23062100060638SBIN_ChallanReceipt.pdf

•

0 likes•8 views

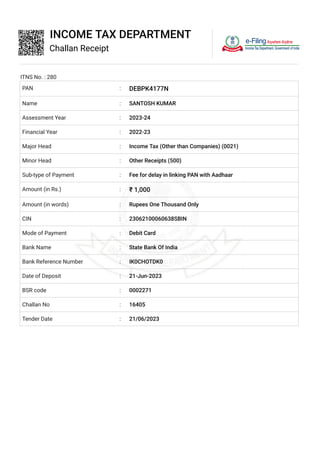

This document is a challan receipt from the Income Tax Department acknowledging a payment of Rs. 1,000 by Santosh Kumar for the assessment year 2023-24. The payment was made on June 21, 2023 as a fee for delay in linking his PAN with Aadhaar. The receipt provides details of the payment including the payment mode of debit card and bank reference number.

Report

Share

Report

Share

Download to read offline

Recommended

Gst one nation one tax - a myth or a reality

GST is a tax on goods and services under which every person is liable to pay tax and entitled to input tax credit on its inputs.

Bsnl bill 03.02.17

This document is a mobile bill from Bharat Sanchar Nigam Limited (BSNL) for Aditi Basak for the billing period of December 1st to December 31st, 2016. The total amount due is Rs. 1552 which includes a previous balance of Rs. 943, a current bill amount of Rs. 608.79, and no payment received. The current bill details include recurring charges of Rs. 325, usage charges of Rs. 630.62, and discounts of Rs. 442.47.

BBXPB3422J_2022- Yashveer Bhardwaj.pdf

The document is a Form 16 certificate issued by Delveinsight Business Research LLP to Yashveer Bhardwaj for the assessment year 2022-23. It summarizes that a total amount of Rs. 371540 was paid to Yashveer Bhardwaj from April 2021 to March 2022, but no tax was deducted at source by Delveinsight Business Research LLP. The certificate is signed by Vishal Agrawal on behalf of Delveinsight Business Research LLP.

Top 15 data warehousing tools

Data migration often occurs after an update of current hardware, a transfer to a completely new system, or situations such as application replacements, business process changes, data volume expansionreativechallengers.in

CIC Report.pdf

Rakshith Rakshith has 9 accounts reported on his CIBIL credit report, including 2 active personal loans with current balances of Rs. 16,464 and Rs. 12,883. He has a low CIBIL CreditVision score of 649 and Personal Loan score of 515, due to factors like presence of delinquency and low credit age. His credit report shows a history of multiple personal loans taken and closed between October 2021-August 2022.

Aabfv9776 h q4_2013-14

This document is a Form 16A, which is a certificate issued under section 203 of the Income Tax Act of 1961 for tax deducted at source. It provides details of TDS deducted by Vijaya Bank from payments made to Vijay Builders for the financial year 2013-2014. A total of Rs. 2832 was deducted as TDS and deposited with the government in quarter 4 of the financial year. The form certifies that TDS was deducted and deposited as per the records of Vijaya Bank.

APRIL 2022.pdf

This pay slip summarizes the earnings, deductions, and net pay for Mr. Bhuvanesh M. for April 2022. It shows a gross salary of 355,586.88 with standard deductions of 50,000. His taxable income was 281,390 and he paid 1,569.50 in taxes. After deductions for loans of 27,432.24, his net pay for the month was 2,200.

suraj tomar.pdf

This 3 sentence summary provides the key details from the invoice document:

The invoice is from Suraj tomer for Dev Internet Solution for monthly charges of October through December 2021 or January 2022, totaling ₹3,200 for 4 units at ₹800 per unit with no additional taxes or shipping fees. It provides billing addresses and bank account information for Dev Internet Solution as well as the issuing party's GSTIN and contact information.

Recommended

Gst one nation one tax - a myth or a reality

GST is a tax on goods and services under which every person is liable to pay tax and entitled to input tax credit on its inputs.

