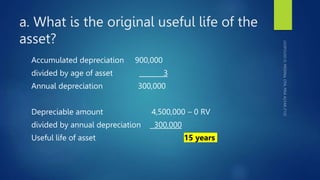

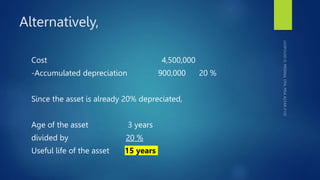

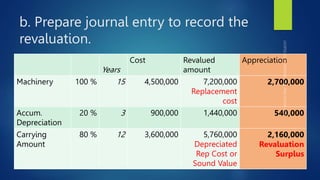

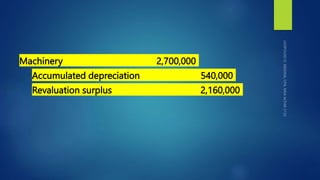

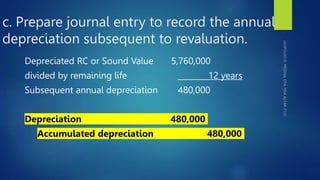

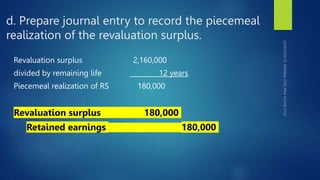

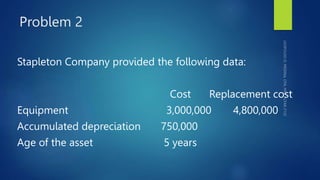

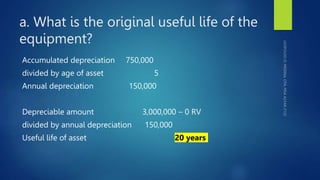

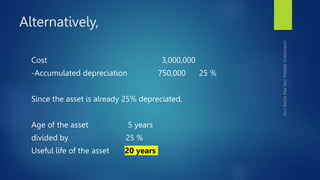

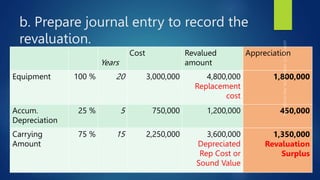

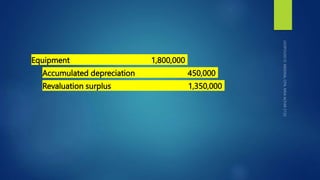

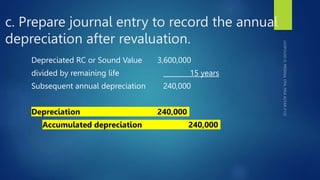

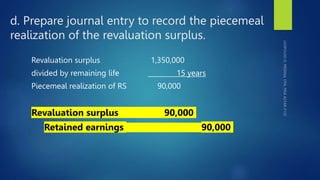

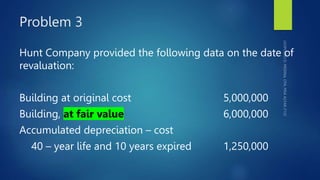

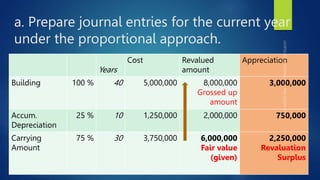

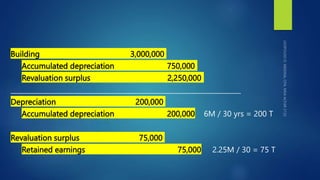

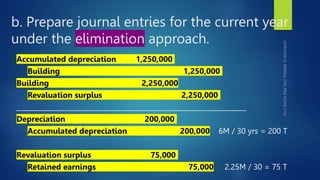

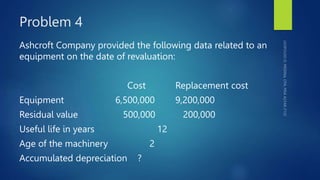

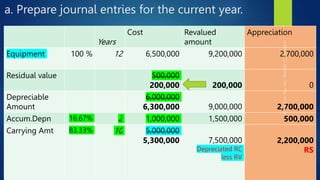

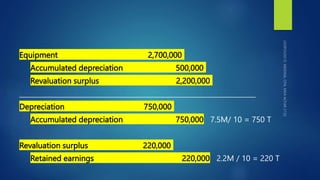

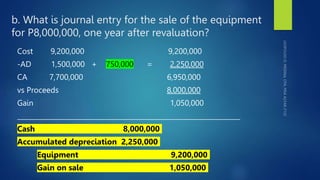

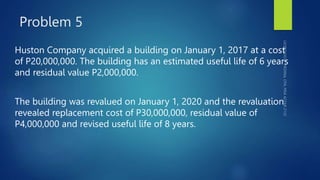

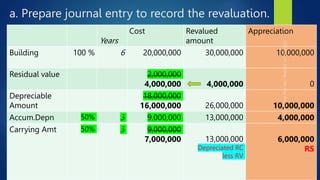

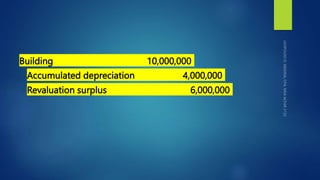

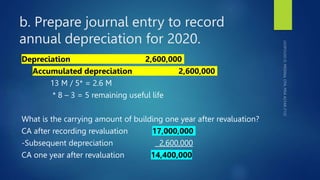

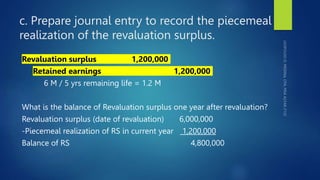

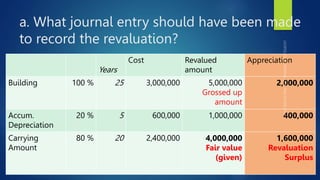

