Embed presentation

Download to read offline

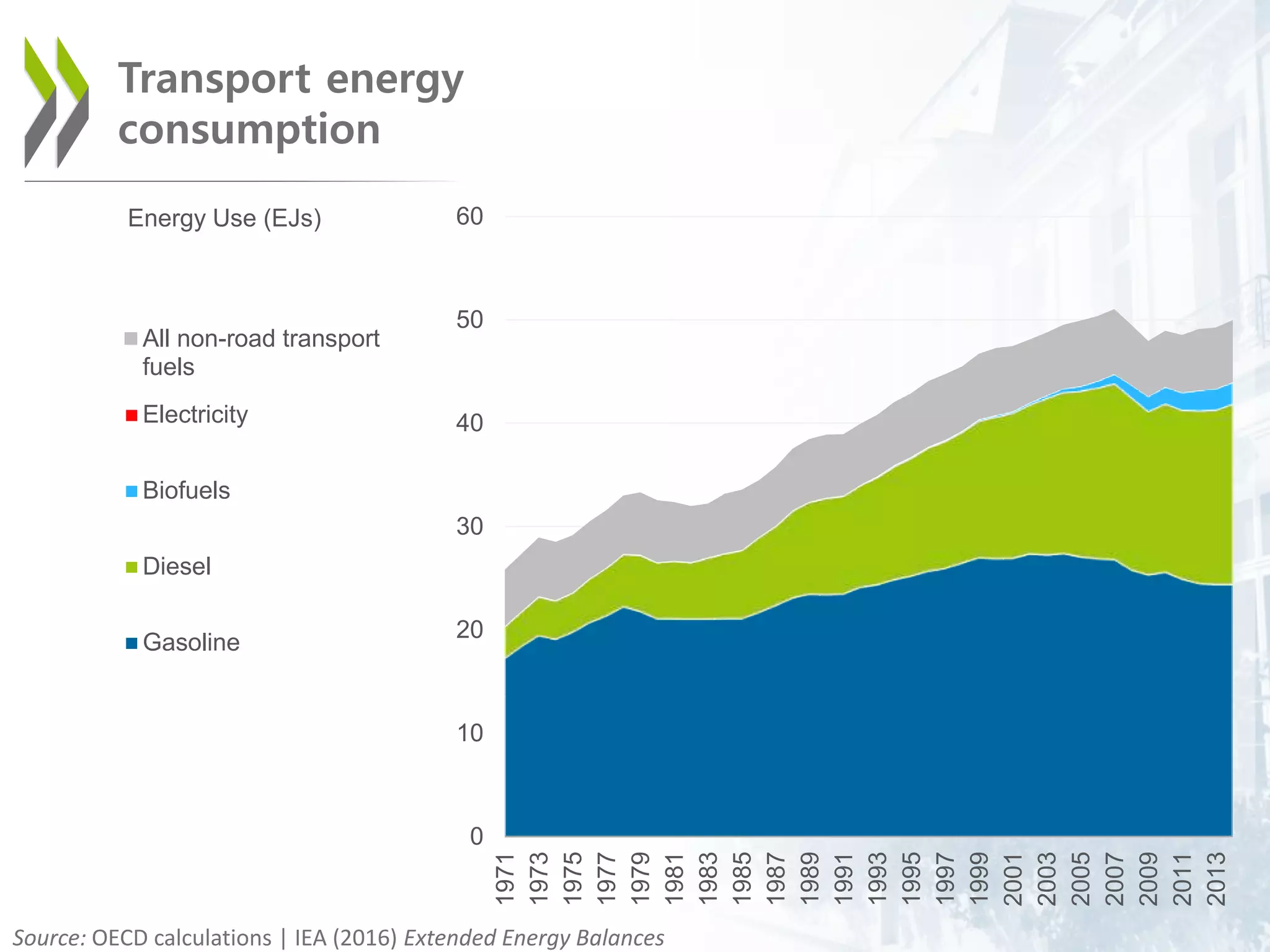

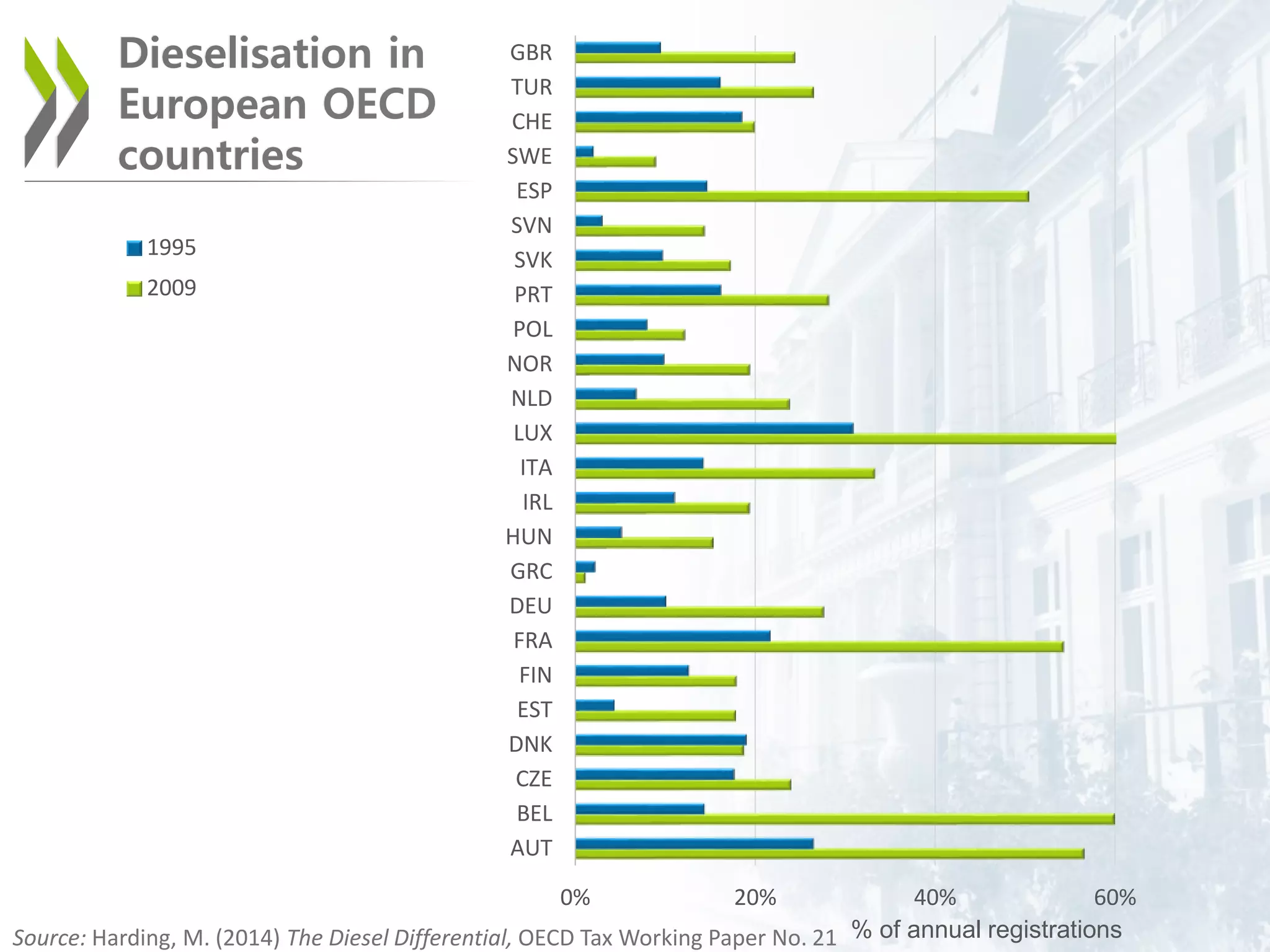

