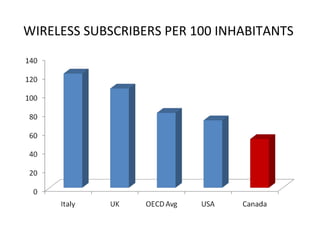

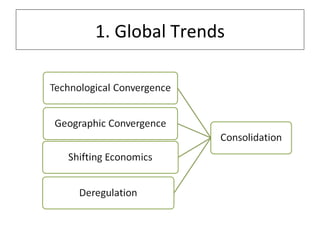

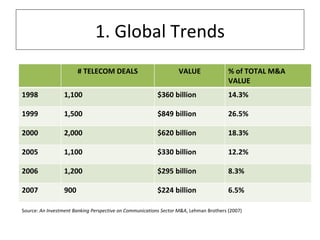

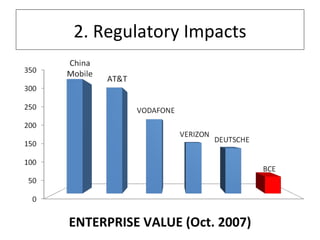

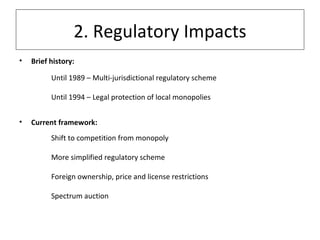

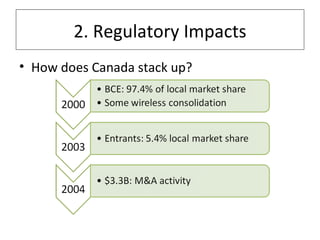

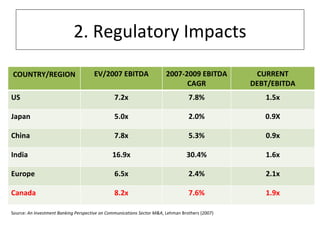

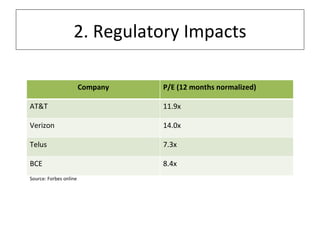

The document discusses the evolution of Canadian telecommunications regulation and competition, highlighting trends and impacts on mergers and acquisitions. It outlines the shift from a multi-jurisdictional regulatory scheme towards simplified competition-based regulations while comparing enterprise values and financial metrics across various countries. Lastly, it raises concerns about market concentration and the future of Canadian telecom amid ongoing changes.