Bsnl bill 03.02.17

This document is a mobile bill from Bharat Sanchar Nigam Limited (BSNL) for Aditi Basak for the billing period of December 1st to December 31st, 2016. The total amount due is Rs. 1552 which includes a previous balance of Rs. 943, a current bill amount of Rs. 608.79, and no payment received. The current bill details include recurring charges of Rs. 325, usage charges of Rs. 630.62, and discounts of Rs. 442.47.

BBXPB3422J_2022- Yashveer Bhardwaj.pdf

The document is a Form 16 certificate issued by Delveinsight Business Research LLP to Yashveer Bhardwaj for the assessment year 2022-23. It summarizes that a total amount of Rs. 371540 was paid to Yashveer Bhardwaj from April 2021 to March 2022, but no tax was deducted at source by Delveinsight Business Research LLP. The certificate is signed by Vishal Agrawal on behalf of Delveinsight Business Research LLP.

Top 15 data warehousing tools

Data migration often occurs after an update of current hardware, a transfer to a completely new system, or situations such as application replacements, business process changes, data volume expansionreativechallengers.in

CIC Report.pdf

Rakshith Rakshith has 9 accounts reported on his CIBIL credit report, including 2 active personal loans with current balances of Rs. 16,464 and Rs. 12,883. He has a low CIBIL CreditVision score of 649 and Personal Loan score of 515, due to factors like presence of delinquency and low credit age. His credit report shows a history of multiple personal loans taken and closed between October 2021-August 2022.

Aabfv9776 h q4_2013-14

This document is a Form 16A, which is a certificate issued under section 203 of the Income Tax Act of 1961 for tax deducted at source. It provides details of TDS deducted by Vijaya Bank from payments made to Vijay Builders for the financial year 2013-2014. A total of Rs. 2832 was deducted as TDS and deposited with the government in quarter 4 of the financial year. The form certifies that TDS was deducted and deposited as per the records of Vijaya Bank.

APRIL 2022.pdf

This pay slip summarizes the earnings, deductions, and net pay for Mr. Bhuvanesh M. for April 2022. It shows a gross salary of 355,586.88 with standard deductions of 50,000. His taxable income was 281,390 and he paid 1,569.50 in taxes. After deductions for loans of 27,432.24, his net pay for the month was 2,200.

suraj tomar.pdf

This 3 sentence summary provides the key details from the invoice document:

The invoice is from Suraj tomer for Dev Internet Solution for monthly charges of October through December 2021 or January 2022, totaling ₹3,200 for 4 units at ₹800 per unit with no additional taxes or shipping fees. It provides billing addresses and bank account information for Dev Internet Solution as well as the issuing party's GSTIN and contact information.

Redirect.do

Mr. Kanubhai Vaghasiya's mobile bill details his previous balance of Rs. 549.59, current charges of Rs. 630.55 including recurring charges of Rs. 499 for his ULTD499 plan, usage charges of Rs. 0, other charges of Rs. 50 and taxes of Rs. 56.55. His total amount due is Rs. 1180.14 and is due by April 2, 2012. The document provides his billing details and instructions for making a payment.

500758-Calc.pdf

Mr. Bhuvanesh M received a pay slip for July 2022 from his employer TPCODL. He earned a gross salary of Rs. 162,050.48 and deductions of Rs. 50,400, leaving a taxable income of Rs. 111,650. His net pay was Rs. 34,699.72 after further deductions including loans. Key earnings included a basic salary of Rs. 15,039, cash allowance of Rs. 12,031.20 and leave encashment of Rs. 8,421.84.

gagan

1. This document provides salary and tax details of Pradip Kumar, who works as a Senior Marketing Assistant at Indian Oil Corporation Limited. It details his gross salary of INR 41,28,635, various exemptions of INR 3,90,003 and deductions of INR 2,52,464 leading to a total taxable income of INR 37,81,113.

2. It notes a tax amount of INR 9,46,833 on his total income and a net tax payable of INR 98,47,08 after taking into account a health and education cess of INR 3,78,733.