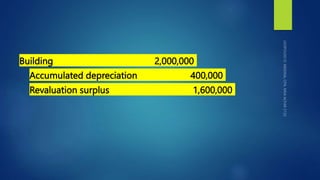

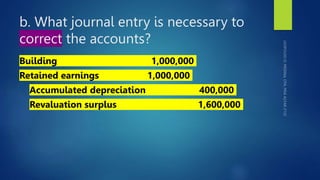

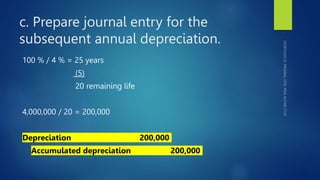

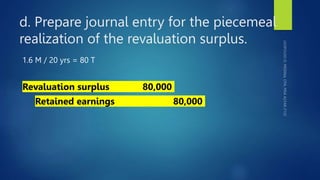

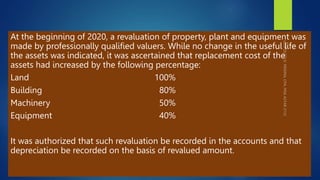

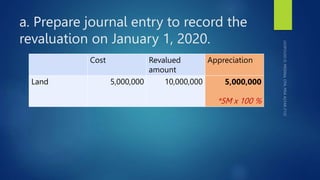

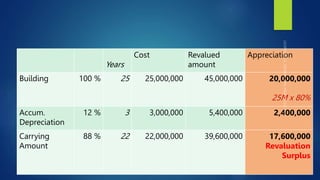

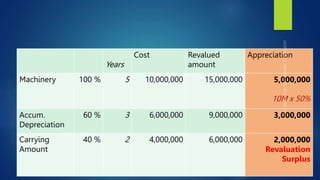

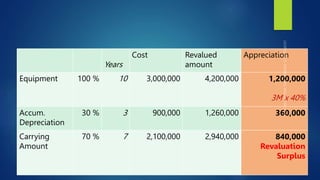

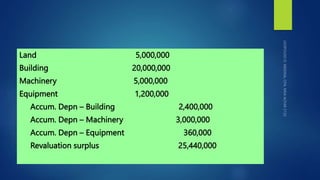

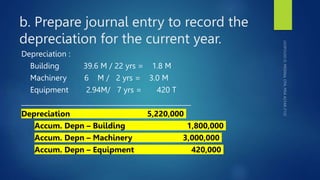

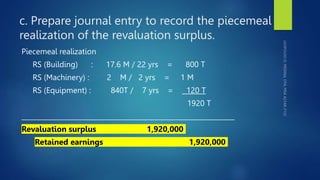

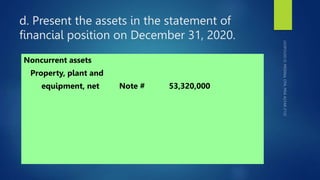

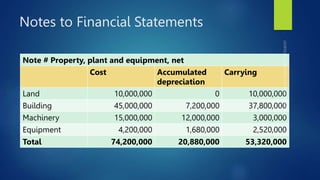

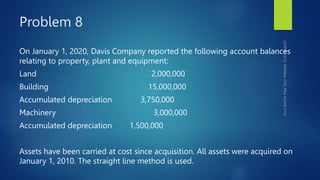

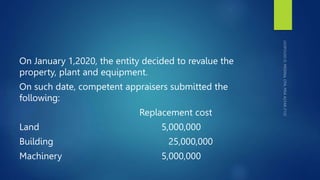

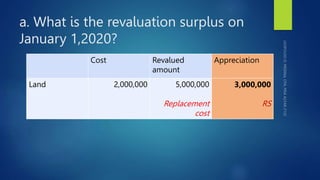

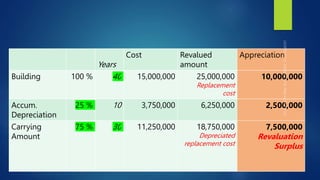

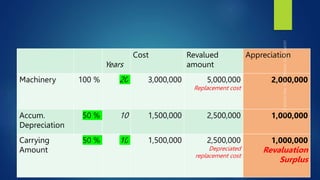

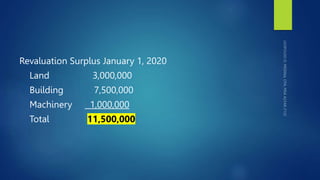

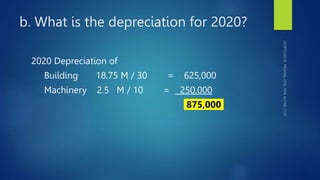

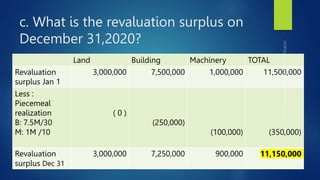

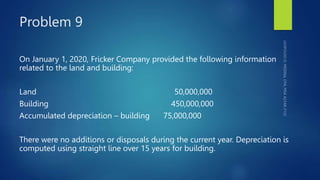

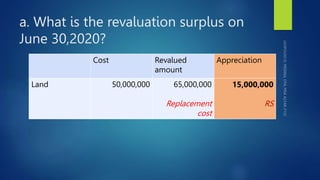

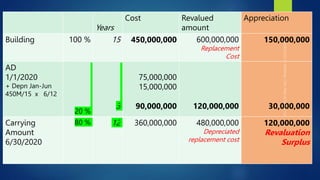

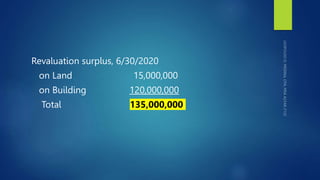

