Recommended

PPTX

7 General Mathematics Types of Deductions.pptx

PDF

Gross and Net Earnings pdf powerpoint pre

PPTX

Gross Pay & Netpay, Mandatory Deductions.pptx

PPTX

Bus Math Group 2 Presentation (Q2 Week 3).pptx

PPTX

2.GROSS AND NET EARNINGS FOR GRADE 11 STUDENTS

PPTX

BENEFITS AND STANDARD DEDUCTIONS_Grade11Senior High

PPTX

CALCULATING SALARY, WAGES, OVERTIME, AND.pptx

PPTX

Commission Business Mathematics for senior high school.pptx

PPTX

8 General Mathematics Payroll Officers.pptx

PPTX

Business mathematics for Grade 11 abm payroll deduction

PPTX

Salaries and wages-Business Mathematics Quarter 1

PPTX

PDF

Payroll Simplified: Mastering Net and Gross Pay Calculations

PPTX

Payroll BABASVHAJHDGAJDBABKAJGDKAHDAB.pptx

PPTX

PPTX

Computing-Salary-Wage-and-Commission-1.pptx

PPTX

Chapter-2-Tax-on-Individuals for 1st sem.pptx

PPTX

general mathematoivcs for strengthened shs

PPTX

Fluorimetric Analysis- Theory, Instrumentation and Application

PDF

Structure-of-the-Atom PPT.pdf/CBSE CLASS 11 CHEMISTRY/ PREPARED BY K SANDEEP ...

PDF

Pratishta Educational Society., Courses & Opportunities

PPTX

How to Track & Manage My Time Section in Odoo 18 Time Off

PPTX

How to Create_Generate Engineering Change Orders ECOs in Odoo 18

PDF

Holm Community Heritage at St Nicholas Kirk - 2025 AGM Minutes (30.04.2025)

PPTX

Overview of How to set priority in Odoo 19 Todo

PPTX

ELIMINATION NEEDS Fundamentals of Nursing .pptx

PPTX

Plato's Insight model teaching and learning.pptx

PDF

Artificial Intelligence in Research and Academic Writing, Workshop on Researc...

PPTX

Methods & Applications of Enzyme Immobilization Technique.pptx

PDF

Conservation of Earthen Structures in India Preserving Traditional and Sustai...

More Related Content

PPTX

7 General Mathematics Types of Deductions.pptx

PDF

Gross and Net Earnings pdf powerpoint pre

PPTX

Gross Pay & Netpay, Mandatory Deductions.pptx

PPTX

Bus Math Group 2 Presentation (Q2 Week 3).pptx

PPTX

2.GROSS AND NET EARNINGS FOR GRADE 11 STUDENTS

PPTX

BENEFITS AND STANDARD DEDUCTIONS_Grade11Senior High

PPTX

CALCULATING SALARY, WAGES, OVERTIME, AND.pptx

PPTX

Commission Business Mathematics for senior high school.pptx

Similar to 5 General Mathematics Gross Pay Vs Net Pay.pptx

PPTX

8 General Mathematics Payroll Officers.pptx

PPTX

Business mathematics for Grade 11 abm payroll deduction

PPTX

Salaries and wages-Business Mathematics Quarter 1

PPTX

PDF

Payroll Simplified: Mastering Net and Gross Pay Calculations

PPTX

Payroll BABASVHAJHDGAJDBABKAJGDKAHDAB.pptx

PPTX

PPTX

Computing-Salary-Wage-and-Commission-1.pptx

PPTX

Chapter-2-Tax-on-Individuals for 1st sem.pptx

PPTX

general mathematoivcs for strengthened shs

Recently uploaded

PPTX

Fluorimetric Analysis- Theory, Instrumentation and Application

PDF

Structure-of-the-Atom PPT.pdf/CBSE CLASS 11 CHEMISTRY/ PREPARED BY K SANDEEP ...

PDF

Pratishta Educational Society., Courses & Opportunities

PPTX

How to Track & Manage My Time Section in Odoo 18 Time Off

PPTX

How to Create_Generate Engineering Change Orders ECOs in Odoo 18

PDF

Holm Community Heritage at St Nicholas Kirk - 2025 AGM Minutes (30.04.2025)

PPTX

Overview of How to set priority in Odoo 19 Todo

PPTX

ELIMINATION NEEDS Fundamentals of Nursing .pptx

PPTX

Plato's Insight model teaching and learning.pptx

PDF

Artificial Intelligence in Research and Academic Writing, Workshop on Researc...

PPTX

Methods & Applications of Enzyme Immobilization Technique.pptx

PDF

Conservation of Earthen Structures in India Preserving Traditional and Sustai...

PDF

Chapter 05 Drugs Acting on the Central Nervous System: Anticonvulsant (Antiep...

PDF

Bones by Sadu Kassam (play) story ppt pdf

PPTX

WEEK 2 (2).pptx TLE COOKERY 10 QUARTER 4

PDF

Nursing care plan for Vomiting /B.Sc nsg

PPTX

PRE TERM LABOR ( PREMATURE LABOUR IN PREGNANCY)

PDF

Workshop 29 Crystal Review All Students by YogiGoddess

PPTX

Greengnorance Toolkit Module1 Climate Change

PDF

The Sheep and the Goat: Beckett’s Subversion of Divine Justice in Waiting for...

