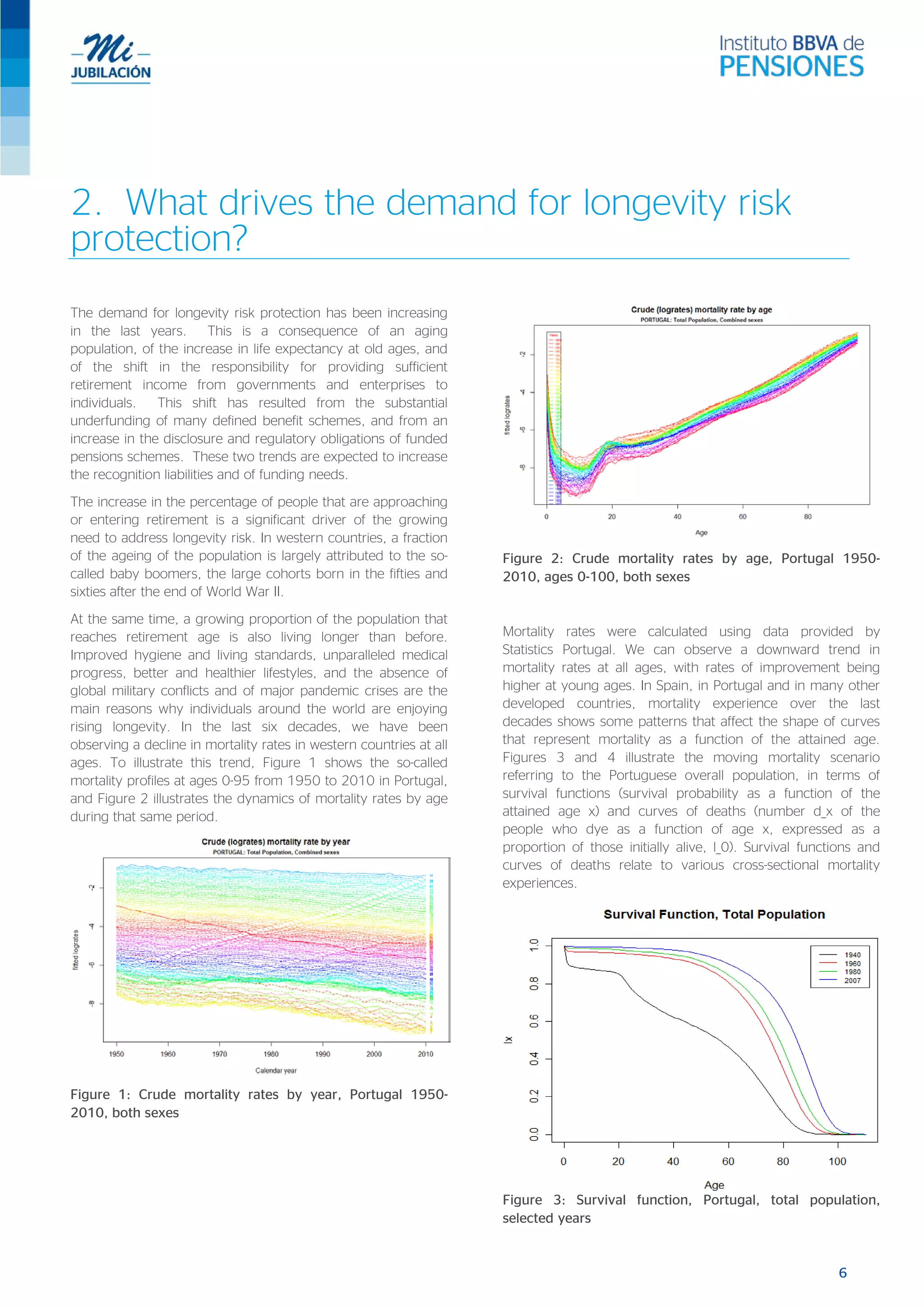

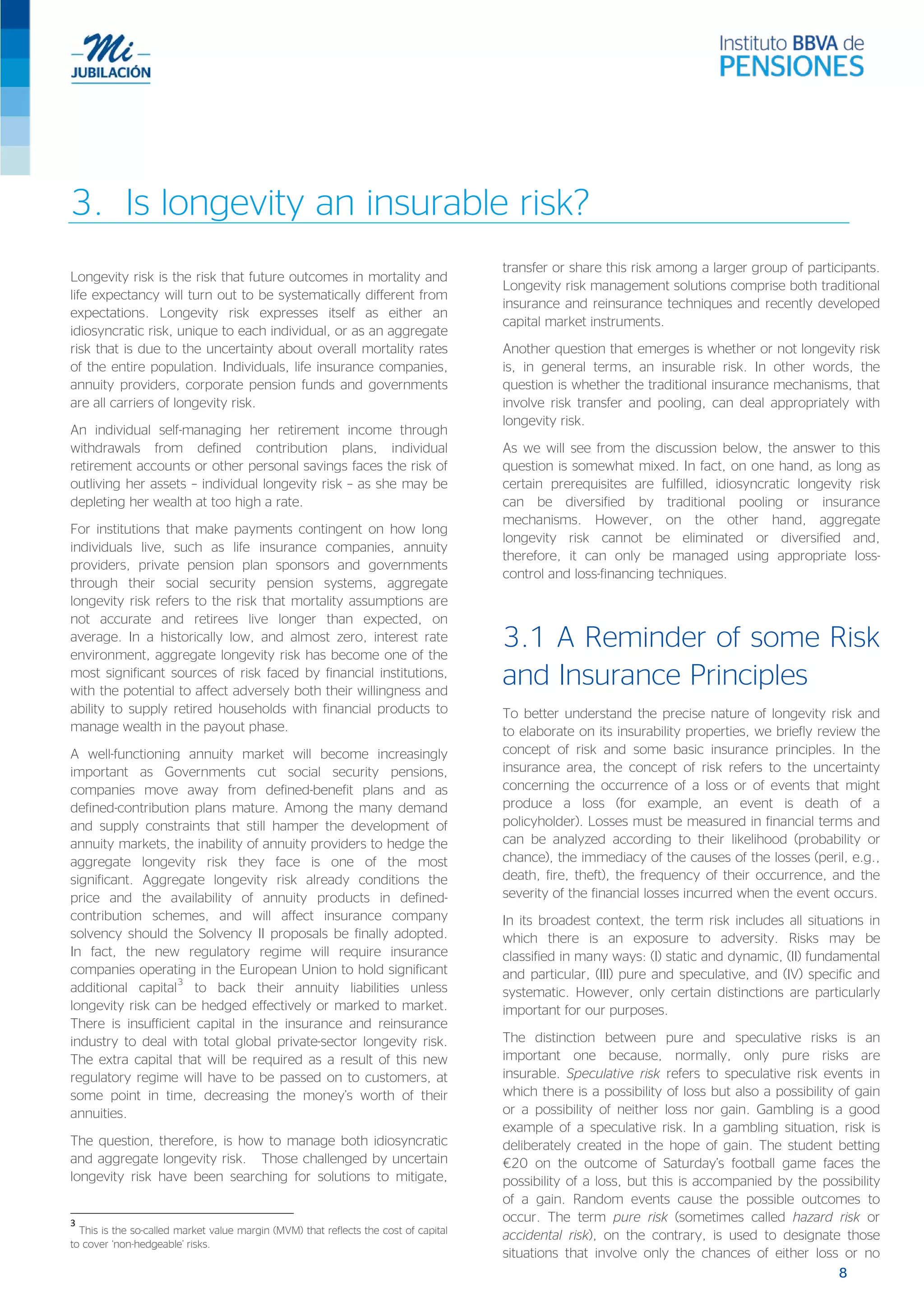

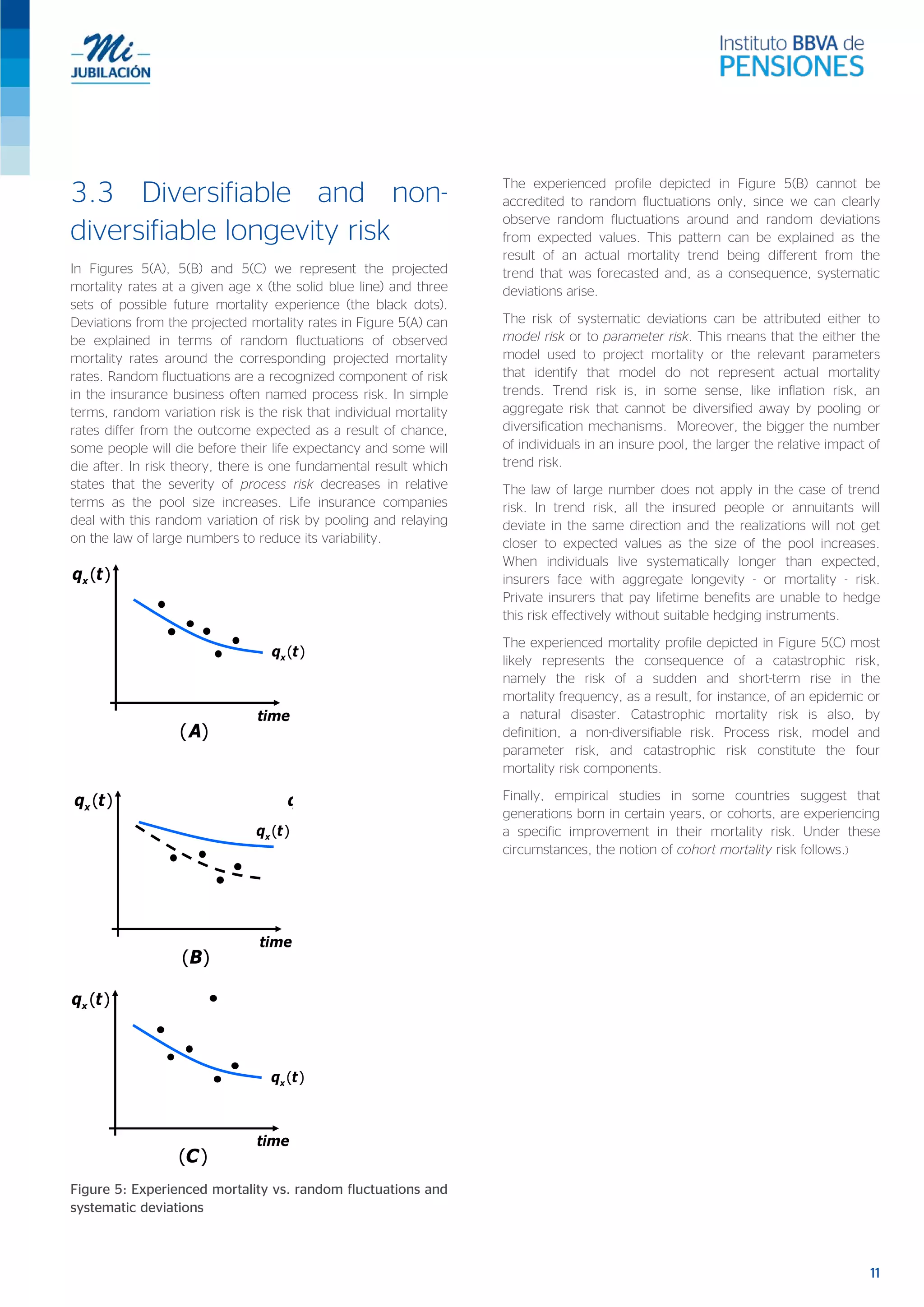

The document explores longevity risk as a significant challenge for pension funds, annuity providers, and public pension schemes, emphasizing the implications of increasing life expectancy and the resulting financial liabilities for these institutions. It examines whether longevity can be effectively insured and discusses various management strategies, including traditional insurance and new capital market solutions. The paper highlights the growing demand for longevity risk protection due to demographic changes and the shift of financial responsibility from governments to individuals.