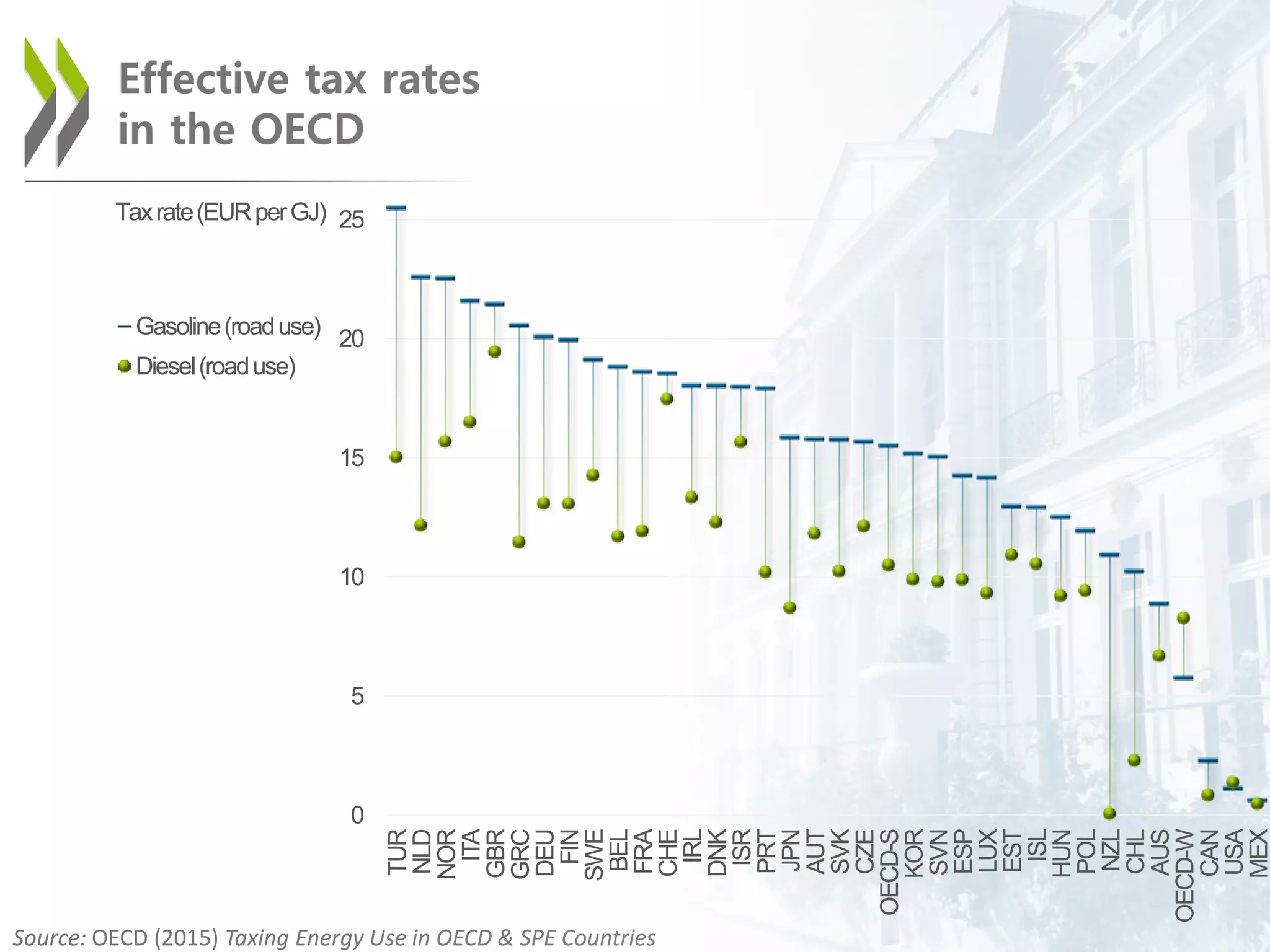

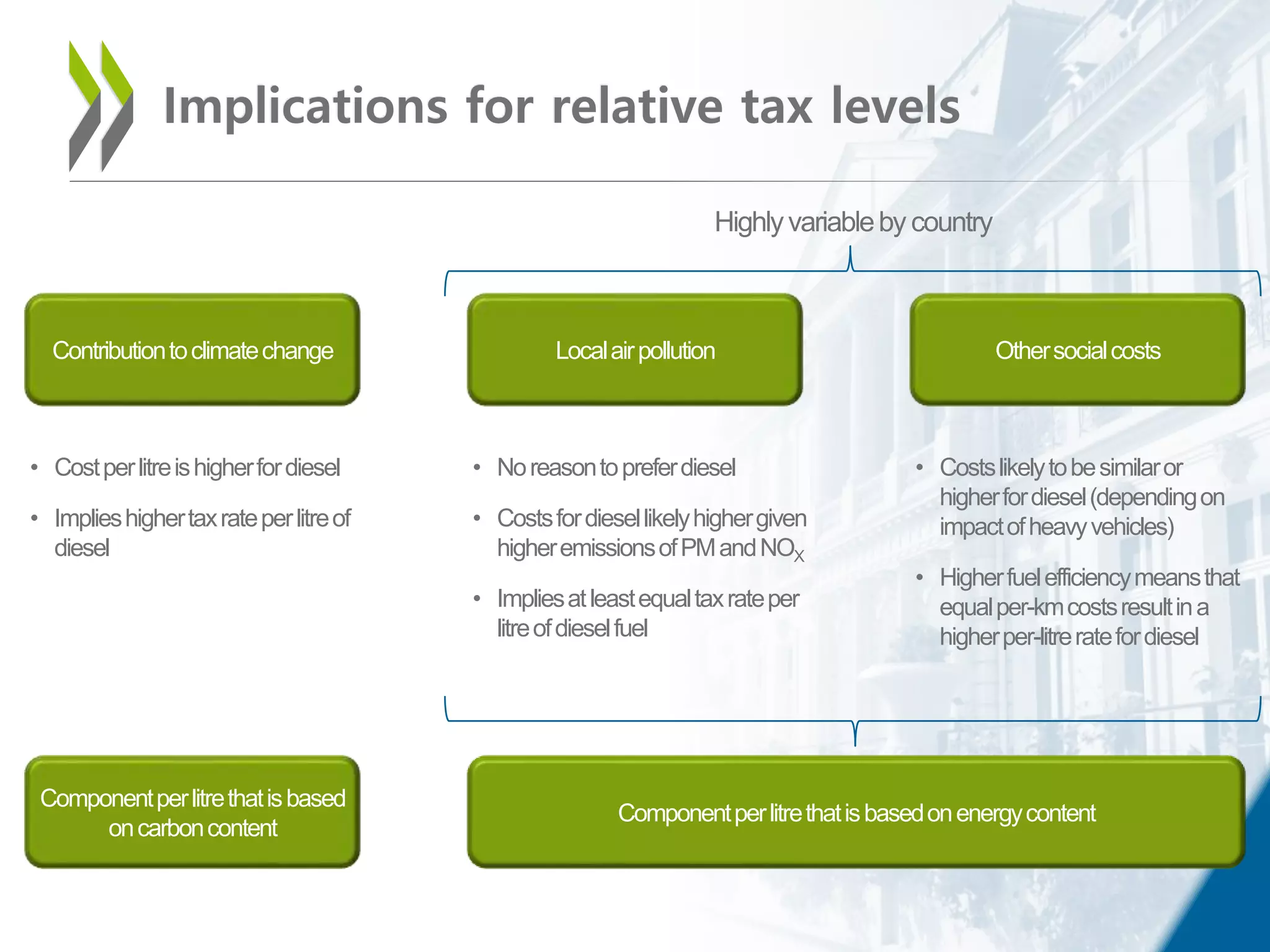