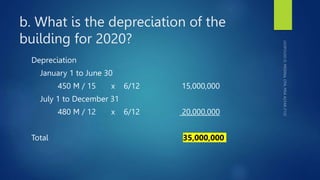

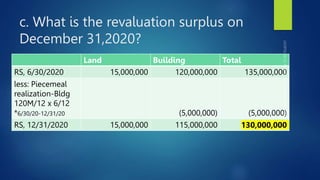

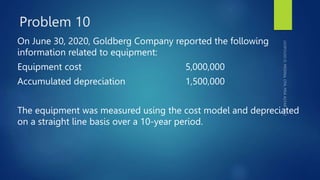

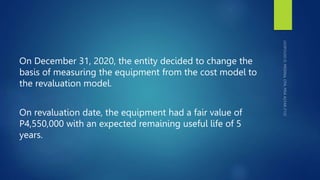

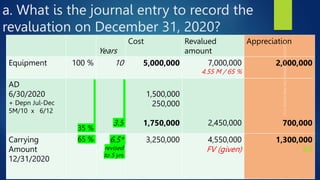

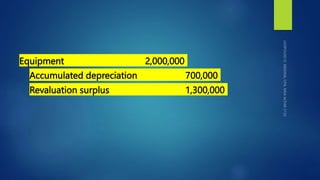

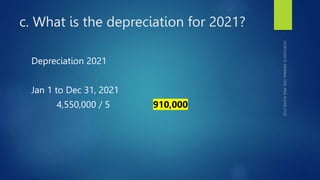

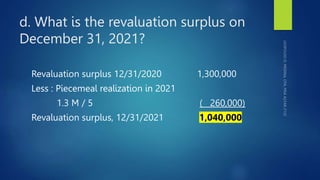

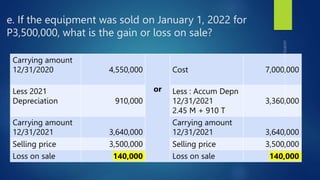

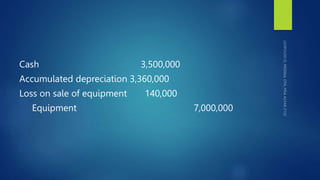

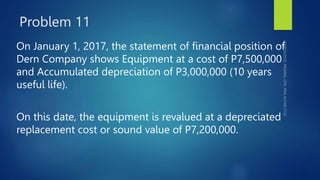

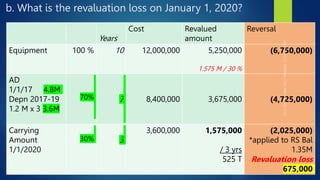

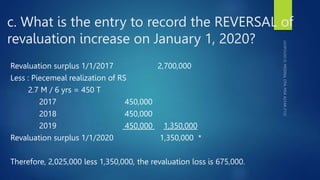

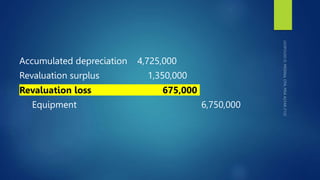

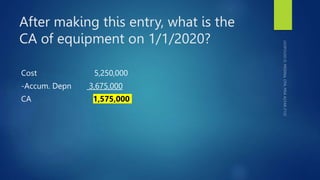

The document contains problems related to revaluation of property, plant and equipment. It provides journal entries to record revaluation, subsequent depreciation, and realization of revaluation surplus over the remaining useful life of the assets. The problems cover machinery, equipment, buildings and land. Journal entries are provided to record revaluation based on replacement cost, adjust accumulated depreciation, record subsequent depreciation, and realize revaluation surplus annually.