Embed presentation

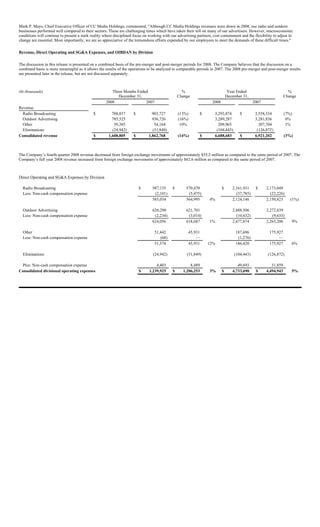

Download to read offline

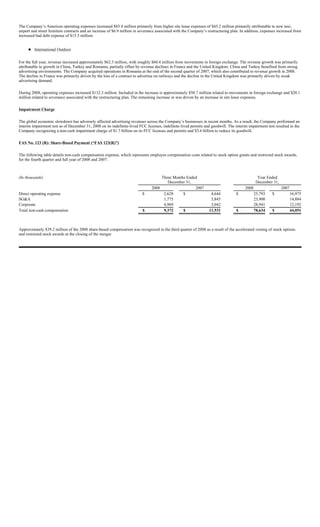

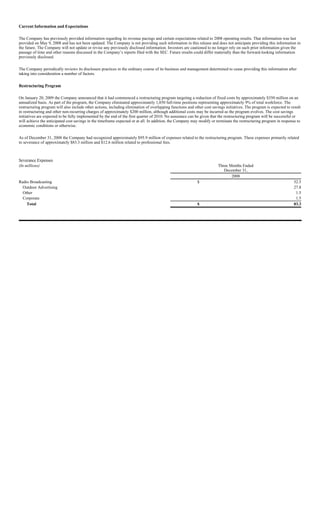

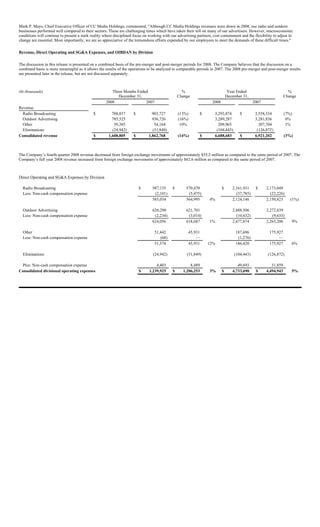

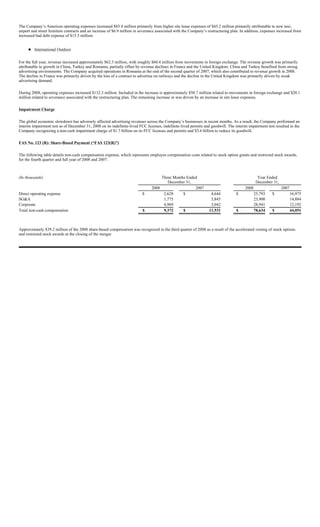

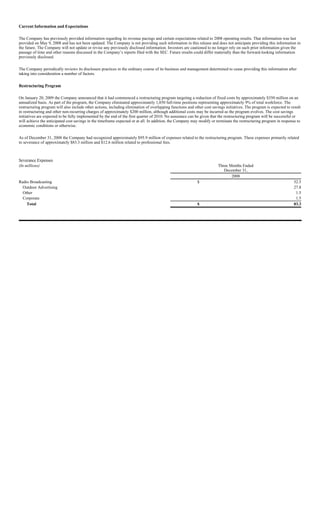

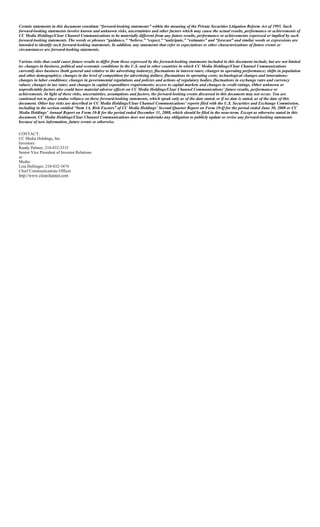

- CC Media Holdings reported financial results for Q4 2008 and full year 2008. Revenue declined 14% to $1.6 billion in Q4 2008 and 3% to $6.7 billion for the full year. - The company recognized a non-cash impairment charge of $5.3 billion in Q4 2008, consisting of $1.7 billion for FCC licenses and permits and $3.6 billion for goodwill. - OIBDAN (operating income before depreciation and amortization) declined 50% to $309 million in Q4 2008 and 21% to $1.8 billion for the full year, as revenues declined across most divisions and markets due to weak advertising spending