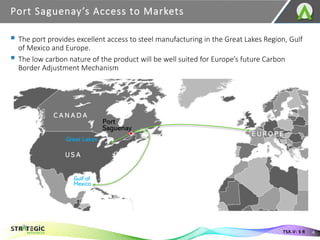

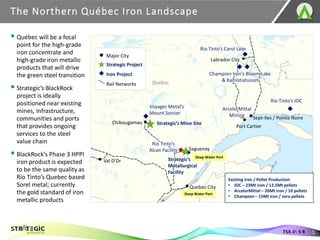

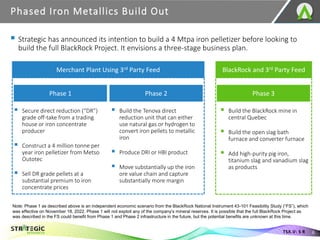

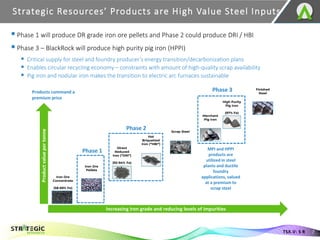

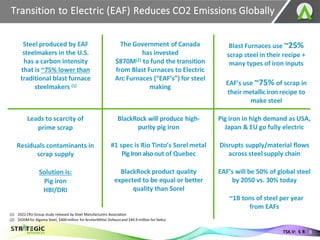

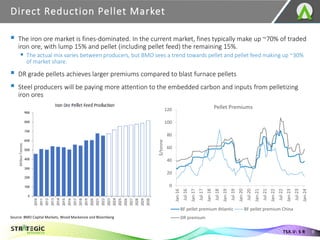

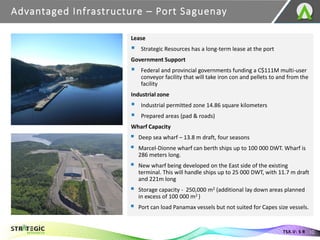

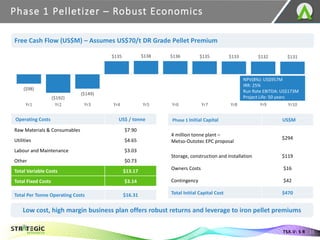

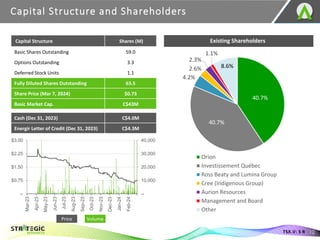

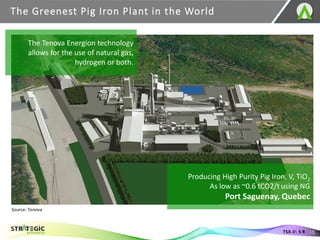

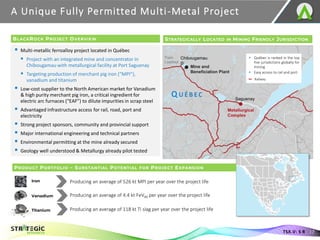

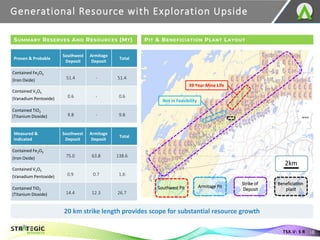

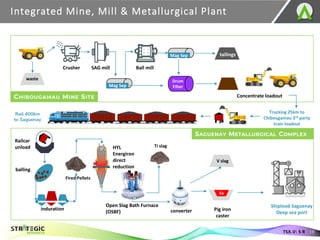

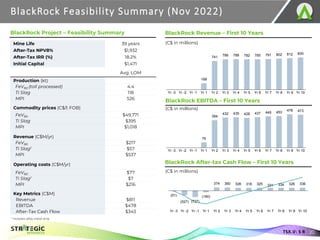

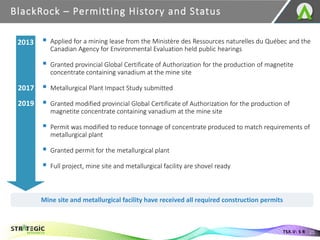

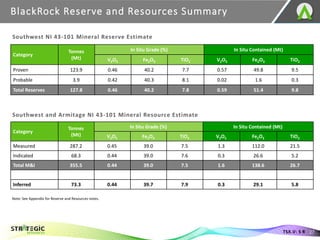

Strategic Resources is presenting on their corporate projects in March 2024. The presentation outlines their phased approach to developing the BlackRock iron ore project in Quebec, beginning with a merchant iron pellet plant using third party feed (Phase 1), followed by direct reduction and hot briquetted iron production (Phase 2), and ultimately the construction of the BlackRock mine and metallurgical facility (Phase 3). Strategic also discusses their leased site at the deep water Port of Saguenay that will be critical infrastructure for shipping iron ore pellets and products internationally. The presentation provides an overview of the economics for the Phase 1 merchant pellet plant and Strategic's capital structure.