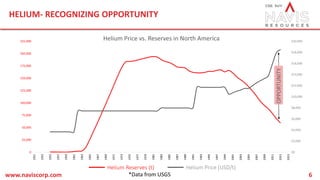

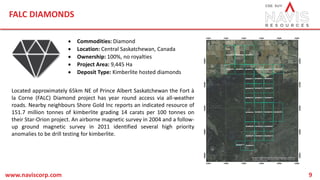

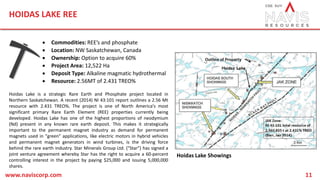

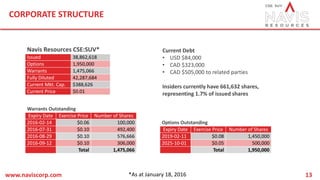

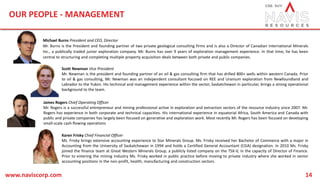

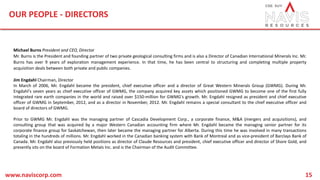

This presentation outlines a company focused on future-oriented financial information regarding resource acquisition and development, highlighting strategic interests in helium and rare earth elements in Saskatchewan. It introduces a new management team and corporate restructuring, including proposals to clean up debt and secure funding for undervalued assets. Forward-looking statements address potential risks, market conditions, and the company's approach to capitalize on high-demand commodities.