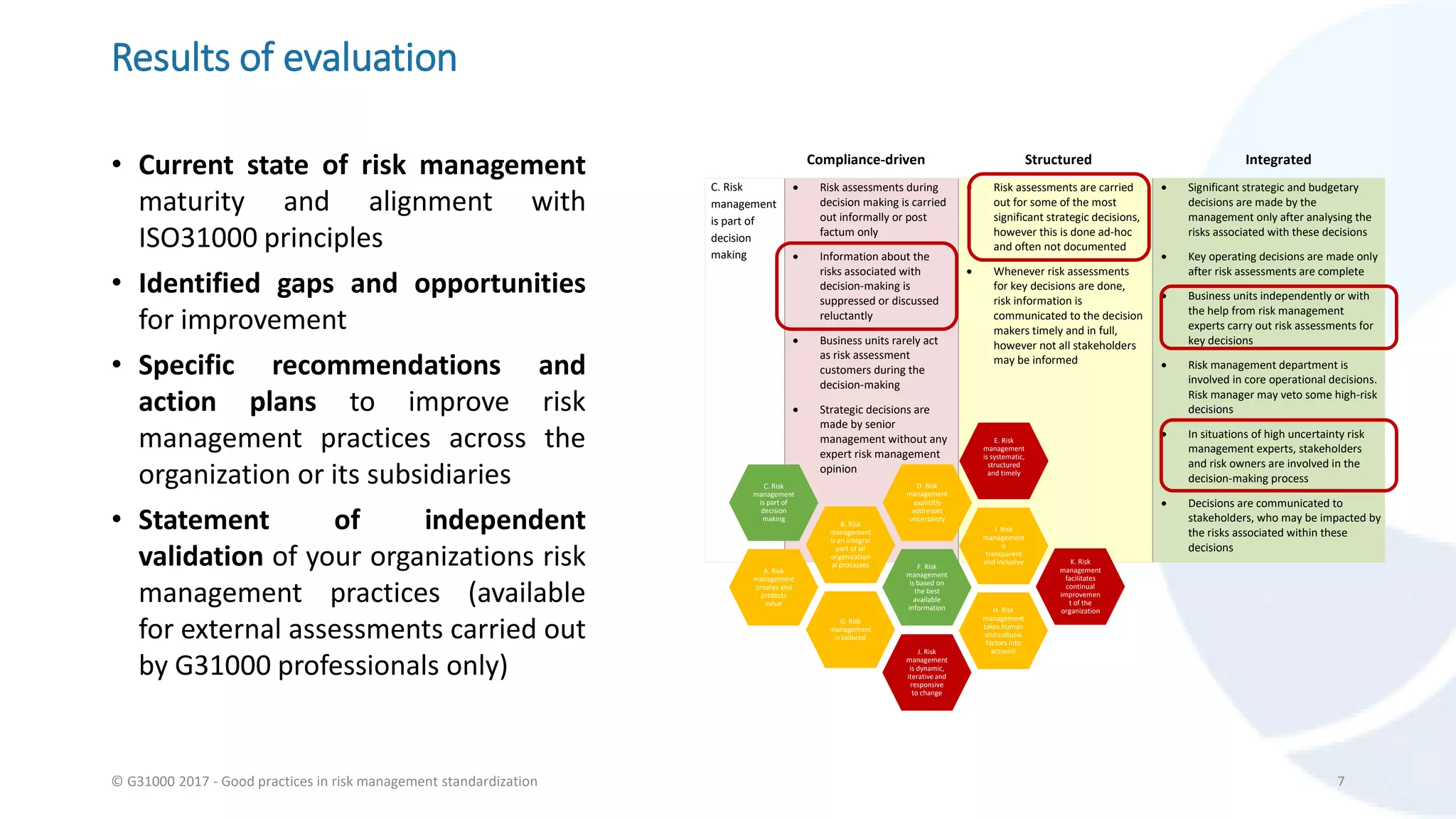

The G31000 Risk Management Maturity Model (RMM) aligns with ISO 31000 principles to help organizations assess their risk management maturity and identify improvement opportunities. It is structured around 11 principles with criteria for evaluation and offers a roadmap for continuous enhancement in risk management practices. Organizations can utilize this model for self-assessment or external validation, promoting the integration of risk management into decision-making and overall processes.