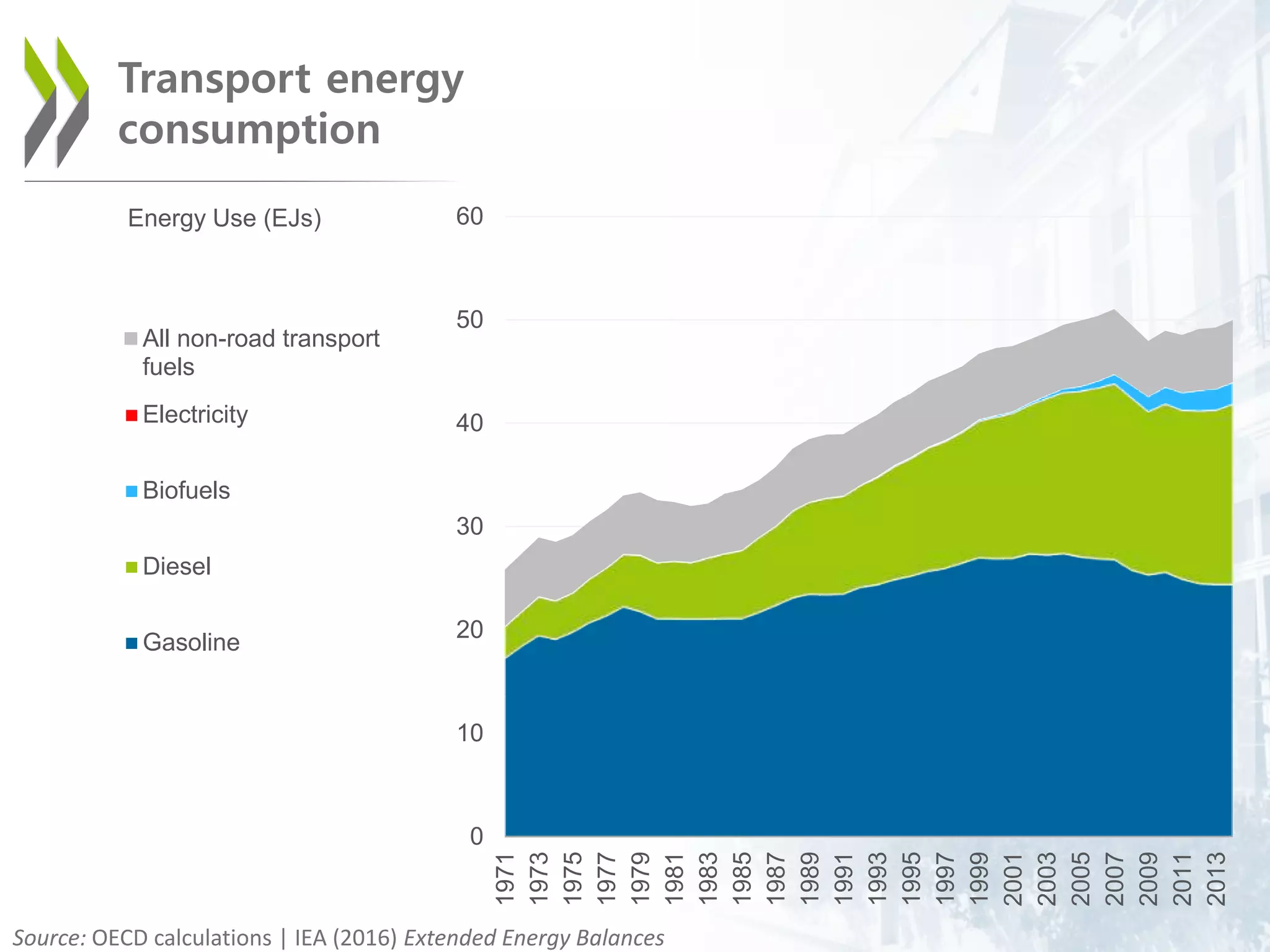

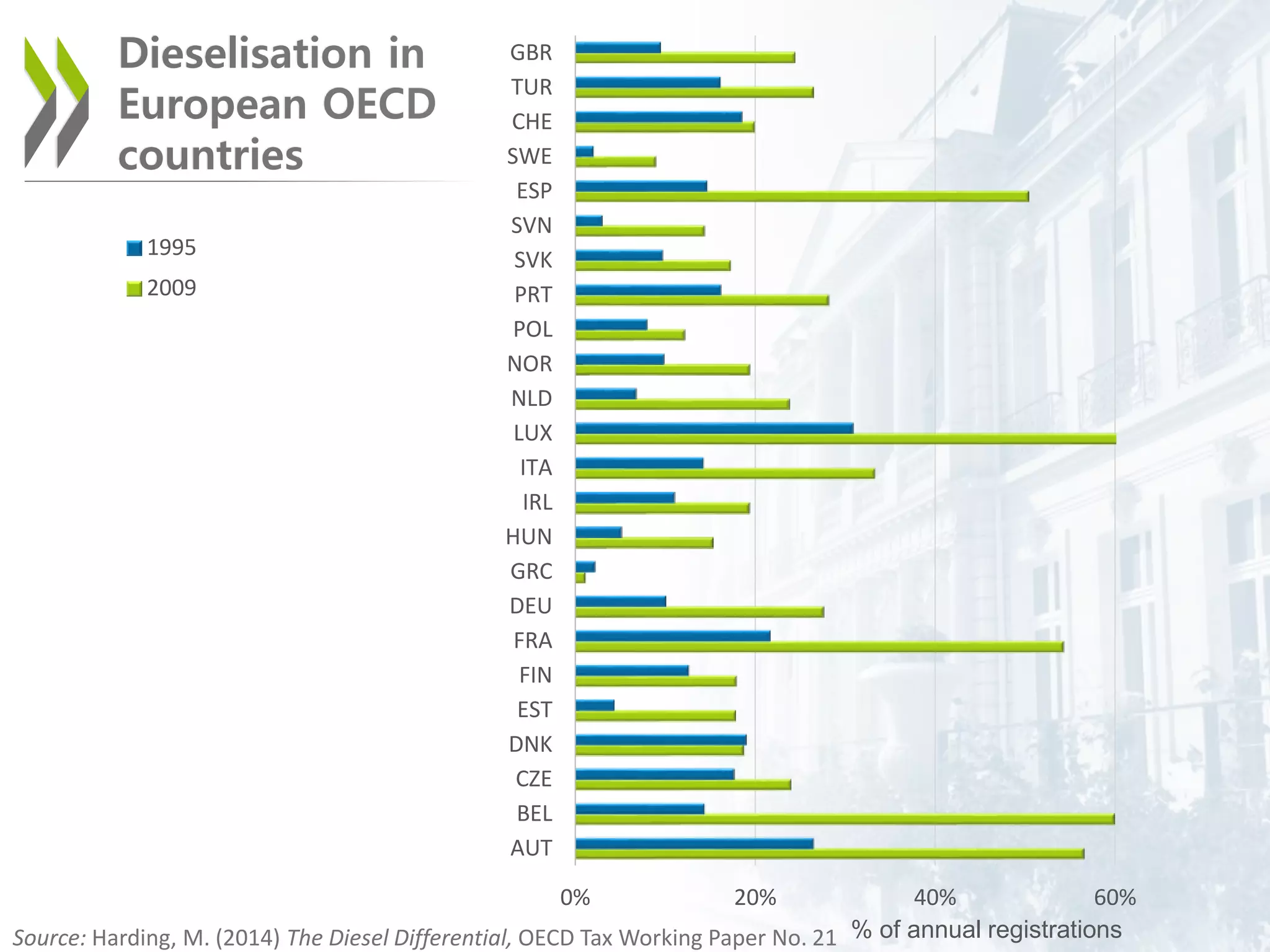

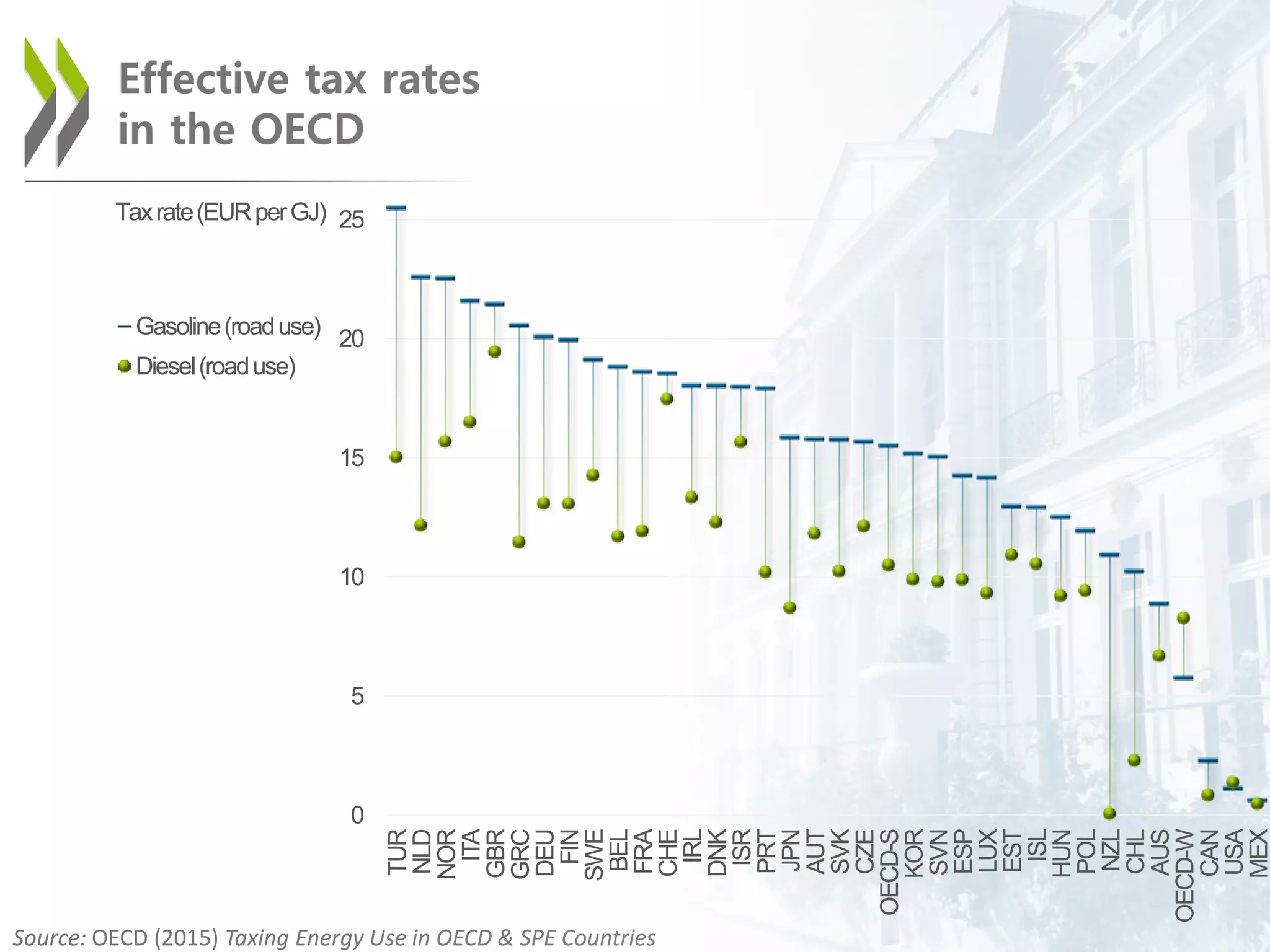

