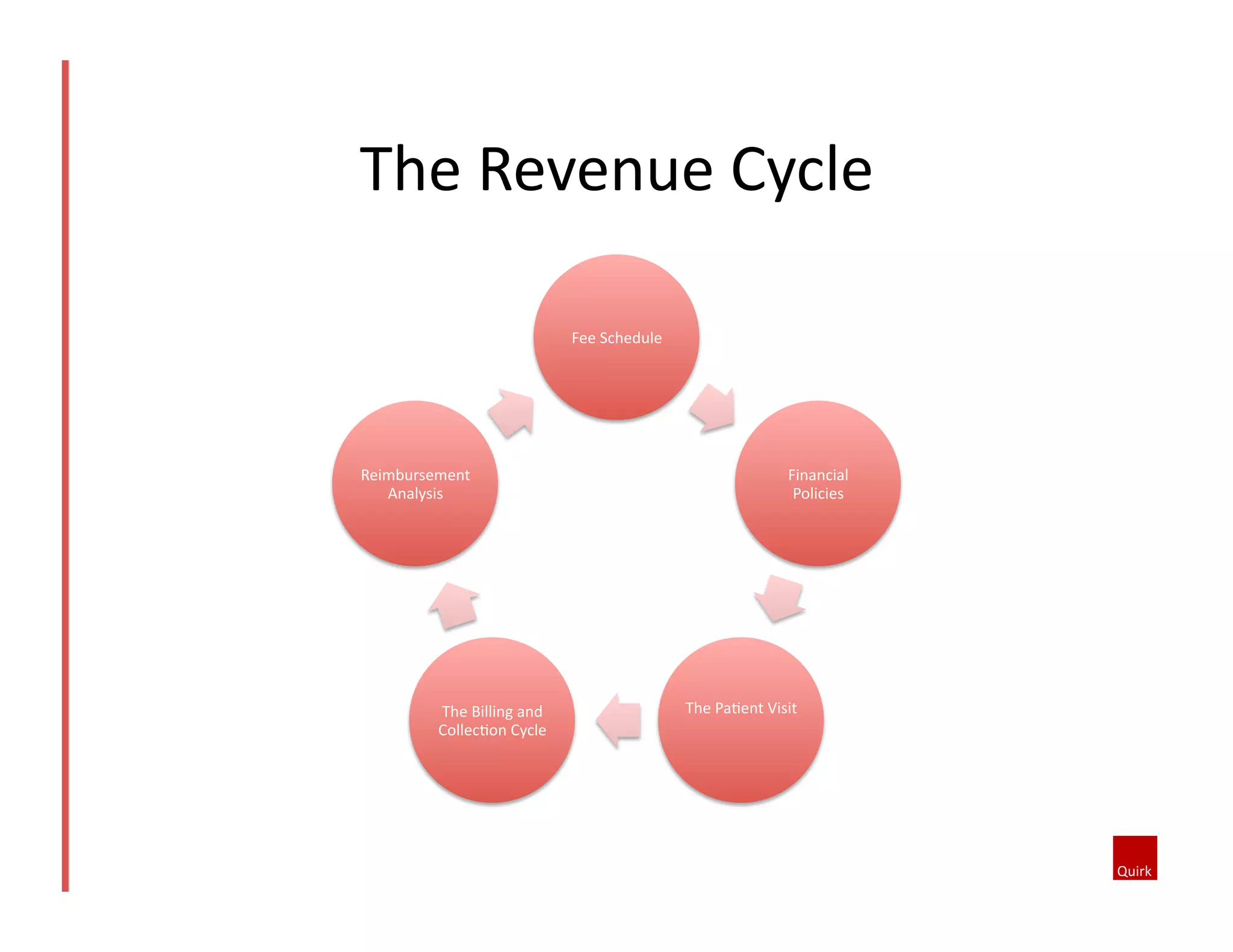

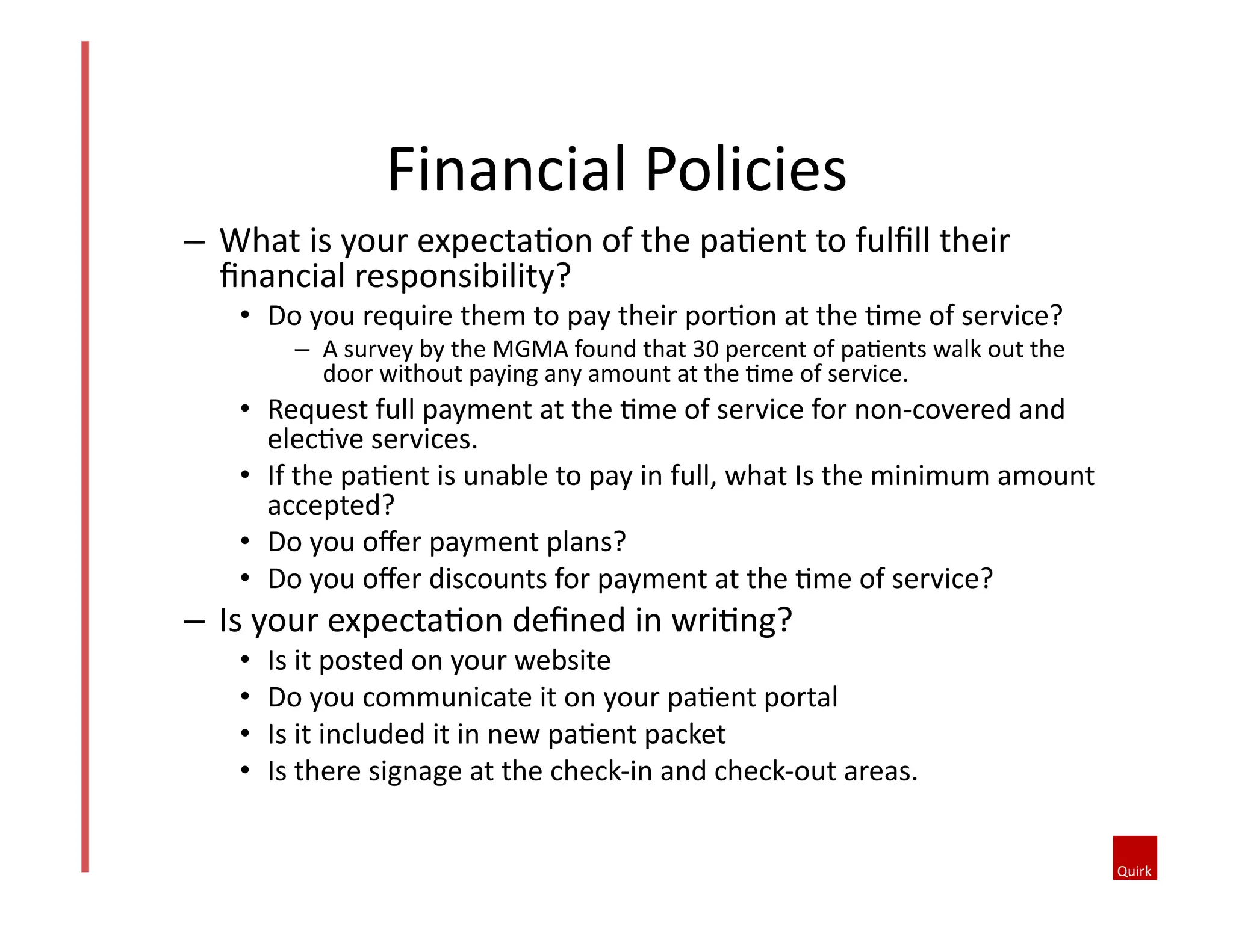

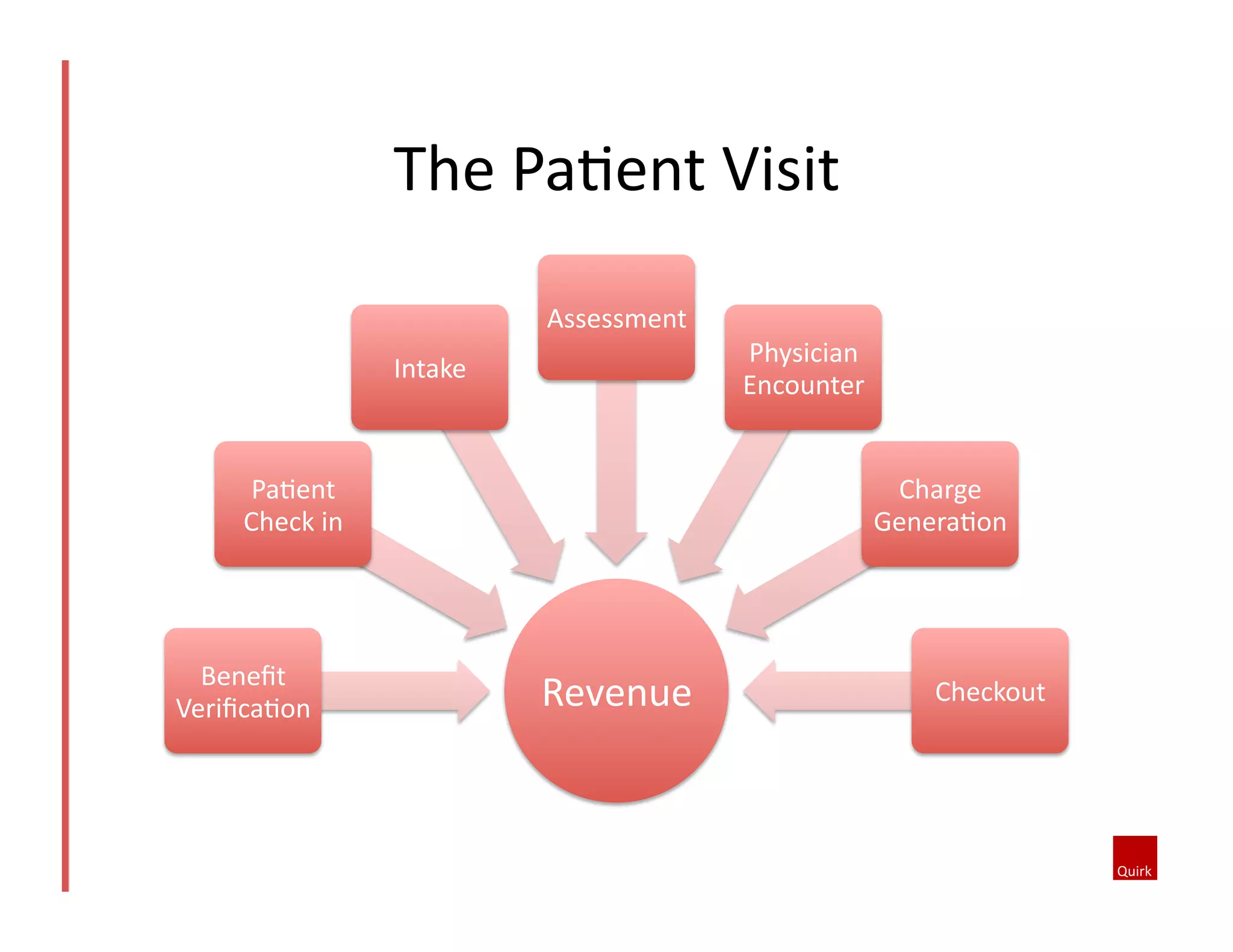