3. Various allowances, perquisites, and income from other sources are also itemized,

Evasion of revenue in Assam, India

The document summarizes an investigation conducted by the Principal Accountant General (A&E) in Assam into the evasion of government revenue in the state. The investigation found that over Rs. 616 crore was not realized by the state treasuries from 2010-2011 to 2012-2013 due to lapsed challans (unpaid bills) that were not revalidated or reconciled. Several state treasuries were affected, with the largest amounts of unrealized revenue in Cachar, Jorhat, Kamrup, and Kokrajhar districts. Most of the evaders were found to be government departmental dues officers and private individuals. The document raises questions about who is responsible for the lapses and what

More Related Content

Similar to 23062100060638SBIN_ChallanReceipt.pdf

Redirect.do

Mr. Kanubhai Vaghasiya's mobile bill details his previous balance of Rs. 549.59, current charges of Rs. 630.55 including recurring charges of Rs. 499 for his ULTD499 plan, usage charges of Rs. 0, other charges of Rs. 50 and taxes of Rs. 56.55. His total amount due is Rs. 1180.14 and is due by April 2, 2012. The document provides his billing details and instructions for making a payment.

500758-Calc.pdf

Mr. Bhuvanesh M received a pay slip for July 2022 from his employer TPCODL. He earned a gross salary of Rs. 162,050.48 and deductions of Rs. 50,400, leaving a taxable income of Rs. 111,650. His net pay was Rs. 34,699.72 after further deductions including loans. Key earnings included a basic salary of Rs. 15,039, cash allowance of Rs. 12,031.20 and leave encashment of Rs. 8,421.84.

gagan

1. This document provides salary and tax details of Pradip Kumar, who works as a Senior Marketing Assistant at Indian Oil Corporation Limited. It details his gross salary of INR 41,28,635, various exemptions of INR 3,90,003 and deductions of INR 2,52,464 leading to a total taxable income of INR 37,81,113.

2. It notes a tax amount of INR 9,46,833 on his total income and a net tax payable of INR 98,47,08 after taking into account a health and education cess of INR 3,78,733.

3. Various allowances, perquisites, and income from other sources are also itemized,

Evasion of revenue in Assam, India

The document summarizes an investigation conducted by the Principal Accountant General (A&E) in Assam into the evasion of government revenue in the state. The investigation found that over Rs. 616 crore was not realized by the state treasuries from 2010-2011 to 2012-2013 due to lapsed challans (unpaid bills) that were not revalidated or reconciled. Several state treasuries were affected, with the largest amounts of unrealized revenue in Cachar, Jorhat, Kamrup, and Kokrajhar districts. Most of the evaders were found to be government departmental dues officers and private individuals. The document raises questions about who is responsible for the lapses and what

Similar to 23062100060638SBIN_ChallanReceipt.pdf (6)

23062100060638SBIN_ChallanReceipt.pdf

- 1. INCOME TAX DEPARTMENT Challan Receipt ITNS No. : 280 PAN : DEBPK4177N Name : SANTOSH KUMAR Assessment Year : 2023-24 Financial Year : 2022-23 Major Head : Income Tax (Other than Companies) (0021) Minor Head : Other Receipts (500) Sub-type of Payment : Fee for delay in linking PAN with Aadhaar Amount (in Rs.) : ₹ 1,000 Amount (in words) : Rupees One Thousand Only CIN : 23062100060638SBIN Mode of Payment : Debit Card Bank Name : State Bank Of India Bank Reference Number : IK0CHOTDK0 Date of Deposit : 21-Jun-2023 BSR code : 0002271 Challan No : 16405 Tender Date : 21/06/2023

- 2. Tax Breakup Details (Amount In ₹) A Tax ₹ 0 B Surcharge ₹ 0 C Cess ₹ 0 D Interest ₹ 0 E Penalty ₹ 0 F Others ₹ 1,000 Total (A+B+C+D+E+F) ₹ 1,000 Total (In Words) Rupees One Thousand Only Thanks for being a committed taxpayer! To express gratitude towards committed taxpayers, the Income Tax Department has started a unique appreciation initiative. It recognises taxpayers’ commitment by awarding certificates of appreciation to them.Login to e-filing portal and visit Appreciations and Rewards to know more. Congrats! Here’s what you have just achieved by choosing to pay online: Time Paper e-Receipt Quick and Seamless Save Environment Easy Access