![References

[1] Blake, D. and Burrows, W., 2001. Survivor Bonds: Helping to Hedge Mortality Risk. The Journal of Risk and Insurance, 68,

339-348.

[2] Blake, D., 2003. Reply to "Survivor Bonds: A Comment on Blake and Burrows". The Journal of Risk and Insurance, 70, 349-

351.

[3] Blake, D., Cairns, A., Dowd, K., 2006. Living with mortality: longevity bonds and other mortality-linked securities. British

Actuarial Journal, 12(1): 153-228.

[4] Bravo, J. M. and Holzmann, R., 2014. The Pay-out Phase of Funded Pensions Plans: Risks and Payment Options. BBVA

Pensions Institute Experts Forum, Madrid, June (mimeo).

[5] Brown, J. and Orzag, P., 2006. The Political Economy of Government-Issued Longevity Bonds. The Journal of Risk and

Insurance, 73(4), 611-631.

[6] Coughlan, G., et al., 2007. Q-Forwards: Derivatives for Transferring Longevity and Mortality Risk. JPMorgan Pension Advisory

Group Report, 2007.

[7] Cummins, J.D., 2006. The securitization of life insurance and longevity risks. In: Presentation at the 2nd International Longevity

Risk and Capital Market Solutions Symposium, Chicago.

[8] Cummins, J.D., Weiss, M., 2009. Convergence of insurance and financial markets: Hybrid and securitized risk transfer

solutions. Journal of Risk and Insurance 76 (3), 493 545.

[9] Holzmann, R., 2014. Addressing Longevity Risk through Private Annuities: Issues and Options. Paper prepared for the 22nd

Annual Colloquium of Superannuation Researchers, CEPAR and ABS’ School of Risk and Actuarial Studies, New South Wales

University, Sydney, July 7-8, 2014.

[10] Milevsky, M., 2005. Real longevity insurance with a deductible: Introduction to advanced-life delayed annuities. North American

Actuarial Journal, 9(4), 109-122.

[11] Olivieri A., 2005, Designing longevity risk transfers: the point of view of the cedant, Giornale dell'Istituto Italiano degli Attuari,

68 (1-2): 1-35. Reprinted on: ICFAI Journal of Financial Risk Management, March 2007

[12] Piggott, J, Valdez, E., Detzel, B., 2005. The simple analytics of pooled annuity funds. The Journal of Risk and Insurance 72 (3),

497–520.

[13] Robine, J. M., Vaupel, J. W., 2001. Supercentenarians: Slower ageing individuals or senile elderly?. Experimental Gerontology

36, 915-930.

[14] Rusconi, R., 2008. National annuity markets: features and implications. OECD Working Papers on Insurance and Private

Pensions, N.º 24.

[15] Stewart, F., 2007. Policy issues for the developing annuity markets, OECD Working Papers on Insurance and Private Pensions,

N.º 2.

[16] Valdez, E., Piggott, J., Wang, L., 2006. Demand and adverse selection in a pooled annuity fund. Insurance: Mathematics and

Economics 39, 251–266.

[17] Vaupel, J. M., 2010. Biodemography of human ageing. Nature 464, 536-542.

19](https://image.slidesharecdn.com/9islongevityaninsurablerisking-150805113905-lva1-app6891/75/9-Is-longevity-an-insurable-risk-2015-ENG-19-2048.jpg)