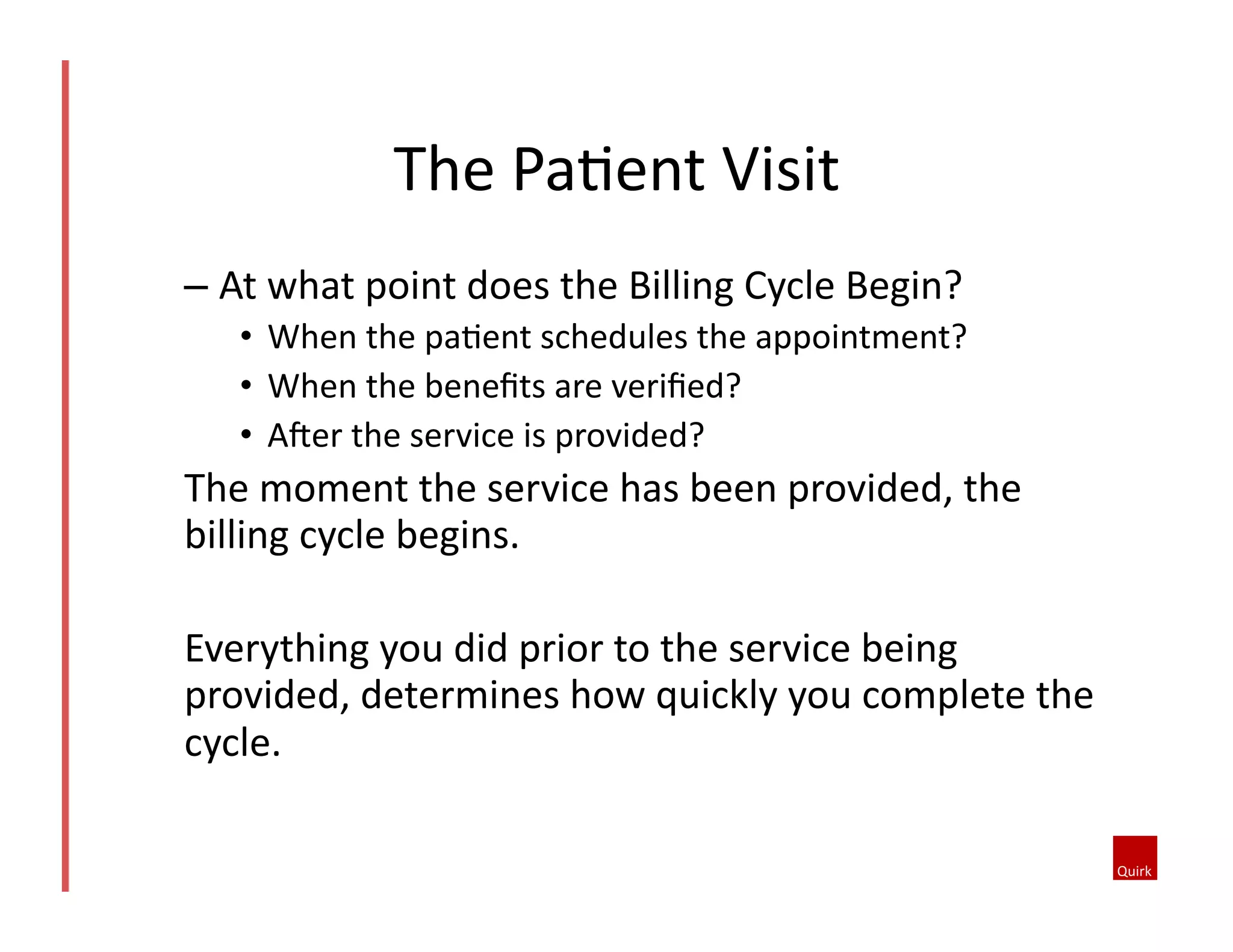

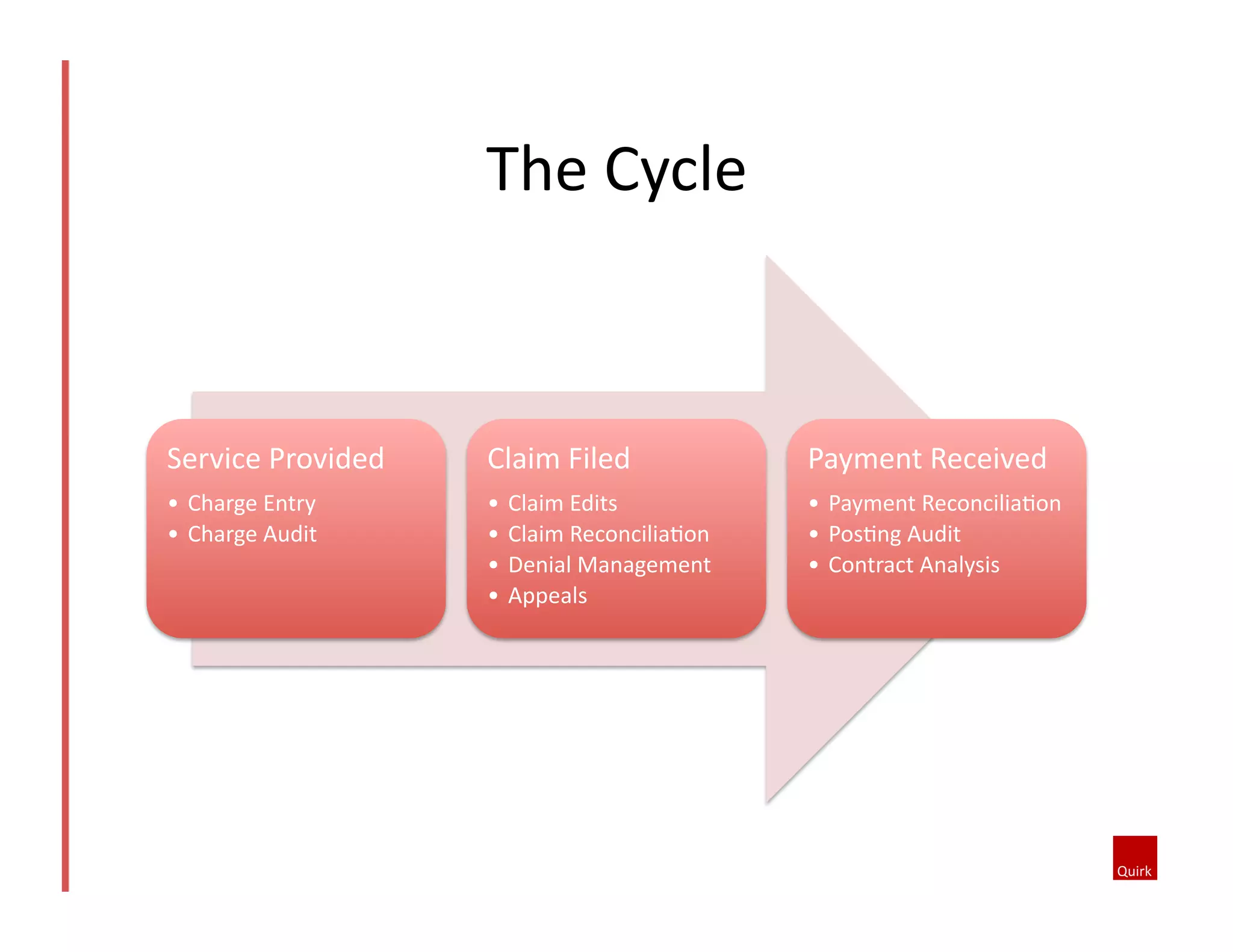

