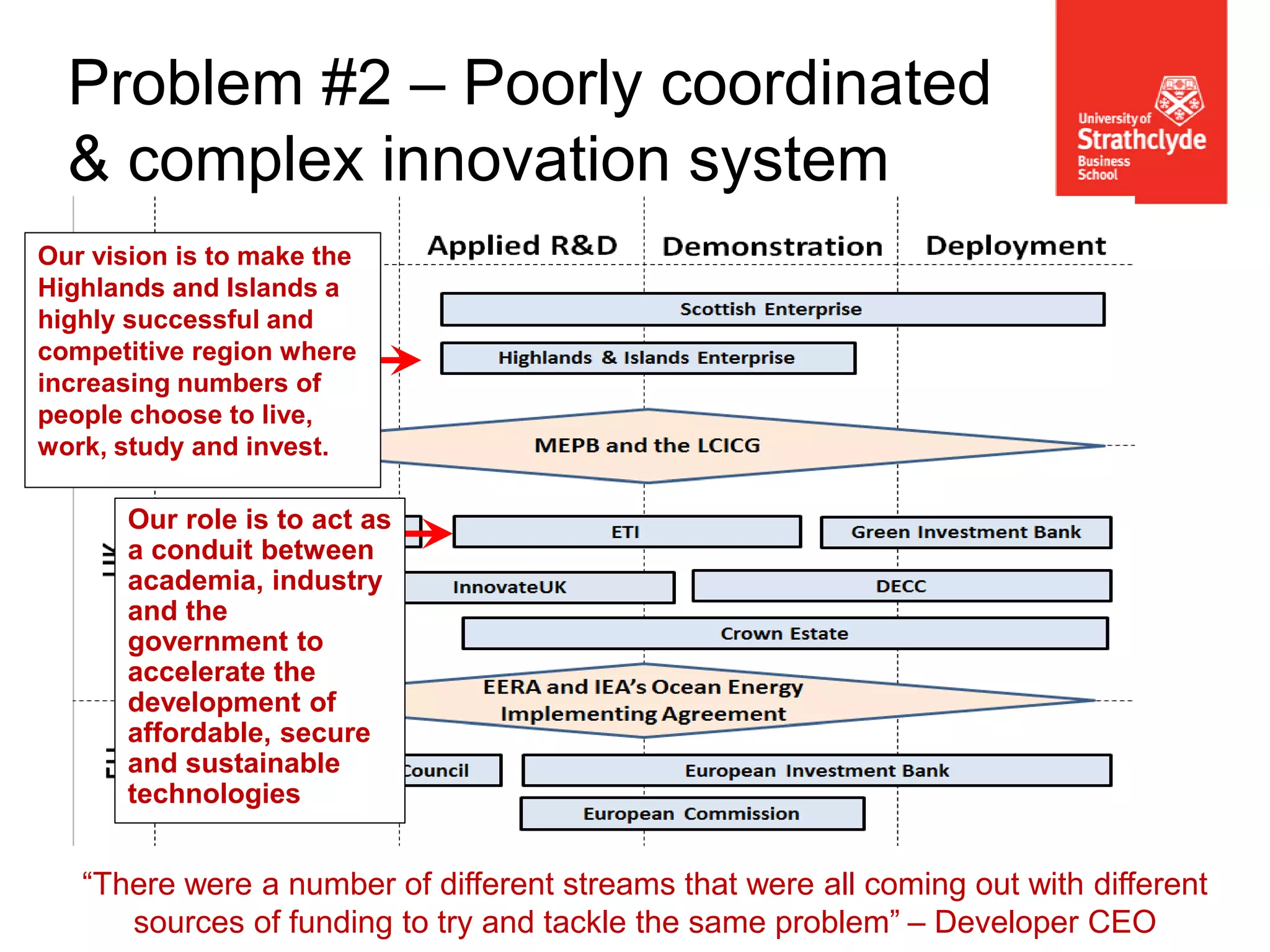

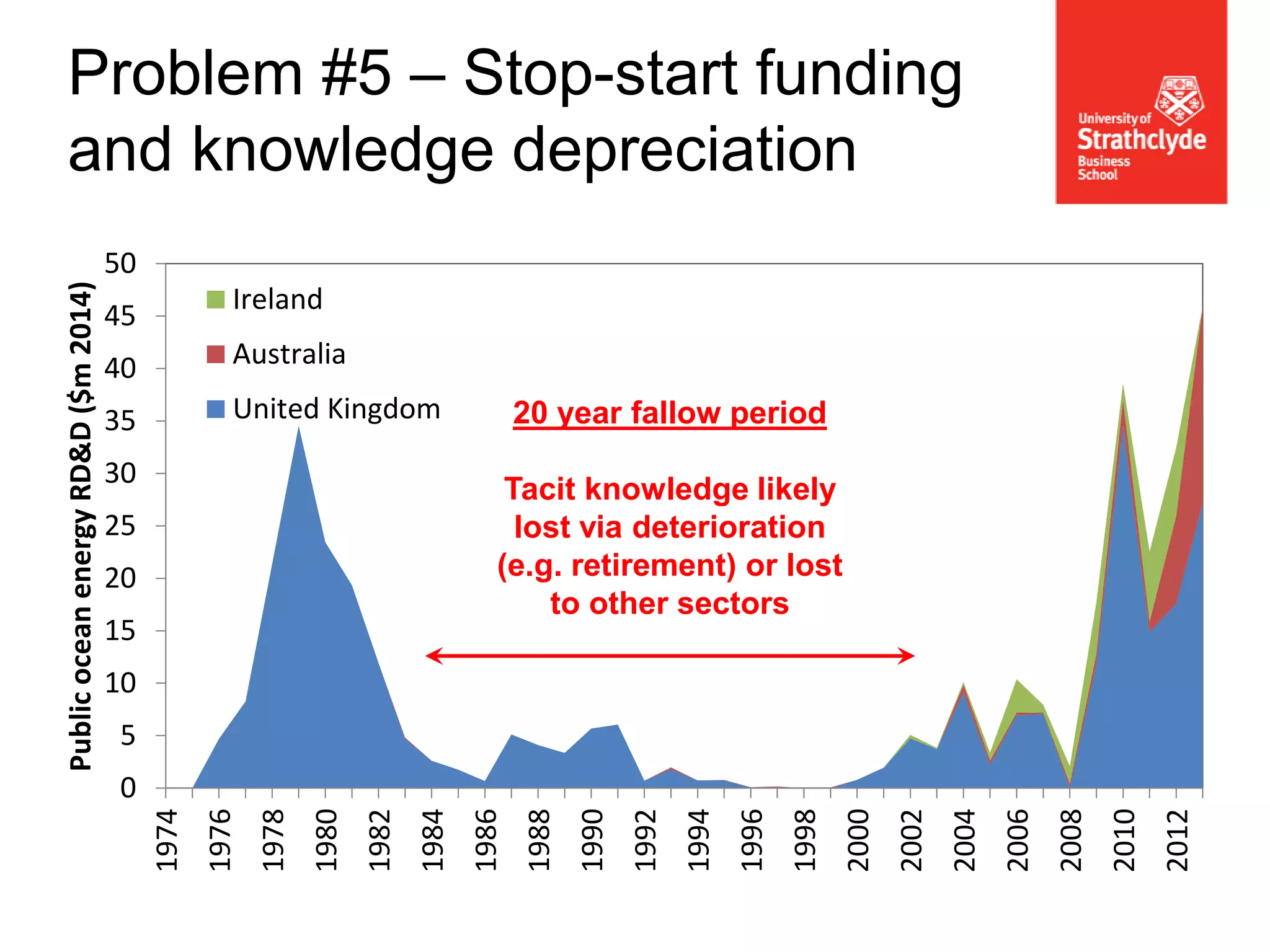

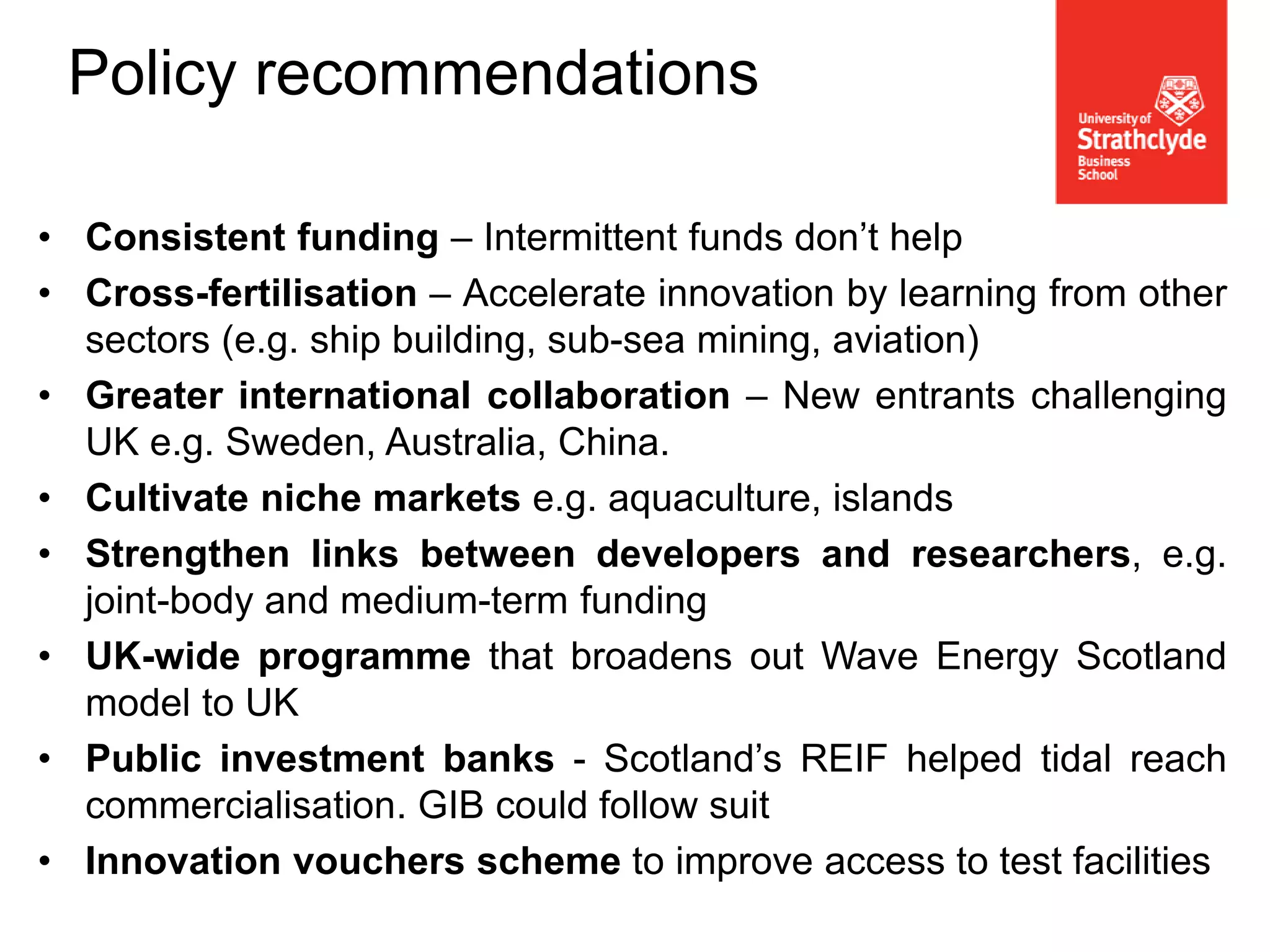

This document discusses the challenges facing wave energy technology commercialization in the UK. It analyzes the UK's performance in wave energy innovation inputs like public funding and outputs like patents and deployments. Five issues are identified that contributed to wave energy's slow progress in the UK: overpromising results, a poorly coordinated innovation system, backing technologies that ultimately failed, bundling wave and tidal funding, and intermittent support. The document provides recommendations to address these issues like consistent funding, increased international collaboration, and strengthening links between developers and researchers.