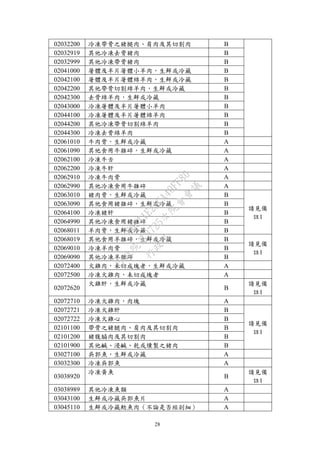

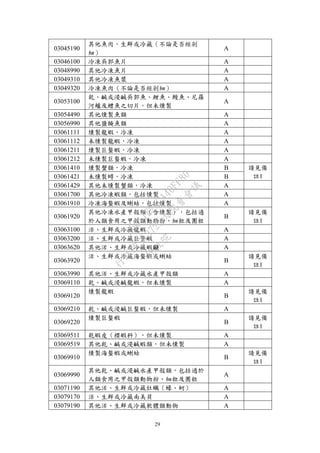

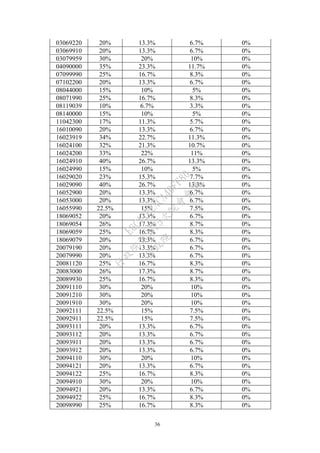

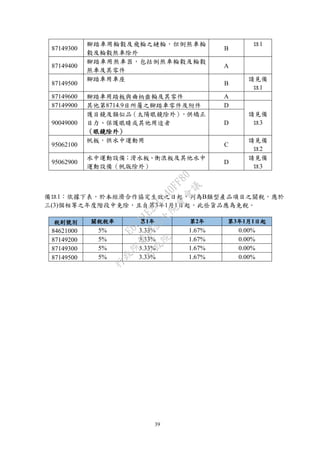

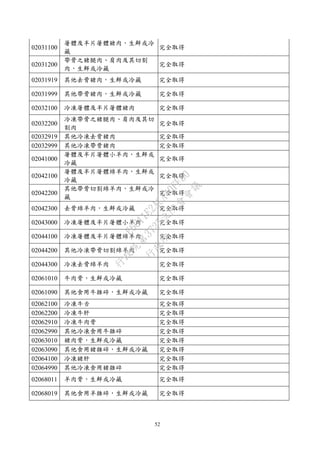

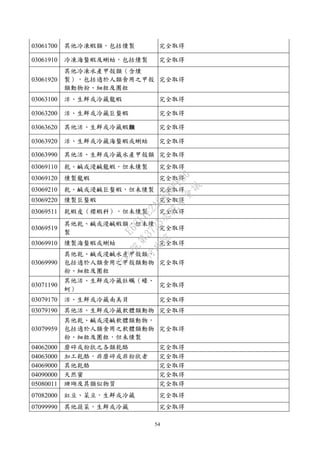

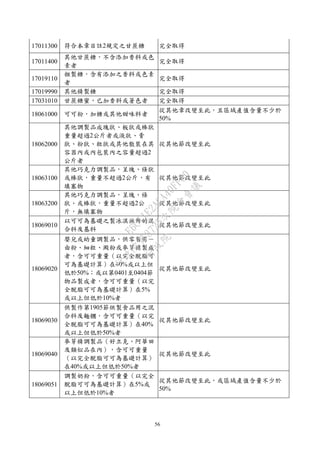

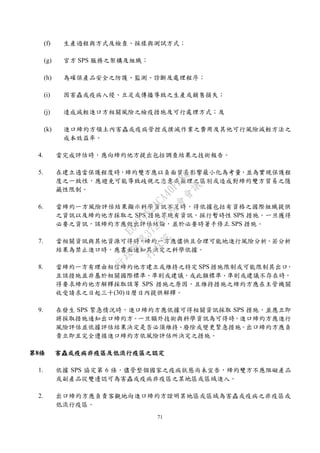

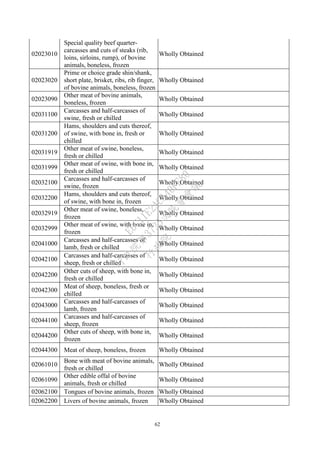

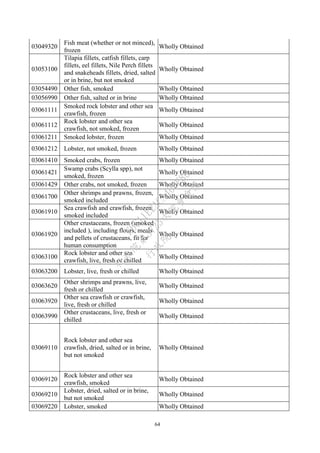

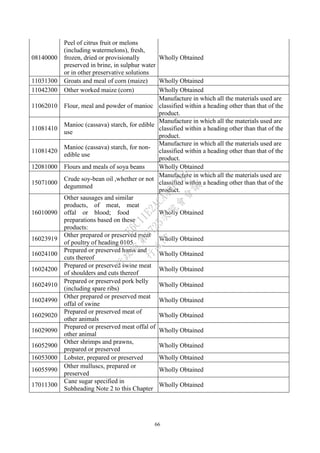

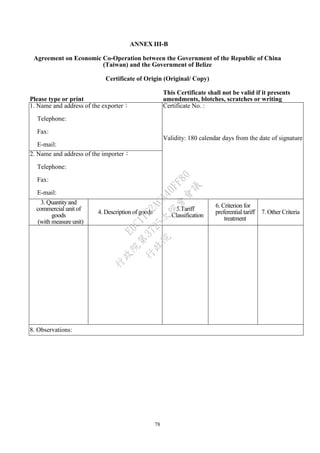

This document summarizes the key points of an economic cooperation agreement between Taiwan and Belize. It was discussed and approved at Taiwan's 3725th Executive Yuan meeting. The agreement aims to strengthen economic and trade relations between the two countries by gradually reducing and eliminating tariffs and non-tariff barriers. It covers 11 chapters on issues like tariffs, rules of origin, trade remedies, investment promotion, and dispute resolution. The agreement and its annexes detailing tariff reductions were submitted to Taiwan's legislature for review.