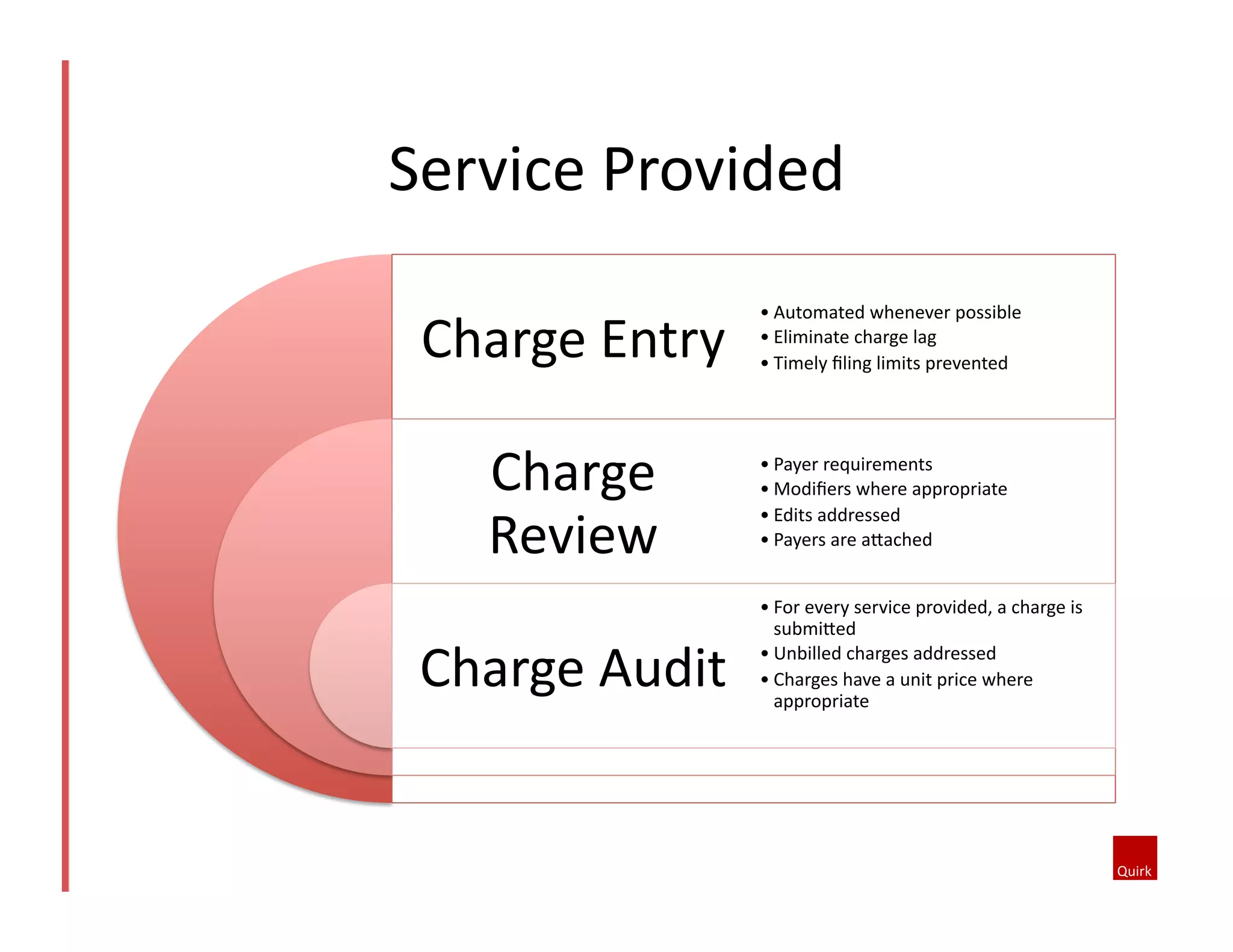

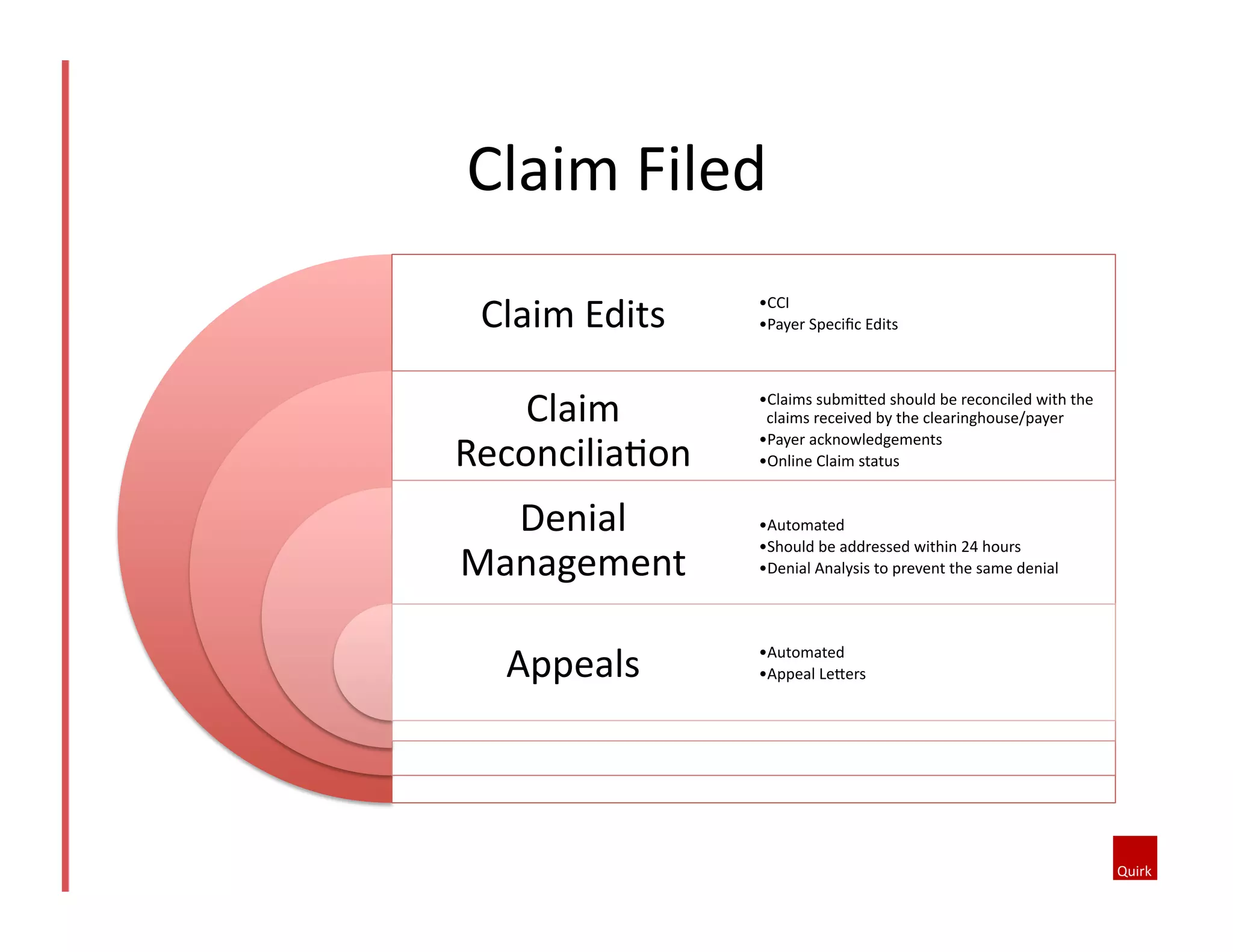

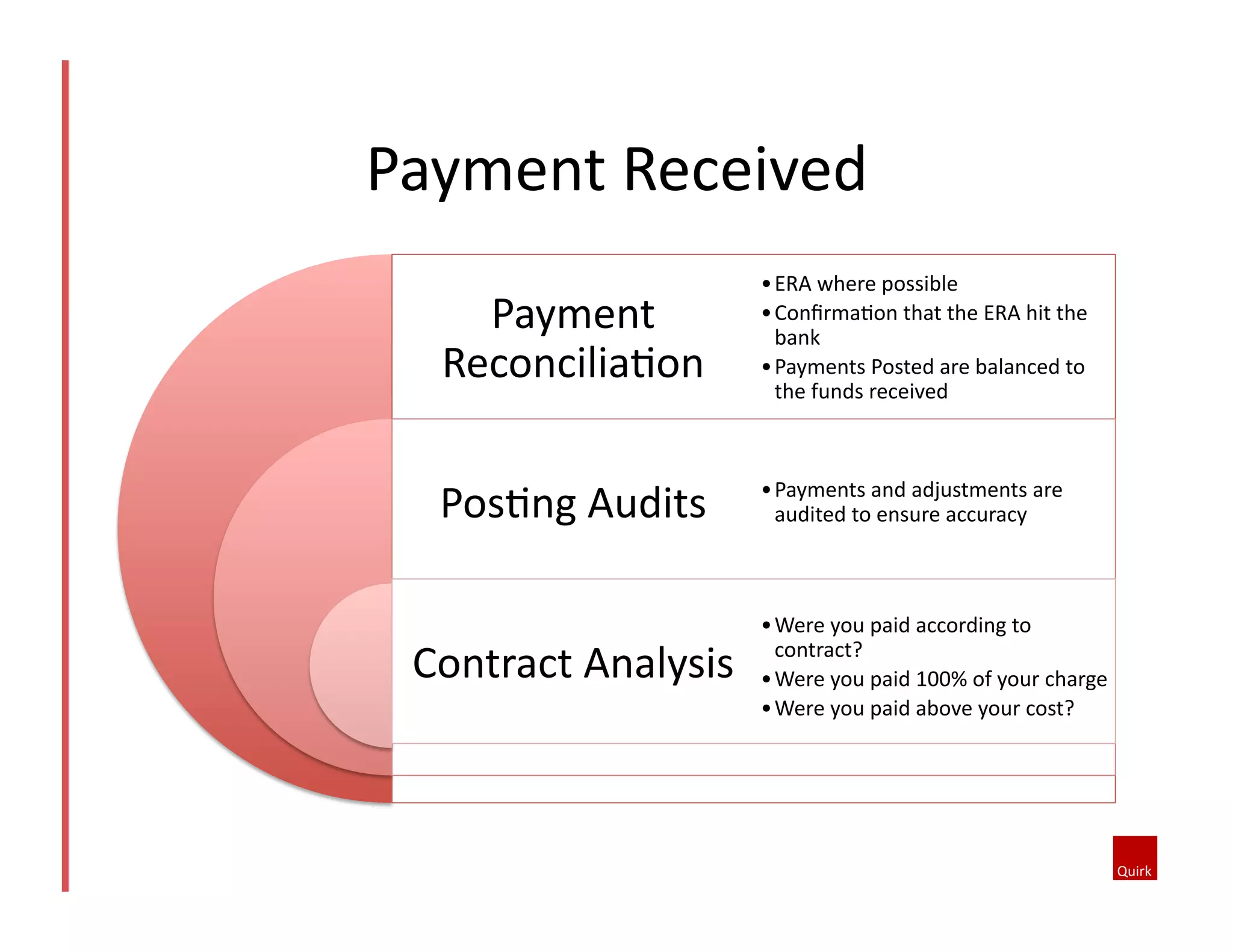