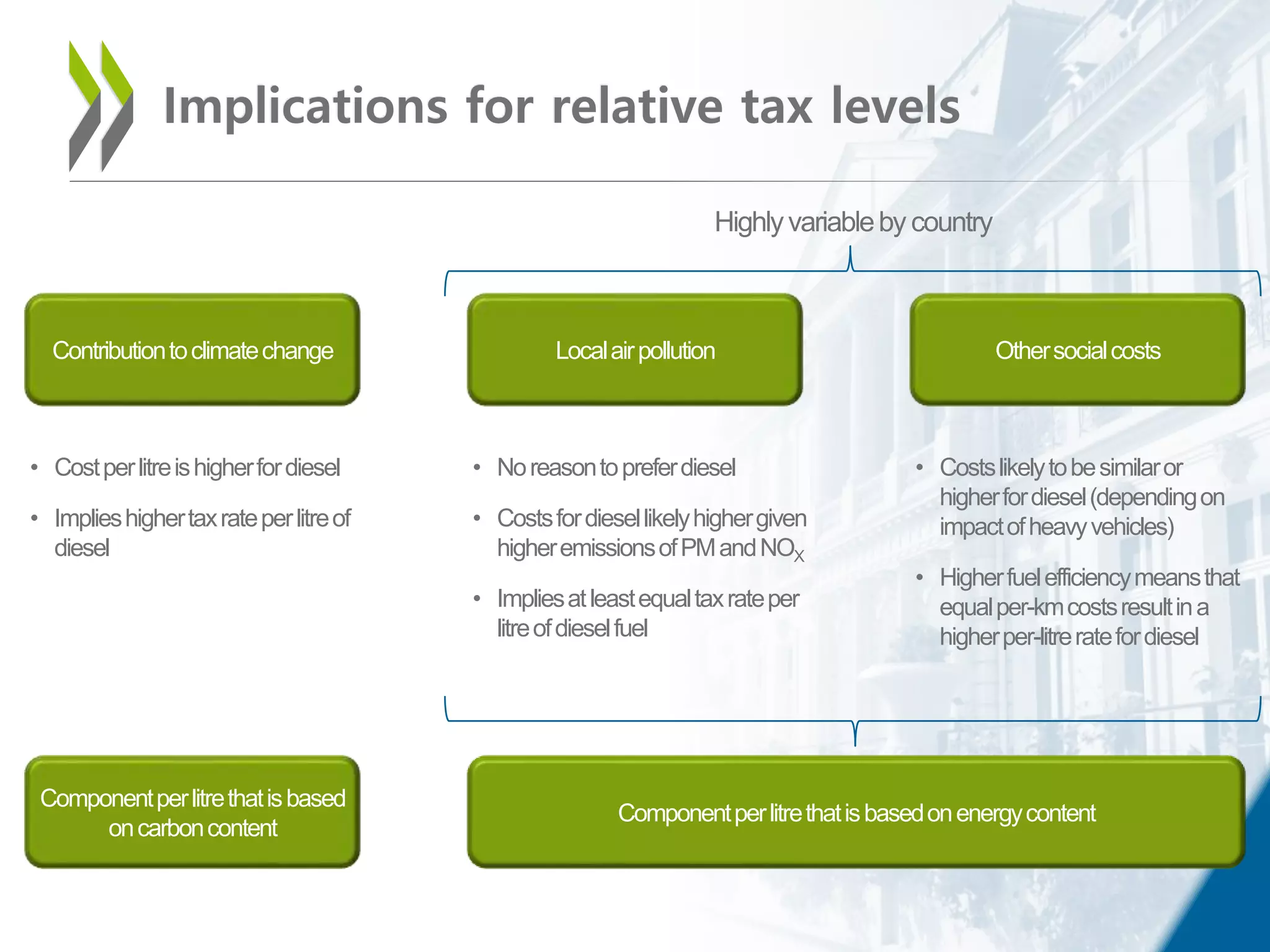

The document discusses the taxation of gasoline and diesel for road transport, highlighting differences in effective tax rates among OECD countries. It addresses implications for climate change, air pollution, and social costs, asserting that diesel's higher emissions could justify equal or higher tax rates compared to gasoline. The analysis indicates variable taxation levels that depend on country-specific factors and highlights the complexity of assessing fuel impacts on transportation.