5 General Mathematics Gross Pay Vs Net Pay.pptx 2. 3. 4. 5. Instructions

You will be shown

different types of word

puzzles.

Guess the correct word

related to the topic.

Raise your hand if you

know the answer.

Let’s have fun and learn

at the same time!

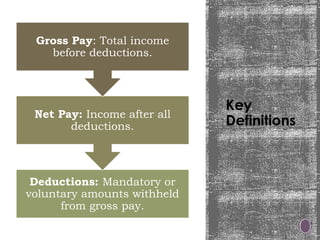

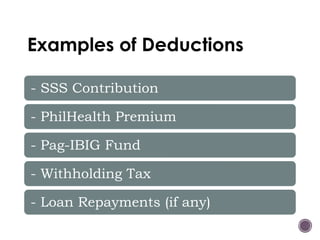

6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Examples of Deductions

- SSS Contribution

- PhilHealth Premium

- Pag-IBIG Fund

- Withholding Tax

- Loan Repayments (if any)

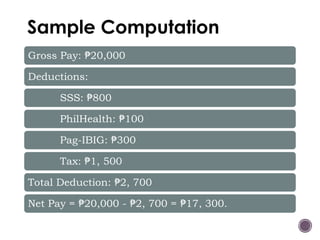

16. Sample Computation

Gross Pay: 20,000

₱

Deductions:

SSS: 800

₱

PhilHealth: 100

₱

Pag-IBIG: 300

₱

Tax: 1, 500

₱

Total Deduction: 2, 700

₱

Net Pay = 20,000 - 2, 700 = 17, 300.

₱ ₱ ₱

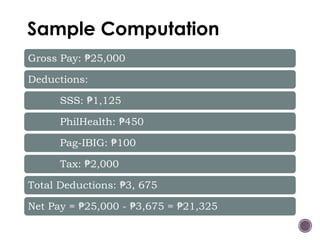

17. Sample Computation

Gross Pay: 25,000

₱

Deductions:

SSS: 1,125

₱

PhilHealth: 450

₱

Pag-IBIG: 100

₱

Tax: 2,000

₱

Total Deductions: 3, 675

₱

Net Pay = 25,000 - 3,675 = 21,325

₱ ₱ ₱

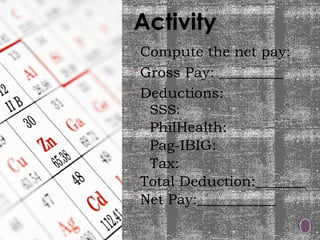

18. Activity

Compute the net pay:

Gross Pay: _________

Deductions:

SSS:

PhilHealth:

Pag-IBIG:

Tax:

Total Deduction:_______

Net Pay:___________

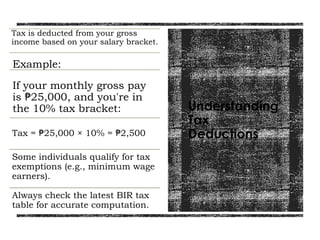

19. Understanding

Tax

Deductions

Tax is deducted from your gross

income based on your salary bracket.

Example:

If your monthly gross pay

is 25,000, and you're in

₱

the 10% tax bracket:

Tax = 25,000 × 10% = 2,500

₱ ₱

Some individuals qualify for tax

exemptions (e.g., minimum wage

earners).

Always check the latest BIR tax

table for accurate computation.

20. Quiz

Time!

You may use a calculator.

Prepare to compute and explain

your answers.

Answer the following questions

based on today’s lesson.

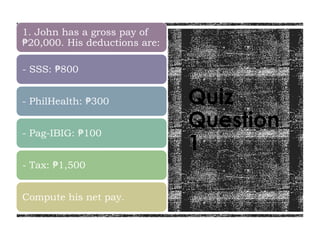

21. Quiz

Question

1

1. John has a gross pay of

20,000. His deductions are:

₱

- SSS: 800

₱

- PhilHealth: 300

₱

- Pag-IBIG: 100

₱

- Tax: 1,500

₱

Compute his net pay.

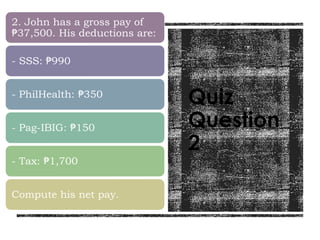

22. Quiz

Question

2

2. John has a gross pay of

37,500. His deductions are:

₱

- SSS: 990

₱

- PhilHealth: 350

₱

- Pag-IBIG: 150

₱

- Tax: 1,700

₱

Compute his net pay.

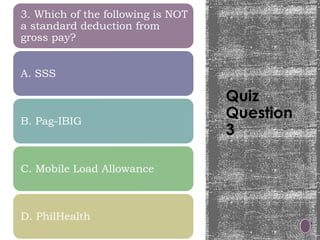

23. Quiz

Question

3

3. Which of the following is NOT

a standard deduction from

gross pay?

A. SSS

B. Pag-IBIG

C. Mobile Load Allowance

D. PhilHealth

24. 25.

![Puzzle

Game –

Gross

Pay vs.

Net Pay

Word Guessing Challenge

FRANCIS C. SALINAS]](https://image.slidesharecdn.com/5generalmathematicsgrosspayvsnetpay-250807011046-29ec89a7/85/5-General-Mathematics-Gross-Pay-Vs-Net-Pay-pptx-4-320.jpg)