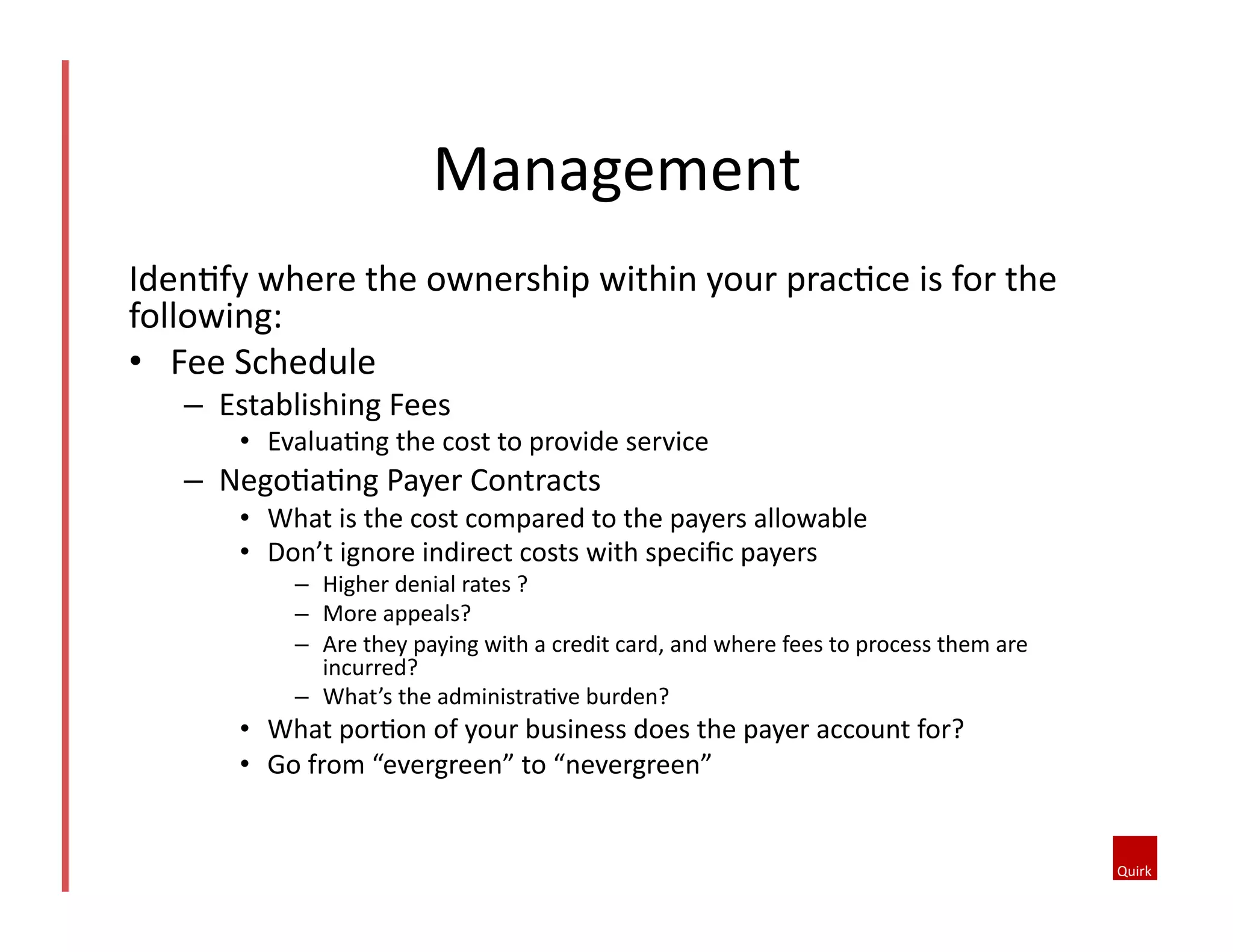

The document provides a comprehensive overview of revenue cycle management, emphasizing the importance of viewing healthcare as a business to ensure profitability. It discusses the elements of the billing and collection cycle, including setting fee schedules, managing patient financial responsibilities, and the critical phases of claim submission and payment reconciliation. Strategies for improving financial policies, managing denials, and effective reporting are also highlighted to enhance the efficiency of the revenue cycle.